Nationwide Insurance Review: Auto, Home, Motorcycle and Renters

Nationwide is a good company, but it tends to be expensive. Its great service and coverage upgrades may be worth the extra cost.

Find Cheap Auto Insurance Quotes in Your Area

Overall, Nationwide is a good insurance company. It offers reliable customer service and the convenience you expect from a large national company. Plus, you can buy a policy and manage your coverage online.

Nationwide is not available in every state. However, it's one of the largest insurance companies in the U.S.

Pros and cons

Pros

Lots of coverage options for auto and home

Numerous discounts

Savings programs for safe and infrequent drivers

Cons

Expensive rates if you don't qualify for discounts

Few motorcycle insurance coverage upgrades

Nationwide car insurance

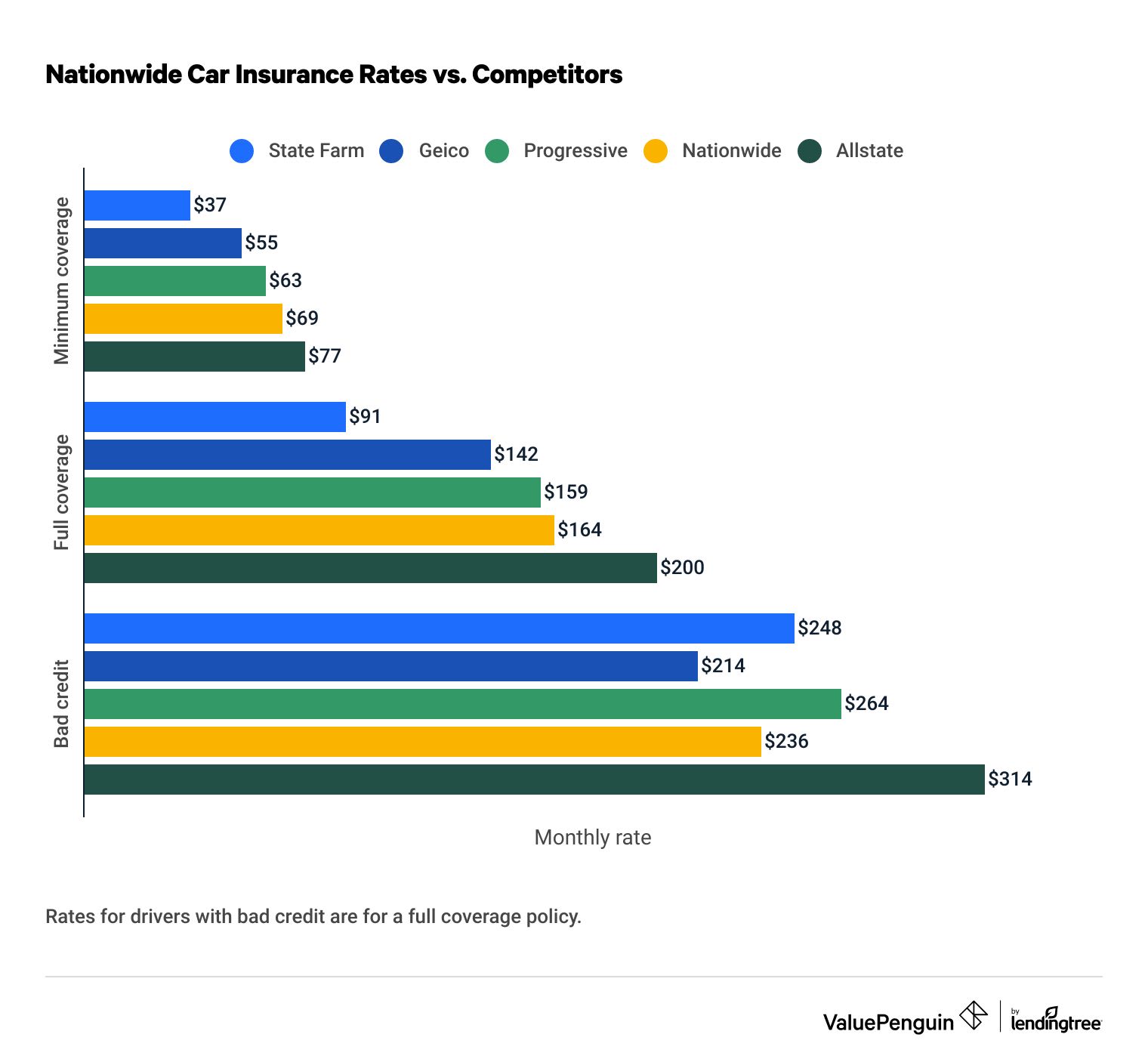

Nationwide's car insurance quotes tend to be more expensive than other major insurance companies.

