Good Student Insurance Discount: Who Offers It, and How to Save

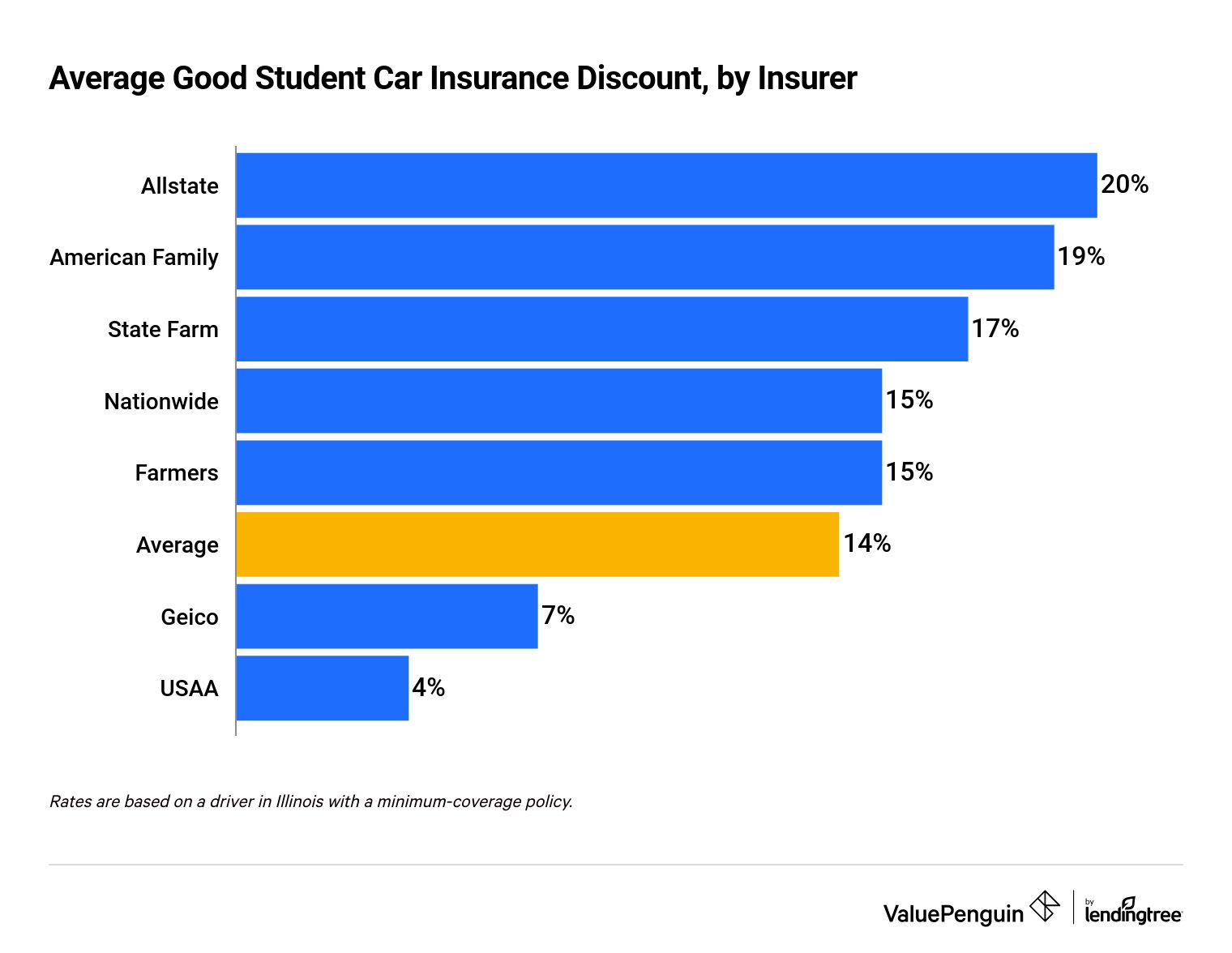

High school and college students can save between 4% and 20% on their car insurance by getting good grades, from companies like Geico, State Farm, or Allstate.

