Best and cheapest health insurance in Texas

Cheapest health insurance companies in Texas

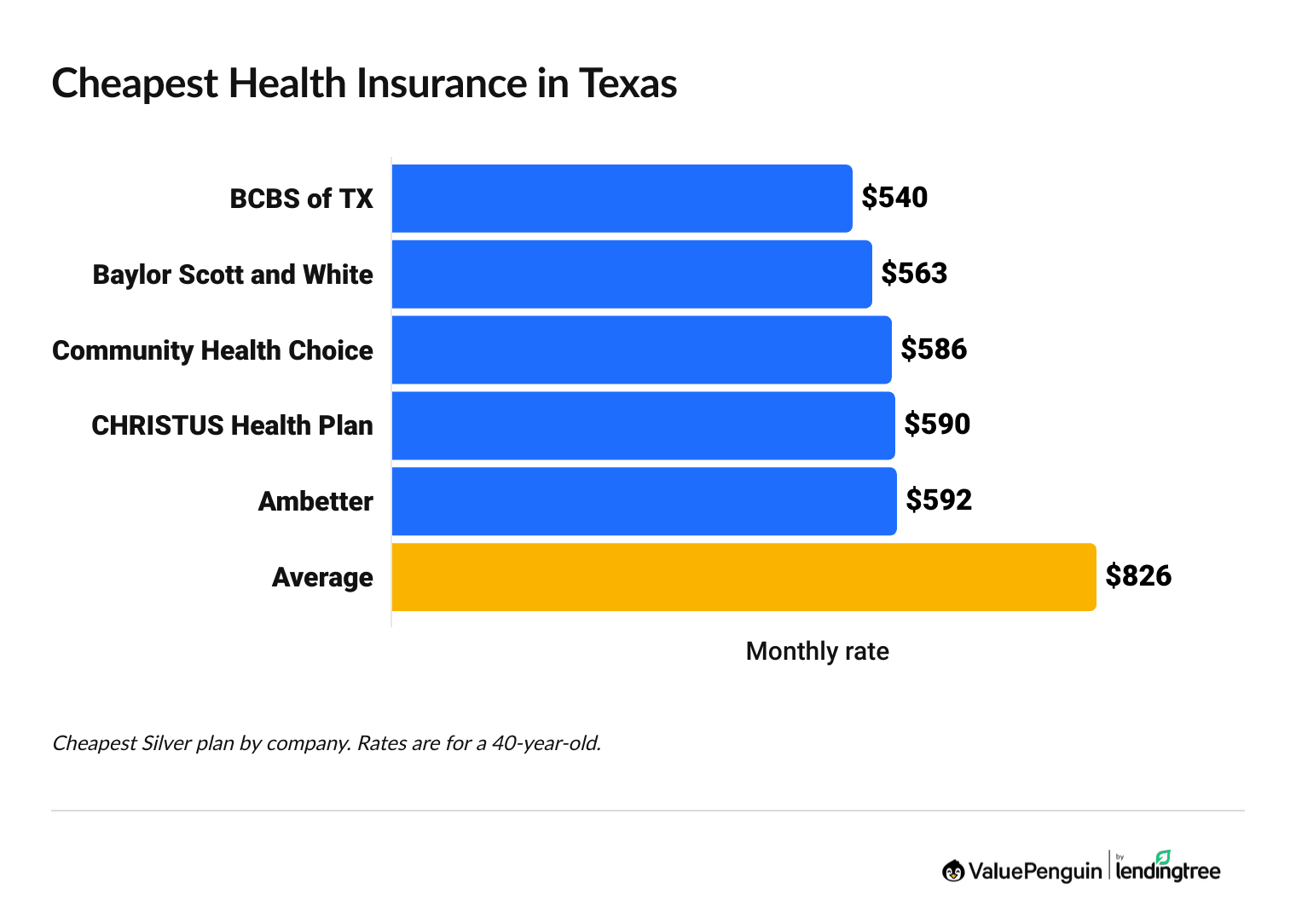

The cheapest health insurance plans in Texas are from Blue Cross Blue Shield, Baylor Scott and White and Community Health Choice, with Silver plans starting at $540 per month before discounts.

