Farmers Car & Home Insurance Review: Good Support at a Cost

An impressive array of coverage and discounts, but higher-than-average rates.

Find Cheap Auto Insurance Quotes in Your Area

Farmers is a good insurance company with positive customer reviews and plenty of customization options for your policy. However, you'll pay extra for its superior customer service: Auto and homeowners insurance rates were about 14% higher than average.

If you're looking for the insurer with the lowest rates, you’ll likely find lower rates with another company. However, if you're willing to pay extra to tailor your policy and have a smooth claim experience, Farmers is a good option.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique Value | |

Pros and cons

Pros

Lots of discounts and coverage add-ons

Reliable customer service

Cons

Expensive rates if you don't qualify for discounts

Doesn't offer gap insurance for your car loan

Is Farmers insurance a good choice?

Auto insurance takeaway: If you wants great customer service and coverage from a dedicated local agent, we recommend comparing quotes from Farmers. Your Farmers agent will work with you to find discounts, understand your coverage and more.

Home insurance takeaway: Farmers offers lots of coverage options for home insurance policies and combines that with great customer service. Unless you’re looking for the cheapest home insurance rates, Farmers will be hard to beat. The company’s national reputation and friendly agents make it one of our top recommended home insurance companies.

Farmers’ strongest feature is its customer service, which means a speedy claim process and a good experience if you need to call support.

Farmers has a strong coverage network with more than 48,000 exclusive and independent agents and approximately 21,000 employees available across all 50 states, but not the District of Columbia.

Farmers typically offers higher rates than major competitors for both home and auto insurance.

However, Farmers offers a plethora of car insurance discounts to help you save, including an above-average bundling discount of up to 20% off an auto and home insurance policy.

Compare Farmers to other insurance companies | |

|---|---|

| |

| |

| |

| |

| |

Find Cheap Auto Insurance Quotes in Your Area

Farmers auto insurance

Quotes comparison: How much is Farmers auto insurance?

