Cheapest Car Insurance in Florida (Best Rates in 2026)

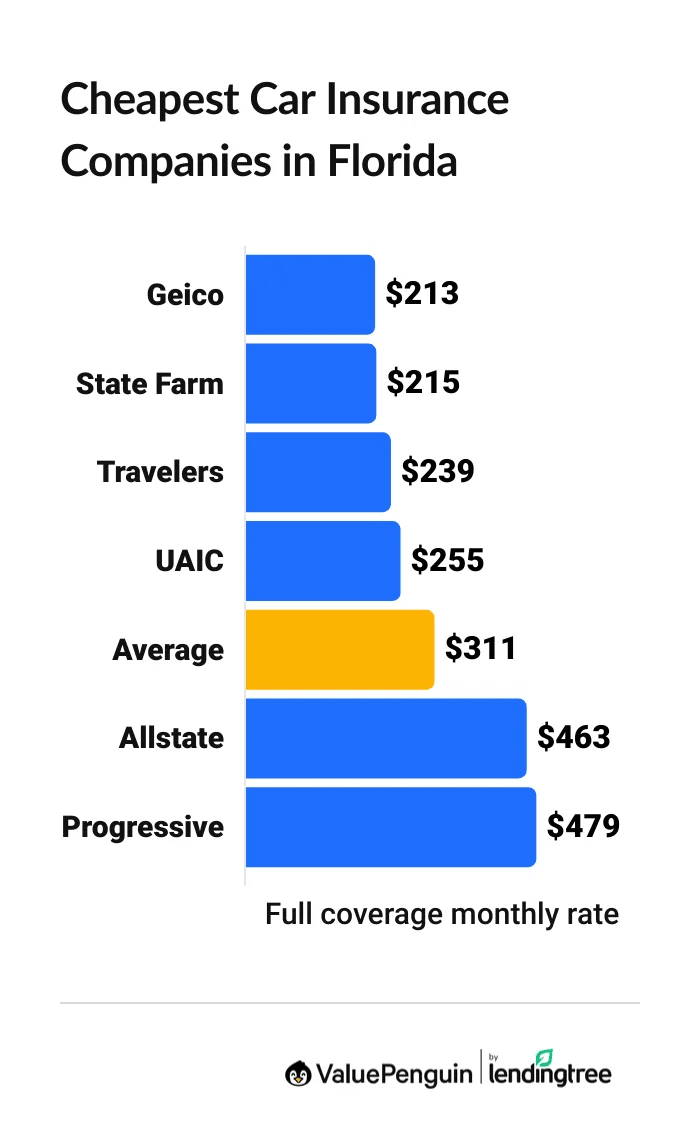

Geico is the cheapest car insurance company in Florida, at $213 per month for full coverage. That's about one-third cheaper than the state average.

Find Cheap Auto Insurance Quotes in Florida

Best cheap auto insurance in Florida

Best and cheapest car insurance in Florida

- Cheapest full coverage: Geico, $213/mo

- Cheapest minimum liability: Geico, $37/mo

- Cheapest for seniors: Geico, $181/mo

- Cheapest for young drivers: Geico, $83/mo

- Cheapest after a ticket: Geico, $213/mo

- Cheapest after an accident: State Farm, $251/mo

- Cheapest for teens after a ticket: Geico, $83/mo

- Cheapest after a DUI: Travelers, $382/mo

- Cheapest for poor credit: UAIC, $255/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm has the best mix of cheap rates and great customer service in Florida.

Although Geico tends to have cheaper rates, its customer service isn't as good as State Farm's. It may be worth spending a few extra dollars per month for the peace of mind that comes with State Farm's well-rated customer service.

Cheapest full coverage car insurance in Florida: Geico

Geico has the cheapest full coverage car insurance in Florida.

Find Cheap Auto Insurance Quotes in Florida

Geico's full coverage saves you about $98 per month off of Florida's average rate of $311 per month.

