Average Cost of Motorcycle Insurance (2026)

The average cost of motorcycle insurance in the U.S. is $33 per month for a full coverage policy.

Find Cheap Motorcycle Insurance Quotes in Your Area

Full coverage motorcycle insurance costs between $10 and $139 per month. The company you choose, where you live, your age and the type of bike you ride tend to have a big impact on your motorcycle insurance rates.

What affects motorcycle insurance rates?

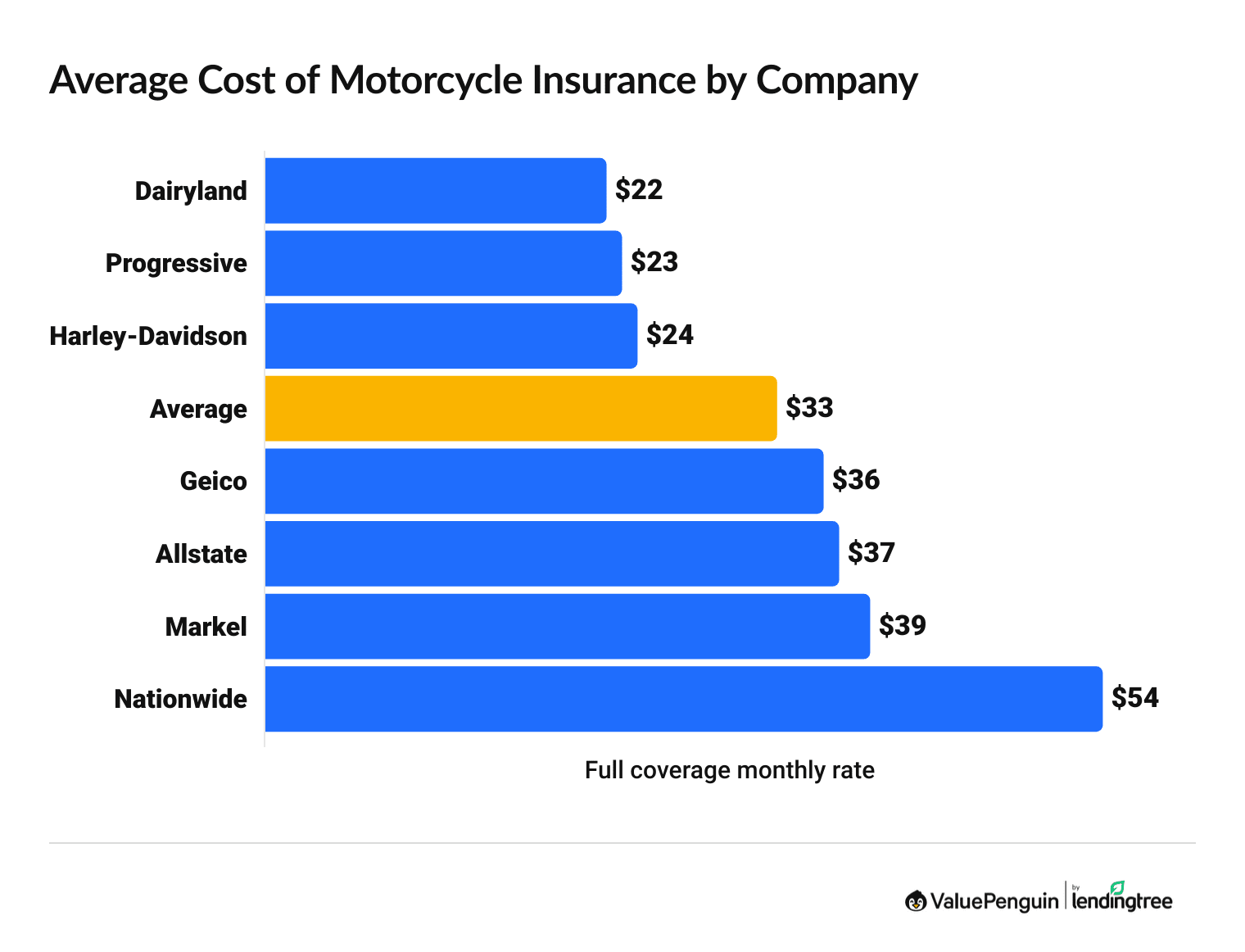

How much is motorcycle insurance by company?