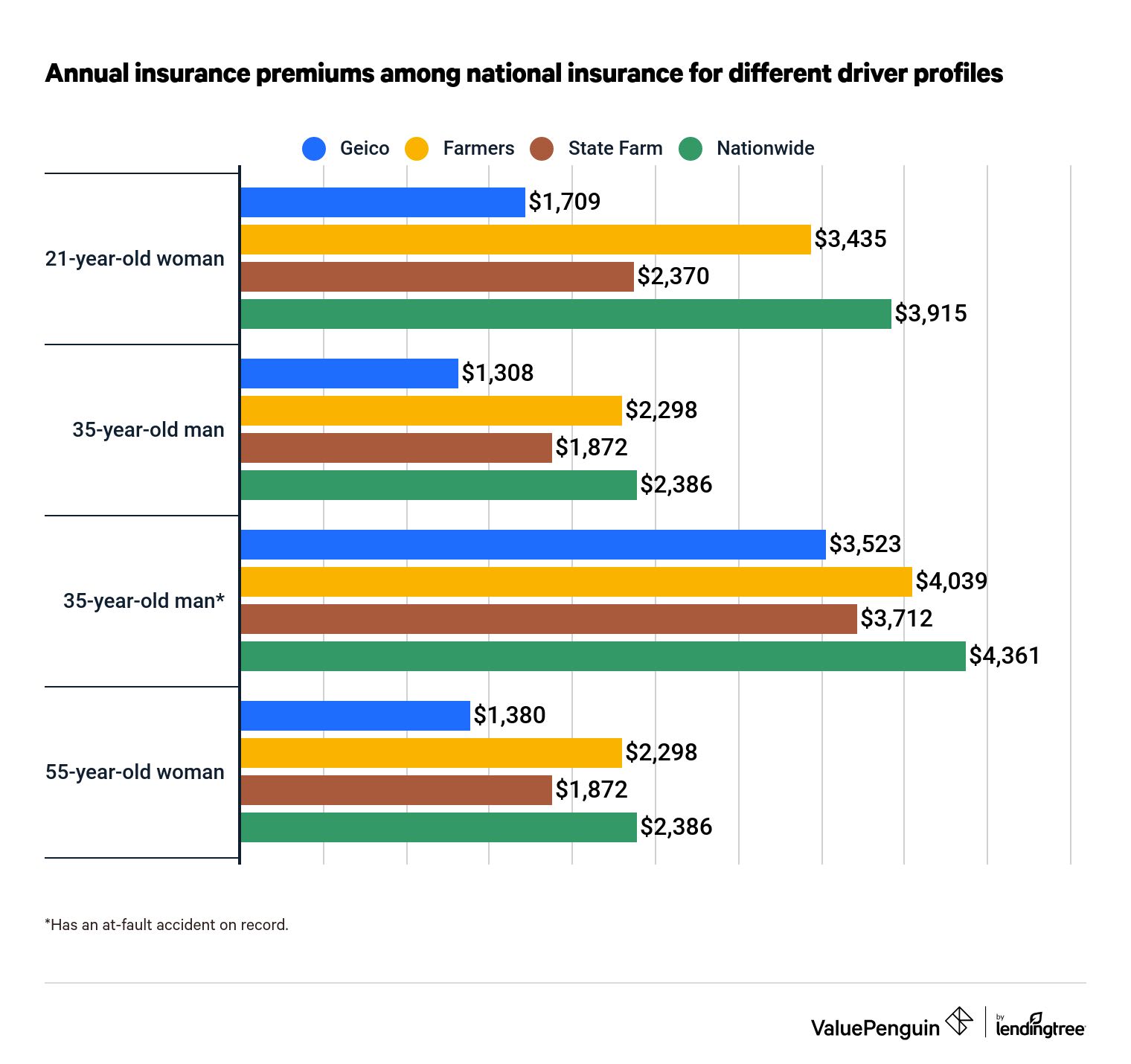

Farmers is the seventh-largest auto insurance company in the country. Across most driver profiles, Farmers falls in the middle in terms of affordability. Auto insurance quotes from Farmers were generally cheaper than quotes from Nationwide, but more expensive than quotes from Geico and State Farm. If you're choosing between these four insurers, it's best to shop around for quotes to ensure you're getting the best rate.

Find Cheap Auto Insurance Quotes in Your Area

Farmer's car insurance rates vs. competitors

Insurer | 21-year-old woman | 35-year-old man | 35-year-old man, one accident | 55-year-old woman |

|---|---|---|---|---|

| Farmers | $3,435 | $2,298 | $4,039 | 2,298 |

| Geico | $1,709 | $1,308 | $3,523 | $1,380 |

| Nationwide | $3,915 | $2,386 | $4,361 | $2,386 |

| State Farm | $2,370 | $1,872 | $3,712 | $1,872 |

If your top priority is to snag cheap rates, you're better off with other insurers such as Geico or State Farm. These companies consistently had lower rates than Farmers. For example, State Farm quoted our sample 21-year-old woman driver rates that were 40% cheaper than average, while Geico quoted her rates that were 17% cheaper than average. Rates from Farmers, by contrast, were 20% more expensive than average.

Even if you're looking to take advantage of Farmers' unique discounts, such as Signal or the Business/Professional Group discount, you're likely to get the best rates by comparing quotes before committing yourself to one auto insurer.

Farmers auto insurance coverage options and discounts

As one of the largest auto insurers in the United States, Farmers offers all of the traditional auto coverage options that other major national insurers do. It also offers notable optional coverages at an additional cost, such as the New Car Pledge, Towing & Roadside Assistance, Extended Customized Equipment Coverage and Farmers Rideshare.

New Car Pledge: Also known as new car replacement coverage, this optional add-on guarantees a brand-new replacement vehicle if your new car is totaled within two years of its model year or before hitting 24,000 miles, whichever limit is reached first.

For instance, if you purchased a 2021 Toyota Camry, it would be covered until 2023 or until the odometer reaches 24,000 miles. Furthermore, if your car can be repaired, Farmers will ensure that mechanics only use original manufacturer parts.

Accident forgiveness: Your insurance rate will normally increase after an accident, but if you purchase accident forgiveness from Farmers and avoid accidents completely for three years, one accident will be forgiven.

Loss of use coverage: Similar to rental car reimbursement, loss of use coverage means Farmers Insurance will help you pay for the cost of transportation while your own car receives covered repairs. Instead of paying for a rental car, however, Farmers will pay you a flat amount that you can then use for public transportation, cabs, ridesharing or rentals.

