Cheapest Car Insurance in California (Best Rates in 2026)

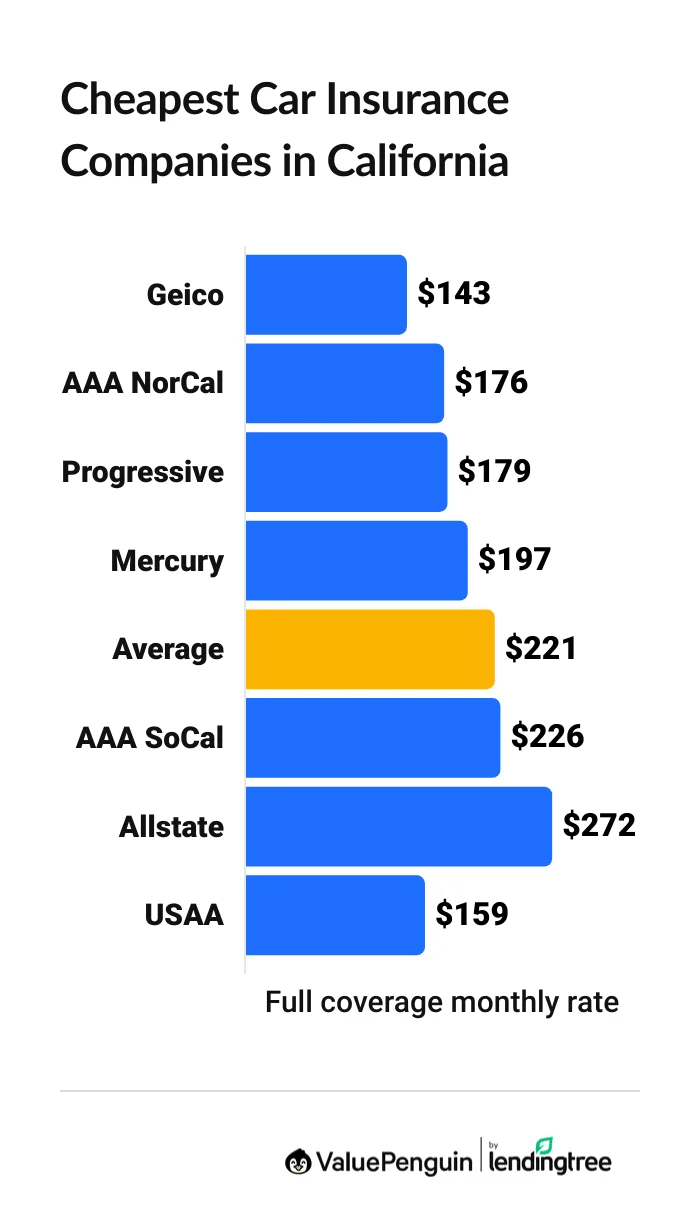

Geico has the best cheap car insurance in California, at $143 per month for full coverage. That's $78 per month cheaper than the state average.

Find Cheap Auto Insurance Quotes in California

Best cheap car insurance companies in California

Best and cheapest car insurance in California

- Cheapest full coverage: Geico, $143/mo

- Cheapest minimum liability: Geico, $41/mo

- Cheapest for young drivers: Geico, $126/mo

- Cheapest after a ticket: Geico, $223/mo

- Cheapest after an accident: Progressive, $293/mo

- Cheapest for teens after a ticket: Geico, $142/mo

- Cheapest after a DUI: Mercury, $351/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Geico offers the best combination of cheap quotes and reliable customer service for most California drivers. AAA has better service than Geico, but rates might be high depending on where you live. AAA is a good deal in Northern California, but a worse deal in SoCal.

People with military ties could get even better rates and service from USAA.

Cheapest full coverage car insurance in California: Geico

Geico has the best full coverage car insurance quotes in California, at $143 per month.

Find Cheap Auto Insurance Quotes in California

Full coverage from Geico is 35% cheaper than California's average rate of $221 per month.

Best full coverage car insurance in California

Company | Monthly rate | |

|---|---|---|

| Geico | $143 | |

| AAA NorCal | $176 | |

| Progressive | $179 | |

| Mercury | $197 | |

| AAA SoCal | $226 |

USAA is only available to current and former military members and their families.