But Nationwide has great savings programs for safe drivers and people who don't drive much. That could make it a good option for people who work from home, retirees and those with a short commute.

Nationwide car insurance quotes

Full coverage car insurance from Nationwide costs around $164 per month, which is 9% more expensive than average. Nationwide charges an average of $69 per month for minimum coverage. That's 15% more than average.

State Farm, Geico and Progressive typically have cheaper quotes than Nationwide, while Allstate's rates are more expensive.

Find Cheap Auto Insurance Quotes in Your Area

However, drivers with a poor credit score can find affordable car insurance with Nationwide. A full coverage policy costs $236 per month for drivers with bad credit, which is 8% cheaper than average.

Nationwide auto insurance quotes vs. competitors

Minimum coverage

Full coverage

Full coverage for drivers with bad credit

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $37 | ||

| Geico | $55 | ||

| Progressive | $63 | ||

| Nationwide | $69 | ||

| Allstate | $77 | ||

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $37 | ||

| Geico | $55 | ||

| Progressive | $63 | ||

| Nationwide | $69 | ||

| Allstate | $77 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $91 | ||

| Geico | $142 | ||

| Progressive | $159 | ||

| Nationwide | $164 | ||

| Allstate | $200 | ||

Full coverage for drivers with bad credit

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $214 | ||

| Nationwide | $236 | ||

| State Farm | $248 | ||

| Progressive | $264 | ||

| Allstate | $314 | ||

Nationwide auto insurance discounts

Nationwide has many of the same discounts you find at other national insurance companies. But people who don't drive often and safe drivers can save a lot of money with Nationwide.

-

Nationwide SmartMiles is a pay-per-mile program that can help you save money if you don't drive much. That's because a portion of your car insurance rate is determined by how many miles you drive each month.

People who drive less than average — which is typically 32 miles per day — can save money with SmartMiles. That makes it a great option for people who are retired or work from home.

-

Nationwide SmartRide helps customers save money if they practice safe driving habits. SmartRide uses an app, plug-in device or in-car system to track things like braking hard or speeding up quickly.

Drivers with good habits can save up to 40% on their car insurance rates. The average discount is around 22%.

Nationwide also offers common discounts that are easier to get. Some discounts may not be available in all states.

- Accident-free discount: Get a discount if you avoid getting into an accident for a set amount of time.

- Anti-theft device discount: Save money if your car has technology to help prevent it from being stolen.

- Automatic payments discount: Earn a discount if you sign up for automatic payments.

- Defensive driving discount: Drivers 55 or older can get a discount for taking a defensive driving class.

- Good student discount: Students ages 16 to 24 can save money if they earn a B average or better in school.

- Multi-policy discount: Save up to 20% if you buy auto and home insurance from Nationwide. The company also offers a discount for bundling your auto policy with renters, motorcycle, boat or life insurance.

- Paperless billing discount: Earn a discount if you agree to have your bills and policy documents sent to you via email.

- Safe driver discount: Get a discount if you avoid at-fault accidents and major traffic tickets for five years or longer.

Nationwide auto insurance coverages

Nationwide offers typical coverage upgrades that you would expect from a major insurance company.

Accident forgiveness

Nationwide accident forgiveness prevents your rate from going up after your first at-fault accident or a minor traffic ticket.

Gap insurance

Nationwide gap insurance pays the difference between the value of your car and the amount you owe on your lease or loan if it's totaled in an accident.

Rental reimbursement

Nationwide insurance rental car expense pays for a rental car or other transportation expenses while your car is in the repair shop after an accident.

