Get Free Car Insurance Quotes Online (February 2026)

Online quotes are the fastest way to compare car insurance rates from multiple companies. See your personalized results from 80+ companies that are competing to insure your car.

Get Free Auto Insurance Quotes In Your Area

Easiest way to get free car insurance quotes

Agents or online marketplaces like ValuePenguin let you get multiple quotes at once. This means you won't have to fill out a quote form for each insurance company.

ValuePenguin works with trusted national car insurance companies to help you find your best rate quickly, simply and easily — for free.

Find InsurersYou can use ValuePenguin's car insurance calculator to estimate your average rates by state and coverage level if you'd rather not share your personal details.

But personalized quotes will give you the most accurate rates, and you'll have to share your personal info before you buy.

- It's easy. Get online car insurance quotes in just a few minutes with no cost or hassle.

- Save money. Comparison shopping is the best way to find the cheapest quotes for you.

- Find an insurance company you trust. We partner with the country's leading companies, so you'll have the protection you need when it counts.

- Get customized results. You get more accurate rates when your online quotes are personalized just for you.

- Shop with confidence. ValuePenguin respects your privacy, and we take extra precautions to ensure your info remains secure.

Best companies for online car insurance quotes

The best car insurance companies to get online quotes are State Farm, Progressive, Geico, Liberty Mutual and Nationwide.

Company |

Quote process

|

Online discount

| |

|---|---|---|---|

| Progressive | About 7% | ||

| State Farm | No | ||

| Liberty Mutual | Up to 12% | ||

| Nationwide | No | ||

| Geico | Yes | ||

Find Cheap Auto Insurance Quotes in Your Area

Insurance companies usually need the same information to give you a car insurance quote. But some companies make the quote process easier by looking up the information for you or having an easy-to-use website.

- Progressive is the easiest company for getting an online car insurance quote.

- State Farm also has cheap rates overall, even though you don't get a discount for shopping online.

- Liberty Mutual has the highest potential discount for getting a car insurance quote online — up to 12% savings.

- Nationwide stands out for its coverage add-ons like accident forgiveness and vanishing deductible, even though its quote process is fairly typical.

- Getting a Geico quote on its website is frustrating because of its old-fashioned format. Instead, you should use Geico's app if you want an easy way to get a quote.

Progressive auto insurance quotes

Progressive monthly quotes | Is it cheap? | |

|---|---|---|

| Minimum liability | $75 | ? |

| Full coverage | $207 | ? |

| After a ticket | $278 | ? |

| Poor credit | $355 | ? |

- Easy online quote process: Progressive has one of the easiest processes for getting online quotes. The form is relatively short and simple to fill out. There's also a tool that helps you adjust your policy's coverage to fit your budget. This lets you scale how much coverage you get to fit in your budget.

- Rates are close to average, but there are lots of ways to save: Progressive's quotes are slightly cheaper than average for most drivers, and rates may be very cheap after Progressive's discounts. You can save an average of 7% just for getting a car insurance quote online and save 10% for signing your documents online.

- Below-average customer service: Progressive only has a 3.5-star rating from ValuePenguin editors because of its longer claims process and poor customer satisfaction. So even though getting quotes is easy, Progressive may be more stressful if you're in a car accident.

State Farm car insurance quotes

State Farm's monthly quotes | Is it cheap? | |

|---|---|---|

| Minimum liability | $73 | ? |

| Full coverage | $192 | ? |

| After a ticket | $210 | ? |

| Poor credit | $801 | ? |

- Quotes are fairly cheap: State Farm has cheap car insurance quotes for most drivers. However, you don't get an extra discount for shopping online. And if you have poor credit, Geico is a better deal than State Farm.

- Getting an online quote is a typical process: State Farm's online quote process is fairly standard, asking for basic info about your car and where you live. One downside is that there can be many questions if you recently moved or if it can't find your driving details. However, the online form helps you understand the questions, which is useful when you're not familiar with car insurance.