Find Cheap Health Insurance Quotes in Texas

Ambetter also has affordable rates, at an average cost of $592 per month. That's roughly 28% less than the Texas state average.

Ambetter also has the cheapest quotes in Dallas and Fort Worth.

Affordable health plans in Texas

Company |

Cost

| |

|---|---|---|

| BCBS of Texas | $540-$1,211 | |

| Baylor Scott and White | $563-$1,045 | |

| Community Health Choice | $586-$776 | |

| CHRISTUS | $590-$746 | |

- Blue Cross and Blue Shield of Texas has the cheapest Silver plans overall and also has the most affordable rates in El Paso, at $593 per month before discounts.

- If you just need basic coverage, Blue Cross and Blue Shield of Texas also has the cheapest rates for most Texans for Bronze plans, at $355 per month before discounts. Plus, it has affordable dental insurance.

- Silver plans are good for most people, but if you need more coverage, you should choose a Gold plan. Blue Cross and Blue Shield of Texas has the cheapest rates for Gold plans, at $467 per month before discounts.

Aetna will stop selling health insurance to Texas residents at the end of this year. If you have a marketplace plan through Aetna, you'll need to switch to a different company at the next open enrollment period (Nov. 1 to Jan. 15).

Ambetter is the best option for most Texas residents, and Blue Cross Blue Shield has the cheapest coverage in the state.

Best affordable health insurance companies in Texas

Ambetter has the best health insurance plans in Texas, at $592 per month for the cheapest plan.

On top of its cheap rates, Ambetter has a perfect 5-star rating from HealthCare.gov for member experience and good coverage options. Nine out of every 10 people in Texas can buy an Ambetter health plan.

Ambetter also stands out for its strong 4-star rating for plan administration. That means the company has a good reputation for service and customers have an easy time getting the information they need.

Plus, Ambetter sells EPOs (exclusive provider organizations), which give you more flexibility when it comes to choosing your doctors than HMOs (health maintenance organizations).

Find Cheap Health Insurance Quotes in Texas

Best-rated health insurance companies in Texas

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Ambetter | ||

| Sendero | ||

| BCBS of Texas | ||

| CHRISTUS | ||

| Molina |

Sendero has the best overall ACA rating in Texas, but it only offers coverage in eight counties near Austin. If you live in the Austin area, getting a quote from Sendero is a good idea.

How much does health insurance cost in Texas?

