Geico Insurance Review: Auto, Home & Motorcycle (2026)

Geico is a good choice if you're looking for basic protection, at $65/mo for liability-only car insurance. Its app and website are easy to use, but you can find better customer service elsewhere.

Find the Cheapest Car Insurance Quotes in Your Area

Is Geico insurance good?

Geico is a good option for car insurance. It offers affordable rates and a convenient user experience. Geico sets itself apart with one of the best apps to get quotes and manage policies online.

However, there's a lot of variety in Geico's home insurance pricing, coverage options and discounts. That's because Geico works with around 45 companies to provide home insurance to its customers. This can make it hard to predict whether you'll get good customer service if you have to make a claim in the future.

Editor's rating breakdown

Pros and cons of Geico insurance

Pros

-

Easy to manage your policy or file a claim online or on the Geico app

Cons

-

Limited number of local agents

Geico car insurance review

Geico auto insurance has affordable quotes for most people.

The company also offers lots of discounts and enough coverage options for most drivers. But customers aren't always happy with Geico's claims process after an accident.

How much is Geico car insurance?

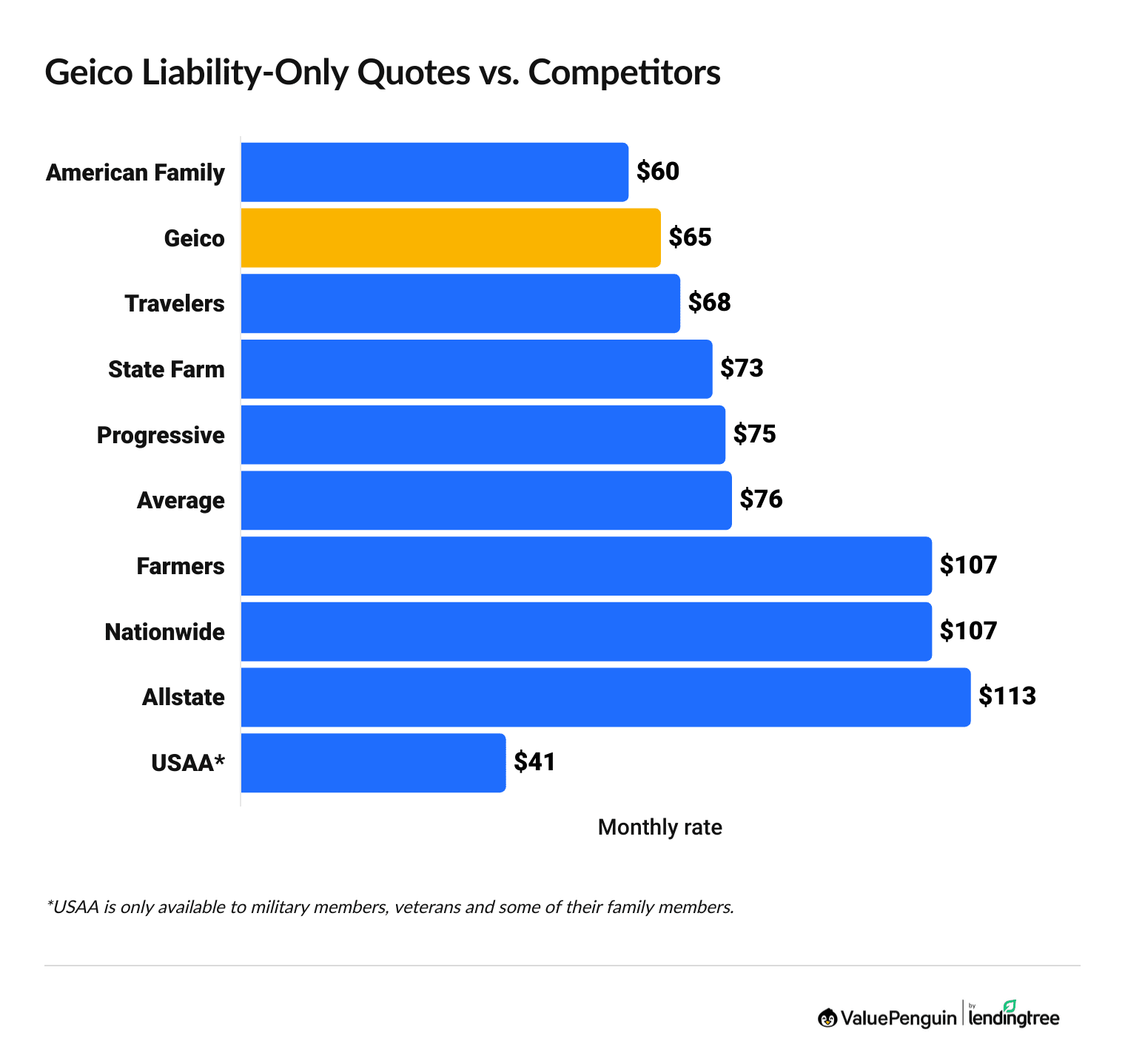

Geico has some of the cheapest liability-only car insurance quotes among major insurance companies, at just $65 per month, on average. Geico also has the cheapest liability-only quotes in 11 states.

Find the Cheapest Car Insurance Quotes in Your Area

Geico's full coverage car insurance isn't as good of a deal.

Full coverage from Geico is cheaper than average at $187 per month. But it's $28 per month more expensive than the cheapest major company, American Family.

But Geico does have the cheapest full coverage car insurance in 11 states and Washington, D.C.

Geico car insurance cost vs. competitors

Liability-only coverage

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| American Family | $60 | ||

| Geico | $65 | ||

| Travelers | $68 | ||

| State Farm | $73 | ||

| Progressive | $75 | ||

*USAA is only available to military members, veterans and their families.

Liability-only coverage