Roadside assistance

Nationwide roadside assistance helps cover the cost to tow your car, deliver gas, change your tire or jump-start your battery if your car breaks down.

Total loss deductible waiver

Total loss deductible waiver helps you replace your car without having to pay your deductible in the event of a total loss.

So, if you're in an accident and your car is damaged beyond repair, Nationwide will send you a check for its current market value. Without this waiver, you would get a check for the value of your car, minus your deductible.

Vanishing deductible

Vanishing deductible can earn you $100 off your deductible for every year that you drive safely. Nationwide allows you to earn a maximum of $500 off your deductible.

A basic car insurance policy from Nationwide includes all of the most common car insurance coverages. This includes liability, collision, comprehensive, medical payments (MedPay), personal injury protection (PIP) and uninsured and underinsured motorist coverage.

Nationwide On Your Side Auto Repair Network

If your car is damaged in an accident, you can use the Nationwide On Your Side Auto Repair Network to find a repair shop. If you choose a shop in Nationwide's network, the repairs come with a workmanship guarantee for as long as you own your car.

Nationwide auto insurance availability

Nationwide offers auto insurance in most states. It is not available in:

Nationwide home insurance

Nationwide's home insurance rates are average, but there are many ways to upgrade your coverage.

That makes Nationwide a great option for homeowners who want peace of mind.