Find Cheap Auto Insurance Quotes in Your Area

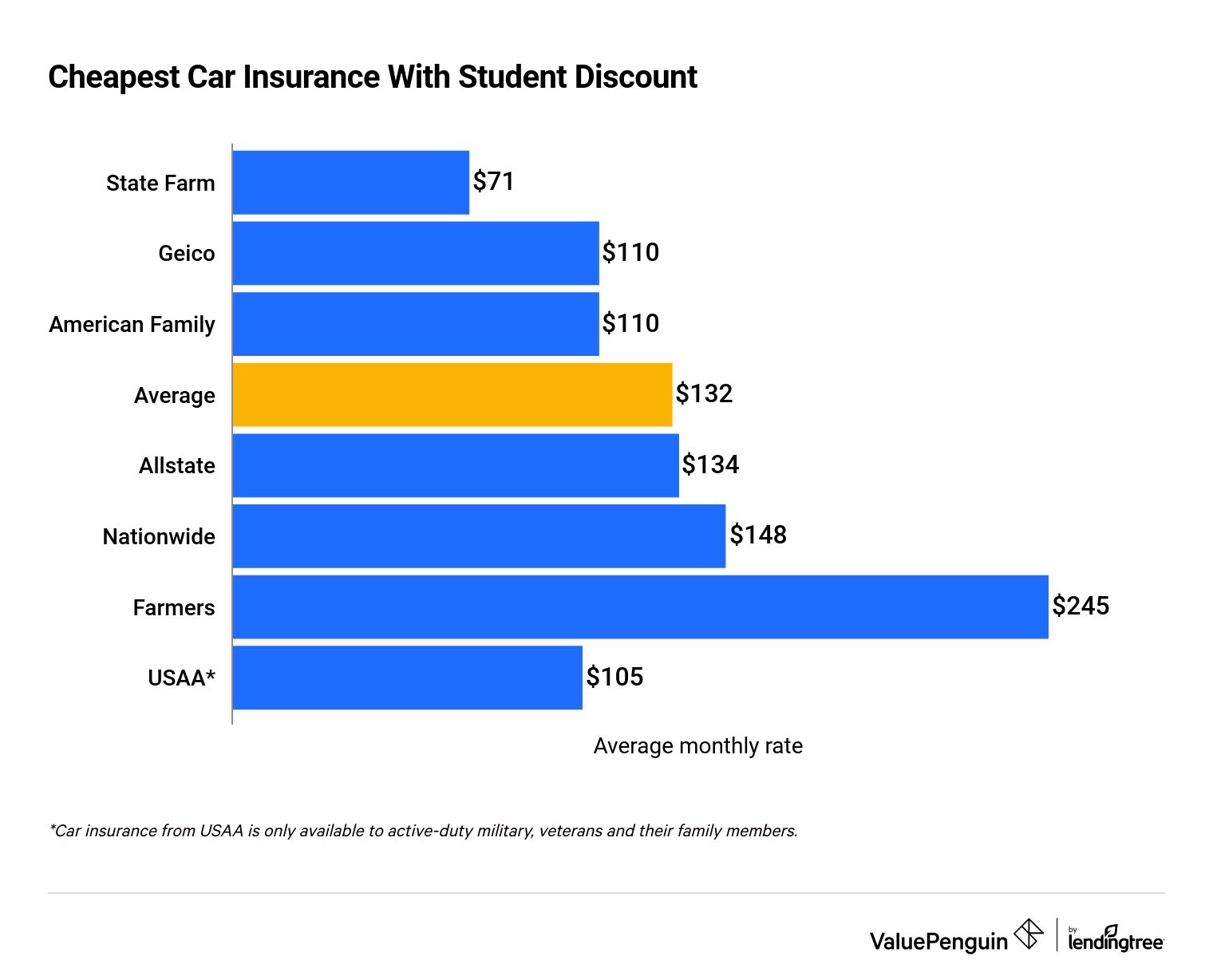

The largest good student discount among major insurance companies is at Allstate. But State Farm, is the best and cheapest car insurance overall, despite a smaller discount.

Most companies require a B average or better or being in the top 20% of the class to earn a good student discount.

Best insurance companies with student discounts

State Farm has the cheapest car insurance overall for good students. A minimum-coverage policy with the discount costs $71 per month, or $848 per year. That amounts to a 17% savings for good students.

Allstate has the largest good student discount, at about 20% off the standard price. But their rates are higher than average, even after the discount. So compare quotes from other companies rather than going with Allstate based only on the discount.