However, State Farm is a better choice for most people. It has much better customer service reviews than Geico, which means State Farm will probably get you back on the road faster after a crash. That could be worth the $2 per month difference between State Farm and Geico.

Best cheap full coverage car insurance in Florida

Company | Monthly rate | |

|---|---|---|

| Geico | $213 | |

| State Farm | $215 | |

| Travelers | $239 | |

| UAIC | $255 | |

| Allstate | $463 |

Data-powered research on Florida car insurance

Data-powered research on FL car insurance |

|---|

Why is Florida car insurance so expensive?

Florida car insurance is expensive because of the state's many uninsured drivers and dense population that causes traffic and accidents.

In addition, Florida's severe weather can cause major damage to cars. This includes flooding due to storm surge or damage from fallen tree branches.

Florida's car insurance is about 55% more expensive than the national average. But you can still get a good deal by shopping around for a cheap company. For a good driver, Geico and State Farm's full coverage rates are about $100 cheaper per month than the state average.

If you're unable to buy insurance through a private company, you can get coverage through the Florida Automobile Joint Underwriting Association (FAJUA), a state-run program.

Cheapest minimum car insurance in Florida: Geico

Geico has the least expensive liability insurance in Florida.

A minimum coverage car insurance policy from Geico costs around $37 per month in Florida, on average. That's two-thirds less than the Florida average of $102 per month. It's also $30 per month less than the second-cheapest company, State Farm.

Most affordable minimum car insurance in Florida

Company | Monthly rate |

|---|---|

| Geico | $37 |

| State Farm | $67 |

| Travelers | $71 |

| UAIC | $127 |

| Progressive | $138 |

Cheapest car insurance in Florida for seniors: Geico

Geico has the cheapest auto insurance for senior drivers in Florida.

A full coverage policy from Geico costs an average of $181 per month for a 65-year-old driver in Florida. That's nearly $100 per month cheaper than the state average for 65-year-olds.

Geico has the cheapest prices for seniors as they get older in Florida, too. Full coverage from Geico costs around $198 per month for a 75-year-old and $240 per month for an 85-year-old.

Lowest-price car insurance quotes for Florida seniors

Company | Age 65 | Age 75 | Age 85 |

|---|---|---|---|

| Geico | $181 | $198 | $240 |

| State Farm | $195 | $222 | $280 |

| Travelers | $204 | $247 | $319 |

| UAIC | $236 | $250 | $250 |

| Progressive | $400 | $561 | $714 |

Car insurance quotes usually go up after age 65. That's because insurance companies believe senior drivers are more likely to get into accidents.

Florida seniors can save money with discounts for retirees. For example, both Geico and State Farm offer a defensive driving discount if you complete an approved driving course.

Find Cheap Auto Insurance Quotes in Florida

Cheapest auto insurance in FL for young drivers: Geico

Geico is the cheapest car insurance company for teen drivers in Florida.

A minimum coverage policy from Geico costs $83 per month for an 18-year-old driver. That's two-thirds less than the average for a teen in Florida, which is $252 per month.

Geico also has the cheapest full coverage quotes for young drivers in Florida. At $527 per month, a policy from Geico is 44% cheaper than average.

Best cheap insurance in Florida for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $83 | $527 |

| Travelers | $157 | $644 |

| State Farm | $170 | $623 |

| Allstate | $279 | $1,261 |

| UAIC | $301 | $581 |

Young drivers in Florida pay more than twice as much for full coverage car insurance as 30-year-old drivers. That's because teens have less driving experience, which means they're more likely to cause a crash.

Teen drivers can get cheaper rates by sharing a policy with their parents. They can also save money with most companies by getting good grades in school or taking a defensive driving course.

Cheapest insurance in Florida after a ticket: Geico

Geico has the cheapest full coverage insurance in Florida after a speeding ticket.

At $213 per month, Geico's rates are less than one-third of the state average of $351.

Florida drivers should also compare quotes from State Farm after a speeding ticket.

It costs an average of $20 per month more than Geico, but has much better customer service. State Farm's great service could be beneficial if you're in an accident in the future.