Dairyland has the cheapest bike insurance, at around $22 per month for full coverage.

Progressive and Harley-Davidson also offer affordable quotes, at less than $25 per month.

Find Cheap Motorcycle Insurance Quotes in Your Area

Average cost of motorcycle insurance by company

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $22 | ||

| Progressive | $23 | ||

| Harley-Davidson | $24 | ||

| Geico | $36 | ||

| Allstate | $37 | ||

Motorcycle insurance from the cheapest company, Dairyland, costs an average of $33 per month less than the most expensive company, Nationwide.

However, there are lots of other things that affect your motorcycle insurance rates. For that reason, it's important to compare quotes from multiple companies to find the cheapest motorcycle insurance for you.

Yes, the cost of motorcycle insurance is rising. That’s because inflation is making labor to repair bikes more expensive, tariffs are making parts more expensive and some states are raising their minimum insurance requirements.

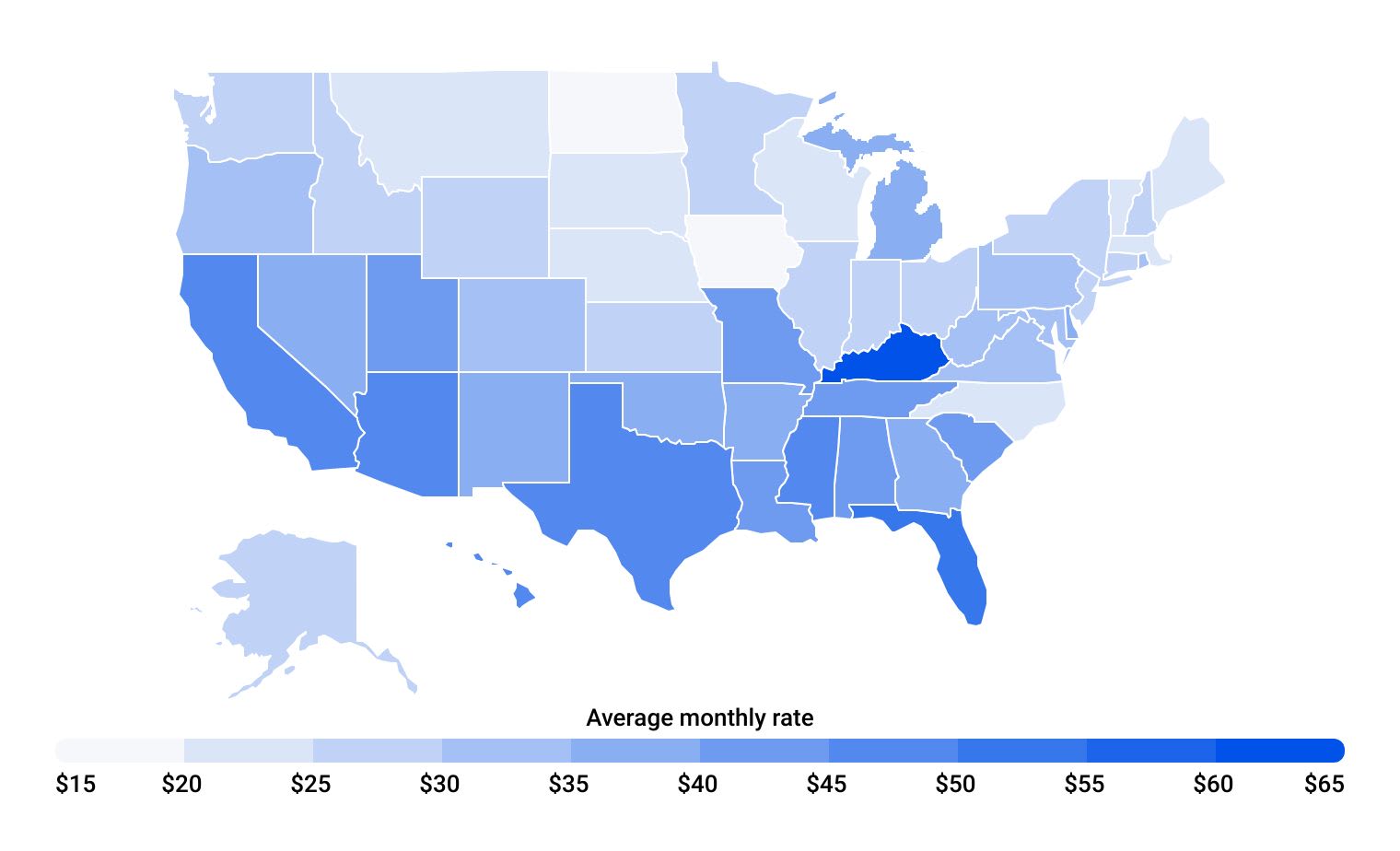

How much is insurance for a motorcycle in my state?