Company | Monthly rate | ||

|---|---|---|---|

| American Family | $60 | ||

| Geico | $65 | ||

| Travelers | $68 | ||

| State Farm | $73 | ||

| Progressive | $75 | ||

*USAA is only available to military members, veterans and their families.

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| American Family | $159 | ||

| Travelers | $173 | ||

| Geico | $187 | ||

| State Farm | $192 | ||

| Progressive | $207 | ||

*USAA is only available to military members, veterans and their families.

Geico also has very affordable rates for drivers with poor credit and teen drivers. But it's more expensive than average after an accident or DUI.

Poor credit

Company | Monthly rate | ||

|---|---|---|---|

| American Family | $263 | ||

| Geico | $305 | ||

| Travelers | $321 | ||

| Progressive | $355 | ||

| Nationwide | $390 | ||

*USAA is only available to military members, veterans and their families.

Teen drivers

Company | Liability-only | Full coverage | |

|---|---|---|---|

| Geico | $179 | $488 | |

| Travelers | $228 | $554 | |

| State Farm | $233 | $569 | |

| American Family | $264 | $627 | |

| Progressive | $271 | $777 | |

*USAA is only available to military members, veterans and their families.

Speeding ticket

Company | Monthly rate | ||

|---|---|---|---|

| American Family | $189 | ||

| State Farm | $210 | ||

| Travelers | $235 | ||

| Geico | $254 | ||

| Progressive | $278 | ||

*USAA is only available to military members, veterans and their families.

Accident

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $218 | ||

| Travelers | $254 | ||

| American Family | $257 | ||

| Progressive | $309 | ||

| Geico | $324 | ||

*USAA is only available to military members, veterans and their families.

DUI

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $268 | ||

| Travelers | $289 | ||

| American Family | $296 | ||

| Allstate | $435 | ||

| Geico | $441 | ||

*USAA is only available to military members, veterans and their families.

Geico auto insurance discounts

Geico offers a lot of discounts, but they're all fairly standard across the auto insurance industry. Most of Geico's discounts are for vehicle safety equipment and good driving habits. Geico also has discounts for members of specific organizations.