Nationwide home insurance quotes

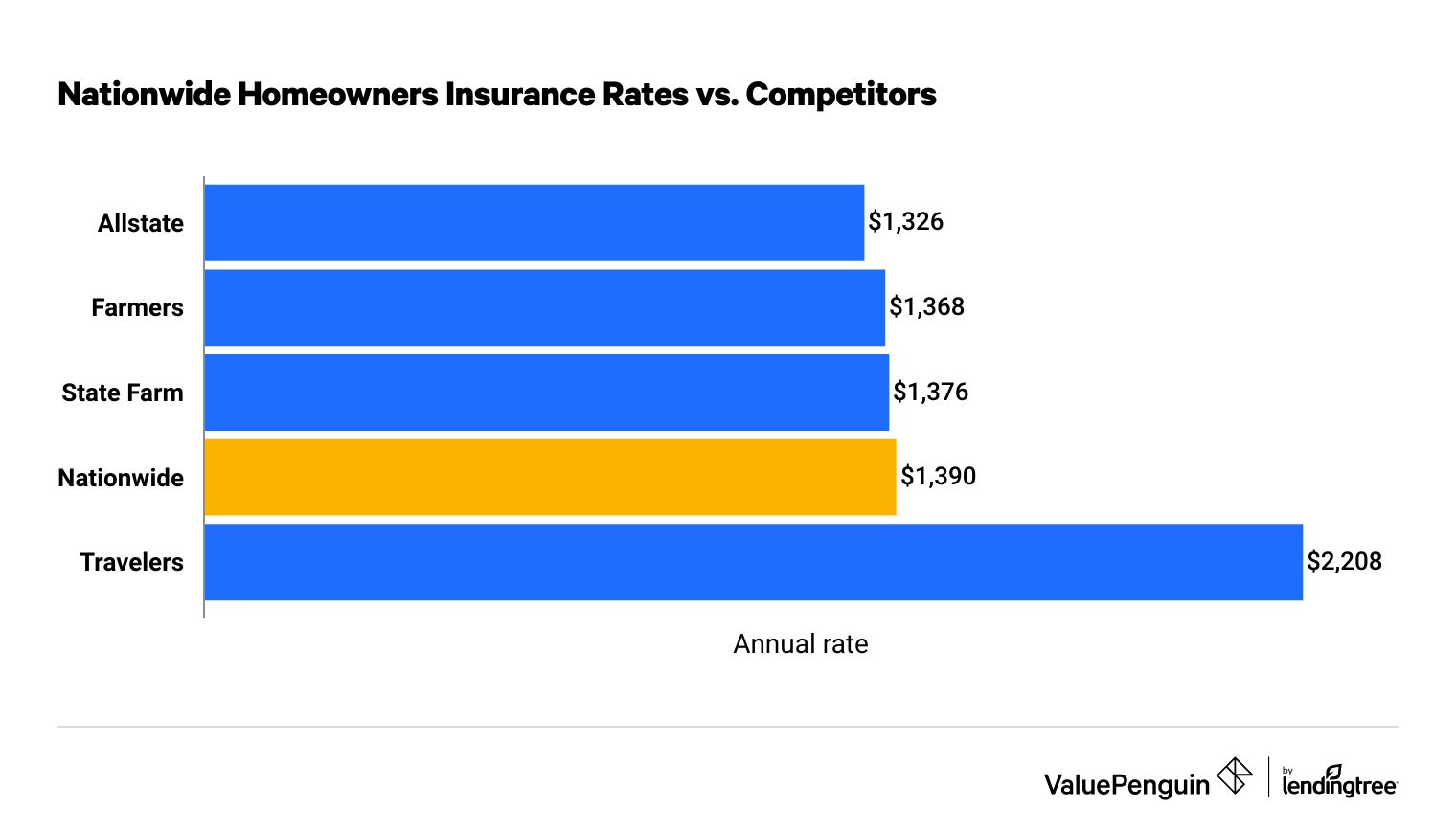

Nationwide's homeowners insurance rates don't stand out from other major insurance companies.

Home insurance from Nationwide costs around $1,390 per year, which is 9% less expensive than average.

Find Cheap Homeowners Insurance Quotes in Your Area

However, homeowners pay slightly less for a policy from Allstate, Farmers or State Farm.

Nationwide homeowners insurance quotes vs. competitors

Company | Annual rate | ||

|---|---|---|---|

| Allstate | $1,326 | ||

| Farmers | $1,368 | ||

| State Farm | $1,376 | ||

| Nationwide | $1,390 | ||

| Travelers | $2,208 | ||

Insurance rates vary depending on where you live and the type of home you own. The best way to get the cheapest rates is to compare prices from multiple companies.

Nationwide home insurance discounts

Nationwide offers customers a number of ways to save on home insurance. Most of the discounts are common, but there are a few unique ways to save, like a home renovation credit and roof rating discount.

- Multi policy discount for insuring your home and car with Nationwide

- Protective device discount for installing smoke detectors, fire alarms or burglar alarms

- Claims-free discount for avoiding home insurance claims

- Home renovation credit after upgrading heating, cooling, plumbing or electrical systems

- Roof rating discount based on the building material and age of your roof

- Home purchase discount if you bought your home within the last 12 months

- Prior insurance discount based on the number of years you were with your previous insurance company

- Gated community discount if entrances to your community are protected by key-lock devices, residence cards or security guards

Nationwide smart home discount

You can also get a smart home discount for installing a Notion home monitoring system.

Nationwide customers can get a Notion smart home starter kit for $25 or less. Notion sensors monitor temperature changes, smoke, carbon monoxide levels, water leaks and the opening and closing of doors and windows.

You'll also save an average of $50 per year on your home insurance rates.

Nationwide's smart home discount is currently available in 28 states and Washington, D.C.

Nationwide home insurance coverage

A Nationwide home insurance policy comes with all the basic coverages you expect. That includes protection for your home, personal liability coverage and medical payments. It also comes with protection against credit card fraud, which most other companies charge extra for.

Nationwide also offers a lot of ways for homeowners to upgrade their coverage, like better roof replacement.

Better roof replacement

Better roof replacement pays to rebuild your roof with stronger, safer materials if it's damaged in a covered event, like a hail storm.

Brand new belongings

Brand new belongings upgrades your personal property coverage to replacement cost so that you can fix any damaged items or replace them with brand new ones.

Dwelling replacement cost

Dwelling replacement cost pays up to 20% more than your dwelling coverage limit if your home has to be rebuilt after a covered loss, like a fire.

Earthquake insurance

Earthquake insurance pays for damage caused by an earthquake or earth movement. For example, it can replace your television if it falls off the wall during a tremor.

Equipment breakdown

Equipment breakdown coverage repairs or replaces electronics or appliances that are damaged by an electrical or mechanical breakdown, like a power surge.

Flood insurance

Flood insurance pays for damage caused by flood waters.

Identity theft coverage

Identity theft coverage protects your personal data from cybercrimes and other risks.

Service line coverage

Service line coverage pays for damage to exterior underground service lines, like water, gas and electricity.

