Best Companies for Home and Auto Insurance Bundles

State Farm has the best home and auto bundles, with cheap rates of around $266 per month to bundle your insurance.

Find Cheap Homeowners Insurance Quotes in Your Area

Best auto and home insurance companies

Best car and home insurance bundles

Bundling your home and auto insurance with one company is not only more convenient for making claims and payments, it can also save you up to 25% for both policies.

Company |

Monthly cost

| ||

|---|---|---|---|

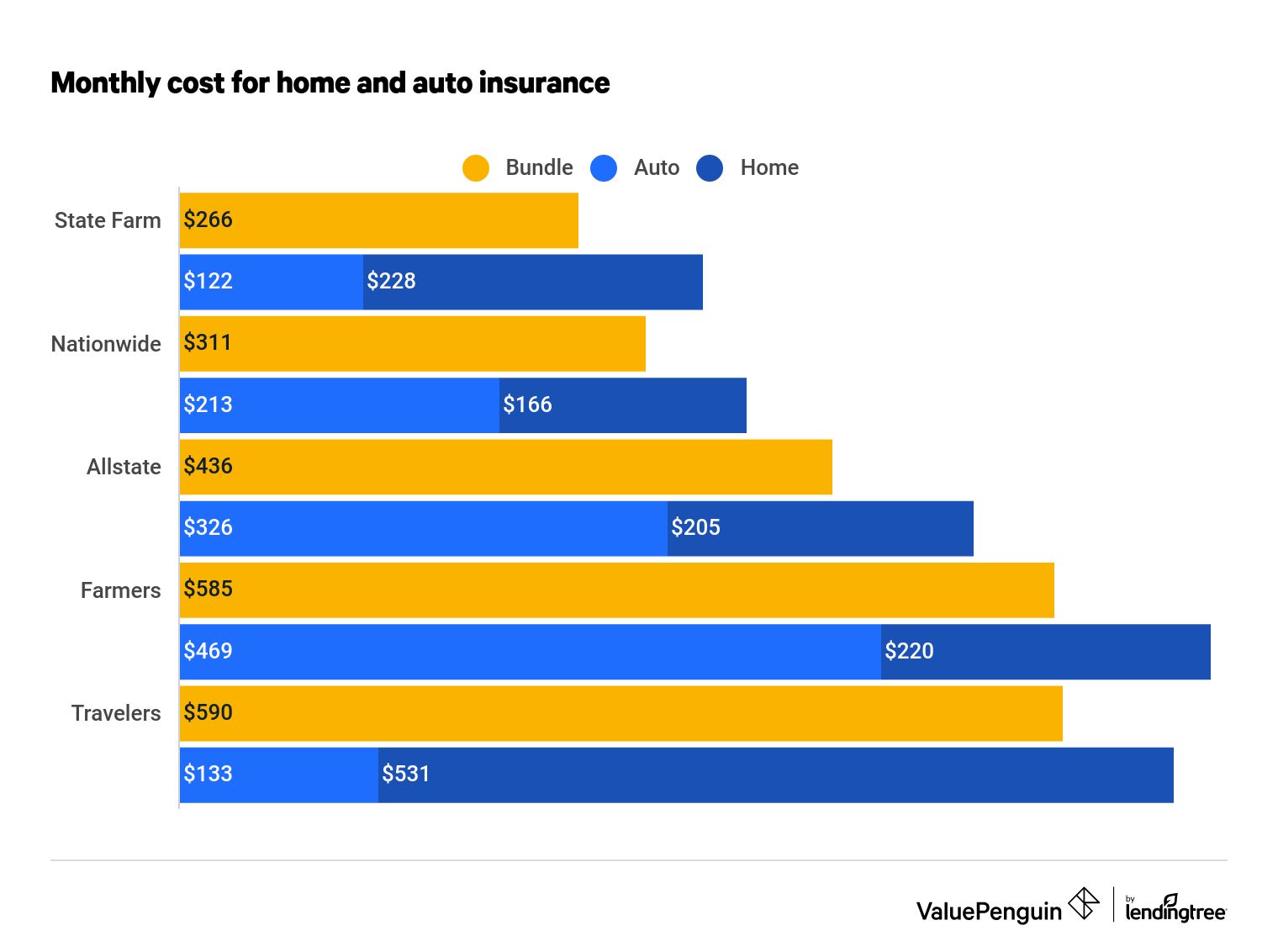

| State Farm | $266 | ||

| Nationwide | $311 | ||

| Allstate | $436 | ||

| Farmers | $585 | ||

| Travelers | $590 | ||

To find the companies that offer the best insurance bundles, ValuePenguin compared costs and customer satisfaction for the largest insurance companies across thousands of ZIP codes in Texas, Illinois and Pennsylvania.

Rates are for a 30-year-old man who is buying full coverage car insurance, has a clean driving record and owns a home that's the median value for his state. See the full methodology.

Best auto and home bundle discounts

State Farm has the best bundling discount, with customers getting an average savings of 24%.

Most people don't get the maximum discount advertised by insurance companies. For example, Allstate's average customer discount of 18% is less than its advertised discount of up to 25%.

Find Cheap Auto Insurance Quotes in Your Area

Home and auto insurance quotes

Monthly cost and savings

Car and home breakdown

Company |

Monthly cost

|

Savings

|

Discount

|

|---|---|---|---|

| State Farm | $266 | $84 | 24% |

| Nationwide | $311 | $68 | 18% |

| Allstate | $436 | $95 | 18% |

| Farmers | $585 | $104 | 15% |

| Travelers | $590 | $74 | 11% |

The cheapest home and car insurance bundle will have good discounts and low-price policies. State Farm has good rates for both types of policies, which is why it's also one of the best car insurance companies and the best homeowners insurance companies.