Although Geico offers a military discount, it's typically not the best option for active-duty or retired military members. Even with Geico's 15% military discount, a liability-only policy from Geico still costs $14 per month more than the same coverage at USAA, on average.

Save up to 23% on your medical payments coverage or personal injury protection if your car has air bags.

Get a discount of up to 5% if your vehicle has antilock brakes.

Save up to 23% on comprehensive coverage when you install an anti-theft system in your car.

Get a discount of up to 3% if your car has daytime running lights.

Save money by taking a defensive driving or driver education course.

Military members can save 25% during an emergency deployment.

Active or retired federal employees can get a discount of up to 12%.

Save up to 25% if you've been accident-free for five years.

Full-time students between 16 and 24 with a "B" average or better may save up to 15% on their Geico quote.

Get a discount if you belong to one of over 500 schools and universities, professional organizations and other institutions.

Active-duty and retired U.S. military members or members of the National Guard or Reserves could save up to 15%.

Save up to 25% when you insure more than one car with Geico.

Get a discount for bundling your homeowners, renters, condo or mobile home policy with Geico.

Save up to 15% if your car is newer than 3 model years old.

Save on your medical payments coverage or personal injury protection if you and your passengers always wear seat belts.

Geico will reduce your first year's payment by 9%, then 6%, 3% and 0% at the next three renewals. Currently only available in Wisconsin, Illinois, Virginia and Oregon.

Geico DriveEasy

Geico also offers a safe driving program. Geico DriveEasy tracks your driving habits and awards good driving with a discount of up to 10%. However, your rates could go up if you have poor driving habits, like speeding or using your phone while driving.

Geico auto insurance coverage

Geico has a few coverage options that you can add to your policy at an extra cost.

Geico roadside service covers jump starts, flat-tire changes and towing if your car breaks down on the side of the road. It will also pay up to $100 for locksmith services.

Mechanical breakdown insurance covers certain car repairs. This can include fixing your engine, transmission or air conditioner. You'll have to pay a $250 deductible, and Geico will cover the remaining cost. However, it doesn't pay for routine maintenance or wear and tear.

Mechanical breakdown insurance is available for cars under 15 months old with fewer than 15,000 miles. Once you have this coverage, you can renew it for up to seven years or 100,000 miles.

Rental reimbursement pays for a rental vehicle while your car is in the repair shop after an accident.

You'll choose limits per day and per claim when you buy rental reimbursement. For example, you might pick $45 per day and $1,350 per claim.

This coverage typically fills the gap between your car insurance and the protection offered by the rideshare company. However, you can't get Geico rideshare insurance online. You must call Geico at 800-207-7847 to buy a rideshare policy.

Geico accident forgiveness

With accident forgiveness, your auto insurance rates won't go up after your first at-fault accident. Geico offers two types of accident forgiveness:

- Free accident forgiveness for drivers who have been accident-free for five years or more

- Upgraded accident forgiveness, which some people with good driving records can get at an extra cost (not available in California, Connecticut or Massachusetts)

Geico also offers the standard car insurance coverages you need to drive legally in your state and full coverage insurance, which includes comprehensive and collision coverage. These coverages pay for damage to your car after an accident.

It's important to note that Geico doesn't offer gap insurance. Gap insurance covers the amount left to pay off your car loan or lease if your vehicle is totaled.

Other Geico car insurance perks

Geico also offers a few helpful perks, like its Prime Time contract for drivers over 50 years old.

Prime Time contract

The Geico Prime Time contract is a program for customers over 50. Drivers with the Prime Time contract will always have the option to renew their insurance policy.

Besides being over the age of 50, to qualify for Prime Time, you must not have:

- Drivers under 25 years old on the policy

- Any tickets or accidents in the last three years

- Business vehicles insured on the policy

This program protects drivers from situations where an insurance company might not offer to renew a policy. Although you must have a clean record when you sign up for Prime Time, if you get multiple tickets after you sign up, Geico won't cancel your policy. The Prime Time contract does not guarantee that your rates will always be the same.