The average cost of insurance for motorcycles varies by up to $51 per month from one state to the next.

Kentucky has the most expensive motorcycle quotes in the country, averaging $69 per month for full coverage. Riders in North Dakota have the cheapest bike insurance quotes, at around $18 per month.

Motorcycle insurance is typically more expensive in places with high crime rates, more traffic and higher accident rates. That's because insurance companies believe riders in these areas are more likely to make a claim.

Motorcycle insurance in Florida costs $56 per month on average, which is on the higher end. Motorcycle insurance in California and Texas costs about $46 per month. But in Washington state, riders pay only $29 on average per month.

Average cost of motorcycle insurance by state

State | Monthly cost | % from U.S. avg. |

|---|---|---|

| Alabama | $40 | 20% |

| Alaska | $27 | -21% |

| Arizona | $49 | 46% |

| Arkansas | $36 | 8% |

| California | $46 | 39% |

States with the cheapest average motorcycle insurance rates

North Dakota, Iowa, South Dakota and Maine have the most affordable motorcycle insurance rates in the country.

Motorcycle insurance quotes in these states are at least 36% cheaper than the national average. That's partially because these states don't have densely populated cities, where accidents and motorcycle thefts are more common.

Cold winters also make for a shorter riding season. Less time on the road means riders aren't as likely to get into an accident.

States with the lowest motorcycle insurance prices

- North Dakota: $18 per month

- Iowa: $18 per month

- South Dakota: $20 per month

- Maine: $21 per month

- Massachusetts: $21 per month

- Vermont: $21 per month

- Montana: $22 per month

- North Carolina: $22 per month

- Wisconsin: $23 per month

- Nebraska: $24 per month

States with the highest average motorbike insurance cost

Kentucky, Florida, Arizona, Mississippi and Texas are the most expensive states for motorcycle insurance.

Riders in Kentucky pay more than double the national average of $33 per month.

In these states with warmer, longer riding seasons, motorcycle insurance costs are at least a third more than the national average.

States with the most expensive insurance rates for motorcycles

- Kentucky: $69 per month

- Florida: $54 per month

- Arizona: $49 per month

- Mississippi: $48 per month

- Texas: $46 per month

- California: $46 per month

- Hawaii: $45 per month

- Louisiana: $44 per month

- South Carolina: $44 per month

- Utah: $43 per month

If you live in a state with expensive rates, it's even more important to compare quotes to find the cheapest motorcycle insurance in your area.