- Sometimes you'll need to talk to an agent: You can usually buy car insurance online from State Farm after getting a quote on its website. However, sometimes the form will connect you with an agent to complete the purchase. For example, if State Farm can't verify details about your car, you may need to talk to an agent to make sure your coverage is right.

Liberty Mutual car insurance quotes

- Can be expensive, but there are ways to save: Liberty Mutual tends to have expensive car insurance rates. But you can save up to 12% by buying online. Plus, Liberty Mutual can have cheap home and renters insurance, so it may be a good choice for bundling your car insurance with another policy.

- Typical process to get quotes: Liberty Mutual has a fairly standard online quotes process. It guides you through the questions. It also makes it easy to choose your coverage with three package levels and options for customization.

Nationwide car insurance quotes

Nationwide's monthly quotes | Is it cheap? | |

|---|---|---|

| Minimum liability | $107 | ? |

| Full coverage | $265 | ? |

| After a ticket | $343 | ? |

| Poor credit | $390 | ? |

- Cheap quotes if you have poor credit: Nationwide's quotes are a good deal if you have a poor credit score. But otherwise, Nationwide car insurance tends to be expensive. You won't get a discount for getting a quote online. But there are other Nationwide discounts, such as for signing up for automatic payments and paperless bills.

- Website can be slow when getting online quotes: You'll have to answer a standard set of questions when getting a Nationwide insurance quote. However, sometimes there will be a delay while the website processes your information.

- Coverage add-ons can be worth it: Nationwide's many coverage options let you get online car insurance with lots of extras.

Geico car insurance quotes

Geico's monthly quotes | Is it cheap? | |

|---|---|---|

| Minimum liability | $65 | ? |

| Full coverage | $187 | ? |

| After a ticket | $254 | ? |

| Poor credit | $305 | ? |

- Has cheap rates: Geico can be cheap if you have a good driving history, or if you have poor credit. But its rates are a little higher than average if you have a ticket.

- Can be frustrating to get online quotes: It can be time-consuming to get car insurance quotes through Geico's website because you'll often have to answer lots of questions, and the form isn't easy to use.

- Geico's app is an easier way to get quotes: Geico's app is a much better tool for getting online car insurance quotes. The app is faster and more user-friendly than the website. Plus, it has at least 4.8 stars from millions of users. And if you buy the policy, the app is a helpful tool for managing your coverage and filing claims.

Average car insurance quotes

Car insurance rates are based on details about your life and you as a driver. Your quotes will change based on the company you choose, where you live, the amount of coverage, your driving history and your credit score.

By driver details

By company

By location

How to get car insurance quotes

Step 1: Choose where to get car insurance quotes

Getting free auto insurance quotes online is the best choice if you want rates quickly. However, using an agent can give you personalized help and advice.

Online quotes from an insurance company

Online quotes from a marketplace

Quotes from an agent

Quotes over the phone or in person

It's a good idea to get quotes from at least three insurance companies. Each company uses a different formula for setting its rates, so comparing quotes helps you find the best deal.

Online quote comparison tools are the fastest way to get auto insurance quotes from multiple companies.

Find Cheap Auto Insurance Quotes in Your Area

Step 2: Decide how much coverage you need

Most drivers should get full coverage auto insurance quotes that include comprehensive and collision coverage.

A full coverage policy will pay for damage to your car, as well as any damage or injuries you cause to others. It's usually required if you have a car loan or lease. And it's worth it if your car has a value of at least $5,000 or you don't have the savings to replace your car if it's totaled.

You can also add on special coverage options such as roadside assistance or rideshare insurance. This can help insurance pay for more of your costs or cover special situations.

Car insurance coverage in your quote

- Bodily injury liability helps pay for medical expenses, emergency services and even funeral expenses for another driver after an accident you caused.