Auto repair program

The Geico Auto Repair Xpress program guarantees any repairs done by a shop in the Geico network. Geico guarantees the repairs for as long as you own your car.

Car-buying service

The Geico car-buying service connects you to local dealerships. It lets you see what other people have paid for a specific vehicle. You can use this service to compare car prices without having a Geico insurance policy.

Geico auto insurance reviews and ratings

Geico car insurance has mixed reviews from well-known rating companies and customers alike.

One benefit of choosing Geico is that it has an A++, or Superior, financial strength rating from AM Best. That means Geico should be able to pay claims even in tough economic times.

Compare Geico car insurance vs. competitors

Geico is a better choice than Allstate if you're shopping for the best price. However, Allstate offers more coverage add-ons for people who want extra protection.

Neither company has great customer service reviews.

Geico | ||

|---|---|---|

| Editor's rating | ||

| Liability-only rate | $65/mo | $113/mo |

| Full coverage rate | $187/mo | $282/mo |

| Discounts | ||

| Coverage | ||

| Customer service |

Rates are based on monthly payments.

Geico is typically a better choice than Mercury Insurance. While Geico's liability-only coverage is slightly more expensive, it offers far more discounts than Mercury. So Geico may be the cheaper option for some people.

Both companies have mixed customer service reviews. While Mercury scores higher on J.D. Power's claims satisfaction survey, it gets more customer complaints than Geico.

Geico | ||

|---|---|---|

| Editor's rating | ||

| Liability-only rate | $65/mo | $58/mo |

| Full coverage rate | $187/mo | $218/mo |

| Discounts | ||

| Coverage | ||

| Customer service |

Rates are based on monthly payments.

Geico is much cheaper than Nationwide, and it offers more discounts. But you may be able to earn a big discount by signing up for Nationwide's behavior-based program, SmartRide, or its pay-per-mile program, SmartMiles.

Nationwide's customer service is also much better than Geico's. So it's a better choice if you don't mind spending more for great service.

Geico | ||

|---|---|---|

| Editor's rating | ||

| Liability-only rate | $65/mo | $107/mo |

| Full coverage rate | $187/mo | $265/mo |

| Discounts | ||

| Coverage | ||

| Customer service |

Rates are based on monthly payments.

Geico is a better choice than Progressive for most people. Geico tends to have cheaper rates than Progressive, and its long list of discounts means you'll probably find more ways to save on your car insurance bill.

However, Progressive offers more coverage add-ons than Geico. That means it may be better for people who need extra coverage, like protection for custom parts and equipment.

Geico's customer service reviews aren't great, but they're better than Progressive's. Progressive earned the third-lowest rating on J.D. Power's claims satisfaction survey.

Geico | ||

|---|---|---|

| Editor's rating | ||

| Liability-only rate | $65/mo | $75/mo |

| Full coverage rate | $187/mo | $207/mo |

| Discounts | ||

| Coverage | ||

| Customer service |

Rates are based on monthly payments.

State Farm is a better choice than Geico for many people. State Farm typically costs a few dollars per month more than Geico. But it could be worth spending a little more for State Farm's excellent customer service, which will likely help you get back on the road faster after an accident.

Geico | ||

|---|---|---|

| Editor's rating | ||

| Liability-only rate | $65/mo | $73/mo |

| Full coverage rate | $187/mo | $192/mo |

| Discounts | ||

| Coverage | ||

| Customer service |

Rates are based on monthly payments.

Geico homeowners insurance review

You should only consider Geico homeowners insurance if you have another policy with Geico and can get its bundling discount.

That's because Geico doesn't sell its own homeowners insurance policies. Instead, it partners with around 45 other home insurance companies. After buying a policy through Geico, you'll work directly with one of these companies. Your customer service experience could be very different depending on which company Geico pairs you with.