Valuables plus

Valuables plus offers extra coverage for high-value items like fine art, jewelry and antiques.

Water backup coverage

Water backup coverage helps pay for damage caused by water backup through sewers or drains, or sump pump overflow.

Nationwide home and renters insurance availability

Nationwide offers homeowners and renters insurance in 43 states and Washington, D.C. It is not available in:

Nationwide motorcycle insurance

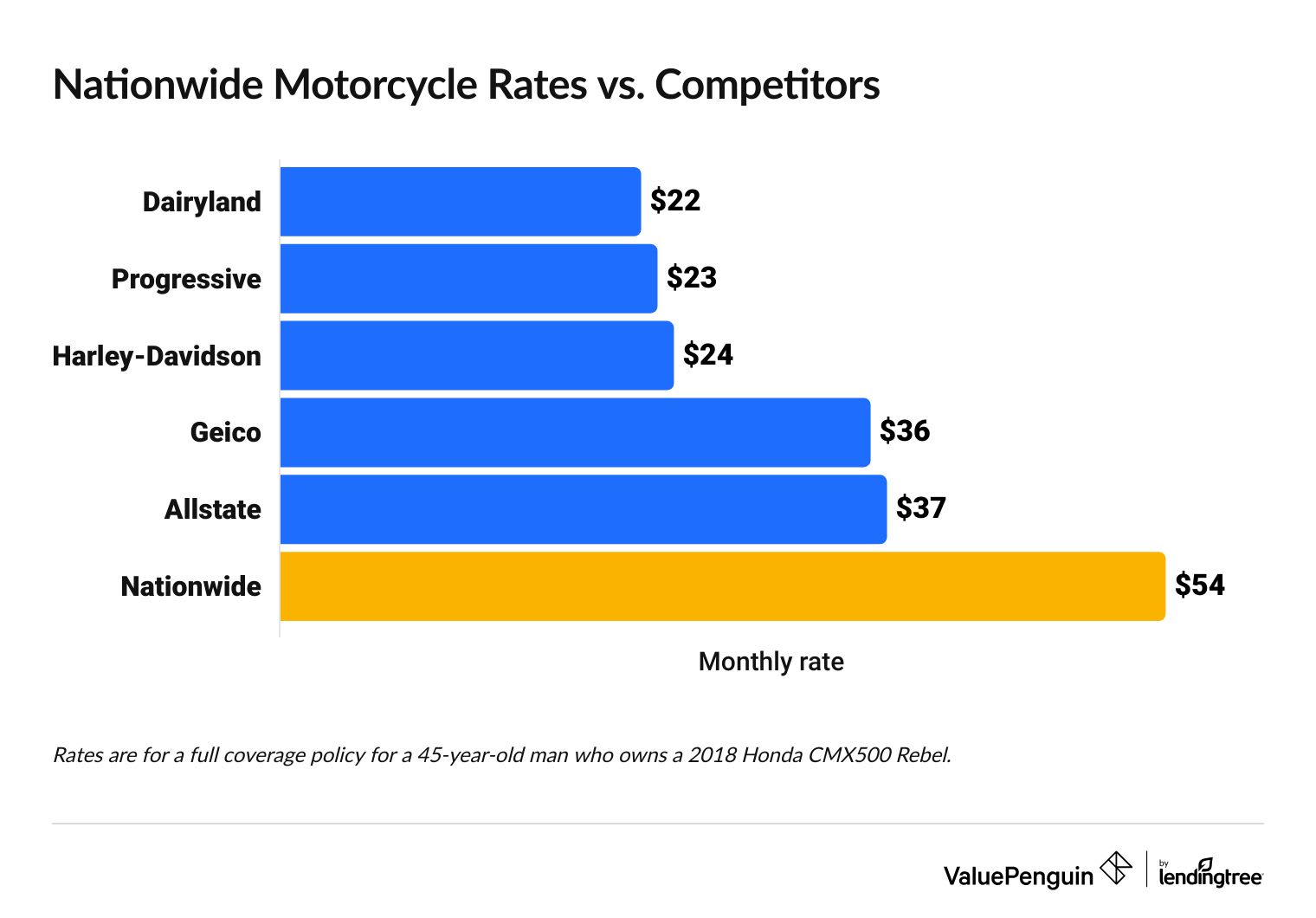

Nationwide's motorcycle insurance rates are very expensive.