Find Cheap Auto Insurance Quotes in Your Area

With a good student discount, you can expect to save around $22 per month for minimum coverage. But you could save up to $174 per month by shopping around.

Average monthly car insurance quotes for students

Company | Good student discount | Cost with discount | Cost without discount |

|---|---|---|---|

| Allstate | 20% | $134 | $167 |

| American Family Insurance | 19% | $110 | $137 |

| State Farm | 17% | $71 | $85 |

| Nationwide | 15% | $148 | $175 |

| Farmers | 15% | $245 | $288 |

| Geico | 7% | $110 | $118 |

| USAA | 5% | $105 | $110 |

Rates are based on a minimum-coverage policy in Illinois.

How do I get a good student discount?

The most important part to getting a good student discount is making sure your grades are high enough. The process is straightforward.

1. Get good grades

To qualify for a good student discount, you need to have a B average or better or be in the top 20% of your class. This is usually based on your cumulative transcript, so don't worry about one subpar semester.

Another option is to score in the top 20% nationally on one of several standardized tests.

Full list of requirements for a good student discount:

- Age: 16–25

- Single

- Full-time enrolled in high school, college or homeschooling

-

One of the following:

- B or 3.0 GPA or top 20% of your class

- Rank in the top 20% on the ACT, SAT, PSAT, TAP, PACT, California Achievement Test or Iowa Test of Basic Skills

2. Shop around for quotes

Many companies give discounts for good grades. The process of finding out your discount is just like getting any other auto insurance quote. Just keep an eye out for a "good student" checkbox on the form.

Companies with good student discounts include:

Keep in mind, a large discount doesn't necessarily mean the cheapest car insurance. Although Allstate has the biggest student discount, at around 20%, the total rate is still twice as high as the cheapest option overall, State Farm.

Find Cheap Auto Insurance Quotes in Your Area

Cheapest car insurance with student discount

Company | Average rate | |

|---|---|---|

| State Farm | $71 | |

| Geico | $110 | |

| American Family Insurance | $110 | |

| Allstate | $134 | |

| Nationwide | $148 |

USAA is only available to active-duty military, veterans, and their family members.

3. Submit proof of your good grades

After you've found the best price and applied for insurance, you'll need to submit proof that you're enrolled in school full time and getting good grades. Often, this will be a copy of your most recent high school or college transcript, but requirements vary by company.

If you're using a standardized test to qualify, you can submit an official printout of your score and percentile. Freshmen in high school may have to wait for a report card, but anyone else should be able to apply at any point.

Can I get a good student discount if I'm homeschooled?

Things are a little trickier for homeschooled students. It says in Allstate's "Good Student Discount" section that kids who are homeschooled qualify for the discount. Geico and State Farm make no mention of homeschooling, though.

Homeschooled students will have to ask the company directly and see if there are specific requirements. A standardized test may be the only way for a homeschooled student to get the discount.

For some companies, including State Farm, you don't even have to be enrolled in college to earn a good student discount. If you have completed a two- or four-year degree and are under 25, a school transcript can earn you the discount.

Other car insurance discounts for students

A good student discount isn't the only way for students to save on car insurance.

Frequently asked questions

Do grades affect car insurance rates?

Yes, student drivers can save 4% to 20% on car insurance by earning a 3.0 GPA or better or earning a spot in the top 20% of their class.

Does Progressive have a student discount?

Yes, Progressive offers a discount for students under 23 with a B average or better. The company's average good student discount starts at 5%.

How much is the good student discount at State Farm?

Good students can save an average of 17% on minimum coverage with State Farm. They also have the cheapest car insurance rate for students — $156 per month for minimum coverage. This includes a good student discount.

How much is USAA's good student discount?

USAA offers the smallest good student discount, at 5%. But it's still the second-cheapest company for minimum-coverage insurance. Good students can expect to pay around $92 per month.

What GPA is needed for a good student discount?

Most companies require a 3.0 GPA or better to earn a good student discount.

Methodology

Car insurance rates were collected for men ages 18, 20 and 22 who live in Illinois and own a 2015 Honda Accord.

Quotes are based on the minimum coverage required in Illinois:

Coverage | Limit |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $20,000 per accident |

| Uninsured motorist bodily injury | $25,000 per person and $50,000 per accident |

This analysis used insurance rate data from Quadrant Information Services. The rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.