You don't get to choose which company you'll work with when you get Geico home insurance. Each has its own rates, coverage options and discounts. In fact, it can be difficult to know which company is insuring you until after you've bought your policy.

That's why we typically recommend Geico home insurance only if you're bundling it with an auto or motorcycle policy.

Alternatives to Geico homeowners insurance

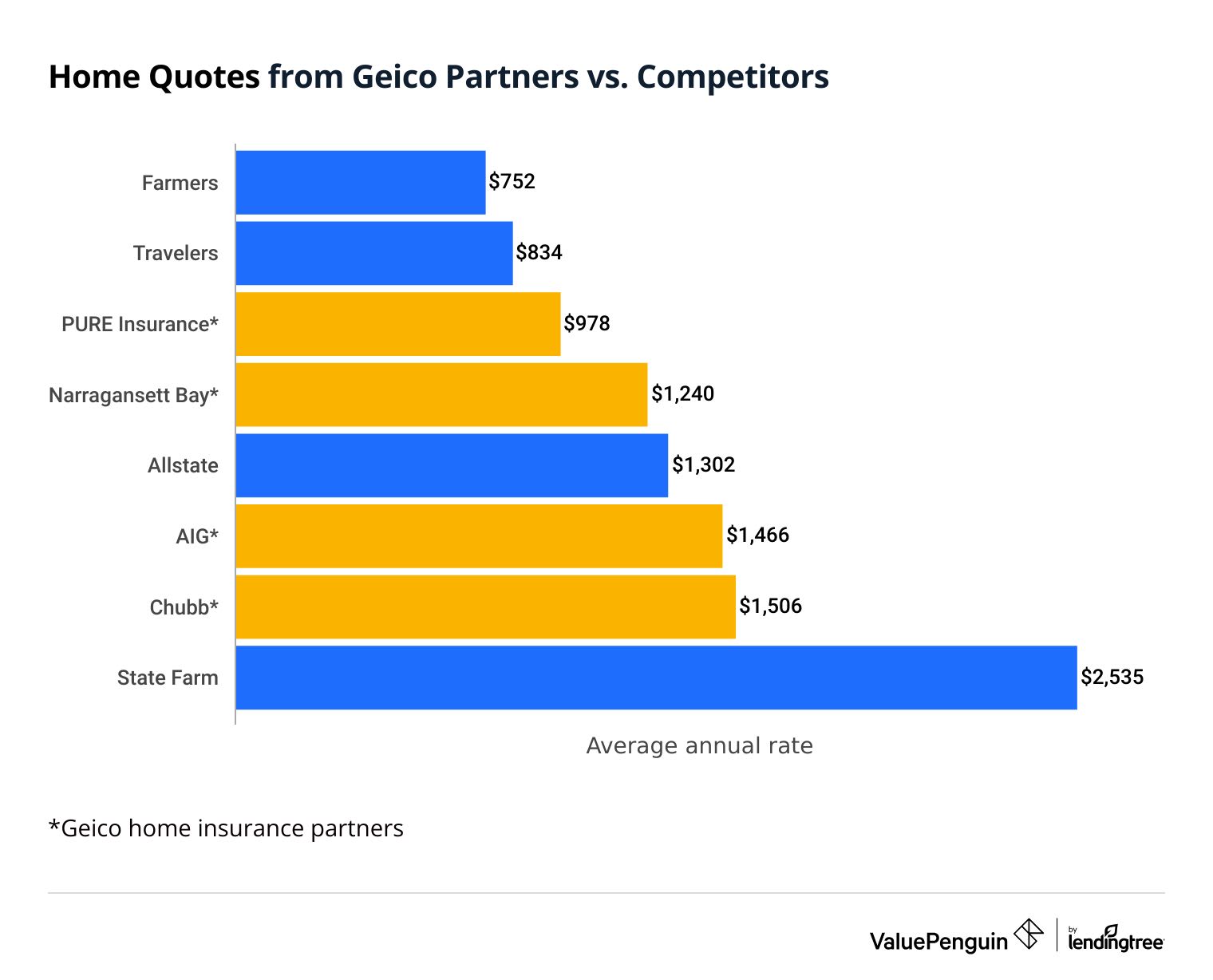

Geico home insurance quotes

Geico isn't typically the cheapest option for homeowners insurance.