Data-powered research on California car insurance

Data-powered research on CA car insurance |

|---|

You can also get cheap car insurance in California from USAA, Mercury, Progressive and AAA.

However, Geico and AAA have better customer service reviews than Mercury or Progressive. That's important if you ever need to make a claim or contact customer service.

There are two separate AAA companies in California, one for SoCal and one for NorCal.

In Northern California, AAA is sometimes called AAA NorCal or CSAA. But it may be called the Auto Club of Southern California or AAA SoCal in Southern California. You can't choose which one you have, but AAA has slightly better prices in NorCal.

Cheap liability insurance in California: Geico

Geico has the cheapest liability-only car insurance in California.

The company charges around $41 per month for a minimum liability policy. That's $34 per month cheaper than the California average of $75 per month.

Best cheap liability car insurance in California

Company | Monthly rate |

|---|---|

| Geico | $41 |

| AAA NorCal | $43 |

| Progressive | $53 |

| Mercury | $68 |

| AAA SoCal | $72 |

USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in California

- Is minimum coverage enough? A minimum coverage insurance policy gives you enough insurance to legally drive and avoid penalties such as getting your vehicle registration suspended, but it usually isn't enough to protect you after a bad accident. So it's often worth it to increase your coverage if you can afford it.

-

Getting help if you can't afford car insurance: Drivers with a low income can also get cheap car insurance with basic coverage through California's low-cost auto insurance program (CLCA). Rates are about $20 to $30 per month.

You're eligible for the low-cost insurance program if you make less than $39,125 per year as an individual or less than $80,375 as a family of four.

It's also a good idea to get quotes from smaller, regional companies, such as Wawanesa.

Find the best cheap car insurance near you

Cheapest insurance for California teens: Geico

Geico has the cheapest auto insurance in California for young drivers.

Minimum coverage from Geico costs around $126 per month for an 18-year-old driver. That's $62 per month cheaper than the statewide average of $188.

Geico also has the cheapest full coverage quotes for teen drivers in California. At $364 per month, full coverage from Geico is $144 per month less than average.

Best car insurance in California for young adults

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $126 | $364 |

| AAA NorCal | $139 | $551 |

| Progressive | $158 | $528 |

| Mercury | $176 | $471 |

| State Farm | $184 | $496 |

USAA is only available to current and former military members and their families.

Young drivers in California pay twice as much as older drivers for auto insurance. That's because young drivers have less experience behind the wheel, which means they're often more likely to cause a crash.

Young drivers in California should consider sharing a car insurance policy with their parents. A family policy costs an average of 44% less than two separate policies.

In addition, teens should get full coverage if they drive a lot or have a newer car. The added protection of collision and comprehensive insurance is especially useful if you're worried about how to replace your car if you cause an accident and it's totaled.

Best cheap CA auto insurance after a speeding ticket: Geico

Geico has the cheapest auto insurance in California for most drivers with a speeding ticket. Full coverage from Geico costs $223 per month after one ticket. That's $95 per month less than the state average of $318 per month for drivers with a speeding ticket.

For drivers in Northern California, AAA has coverage for the same price, and with better customer service than Geico. But it also requires that you sign up for a membership to AAA in order to buy a policy, and prices are higher for SoCal drivers.

USAA is a good option for drivers with military ties. At $193 per month, full coverage from USAA is $30 per month cheaper than Geico.

Cheapest car insurance rates in California after a ticket

Company | Monthly rate |

|---|---|

| Geico | $223 |

| AAA NorCal | $223 |

| Progressive | $274 |

| Mercury | $281 |

| AAA SoCal | $309 |

USAA is only available to current and former military members and their families.

Full coverage car insurance in California costs $97 more per month after a speeding ticket. That's a 44% increase. You'll typically pay more for car insurance after a speeding ticket because insurance companies believe you're more likely to cause an accident in the future.

Don't rush to switch insurance companies if you just got a speeding ticket in the mail or made a claim after a car crash. You'll get higher rates when you shop, but you won't pay higher rates with your current company until your policy renews.