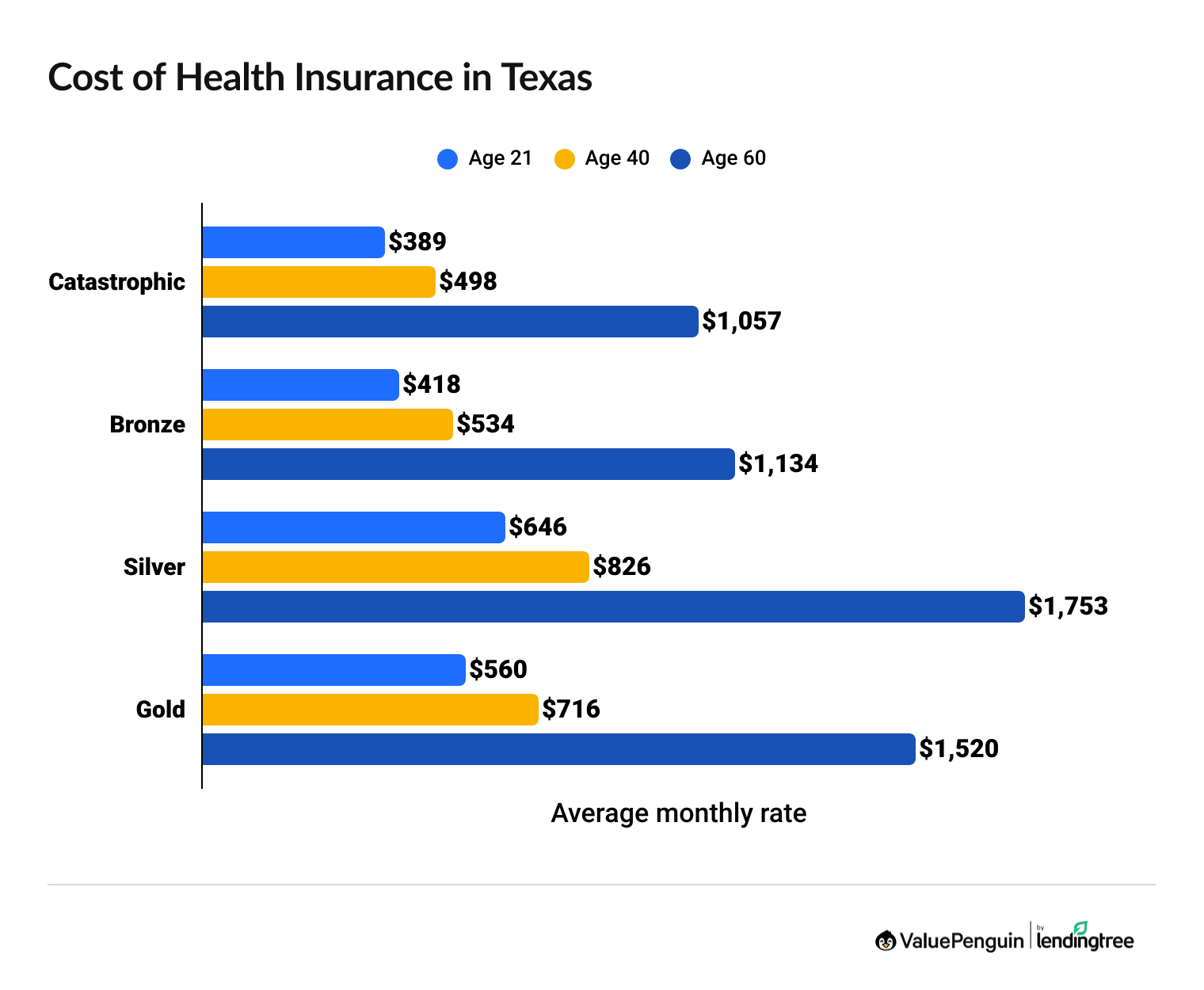

Health insurance in Texas costs $826 per month, on average, but you could potentially pay around $124 per month or even less if you get discounts based on your income.

Find Cheap Health Insurance Quotes in Texas

- Your age affects your health insurance costs. Rates grow slowly in your 20s and 30s before increasing rapidly as you move into middle age.

- In Texas, a 40-year-old will pay 28% more for health insurance than a 21-year-old across all plan tiers. By contrast, a 60-year-old will pay more than twice as much as a 40-year-old for the same level of coverage, regardless of which plan tier they choose.

- Health insurance gets cheaper when you're eligible for Medicare. Texas Medicare Advantage plans cost an average of $26 per month on top of the standard cost of the Medicare program, which is currently $185 per month.

Health insurance discount changes in Texas for 2026

Medical insurance costs $826 in TX, or it could possibly cost around $124 per month, on average, if you get discounts based on your income.

The cost of health insurance after discounts is projected to rise from about $47 per month in 2025 to $124 per month in 2026. That's because the amount of money available for subsidies is going down in 2026.

Between 2021 and 2025, shoppers on HealthCare.gov got larger discounts called "expanded subsidies." Although the subsidies aren't going away entirely, the amount you can get will decrease for 2026.

Health insurance rates in Texas after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000+ | $489 | $661 | 35% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- Who can get subsidies? You're eligible for subsidies if you earn between $15,650 and $62,600 per year as a single person ($32,150 and $128,600 per year for a family of four). The less you make, the larger your subsidy.

- How do subsidies work? When shopping for Bronze, Silver or Gold plans on HealthCare.gov, you'll see how much each plan costs with your subsidy applied. You can choose to pay a discounted monthly rate, or you can pay the full cost of your health insurance plan every month and get your entire subsidy in a lump sum when you file your taxes.