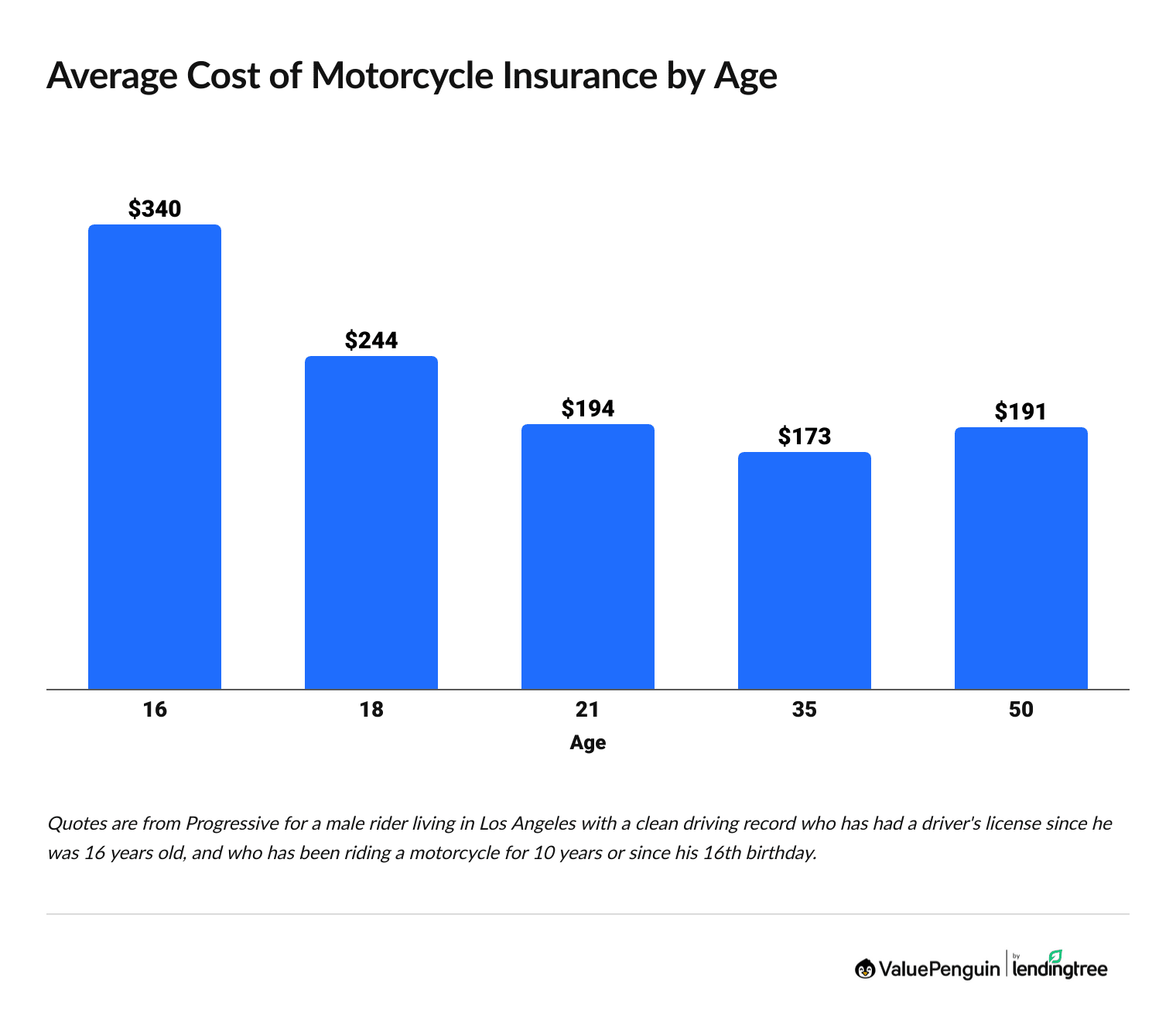

How much does motorcycle insurance cost by age?

An 18-year-old rider pays $244 per month on average for full coverage insurance, which is 41% more than what a 35-year-old pays.

Young drivers usually pay more for motorcycle insurance because they have less riding experience and are more likely to cause an accident.

Find Cheap Motorcycle Insurance Quotes in Your Area

Your insurance rate should go down quickly as you gain experience on the road, as long as you have a clean record. A 16-year-old pays an average of $340 a month for full coverage motorcycle insurance. The average motorcycle insurance cost for 18-year-olds is roughly 28% cheaper. And a 21-year-old rider pays $194 a month, which is 43% cheaper than the rate for 16-year-olds.

Full coverage motorcycle insurance can be very expensive for young riders. One way to lower your rate is to get liability-only insurance. This can be good if you have a cheaper bike and won't get much of a payout if it's totaled.

How much is bike insurance for sport vs. touring vs. cruiser vs. scooter?

Sport, supersport and street bikes are generally much more expensive to insure than other bikes.

That's because they usually cost a lot to replace and thieves often steal street bikes.

Find Cheap Motorcycle Insurance Quotes in Your Area

Compared to cruiser-style bikes, sport bikes cost more than three and a half times as much to cover.

Similarly, touring bikes are 33% cheaper to insure than sport bikes, even though they're much more expensive to replace.