- Property damage liability covers repair and replacement costs of damage to homes, storefronts, vehicles and other property for an accident you cause.

- Collision and comprehensive coverage pay for damage to your car in most situations — like a car crash, weather, vandalism or hitting a deer — even if it's your fault.

- Personal injury protection (PIP) helps pay for your own medical expenses, regardless of who was at fault in an accident.

- Uninsured/underinsured motorist pays for expenses when another driver doesn't have any insurance or doesn't have enough insurance to cover all the bills.

The cheapest car insurance you can get is a liability-only car insurance policy. This gives you enough coverage to meet your state's rules, but typically, it isn't enough to cover the cost of a major accident.

Step 3: Fill out the quote forms

To get an online car insurance quote, you need to enter basic info about yourself, your car and your driving record. That's because rates are based on your personal details.

Some quote forms will make the process easier by using records from your state's DMV to automatically fill in details about your car model, driving history and current coverage.

What info do I need for online car insurance quotes?

- Name, address and birth date

- Driver's license info

- Current insurance company

- Vehicle info, including the VIN, make, model and year

- Info about your lender if you have a loan or lease

- Any claims, tickets or accidents in the past three to five years

- About how many miles you drive per year

Be as accurate as you can when you're asked about dates for prior policies or accidents. Insurance companies check your answers against a database of previous insurance claims, called CLUE.

It usually takes about five minutes to enter your information into an online car insurance quote form. You'll see your quote instantly. Then you can usually buy a policy that starts as soon as the same day.

Step 4: Compare your quotes

Compare car insurance quotes from about three companies to find the best deal for your situation. Each company sets rates in a different way and will charge different amounts for the same level of coverage.

- Use the same coverage details when comparing quotes. Even small changes, such as how you'll pay, can affect which company is cheapest.

- Write down the reference number of your quote so you can return to it later. This saves you from having to fill out the form again when you're ready to buy. It also lets you lock in that rate because insurance prices change all the time.

- You may need to speak to an agent if you have a bad driving record or poor credit score. This can be inconvenient, but it helps you get the right coverage.

What to do if your quotes aren't affordable

If you get an extremely high car insurance quote, shop around to get quotes from more companies.

When a company's quote is much higher than the average cost of car insurance for your area and driving history, it usually means the companies don't want to give you insurance. They'll give you a very high quote instead of saying "no" outright.

For example, if a company wants to stop issuing policies near the coast, it may give auto insurance quotes of $1,000 per month as a way to avoid getting new customers.

Factors that affect car insurance quotes

Insurance companies use your age, location, driving history, credit score and other factors to predict how likely you are to file a claim.

Car insurance quotes differ by state, city and even ZIP code.

Insurance companies typically set quotes based on the average number of claims in an area. Urban areas with narrow roads and more cars typically have more car accidents and claims. That's why drivers in large cities often get higher quotes than people in rural areas.

Car insurance quotes may be higher if a state, city or neighborhood has more uninsured drivers or dangerous roads. Severe weather, like hurricanes or hail, can also affect your rates. That's because these factors can lead to more claims.

Quotes vary by state in part because state governments set minimum requirements for coverage. In addition, insurance companies must get their quotes approved by the state government.

Find the best cheap insurance quotes near you

More car insurance coverage typically means higher insurance quotes.

But you'll also get more protection after a crash.

People with tickets or accidents on their record usually have more expensive quotes.