The company's coverage options are also very basic. Most riders can find better protection elsewhere.

Nationwide motorcycle insurance quotes

Full coverage motorcycle insurance from Nationwide costs around $54 per month. That's $21 per month more expensive than the national average. It's also $31 more per month than the cheapest company, Dairyland.

Find Cheap Motorcycle Insurance Quotes in Your Area

Nationwide motorcycle insurance rates vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $22 | ||

| Progressive | $23 | ||

| Harley-Davidson | $24 | ||

| Geico | $36 | ||

| Allstate | $37 | ||

| Nationwide | $54 | ||

Nationwide bike insurance discounts

Nationwide has a number of discounts that can help make your rates more affordable. But they're not much different from what you would find with most major insurance companies.

Get an automatic discount if your bike has factory-installed anti-lock brakes.

Save money if you bundle your motorcycle insurance with a Nationwide home, car or life insurance policy.

Get a discount if you pay for your policy up front.

Save money if you belong to a motorcycle association, like the Harley Owners Group (HOG).

Earn a discount if you take a safety course approved by the Motorcycle Safety Foundation.

Get a discount if you have a professionally installed GPS or radio theft recovery system on your bike.

Nationwide motorcycle coverage

Nationwide's motorcycle insurance coverage options are limited. If your motorcycle isn't your main vehicle and you don't need extra protection, Nationwide's coverage choices may be enough.

Aside from basic motorcycle insurance coverages, Nationwide offers riders:

Roadside assistance helps pay for towing, delivering gas or oil and changing a tire if your bike breaks down on the side of the road.

Custom equipment coverage pays for damaged or stolen after-market parts. Nationwide's basic policy includes $3,000 of coverage, but bikers can get up to $30,000 of protection.

Original manufacturer, or OEM, coverage guarantees that Nationwide will repair your motorcycle using original equipment manufacturer parts after an accident. If OEM parts aren't available, Nationwide will pay you based on the market value of the original manufacturer parts.

Vanishing deductible lowers your comprehensive and collision deductible by $100 for each year of safe driving. Overall, your deductible can go down by up to $500.

Nationwide doesn't offer rental reimbursement for motorcycle riders. So, if your bike is your main vehicle and it's damaged in an accident, you'll have to pay for a rental yourself.

If you need more protection, you might need to choose a company with more coverage options, like Progressive or Markel.

Where is Nationwide motorcycle insurance available?

Nationwide motorcycle insurance is available in 43 states. It is not available in:

Nationwide renters insurance

Nationwide renters insurance is affordable and comes with extra features in a basic policy.

You can easily customize a Nationwide policy to fit your needs. And the company earned a very high score on J.D. Power's renters insurance study, which means customers are happy with the service they get from Nationwide.