Wait to shop for quotes until you see your new rate from your current company. Then, compare that with rates from cheaper companies in California.

Cheap auto insurance in CA after an accident: Progressive

Progressive has the cheapest full coverage car insurance quotes in California for drivers with an accident on their record. The company's average rate after an accident is $293 per month. That's one-third less per month than the California state average of $437 per month.

Inexpensive car insurance in California after an accident

Company | Monthly rate |

|---|---|

| Progressive | $293 |

| Mercury | $312 |

| AAA NorCal | $357 |

| Geico | $359 |

| AAA SoCal | $387 |

USAA is only available to current and former military members and their families.

California drivers pay about twice as much for car insurance after an accident. That's an average increase of $216 per month for full coverage.

Cheapest for teens after a ticket or accident: Geico and USAA

Geico has the best rates for most young drivers in California after a speeding ticket. Minimum liability insurance from Geico costs $142 per month with a speeding ticket in California. That's $112 per month cheaper than the average cost after one ticket, which is $254 per month.

Geico also has the cheapest quotes for most teens who have had an accident, at $173 per month for minimum coverage. Plus, Geico offers accident forgiveness. So you could avoid higher rates after your first accident if you have this perk.

Cheap quotes for CA teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Geico | $142 | $173 |

| Progressive | $205 | $229 |

| AAA NorCal | $210 | $258 |

| Mercury | $234 | $221 |

| Farmers | $286 | $286 |

USAA is only available to current and former military members and their families.

In California, 18-year-old drivers pay $66 per month more for liability-only car insurance after a speeding ticket. Rates go up by an average of $92 per month after an accident.

Cheap California auto insurance quotes after a DUI: Mercury

Mercury has the most affordable car insurance in California for drivers with a DUI. Its average rate of $351 per month for full coverage is $269 cheaper each month than the California average.

Low-cost insurance in California after a DUI

Company | Monthly rate |

|---|---|

| Mercury | $351 |

| Geico | $361 |

| Progressive | $428 |

| Farmers | $510 |

| Travelers | $629 |

USAA is only available to current and former military members and their families.

The average cost of full coverage insurance after a DUI in California is $620 per month. That's nearly three times as much as what drivers with a clean driving record pay for coverage.

High-risk drivers may also need SR-22 insurance after a DUI in California. This means your insurance records are sent to the California Department of Motor Vehicles.

Top-rated auto insurance in California: USAA

USAA is the best California auto insurance company because of its dependable coverage, great support and affordable rates.

However, only military members, veterans and their family members can get car insurance from USAA.

AAA and State Farm are also great options for California drivers who don't qualify for USAA. These companies offer reliable service, though they aren't always the cheapest option.

Best California auto insurance companies

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| AAA NorCal | 652 | NR | |

| AAA SoCal | 652 | NR | |

| State Farm | 650 | A++ | |

| Farmers | 622 | A |

Average auto insurance rates in California by city

Beverly Hills is the most expensive city in California for car insurance, at $356 per month for full coverage.

The cheapest city, Mount Shasta, has an average rate of $166 per month.

California car insurance quotes near you

City | Monthly rate | % from average |

|---|---|---|

| Acalanes Ridge | $202 | -8% |

| Acampo | $208 | -6% |

| Acton | $225 | 2% |

| Adelanto | $257 | 16% |

| Adin | $189 | -14% |

The average cost of a full coverage car insurance policy in California is $221 per month. But the average cost of car insurance can vary by up to $191 per month or more, depending on where you live.

You might have a higher insurance rate if there's a lot of car theft where you live, your roads are in bad shape or there are a lot of expensive cars on the road, like in Beverly Hills. If your neighbors all drive luxury cars, a crash will be more expensive because there's a higher cost to repair the vehicle.

Cheap car insurance in CA by driver type

Geico and Mercury are the cheapest car insurance companies for most drivers in California.

Driver type | Cheapest company |

Monthly cost in CA

|

|---|---|---|

| Cheapest minimum coverage | Geico | $41 (45% savings) |

| Cheapest for a safe driver | Geico | $143 (35% savings) |

| Cheapest after a ticket | Geico | $223 (30% savings) |

| Cheapest after an accident | Progressive | $293 (33% savings) |

| Cheapest after a DUI | Mercury | $351 (43% savings) |

| Cheapest for teens | Geico | $126 (33% savings) |

Minimum car insurance requirements in California

California requires minimum liability limits of 30/60/15 for bodily injury liability and property damage liability coverage, as of Jan. 1, 2025.