Cheap Florida auto insurance with a ticket

Company | Monthly rate |

|---|---|

| Geico | $213 |

| State Farm | $233 |

| UAIC | $255 |

| Travelers | $295 |

| Allstate | $463 |

*USAA is only available to current and former military members and their families.

You can expect auto insurance quotes in Florida to go up by around 13% after one speeding ticket. That's an average increase of $40 per month for full coverage insurance.

Best FL auto insurance after an accident: State Farm

State Farm has the cheapest car insurance quotes in Florida after an accident.

At an average of $251 per month, full coverage from State Farm costs $204 per month less than the Florida average after a crash. It's also $35 per month less than the second-cheapest company, Geico.

Cheapest auto insurance in Florida after an accident

Company | Monthly rate |

|---|---|

| State Farm | $251 |

| Geico | $286 |

| Travelers | $327 |

| UAIC | $334 |

| Progressive | $723 |

*USAA is only available to current and former military members and their families.

Just one accident raises full coverage rates by around $145 per month in Florida. That's an average increase of 46%.

Don't rush to buy a new policy right after an accident.

Your current company usually won't raise rates until your policy renews. You should wait to shop for new insurance until you get your renewal offer from your current company, about one month before your insurance expires.

Cheapest for teens with a ticket or accident: Geico

Geico has the most affordable auto insurance in Florida for young drivers with a speeding ticket or an accident on their record.

Minimum coverage from Geico costs $83 per month for an 18-year-old with a speeding ticket. That's two-thirds less than the Florida average of $268 per month. It's also over $100 less than the second-cheapest company, State Farm.

After an at-fault accident, minimum coverage from Geico costs just $85 per month, on average. That's nearly one-quarter of the Florida average for teens with an accident on their record.

Best Florida insurance quotes for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Geico | $83 | $85 |

| State Farm | $187 | $206 |

| Travelers | $191 | $218 |

| Allstate | $279 | $522 |

| UAIC | $301 | $375 |

*USAA is only available to current and former military members and their families.

On average, car insurance costs 6% more after a ticket and 32% more after an accident for 18-year-old drivers.

Car insurance rates typically go up less for teens after a ticket or accident than they do for adult drivers. That's because young drivers are already considered high-risk, even with a clean driving record.

Cheapest Florida car insurance rates after a DUI: Travelers

Travelers has the most affordable car insurance in Florida for drivers with a DUI.

Full coverage from Travelers costs $382 per month after a DUI, which is $140 per month cheaper than average. It's also $41 per month less than the second-cheapest company, Geico.

Cheap auto insurance companies in Florida after a DUI

Company | Monthly rate |

|---|---|

| Travelers | $382 |

| Geico | $423 |

| UAIC | $453 |

| Progressive | $584 |

| State Farm | $625 |

*USAA is only available to current and former military members and their families.

Rates increase by an average of 68% for drivers who have a DUI or DWI in Florida.

In addition, you may have to get FR-44 insurance in Florida after a DUI. Drivers with an FR-44 must have higher liability limits in Florida. This can cause your rates to be even more expensive.

Cheapest Florida car insurance for drivers with bad credit: UAIC

UAIC has the lowest car insurance rates for Florida drivers with poor credit.

At an average of $255 per month, a full coverage policy from UAIC is less than half the state average. And UAIC costs $139 per month less than the second-cheapest company, Geico.

Best rates for car insurance with bad credit in FL

Company | Monthly rate |

|---|---|

| UAIC | $255 |

| Geico | $394 |

| Travelers | $487 |

| Progressive | $807 |

| Allstate | $864 |

*USAA is only available to current and former military members and their families.

In Florida, drivers with poor credit pay about twice as much for car insurance as those with good credit.

Your credit score doesn't have anything to do with how well you drive, but Florida state law lets insurance companies use this info when setting rates. That's because insurance companies believe drivers with bad credit scores are more likely to make a claim in the future.