- How much do you save? You can use ValuePenguin's subsidy calculator to get an estimate of how much you'll pay for coverage after discounts.

Find Cheap Health Insurance Quotes in Texas

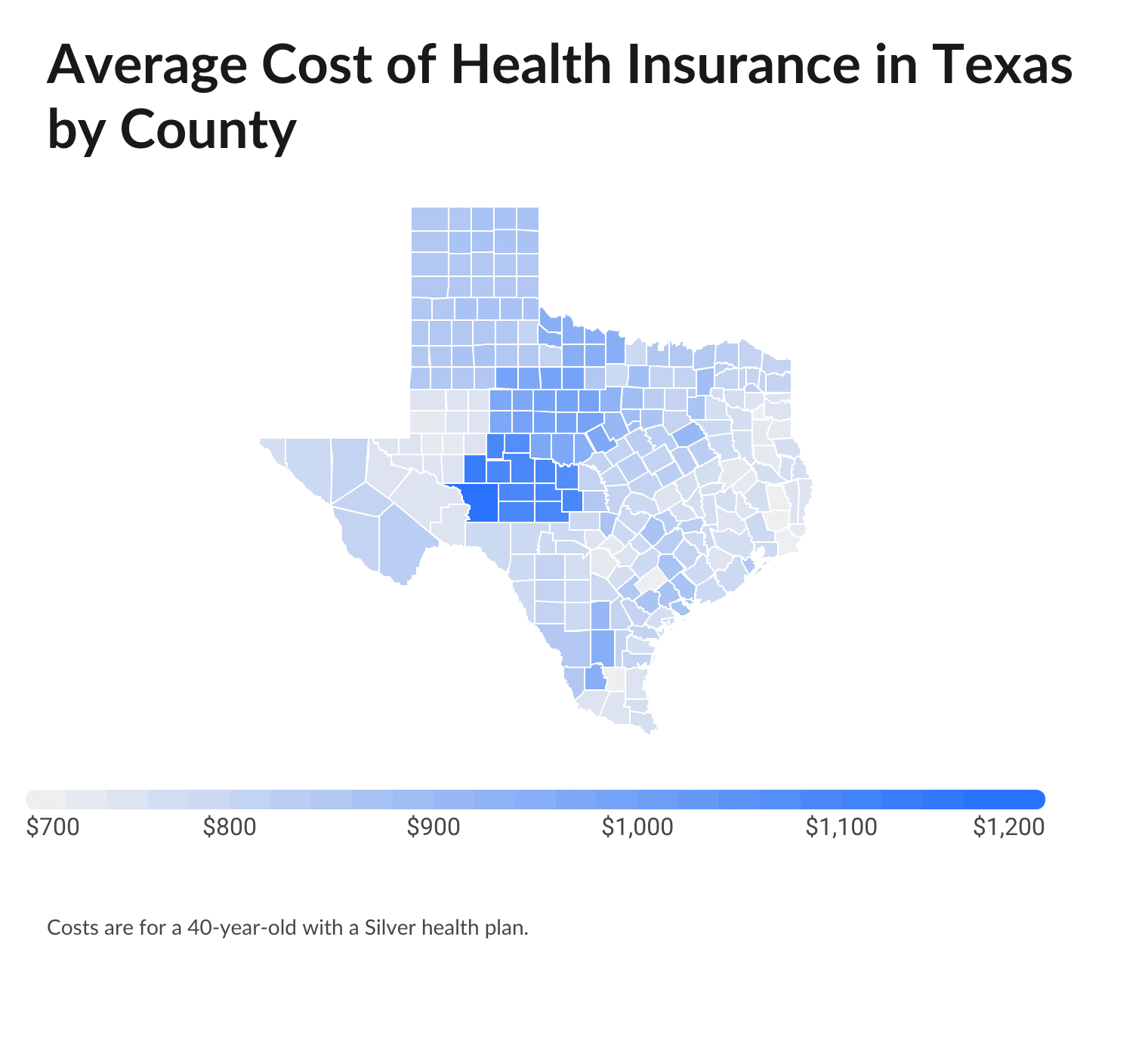

Average cost of medical insurance by TX county

Brooks County has the most affordable health insurance in Texas, at $712 per month, on average.