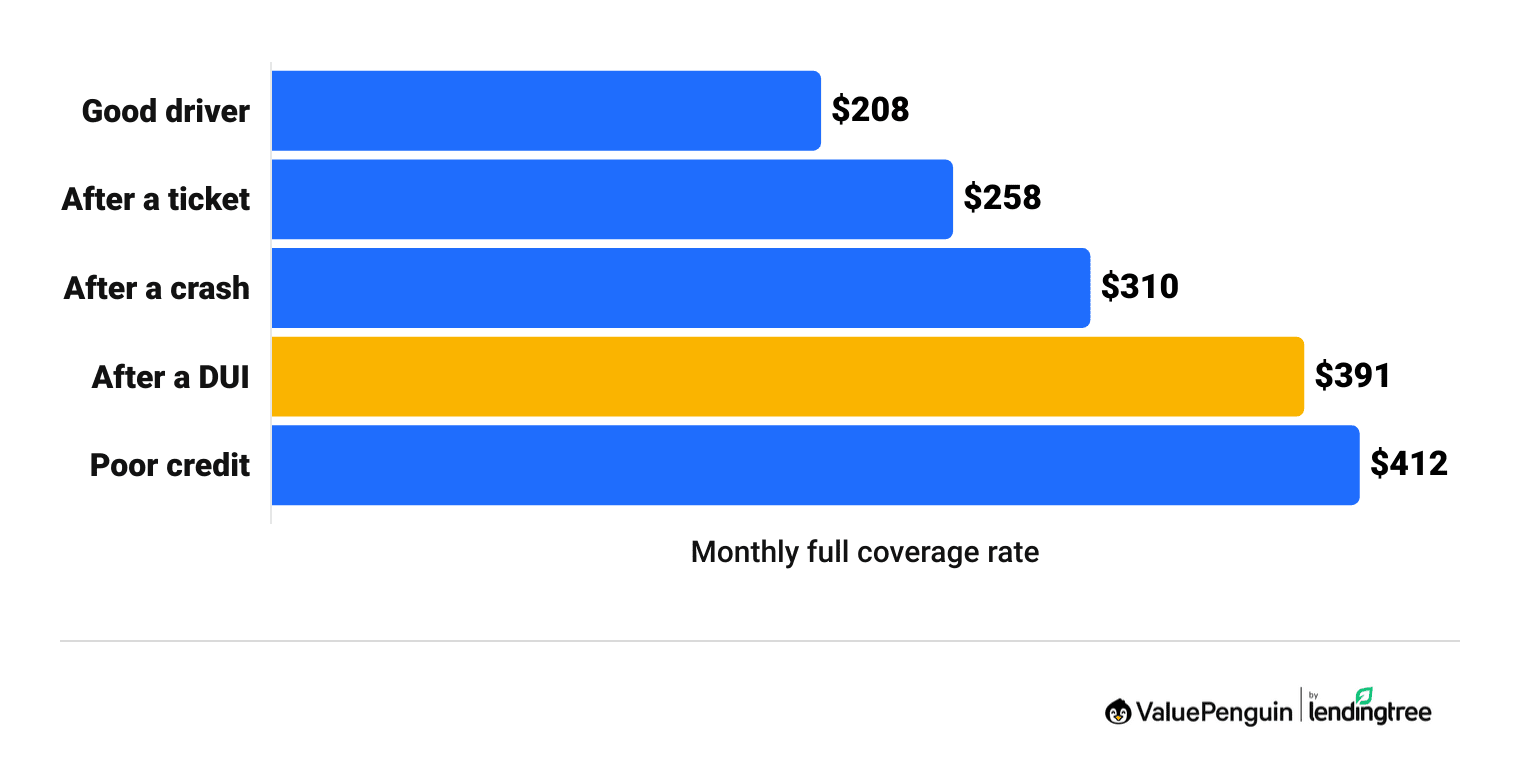

Car insurance quotes can go up by about 50% after an accident, ticket or DUI. That's because insurance companies believe you're more likely to file a claim.

Auto insurance quotes are usually expensive for teens and new drivers. This is because they have less experience on the road. Quotes typically level off around 30 years old and increase slightly after age 65.

Cars that are newer, more expensive, faster and less safe typically have higher insurance quotes.

Among top-selling cars, the Honda CR-V and the Jeep Wrangler have some of the cheapest full coverage insurance quotes.