Best car insurance in Florida

State Farm is the best auto insurance company in Florida.

That's because State Farm offers affordable rates and has a reputation for dependable customer service. It also gets fewer customer complaints than an average company its size.

Best insurance companies in FL

Company |

Editor's rating

|

JD Power

|

AM Best

|

|---|---|---|---|

| State Farm | 650 | A++ | |

| Travelers | 613 | A++ | |

| Geico | 645 | A++ | |

| Progressive | 621 | A+ | |

| Allstate | 635 | A+ |

Find the best cheap Florida car insurance near you

Average Florida car insurance rates in by city

Santa Rosa Beach, a town in the Florida panhandle, has the cheapest car insurance in the state.

People in Santa Rosa Beach pay an average of $224 per month for full coverage car insurance.

Westview, just outside Miami, is the most expensive city. At $453 per month, drivers in Westview pay $142 per month more than the state average.

Florida car insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Alachua | $233 | -25% |

| Alafaya | $299 | -4% |

| Alford | $237 | -24% |

| Allentown | $259 | -17% |

| Altamonte Springs | $278 | -11% |

The average cost of auto insurance in Florida varies by up to $230 per month between the most and least expensive cities in the state.

Major cities typically have higher rates because drivers in these cities are more likely to be in an accident or have their car stolen.

Cheap car insurance in FL by driver type

Geico has the cheapest coverage for most Florida drivers.

Driver type | Cheapest company |

Monthly cost

|

|---|---|---|

| Cheapest minimum liability | Geico | $37 (63% savings) |

| Cheapest for teens | Geico | $83 (67% savings) |

| Cheapest for seniors | Geico | $181 (35% savings) |

| Cheapest for a safe driver | Geico | $213 (31% savings) |

| Cheapest after a ticket | Geico | $213 (39% savings) |

| Cheapest after an accident | State Farm | $251 (45% savings) |

| Cheapest for poor credit | UAIC | $255 (61% savings) |

| Cheapest after a DUI | Travelers | $382 (27% savings) |

Florida state auto insurance requirements

Florida's minimum car insurance requirements are $10,000 of personal injury protection (PIP) and $10,000 of property damage liability. This is less insurance than most other states require.

- Personal injury protection (PIP): $10,000 per accident

- Property damage liability (PDL): $10,000 per accident

Bodily injury liability and uninsured motorist coverage come standard with most policies. You can reject them in writing, but you'll miss out on valuable protection. The minimum limits for them are $10,000 per person and $20,000 per accident.

Unlike in most states, you aren't required to carry liability coverage for bodily injury in Florida. But it's a good idea to buy it anyway in case you hurt someone in a crash.

What's the best auto insurance in Florida for most people?

Full coverage car insurance is a good idea for most Florida drivers. Your lender typically requires full coverage if you have a car loan or lease. It's also a smart choice if your car is worth more than $5,000 or newer than eight years old.

-

Full coverage includes collision and comprehensive coverage. This pays to fix your car after a crash, a hurricane, a hit-and-run or another accident.

In addition, full coverage policies typically have higher liability limits than the state requirements. They also have coverage for bodily injury liability. This pays for injuries to the other driver and their passengers if you cause an accident.

-

Minimum coverage policies meet Florida's minimum insurance requirements. This means they have $10,000 of personal injury protection (PIP) coverage and $10,000 of property damage liability per accident. But that's probably not enough coverage for repairs and medical bills if you cause a major accident.

For example, if you hit and total a new or expensive car, $10,000 of property damage liability coverage won't be enough to fully replace it.

Florida no-fault law

Florida is a no-fault state. This means your insurance will pay your medical costs regardless of who causes an accident. The Florida Motor Vehicle No-Fault Law helps drivers get medical care and some financial protection.

Florida drivers need PIP and property damage liability coverage.

PIP covers up to 80% of medical costs and 60% of lost income if you can't work, up to $10,000 per accident.

Property damage liability pays for repairs to the other driver's car after an accident you cause, up to $10,000. If someone hits your car, the other driver's policy will pay to fix it.