Average health insurance costs in Texas can differ by up to $450 per month, depending on the county you live in. It's important to remember that where you live also determines what plans are available to you. Counties with larger populations tend to have more companies selling plans, which often leads to lower rates.

Other factors, such as the average health of people in your community and local health care costs, can also play a role in determining how much you pay for medical insurance.

Average Silver rates by TX county

TX county | Monthly rate |

|---|---|

| Anderson | $783 |

| Andrews | $730 |

| Angelina | $779 |

| Aransas | $775 |

| Archer | $944 |

Monthly rates for a 40-year-old who's not eligible for subsidies.

Cheap Texas health insurance plans by city

Oscar has the cheapest Silver health insurance plans in Houston, at $647 per month.

Ambetter has the lowest rates in Dallas and Fort Worth. UnitedHealthcare sells the most affordable coverage in San Antonio, and Sendero has the cheapest quotes in Austin.

Cheapest health insurance plans by TX county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Anderson | CHRISTUS Value Silver | $653 |

| Andrews | Ambetter Standard Silver | $645 |

| Angelina | UnitedHealthcare Silver Standard | $706 |

| Aransas | CHRISTUS Value Silver | $656 |

| Archer | BCBS of Texas Blue Advantage Silver HMO | $913 |

Cheapest Silver plan with rates for a 40-year-old

Best health insurance by level of coverage

Finding the best health insurance plan for you depends on how much medical care you need and how much you can afford to spend each month.

- A Silver tier plan is usually the best deal if you earn less than $39,125 as a single person or $80,375 as a family of four. That's because you'll get a government subsidy that improves the plan's benefits and a discount on your rate. After the savings, you could pay very little for health insurance and health care.

- A Gold tier plan is best for most people in Texas who earn too much to qualify for cost-sharing reductions. Gold plans cover a large portion of your medical costs, and in Texas, Gold plans are cheaper than Silver if you don't qualify for discounts.

Gold plans: Best if you have a moderate or high income

| Gold plans pay for about 80% of your medical care. |

Gold plans cost an average of $716 per month in Texas.

A Gold plan is a way to get affordable health insurance in Texas with good benefits. In Texas, Gold plans cost less than Silver plans unless you qualify for discounts, and about a third of people in the state have a Gold plan.

Gold plans typically have a smaller deductible than other tiers, meaning you'll pay less before your health insurance kicks in. And after your plan's full benefits begin, you'll pay less when you visit the doctor or fill a prescription than with other plans.

Silver plans: Best affordable plans for most people

| Silver plans pay for about 70% of your medical care. |

You'll pay an average of $826 per month for a Silver plan in Texas.

Silver health plans usually balance affordable monthly rates with inexpensive out-of-pocket costs, making them the most popular level of coverage in Texas. If you have a low income, you might pay less for health care and get discounts on your insurance rate with a Silver plan.

Bronze plans: Best for healthy individuals with emergency savings

| Bronze plans pay for about 60% of your medical care. |

In Texas, Bronze plans cost $534 per month, on average.

Bronze plans are cheaper than Gold or Silver plans, but they also pay less when you go to the doctor. That means you have to pay more of your medical bills yourself. You should only consider a Bronze plan if you're in good health and you have enough savings to cover an unexpected illness or accident.

Catastrophic plans: Best for affordable monthly rates

Catastrophic plans cost an average of $498 per month in Texas.

Catastrophic health insurance is the cheapest option you can buy, but it doesn't pay much when you go to the doctor. It's better than no health insurance, but it's not a good deal unless you're willing and able to pay a lot if you get sick or hurt.

You can only get a Catastrophic plan if you're under 30 or if you qualify for a hardship exemption. Catastrophic health insurance isn't eligible for marketplace subsidies, also called premium tax credits.

Cheap or free medical insurance in Texas if you have a low income

If you can't afford health insurance or need help paying for medical bills even after you get a plan, you have a few options.

Medicaid in Texas

Medicaid is a type of free health insurance for people who have a low income.