Insurance companies believe drivers with bad credit are more likely to file claims.

So, a better credit score can mean cheaper quotes. Drivers with good credit pay about half as much for full coverage as those with poor credit.

Some states don't allow companies to use credit scores to set insurance quotes. This includes California, Michigan, Massachusetts and Hawaii. In these states, your credit score will not affect your auto quote.

Car insurance quotes are typically more expensive for men than women.

This is especially true for young drivers. That's because young men tend to be riskier drivers than young women. The cost of car insurance for men versus women is about the same starting around age 25.

However, some states don't allow companies to use gender to set your car insurance quotes. This includes California, Massachusetts and Michigan.

Frequently asked questions

What is a car insurance quote?

An insurance quote is an estimate of how much you'll pay for car insurance. Insurance companies base your quote on details like your address, car and driving history. You can get free quotes online, from an agent or by phone.

How do I find car insurance quotes online?

One of the best ways to find car insurance quotes online is through car insurance comparison sites, like ValuePenguin. That's because comparison tools let you shop for car insurance quotes from multiple companies at the same time.

You can also get car insurance quotes using insurance company websites. However, this typically takes a lot longer because you must enter your info into each company's website.

What is the cheapest car insurance I can get online?

State Farm, Geico and USAA typically have the best rates, and they all offer online quotes. But everyone will pay different rates based on where they live, what car they own and their driving history.

Is buying auto insurance online cheaper?

You can sometimes get a discount for buying car insurance online, but it depends on the company. The best online discount is from Liberty Mutual, where you can save up to 12% for getting an online quote. But cheap car insurance companies like State Farm may be a better deal, even though there isn't a discount for buying online.

Methodology

ValuePenguin collected millions of car insurance quotes from 56 companies across the U.S. to find auto insurance quotes for the cheapest companies, states and drivers with issues on their records.

Average car insurance prices are based on quotes from all available ZIP codes in the U.S. Quotes are for a 30-year-old man who owns a 2018 Honda Civic EX. He has good credit and a clean driving record.

Full coverage quotes include comprehensive and collision coverage, along with liability coverage:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

- Personal injury protection: Minimum when required by state

Rate data was provided to ValuePenguin by Quadrant Information Services. Insurer filings were used to publicly source rate information. These quotes are intended for comparative purposes only. Your rates could differ.

The car insurance quote process was rated by using a sample shopper to request an online quote on each company's website. We considered how long the process took, how easy the form was to use and the results after completing the form.

Expert insights to help you make smarter financial decisions

ValuePenguin has assembled an exclusive panel of professionals across various areas of expertise to help you understand complex topics and empower you to make smarter financial decisions.

- Mandatory financial products, like car insurance, allow socioeconomic status and geotargeting by ZIP code to influence the price one consumer gets compared to another. Do you believe these nondriving characteristics should play a role? Why or why not?

- A 2022 study conducted by ValuePenguin highlighted that 92% of policyholders who recently switched auto insurance companies saved money. Despite this, most policyholders (65%) don't get outside quotes for comparison. Why might these drivers be hesitant to seek additional quotes from other insurers?

- According to a ValuePenguin analysis, quotes for teenagers are three times as expensive as quotes for drivers in their mid-30s and closer to four times the rate for drivers in their mid-50s. Do you believe these prices appropriately reflect their increased risk? Why or why not?

- Electric vehicles are becoming more and more popular by the day. With the rise of EVs comes new risks for insurers to consider, such as battery fires and cybersecurity. How do you think the increasing use of electric vehicles will affect the auto insurance industry and pricing going forward?

- Lars Powell, Ph.D.

- Executive Director of the Alabama Center for Insurance Information and Research

- Read answer

- Lynne McChristian

- Director of the Office of Risk Management & Insurance Research

- Read answer

Lars Powell, Ph.D.