Although Florida's no-fault law requires drivers to carry PIP, another driver or their family can sue you for severe injury or death. You should get bodily injury liability coverage to help protect you from expensive lawsuits.

Does car insurance cover hurricane damage in Florida?

Your car insurance covers hurricane damage only if you have comprehensive coverage.

That's because comprehensive coverage pays for damage caused by events outside of your control. This includes hurricane damage such as flooding, a fallen tree or branch and hail.

Comprehensive coverage is typically included in full coverage car insurance. It's also usually required if you have a car loan or lease by your lender.

Number of cars damaged by major Florida hurricanes

Storm |

Cars damaged

|

|---|---|

| Hurricane Milton, 2024 | 42,951 |

| Hurricane Helene, 2024 | 62,578 |

| Hurricane Ian, 2022 | 151,892 |

Hurricanes damage a significant number of cars across Florida each year.

If you're worried about getting back on the road after hurricane damage, you should consider a company with great customer service, which can lead to a quick and easy claims process.

It's also important to choose a company with a strong financial stability grade. Companies with "A" ratings or better shouldn't have a problem paying out customer claims, even after a major disaster.

If you don't have comprehensive insurance and a hurricane damages your car, you may be able to get help fixing or replacing it through FEMA's Other Needs Assistance program.

This program is meant to help you get back on the road if your car no longer works after a disaster. It doesn't pay for cosmetic damage, such as dents caused by hail.

Florida SR-22 and FR-44 policies

If you cause an accident that injures another person or you get a DUI, you have to buy extra coverage with higher limits. This is called SR-22 or FR-44 insurance.

SR-22 insurance requirements in Florida

After accidents that cause an injury, you must get SR-22 insurance or a certificate of financial responsibility.

In addition to Florida's no-fault requirements, SR-22 insurance requires:

- $10,000 of bodily injury liability per person

- $20,000 of bodily injury liability per accident

This coverage pays for injuries to other drivers or passengers in an accident you cause.

FR-44 insurance requirements

Florida drivers convicted of driving under the influence (DUI) of alcohol or drugs must get FR-44 insurance. FR-44 coverage requirements are much higher than state minimum coverage.

FR-44 insurance requires:

- $100,000 of bodily injury liability per person

- $300,000 of bodily injury liability per accident

- $50,000 of property damage liability per accident

Frequently asked questions

How much is car insurance in Florida?

The average cost of car insurance in Florida is $102 per month for minimum coverage. Full coverage insurance costs $311 per month.

Who has the cheapest car insurance in FL?

In 2026, Geico has the cheapest car insurance in Florida. Geico charges $213 per month for full coverage insurance in Florida, on average. That's 31% less than the state average of $311 per month.

Geico also has the cheapest rates in Florida for a minimum liability policy, at $37 per month, on average.

Why is car insurance so expensive in Florida?

Car insurance costs more in Florida than in other states because of the many uninsured drivers in the state. Plus, millions of tourists drive to Florida each year. More drivers on the road may mean more accidents. Hurricanes also affect rates because insurance pays for repairs if you have comprehensive coverage.

How much car insurance do I need in Florida?

You must have $10,000 in personal injury protection and $10,000 in property damage liability to drive legally in Florida. The state doesn't require bodily injury liability, which pays for other drivers' injuries, unlike almost every other state.

Methodology

To find the cheapest car insurance quotes in Florida, ValuePenguin collected thousands of rates from every ZIP code in Florida for the largest car insurance companies. Quotes are for a 30-year-old man with good credit who drives a 2018 Honda Civic EX.

Unless otherwise noted, rates are based on a full coverage policy.

- Liability: 50/100/50 in bodily injury and property damage

- Uninsured driver: 50/100 $50,000 in bodily injury per person, $100,000 in bodily injury per accident,/tooltip] in bodily injury

- PIP: $10,000 per accident

- Collision and comprehensive: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should only be used for comparative purposes. Your own quotes may be different.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.