Low-income health insurance in Texas can be difficult to get because Texas sets stricter rules about who can qualify, rather than expanding Medicaid under the Affordable Care Act (ACA). That means you must have a low income and be one of the following to qualify for Medicaid in Texas.

- Pregnant

- 65 or older

- Responsible for a child age 18 or younger

- Blind

- Disabled

- A caretaker for a disabled family member

Use cost-sharing reductions for cheaper medical care

If you have a low income and you buy a Silver plan, you can qualify for discounts called cost-sharing reductions (CSRs). These discounts lower the amount you have to pay when you go to the doctor, so health care is cheaper.

To qualify for CSRs, you can't make more than $39,125 as a single person or $80,375 as a family of four.

Are health insurance rates going up in TX in 2026?

The average cost of health insurance in Texas rose by 30% between 2025 and 2026.

Bronze plans had the smallest average increase, at 21%, while Catastrophic and Gold plans both increased by 33%. Silver plans rose by an average of 35% year on year. The cost of a Silver health plan has increased by 44% since 2022.

Are health insurance rates going up in TX in 2026?

Catastrophic

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $354 | – |

| 2023 | $351 | -1% |

| 2024 | $356 | 1% |

| 2025 | $375 | 5% |

| 2026 | $498 | 33% |

Monthly costs are for a 40-year-old.

Catastrophic

Year | Cost | Change |

|---|---|---|

| 2022 | $354 | – |

| 2023 | $351 | -1% |

| 2024 | $356 | 1% |

| 2025 | $375 | 5% |

| 2026 | $498 | 33% |

Monthly costs are for a 40-year-old.

Bronze

Year | Cost | Change |

|---|---|---|

| 2022 | $445 | – |

| 2023 | $413 | -7% |

| 2024 | $415 | 0% |

| 2025 | $443 | 7% |

| 2026 | $534 | 21% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Silver

Year | Cost | Change |

|---|---|---|

| 2022 | $575 | – |

| 2023 | $589 | 2% |

| 2024 | $584 | -1% |

| 2025 | $610 | 5% |

| 2026 | $826 | 35% |

Monthly costs are for a 40-year-old.

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $652 | – |

| 2023 | $522 | -20% |

| 2024 | $519 | -1% |

| 2025 | $537 | 3% |

| 2026 | $716 | 33% |

Monthly costs are for a 40-year-old.

Why is health insurance expensive in TX in 2026?

Health insurance in Texas is getting more expensive because wages and prescription drug prices are rising and because of general inflation.

The increased use of weight loss drugs such as Wegovy and Ozempic is also helping drive up the cost of Texas health insurance.

Expiring tax subsidies are expected to contribute to more expensive rates for all ACA customers. That's because healthier people are more likely to go without coverage when insurance rates go up.

What's causing health insurance to increase

Cause | Increase in health insurance rates |

|---|---|

| Rising health care costs | 8% |

| Expiring enhanced tax credits | 4% |

| New tariffs | 3% |

How to prepare for higher medical insurance prices in 2026

- Consider a high-deductible health plan (HDHP) to lower your monthly rate. With an HDHP, you can open a health-savings account, which offers significant tax benefits.

- Shop around and compare quotes to get the best rates. The difference between the cheapest and most expensive Silver health plan in Texas is $869 per month.

- Check if you're eligible for free government health insurance, called Medicaid.

Affordable Care Act plans — also called ACA plans, marketplace plans and Obamacare plans — are health insurance plans you can buy on HealthCare.gov. All the plans cover at least 10 health circumstances, like emergency care and prescription medications.

The difference between the plans is how much of your medical bills they'll pay for. Lower-tier plans like Bronze and Catastrophic pay less, which means you have to pay more when you go to the doctor. Higher-tier plans like Silver and Gold pay a higher share of your bills, so you pay less for medical care.

Average cost of medical insurance by family size in Texas

The cost of your health insurance policy will increase along with the size of your family. In Texas, a single parent with a child will pay $1,320 per month, on average, for a Silver plan. The average monthly bill for a married couple of two 40-year-olds is $1,651.