And quotes vary widely depending on which affiliate the company pairs you with. For example, some of Geico's larger affiliates in New York are AIG, Chubb, Pure Insurance and Narragansett Bay. Pure is the cheapest of these options, at around $978 per year. However, home insurance from Chubb costs an average of $1,506 per year. That's a difference of $528 per year.

Unfortunately, you can't choose which provider Geico pairs you with, so there's no way to shop around to find the best rate.

Find the Cheapest Home Insurance Quotes in Your Area

Even if you're getting a discount from Geico for bundling your home and auto insurance, you may be able to pay less by buying policies from two different companies.

For example, the average cost of Farmers home insurance is $752 per year. Even if Geico matched you with Pure Insurance, it's still 30% more expensive than Farmers. That's typically more than you would save with a bundling discount.

Home insurance quotes from Geico affiliates vs. competitors

Company | Annual rate | |

|---|---|---|

| Farmers | $752 | |

| Travelers | $834 | |

| * Pure Insurance | $978 |

| * Narragansett Bay | $1,240 |

| Allstate | $1,302 | |

| * AIG | $1,466 |

| * Chubb | $1,506 | |

| State Farm | $2,535 | |

*Geico affiliate

Geico homeowners insurance discounts

Geico only offers three home insurance discounts on its policies. That's far fewer than most major companies offer.

- Multipolicy discount for bundling your home insurance with a car, motorcycle or other type of insurance policy

- Home security systems discount for protecting your home with a security system

- A discount for having smoke alarms and fire extinguishers in your home

Geico homeowners insurance coverage options

Each of Geico's home insurance partners offers its own unique set of insurance coverages.

You can expect Geico's partners to offer the basic protection included in most home insurance policies. This includes:

- Medical payments coverage

- Loss or use or additional living expenses

They may also offer common add-ons like protection for valuable jewelry or identity theft coverage. But, unfortunately, you won't know which coverage options you have until you're toward the end of the quote process.

Geico home insurance reviews and ratings

It's hard to predict what type of customer service you'll get from Geico home insurance until you buy a policy.

That's because around 45 different partner companies underwrite Geico home insurance. Once you have a policy, you'll contact your underwriting company directly to file a claim. It will also help you make changes to your policy or answer billing questions.

Some of Geico's partners have better customer service reviews than others.

For example, J.D. Power's customer satisfaction survey ranked AIG 5th out of 22 of the largest home insurance companies. That means homeowners are typically happy with the service they get at AIG.

However, Homesite, another Geico partner, earned the lowest score of the group. That means Homesite customers may have difficulty getting the company to pay for repairs after an emergency.

Geico home insurance customers on Reddit tend to have similar complaints.

For example, one Redditor who bundled their auto and home insurance with Homesite through Geico complained that the company offered significantly less money to repair their home after Hurricane Helene than the quotes they received from local contractors.

Geico motorcycle insurance

Geico motorcycle insurance is only worth considering if you're already a Geico auto insurance customer.

Geico's motorcycle insurance rates are a little more expensive than average, and the company doesn't offer many extra coverage options or discounts. The main reason to consider Geico motorcycle insurance is the convenience of having your motorcycle and auto insurance policies with the same company.