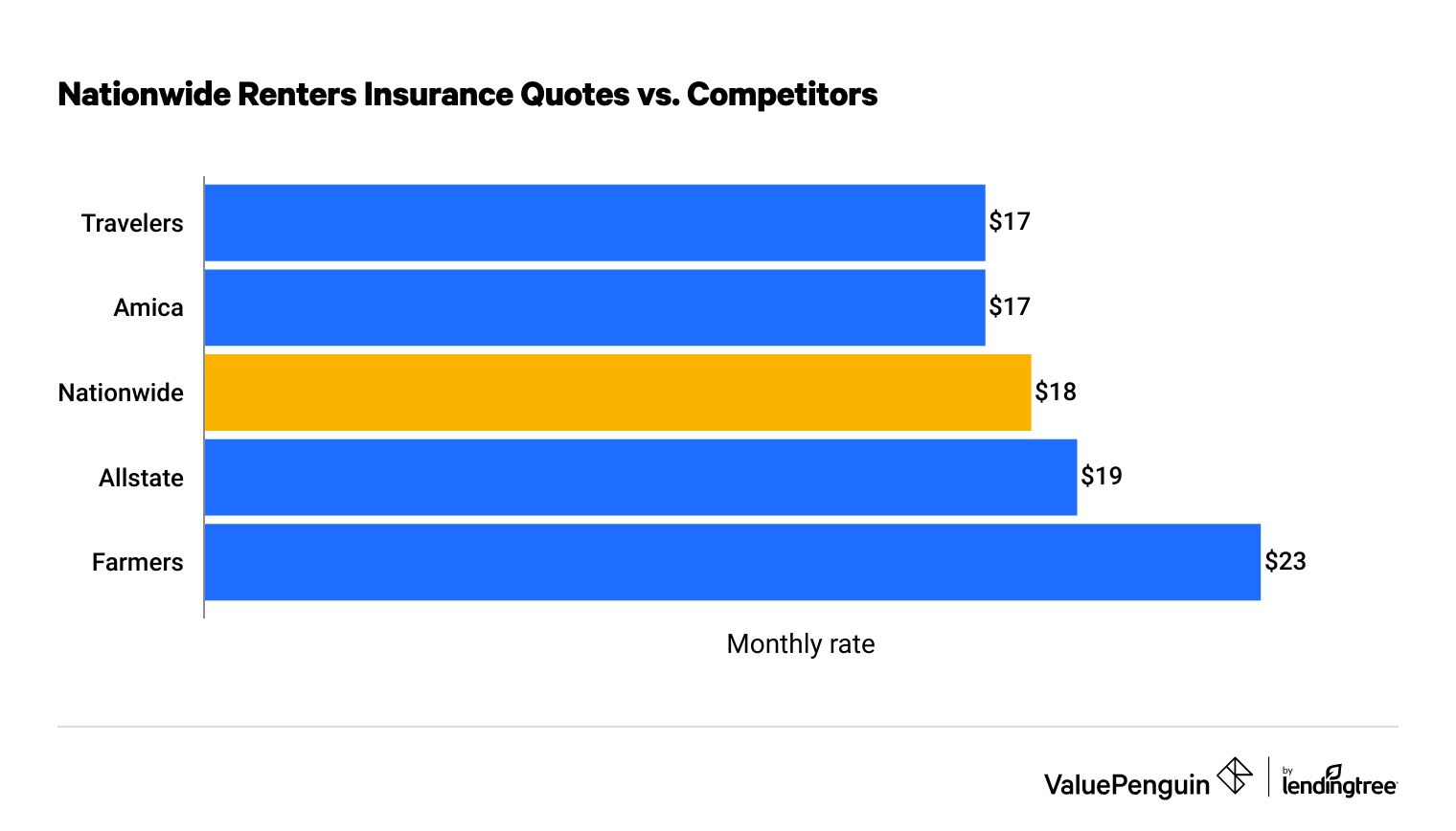

Nationwide renters insurance quotes

Nationwide renters insurance costs an average of $18 per month. That's 7% cheaper than average.

However, renters can find slightly cheaper rates from Amica and Travelers. Both companies charge an average of $17 per month for renters insurance.

Nationwide renters insurance rates vs. competitors

Nationwide renters insurance discounts

Nationwide only offers a few ways for renters to save money on insurance. Its discounts are fairly common among major companies.

- Claims free discount: Save money if you haven't made a renters insurance claim.

- Multi policy discount: Get a discount if you buy renters and auto insurance from Nationwide. You may also get a discount if you bundle other policies, like motorcycle or life insurance.

- Protective device discount: Earn a discount if your home has fire alarms, smoke detectors or burglar alarms.

Nationwide renters insurance coverage

A basic renters insurance policy from Nationwide includes some extra coverages that you typically have to pay for with other insurance companies.

In addition, Nationwide customers can increase their protection with a number of optional add-ons.

Brand new belongings coverage

Brand new belongings coverage replaces your stuff with brand new items if it's damaged or stolen. In comparison, most renters insurance policies factor in wear and tear, so you would pay extra to buy new things.

Earthquake coverage

Earthquake coverage replaces your things if they're damaged by earth movement or in the aftermath of a quake, like a landslide.

Theft extension

Theft extension gives you extra protection for your stuff if it's stolen from your car, trailer or boat.

Valuables plus

Valuables plus increases your protection for expensive items like jewelry, artwork, sports equipment or musical instruments.