Family size | Average monthly cost |

|---|---|

| Individual | $826 |

| Individual and Child | $1,320 |

| Couple | $1,651 |

| Family of three | $2,145 |

| Family of four | $2,640 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Add $494 per month, on average, for each additional child 15 or younger in your family.

How much is COBRA in Texas?

COBRA health insurance in Texas costs about $702 per month for a single person and $2,087 per month for a family, on average.

If you lose, quit or retire from your job, COBRA lets you continue the health insurance plan you had with your employer for 18 months.

COBRA health insurance is usually expensive because you'll have to pay the full cost of the plan without any help from your former employer. When you were working, your employer paid much of the bill, so you were only paying part of the cost.

COBRA plans also aren't eligible for any subsidies or discounts, making them one of the most expensive types of health insurance when unemployed.

Rather than continuing the health insurance plan through your former job, you'll usually get a better deal by shopping for a plan on the Texas health insurance marketplace, HealthCare.gov.

Short-term health insurance in Texas

In early 2025, the Trump administration rolled back a Biden-era rule that would limit the length of a short-term health policy to three months.

Short-term health insurance is now available in Texas for up to 364 days.

You can buy short-term health insurance in Texas. Policies typically have less coverage than marketplace plans, but you can get them at any time during the year.

Pros of short-term health insurance in Texas

Cons of short-term health insurance in Texas

Health insurance enrollment by income level in Texas

Texas residents who earn a low income will be most impacted by the 2026 changes to Affordable Care Act (ACA) subsidy levels.

That's because people with below-average incomes are more likely than other groups to get health coverage through HealthCare.gov. For example, more than three-quarters of individuals with ACA coverage in Texas earn less than $30,120 per year.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 2% |

| $15,060 to $20,783 | 50% |

| $20,784 to $22,590 | 11% |

| $22,591 to $30,120 | 15% |

| $30,121 to $37,650 | 9% |

Enrollment in 2025 marketplace plans made during the 2024-2025 Open Enrollment period. Total may not be 100% due to rounding

Frequently asked questions

Does Texas have free health care?

Texas has free health care, but only for some people. In Texas, you can qualify for Medicaid, a type of free government health insurance, if you earn a low income and you are pregnant, have a child at home, are a senior, have a disability or are in another eligible situation. If you have a low income but you don't qualify for Medicaid, you should see if you're eligible for an ACA (Obamacare) subsidy.

How much does health insurance cost per month in Texas?

The average Silver health plan in Texas costs $826 per month for a 40-year-old. That's 35% more expensive than in 2025. A Gold plan costs $716 per month, on average. That makes it a good choice if you're not eligible for cost-sharing reductions (CSRs).

If you qualify for discounts based on your income, you could pay around $124 per month for coverage.

Is medical insurance getting more expensive in Texas in 2026?

Yes, medical insurance in Texas is getting 30% more expensive in 2026. Silver health plans have the largest average increase, at 35%. If you qualify for discounts, called subsidies, you can expect an average increase of 165%. This triple-digit increase is largely because of expiring Covid-era enhanced subsidies.

What is the best affordable health insurance in Texas?

Ambetter has the best health insurance plans in TX because of its good customer service, strong coverage options and affordable prices. Silver health plans from Ambetter start at $540 per month before discounts, called subsidies.

Is $200 a month a lot for health insurance in Texas?

A Texas health insurance plan for $200 per month is a good deal, as it's about three-quarters less than average. The best way to get a plan that costs $200 per month or less is to shop on HealthCare.gov and use health insurance subsidies to get discounted rates. The lower your income, the more you'll save on insurance.

How do I find affordable medical insurance in Texas?

If you can't sign up for a group health plan through your employer, you should use HealthCare.gov to shop for a health marketplace plan.

Methodology

Texas health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses calculated rates by income, which are weighted using CMS data on the incomes of those who purchased plans during last year's open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Texas for medical care, member experience and plan administration. This 2026 plan quality data from CMS is based on data from last year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2025 open enrollment period.

Other sources include S&P Global Capital IQ and the National Association of Insurance Commissioners (NAIC).

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.