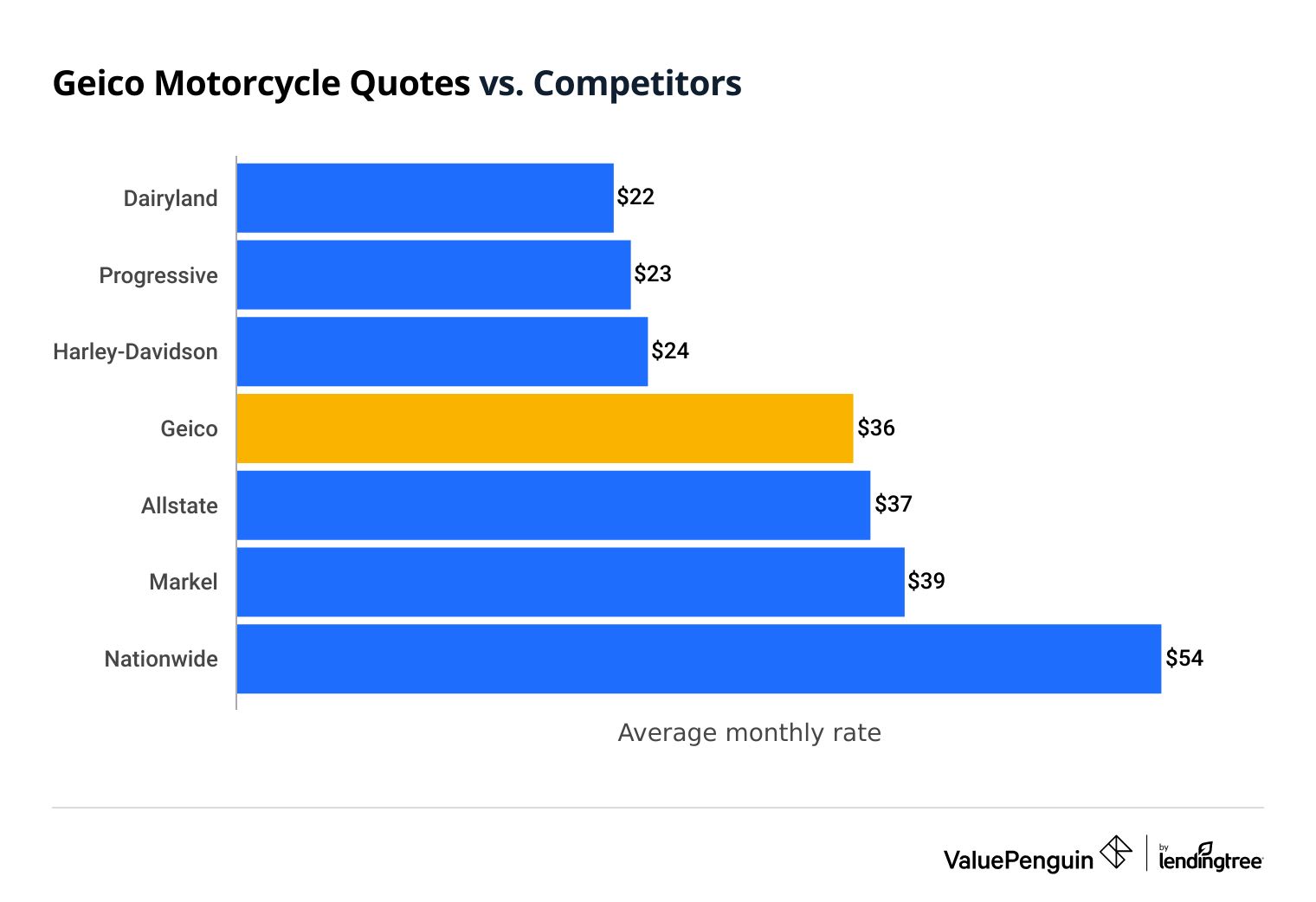

Geico motorcycle insurance quotes

Full coverage motorcycle insurance from Geico costs around $36 per month. That's 8% more expensive than the national average.

Compare Motorcycle Insurance Quotes

However, coverage from Progressive costs just $23 per month, on average. That's $13 per month less than a policy from Geico. In addition, Progressive's standard policy includes extra coverage perks that aren't available from Geico.