Motorcycle insurance average cost by type

Type | Model |

Value

| Monthly cost |

|---|---|---|---|

| Cruiser | Yamaha V Star 250 | $3,620 | $116 |

| Cruiser | Honda Rebel 500 | $5,645 | $158 |

| Cruiser | Harley-Davidson Street 750 | $6,230 | $154 |

| Touring | BMW R 1250 RT | $18,920 | $283 |

| Touring | Harley-Davidson Road King | $17,900 | $223 |

- Value: More expensive motorbikes cost more to repair and replace. For that reason, insurance companies charge more for comprehensive and collision insurance on these bikes.

- Safety features: Bikes with more safety features, like anti-lock brakes, are less likely to be in an accident. That generally makes them cheaper to insure.

- Crash rate: Certain motorcycle models and styles have more accidents than others. If the type of bike you own is often in accidents, companies will assume you're more likely to file a claim.

- Theft rate: Insurance companies usually charge more to protect bikes that are often stolen with comprehensive insurance. That's because there's a higher chance the company will have to pay out a claim. Flashy and expensive bikes with higher theft rates are more expensive to insure.

How do I lower my motorbike insurance cost?

If you're looking to lower the cost of your motorcycle insurance, you should shop around for the cheapest rate, qualify for as many discounts as you can and adjust your coverage.

Compare motorcycle insurance quotes from multiple companies.

There's a difference of $33 per month between the most and least expensive motorcycle insurance companies nationally. The number may be even higher in your state. That's why you should always shop for rates from multiple companies before buying a motorcycle insurance policy.

Qualify for motorcycle insurance discounts. Most companies offer bikers a variety of ways to lower their motorcycle insurance rates.

You can typically save by bundling your motorcycle policy with auto or home insurance. You can also usually lower your rates by taking a motorcycle safety course or installing an anti-theft device on your bike.

Adjust your coverage. You can sometimes save a lot of money by adjusting your motorcycle insurance coverage, especially if there are add-ons that you don't need.

For example it may not be worth it to have comprehensive and collision coverage on an older bike. And if you have another vehicle or easy access to public transportation, you probably don't need rental car reimbursement.

You can also consider raising your deductible. A higher deductible typically leads to lower monthly payments. That's because your insurance company will pay less money if you're in a crash. However, it's important to choose a deductible you can afford to pay after an accident, especially if your bike is your only way to get around.

Frequently asked questions

How much is motorcycle insurance in the U.S.?

The average cost of motorcycle insurance in the U.S. is $33 per month, or $399 per year. There are a number of things that may make your insurance rates more or less expensive, including where you live, the company you choose, your age and the type of bike you drive.

Why is my motorcycle insurance so expensive?

The four main things that affect motorcycle insurance quotes are your age, your driving history, where you live and what type of motorcycle you have.

Less experienced riders or those with a recent accident pay more than riders with years of accident-free experience. If you live in an area with a lot of motorcycle theft, you'll likely pay more. And a powerful sport bike costs more to insure than a lower-power cruiser.

Are motorcycles expensive to insure?

Motorcycles are much cheaper to insure than cars. The average cost of full coverage motorcycle insurance is just $33 per month. Full coverage car insurance costs $175 per month, on average.

That's partially because many riders use their motorcycle as a second vehicle. Motorcycles are also typically cheaper to replace after an accident.

Do motorcycles need insurance?

In most states, the answer is yes. How much coverage you need to buy changes by state.

A few states allow you to legally ride a motorcycle without insurance or proof of financial responsibility. However, you should still protect yourself with an insurance policy.

Which motorcycles are expensive to insure?

Supersport or street bikes are typically the most expensive to insure. That's because people with street bikes tend to have riskier riding behaviors. Thieves tend to steal street bikes more than other types of bikes, like cruisers.

Methodology

ValuePenguin collected thousands of quotes from top insurance companies across the country to find the average cost of motorcycle insurance by state. Quotes are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

Rates are for a full coverage policy, which includes higher liability limits than the state requirement along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

To find out how driver age affects motorcycle insurance rates, ValuePenguin gathered quotes from Progressive for a man living in Los Angeles with a clean driving record. He has had his driver's license since he was 16 years old and has been riding a motorcycle for 10 years or since his 16th birthday, whichever is shorter.

When comparing the rates for different types of motorcycles, our editors collected quotes from Progressive for a 50-year-old single man with a clean record living in Los Angeles. He has had a driver's license since he was 16 years old and has been riding a motorcycle for 10 years.

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.