Water backup coverage

Water backup coverage pays for damage caused by a backed up drain, sewer or sump pump.

A basic policy also comes with all of the standard coverage you would expect, like protection for your belongings.

Nationwide customer service ratings

Overall, Nationwide has dependable customer service.

Nationwide receives fewer complaints than other insurance companies of a similar size, according to the National Association of Insurance Commissioners (NAIC). The company only gets a third as many auto and motorcycle insurance complaints as competitors. Its home insurance customers file only 75% as many complaints expected for an average company its size.

That means customers can count on Nationwide to help them get their life back to normal quickly after an accident.

However, J.D. Power gave Nationwide below-average customer satisfaction scores for both car and home insurance. This suggests that customers of other major insurance companies may be happier with the service they receive.

But Nationwide earned top marks from J.D. Power for its renters insurance. That means renters are typically happy with the service they get from Nationwide.

Nationwide customers don't have to worry about the company's ability to pay out claims. It earned an A+ Financial Strength Rating from A.M. Best. That means that the company should have enough money to pay out insurance claims, even in a disaster.

Contact Nationwide

You can report an accident and file a claim with Nationwide via its website or mobile app, or by calling the Nationwide claims department.

What is the phone number for Nationwide insurance?

To file a Nationwide insurance claim, call 800-421-3535.

For customer service, contact Nationwide at 877-669-6877.

For roadside assistance, call Nationwide at 866-854-4140.

Frequently asked questions

Is Nationwide good at paying out claims?

Nationwide's reputation is a bit mixed. Many of the complaints against Nationwide focus on claims. But the company gets far fewer complaints than other companies of the same size, according to the National Association of Insurance Commissioners (NAIC) Complaint Index.

In addition, Nationwide has an A+ Financial Strength Rating from A.M. Best. That means it should have enough money to pay out claims, even if it gets a lot of claims at once.

Is Nationwide a good insurance company?

Yes, Nationwide is a good company. It has a reputation for dependable customer service and offers enough protection for most people. But Nationwide tends to be more expensive than other major companies, like State Farm or Geico.

Is Nationwide cheap?

Nationwide's auto and motorcycle rates tend to be more expensive than average. Home insurance rates from Nationwide are more affordable, but you can probably still find cheaper quotes elsewhere.

Who owns Nationwide?

Nationwide is a mutual insurance company, meaning it is owned by the people who carry Nationwide insurance policies. Nationwide is not owned by a larger group.

Methodology

To compare the costs of Nationwide's car insurance quotes, ValuePenguin gathered rates across 19 states and Washington, DC. Rates are for a 30-year-old single man with a clean driving record and good credit score who owns a 2015 Honda Civic EX.

Full coverage quotes have higher liability limits than the state requirements, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per accident and $100,000 per person

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist property damage: $50,000 per accident and $100,000 per person

- Personal injury protection or medical payments: $5,000

- Comprehensive and collision deductible: $500

To review home insurance rates, ValuePenguin collected quotes across 19 states. Quotes are for a 45-year-old married man with no history of home insurance claims.

The dwelling coverage limit is based on the median home value in each individual state. Quotes include $100,000 of personal liability coverage and $5,000 of medical payments coverage, and have a $1,000 deductible.

To review motorcycle insurance rates, ValuePenguin collected quotes from 33 states. Rates are for a 45-year-old man who owns a 2018 Honda CMX500 Rebel.

Full coverage motorcycle insurance quotes have higher liability limits than required by state law, as well as comprehensive and collision coverage.

- Bodily injury liability: $50,000 per accident and $100,000 per person

- Property damage liability: $25,000 per accident

- Personal injury protection or medical payments: $5,000

- Comprehensive and collision deductible: $500

To compare renters insurance rates, ValuePenguin collected quotes from 40 states. Rates are for a 25-year-old single man with no roommates or pets and no history of insurance claims.

Renters insurance quotes include $30,000 of personal property coverage, $100,000 of personal liability and $1,000 of medical payment coverage, with a $500 deductible.

Quadrant Information Services supplied the home and auto insurance rate data in this analysis. Rates were publicly sourced from insurance company filings and are intended for comparative purposes only. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.