Geico motorcycle quotes vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $22 | ||

| Progressive | $23 | ||

| Harley-Davidson | $24 | ||

| Geico | $36 | ||

| Allstate | $37 | ||

| Nationwide | $55 | ||

Geico motorcycle insurance discounts

Geico offers a few motorcycle insurance discounts, but not as many as most of its competitors. The discounts Geico offers are generally easy to qualify for, however.

For example, switching to Geico from a different insurance company can get you a discount of up to 10%.

Motorcycle Safety Foundation instructors get a discount of up to 20%.

Get up to 10% off when you renew your motorcycle insurance policy with Geico.

Mature riders can save up to 10%.

Insure more than one motorcycle with Geico and earn a discount of up to 10%.

Bundle your motorcycle and car insurance with Geico to earn up to 5% off motorcycle insurance.

Complete a motorcycle safety course and get a discount of up to 10%.

Geico motorcycle insurance coverage options

Geico offers fewer extra motorcycle coverage options than other insurance companies.

Riders can upgrade their basic motorcycle insurance policy to include roadside assistance and coverage for accessories, like a saddlebag or CB radio.

However, Geico doesn't offer some popular coverage options you can find with other companies. For example, you can't get rental car coverage to help pay for a vehicle while your motorcycle is in the shop after a crash.

For that reason, Geico motorcycle insurance is only a good choice if you're shopping for the most basic coverage available.

About Geico insurance company

Established in 1936, Geico is now the third-largest car insurance company in the U.S.

Geico sells many types of insurance in addition to auto, home and motorcycle insurance.

Other types of insurance from Geico

One drawback of Geico is that it has very few in-person offices compared to other large insurance companies. If you prefer to work with your insurance agent in person, another company may be a better fit.

Frequently asked questions

Is Geico or Progressive cheaper?

Geico is cheaper than Progressive for most drivers. Full coverage car insurance from Geico costs an average of $187 per month. That's $20 per month cheaper than Progressive.

Geico's liability-only coverage costs an average of $10 per month less than a policy from Progressive.

How much is Geico car insurance?

The average cost of a full coverage policy from Geico is $187 per month. That's 2% cheaper than the national average. However, your rates may vary depending on where you live, your driving history, the type of car you drive and your personal info.

Is Geico a good insurance company?

Yes, Geico is a good company. It has affordable car and motorcycle insurance rates, and it's easy to buy a policy online. But Geico doesn't use insurance agents. So look elsewhere if you want to have a dedicated person who helps you manage your insurance.

Is Geico home insurance good?

Geico home insurance can be unpredictable. That's because Geico doesn't underwrite its home insurance. Instead, it partners with over 40 companies to offer its customers home insurance.

Each of these companies has different pricing, discounts and coverage options. They also have varying customer service reputations. So, it's hard to know whether you'll get quality service unless you spend time researching the specific partner Geico pairs you with.

Methodology

ValuePenguin's auto and home analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Geico's overall rating is weighted by 50% car insurance, 25% home insurance and 25% motorcycle insurance.

Auto insurance

To find the average cost of Geico car insurance, ValuePenguin gathered rates across 50 states and Washington, D.C. Rates are for a 30-year-old man with good credit and a clean driving record, unless otherwise noted. He owns a 2018 Honda Civic EX.

Full coverage quotes include collision and comprehensive, plus higher liability limits than required in each state.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

- Personal injury protection: Minimum when required by state

Home insurance

To find the cost of home insurance for Geico affiliates, ValuePenguin gathered quotes from all residential ZIP codes across New York state. Rates are for a 45-year-old married man with no prior home insurance claims. He has $313,700 of dwelling coverage and $100,000 of personal liability coverage with a $1,000 deductible.

Motorcycle insurance

To find the cost of Geico motorcycle insurance, ValuePenguin collected quotes across all 50 states. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Quotes are for a full coverage motorcycle policy, which includes higher liability limits than the state requirement, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision: $500 deductible

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.