If either the home or car insurance policy is expensive, the bundle may not save you money. For example, Farmers has high rates for car insurance, and Travelers has high rates for home insurance. Choosing to insure your home and car with one of those companies will likely not save you money, even after the discount.

Best overall bundle: State Farm

- Bundle cost: $266

- Bundle savings: 24%

-

Editor rating:

Pros and cons

State Farm has cheap prices and satisfied customers, making it the best home and auto insurance company. Plus, you can qualify for other discounts if you have multiple cars, are a safe driver, have a home security system and more.

Best bundle for add-on options: Nationwide

- Bundle cost: $311

- Bundle savings: 18%

-

Editor rating:

Pros and cons

Nationwide's good prices and add-on options make it a top company for car and home insurance bundles. Options include smart home discounts, home renovation credit, roadside assistance coverage and accident forgiveness.

Best bundle for specialty coverage: Allstate

- Bundle cost: $436

- Bundle savings: 18%

-

Editor rating:

Pros and cons

Allstate's insurance bundles can be modified to cover different types of valuables including sports equipment, musical instruments, landscaping, jewelry, antiques, electronic data and more.

Geico and Progressive bundles outsource their home insurance

Geico and Progressive are not among our top picks for bundled car and home insurance.

These companies can sometimes have cheap rates for auto insurance. However, for home insurance, the companies match you with one of their partners. This means home insurance rates vary widely. Plus, bundling discounts are small, typically less than 5%.

Find the best home and auto insurance quotes

The best auto insurance and home insurance bundle is the one that gets you a good price on both policies.

Just because one company offers cheap car insurance does not mean it will also offer affordable rates for homeowners insurance, and vice versa.

Every major insurance company has bundling discounts, including:

- Allstate

- American Family

- Amica

- Auto-Owners

- Erie

- Esurance

- Farmers

- Geico

- Liberty Mutual

- Mercury

- MetLife

- Nationwide

- Progressive

- State Auto

- State Farm

- The Hartford (AARP)

- Travelers

- USAA

Should you bundle your home and car insurance?

Reasons to bundle:

Reasons not to bundle:

When is bundling not worth it? State Farm could cost $100 per month for auto and $100 per month for home. After a $20 bundling discount, that would total $180 per month.

However, if you can find a car insurance policy from Progressive that costs $50 per month, you could pay a total of $150 if you use Progressive for car insurance and State Farm for home insurance. In this case, bundling would not help you save money.

Home and auto insurance companies by state

Insurance rates can vary widely based on where you live. Comparing personalized quotes is the best way to find good rates for your situation. Start by considering the companies that have the cheapest rates in your state.

Cheapest car and home insurance companies in each state

State | Car insurance | Home insurance |

|---|---|---|

| Alabama | State Farm | Farmers |

| Alaska | Geico | Country Financial |

| Arizona | Travelers | State Farm |

| Arkansas | State Farm | Shelter |

| California | Geico | Allstate |

How to bundle your auto and home insurance

Compare rates from different companies: Comparing quotes from different companies, either online or with an insurance agent, is the best way to make sure you have the cheapest offer.

When you are getting a quote for either car or home insurance, at the end of the quote process the insurance company will ask if you would like to add another type of policy to your estimate.

Give your insurance 30 days’ notice: Give your insurance company at least 30 days’ written notice of your intention to cancel service; this stops the billing cycle for your old insurance company and gives your new company time to process your paperwork. Specify when you want your new policy to begin to avoid a lapse in coverage.

The trickiest part of bundling your insurance is transitioning from your old to your new insurance policy without a lapse in coverage.

Keep shopping for quotes regularly: In order to keep the lowest rate on insurance, you want to check other companies' rates. While the company you are with might be the cheapest right now, rates can change drastically from year to year, and checking around can ensure you are always getting the cheapest quotes.

Other home and auto insurance companies to consider:

Frequently asked questions

How much do you save with a home and auto insurance bundle?

Bundling your car and home insurance saves you an average of 17%. State Farm has the cheapest rates, costing $266 per month for a home and auto insurance bundle after a 24% discount.

What types of insurance policies can I bundle?

You can get a bundle discount for a wide range of policies, including home, auto, motorcycle, life and renters insurance. However, the most common bundle offered by insurers includes home and auto insurance.

What are the best home and auto insurance bundles?

State Farm has the cheapest and best home and auto insurance bundle, costing an average of $266 per month.

Should I bundle my home and auto insurance?

You should bundle your insurance if the bundling discount helps you pay less than if you used two companies. Bundling also lets you streamline your bills, and you may only have to pay one deductible if there's an incident that damages both your home and car.

Methodology

ValuePenguin studied homeowners and auto insurance quotes from major insurance companies to see how base rates and bundling discounts impact total insurance costs. Average rates are based on quotes for all ZIP codes in Texas, Illinois and Pennsylvania.

Auto insurance rates are based on a full coverage policy for a 30-year-old man who has good credit, has a clean driving history and drives a 2015 Honda Civic EX. Homeowners insurance rates are based on the median home value in each state. Other data sources include J.D. Power, the National Association of Insurance Commissioners (NAIC) and AM Best.

Insurance rate data is from Quadrant Information Services and is publicly sourced from insurer filings. Rates are for comparative purposes only. Your rates may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.