The change makes California's requirements among the top 10 highest in the country. Only eight states have requirements at that level or higher.

If you already have car insurance, you don't have to do anything to meet the new requirement. Your insurance company should automatically increase your limits.

- Bodily injury liability: $30,000 per person and $60,000 per accident

- Property damage liability: $15,000 per accident

This is the lowest amount of insurance coverage you can have. Any quotes you get will include at least this amount of coverage. However, these limits may not be high enough to cover the cost of a serious accident.

What's the best car insurance coverage for California drivers?

You usually have to have full coverage with comprehensive and collision insurance in California if you have a car loan or drive a newer car.

You should add collision and comprehensive coverage if your car is worth at least $5,000 or is newer than 8 years old. Your lender will typically require you to have both if your car is loaned or leased.

- Minimum coverage car insurance quotes meet California's minimum legal requirements.

- Full coverage goes beyond minimum coverage to include comprehensive and collision insurance. This protects your own car from damage after a crash, theft, vandalism or a storm, regardless of whose fault it is.

If you live in one of California's expensive ZIP codes and have savings or investments, you should raise your liability insurance limits. You should also consider adding umbrella coverage for extra financial protection.

On the other hand, if you're a college student with an older car who doesn't drive often, you may not need the same level of protection.

Car insurance discounts in California for affinity groups

The California Department of Insurance recently proposed regulations to limit discounts based on your job (such as lawyers and teachers) or group discounts (such as alumni associations). These discounts are sometimes called affinity group discounts.

Farmers offers the largest affinity group discount among the biggest insurance companies in California. The company discounts policies by 14% for a variety of professionals.

Company | Affinity group | Discount |

|---|---|---|

| 21st Century | American Medical Association membership | 4% |

| AAA | Accountants, educators | 8% |

| Allied | Accountants, dentists, educators | 10% |

| Allstate | Specialized professionals | 3% |

| Farmers | Accountants, aerospace engineers, dentists, educators, scientists | 14% |