Executive Director of the Alabama Center for Insurance Information and Research, University of Alabama

Mandatory financial products, like car insurance, allow socioeconomic status and geotargeting by ZIP code to influence the price one consumer gets compared to another. Do you believe these nondriving characteristics should play a role? Why or why not?

Very few of the variables used to rate and underwrite auto insurance would be considered "driving factors," but all of them are highly correlated with crashing and claims. In fact, because they are all used based on their correlation with claims, they could all reasonably be considered driving factors. I believe they should be used to set insurance rates because they are accurate predictors of claims.

A 2022 study conducted by ValuePenguin highlighted that 92% of policyholders who recently switched auto insurance companies saved money. Despite this, most policyholders (65%) don't get outside quotes for comparison. Why might these drivers be hesitant to seek additional quotes from other insurers?

People do a lot of things that seem to go against their financial interests. Some people lack knowledge of the insurance market; some people don't think shopping is worth the trouble, and other people like or trust their insurance agent and don't want to find a new one. I expect this behavior to become less frequent as more people buy insurance online.

According to a ValuePenguin analysis, quotes for teenagers are three times as expensive as quotes for drivers in their mid-30s and closer to four times the rate for drivers in their mid-50s. Do you believe these prices appropriately reflect their increased risk? Why or why not?

These prices are still too low in most cases. The average 15-year-old male driver has a 1-in-5 chance of crashing in the first year that they drive. The average 50-year-old driver might have a 1-in-35 chance of crashing. Insurers subsidize youthful driver premiums so that they do not lose the rest of the family as customers.

Electric vehicles are becoming more and more popular by the day. With the rise of EVs comes new risks for insurers to consider such as battery fires and cybersecurity. How do you think the increasing use of electric vehicles will affect the auto insurance industry and pricing going forward?

Electric vehicles can only increase the cost of insurance. Battery fires could increase homeowners insurance risk, and the cost of repairing EVs increases auto insurance risk.

Lynne McChristian

Director of the Office of Risk Management & Insurance Research at Gies College of Business, University of Illinois Urbana-Champaign

Mandatory financial products, like car insurance, allow socioeconomic status and geotargeting by ZIP code to influence the price one consumer gets compared to another. Do you believe these nondriving characteristics should play a role? Why or why not?

The saying in real estate is that location matters. It matters with driving, too. If one lives in a rural area absent the daily annoyance of rush hour traffic, there are typically fewer car crashes and related injuries.

If a ZIP code is in a big city with considerable traffic congestion and a high population, then accidents are more likely. Big city drivers pay more.

It's what happens in that ZIP code that provides a data point that makes insurance pricing reflect the risk. Absent using data that has been consistently proven to correlate to increased insurance claims, those rural drivers would pay more than what is fair based on their risks.

A 2022 study conducted by ValuePenguin highlighted that 92% of policyholders who recently switched auto insurance companies saved money. Despite this, most policyholders (65%) don't get outside quotes for comparison. Why might these drivers be hesitant to seek additional quotes from other insurers?

I think many policyholders do not shop for coverage because they are satisfied with their current insurance carrier. In fact, auto insurance claims satisfaction is high, and that means people want to stick with the companies they know that have delivered good customer service.

Another issue is that many people really don't take the time to shop around. It could pay off and be educational at the same time. When you shop, however, you want to make sure the insurance protection remains consistent with what you need. Buying what is cheaper could shortchange your protection level.

According to a ValuePenguin analysis, quotes for teenagers are three times as expensive as quotes for drivers in their mid-30s and closer to four times the rate for drivers in their mid-50s. Do you believe these prices appropriately reflect their increased risk? Why or why not?

The cost of insurance reflects the risks. Automobile insurance for teen drivers is three times the cost of mid-aged drivers because teen drivers are three times more likely to be involved in a fatal crash, according to data from the Insurance Institute for Highway Safety. The number of crashes and fatalities is disproportionally higher for drivers between the ages of 16 and 19.

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.