Cost of California auto insurance over time

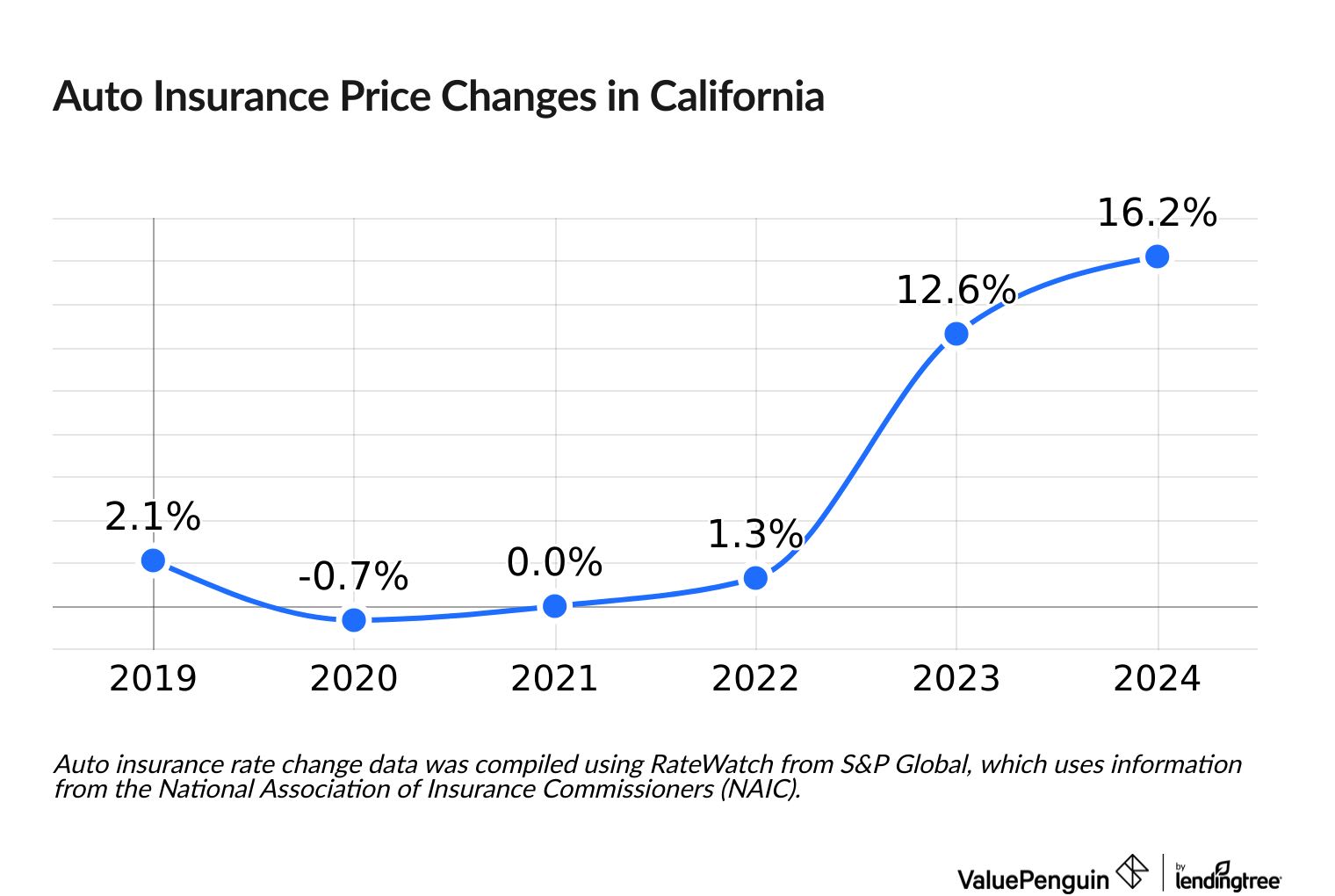

The cost of car insurance in California has gone up 29% since the start of 2023, after an informal pause on rate increases by the state’s insurance department during the COVID-19 pandemic.

The California Department of Insurance strictly limited how much insurance companies could raise rates through 2022. But as regulators began to approve rate increases, companies raised prices significantly to match the high inflation that occurred during and after the pandemic.

Auto insurance prices in California saw little to no increase between 2019 and 2022, but they shot up nearly 13% in 2023. Insurance companies raised rates by over 16% in 2024.

American Family had the biggest rate increase in 2024, at 46%. Allstate, State Farm and Mercury all raised rates by over 20%. Progressive and USAA customers saw the smallest increases.

Frequently asked questions

How much is car insurance in California per month?

The average cost of car insurance in California is $221 per month for a full coverage policy. Liability-only coverage costs an average of $75 per month.

Is insurance expensive in California?

California car insurance is cheaper than the national average. Full coverage in California costs an average of $221 per month, which is 5% cheaper than national rates. Minimum coverage in California costs about $75 per month, which is 16% cheaper than national rates.

Who has the cheapest car insurance in California?

What is the best place to get car insurance in California?

Is Geico leaving California?

No, Geico is still available in California. However, you can only get a policy if you shop on the website or the mobile app. Geico closed its physical offices in California in 2022, so there's no way to get a policy in person. It's worth it to get an online quote from Geico because it has the cheapest California car insurance, costing only $41 per month for minimum coverage.

Methodology

To find the best cheap California insurance, ValuePenguin collected thousands of rates from ZIP codes across California for the largest insurance companies. Quotes are for a 30-year-old man with good credit who drives a 2018 Honda Civic EX.

Full coverage car insurance premiums include:

- $50,000 bodily injury limit per person

- $100,000 bodily injury limit per accident

- $50,000 limit on property damage

- Uninsured motorist coverage with the same 50/100/50 limits

- Collision and comprehensive coverage with a $500 deductible

AAA insurance is available from two companies in California: AAA SoCal and AAA NorCal. These are two separate companies with different rates. You'll only be able to buy insurance from one or the other based on where you live. Other data sources include J.D. Power and AM Best.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Auto insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.