Towing & Roadside Assistance: If you want roadside assistance, be sure to add this optional coverage when you're purchasing your policy. The coverage offers 24/7 roadside assistance that includes the following services:

- Towing (up to $150)

- Locksmith assistance

- Battery jump-starts

- Flat tire change

- Winching (pulling a car back on the road, provided it's within 10 feet of a paved public road)

Customized Equipment Coverage: If you're someone who enjoys customizing your car with aftermarket parts, you should know that this optional coverage protects the custom parts of your vehicle if they're ever stolen or damaged. This optional coverage is useful since vehicle upgrades, like infotainment systems and custom wheels, aren't usually covered under a standard insurance policy. You'll need to buy a full coverage auto insurance policy — which includes collision and comprehensive insurance — from Farmers to get this coverage.

Other helpful add-on coverages from Farmers include:

Coverage | Explanation |

|---|---|

| Original equipment manufacturer (OEM) | Covers the use of factory-original equipment for repairs to cars less than 10 years old. |

| Spare parts coverage | Pays up to $750 for the replacement of any spare parts you keep on hand. |

| Glass deductible buyback | Covers repairs to and replacement of windshield and glass, with a $100 deductible. |

| Full windshield and glass coverage | Covers repairs to and replacement of windshield and glass, with no deductible. |

| Guaranteed value | Reimburses you a value agreed upon in advance if your car is totaled. |

| Rental car reimbursement | Pays for a rental car for 30 days while your vehicle receives repairs. |

If you drive a specialty car, such as a classic or collectors automobile, Farmers is a good option for auto insurance. Several of these coverages — such as the guaranteed value and spare parts coverages — can help offset the cost of maintaining and repairing these unusual vehicles.

By contrast, Farmers may not be a great fit if you drive a financed car. Farmers does not offer gap insurance — the coverage that pays the difference on your auto loan if your car is totaled before you finish payments.

Standard auto insurance coverage available through Farmers

- Comprehensive coverage

- Medical payments coverage

- Personal injury protection

- Collision coverage

- Uninsured/underinsured motorist coverage

- Liability coverage

Highlight coverage feature: Farmers Rideshare

For drivers of Uber, Lyft or other apps, ridesharing insurance from Farmers extends your auto insurance coverage through the first phase of ride-hailing, which is when your app is on and you're looking for, but haven't found, a passenger.

If you don't have ride-hail insurance, it's likely that you're not covered for the first phase of ride-hailing under your existing auto insurance policy. Once you have a passenger, the ride-hail company's insurance will cover you until you're back in the first phase of ride-hailing.

Farmers’ auto insurance discounts

Farmers offers all of the standard discounts you would find at other large auto insurance companies. What makes it stand out, however, are its Business/Professional Group Discount and the Signal program, which we discuss below.

Signal by Farmers: Farmers' usage-based insurance program, Signal, gives you an automatic 5% discount when you sign up. The free mobile app uses your cellphone to track your driving behaviors.

When you renew your policy, Farmers adjusts your savings rate based on the data collected through the Signal app, up to 15%. The app gives you suggestions on how to improve your score, thereby improving your savings. Currently, the program is not available in California, Hawaii, New York or South Carolina.

Business/Professional Group Discount: If you're a member of an eligible occupation or business group, you might be eligible to receive a discount on your auto insurance. It's best to contact your agent to see if you qualify for this discount since eligibility varies by state. Below, we list common eligible occupations.

- Accountants

- Architects

- Dentists

- Educators

- Engineers

- Firefighters

- Judges/lawyers

- Librarians

- Military personnel

- Physicians

- Police

- Pilots

- Scientists

Other discounts available from Farmers include:

Discount | How do you receive it? |

|---|---|

| Bundle discount | Bundle multiple Farmers Insurance policies. |

| Multicar discount | Insure multiple vehicles with Farmers. |

| ePolicy | Enroll in ePolicy, Farmers' paperless, electronic document delivery service. |

| Good payer discount | Avoid late fees for the previous 12 months. |

| Safe driver discount | Applies to any rated driver who has no BI points. |

Farmers home insurance

Quote comparison: How much is Farmers home insurance?

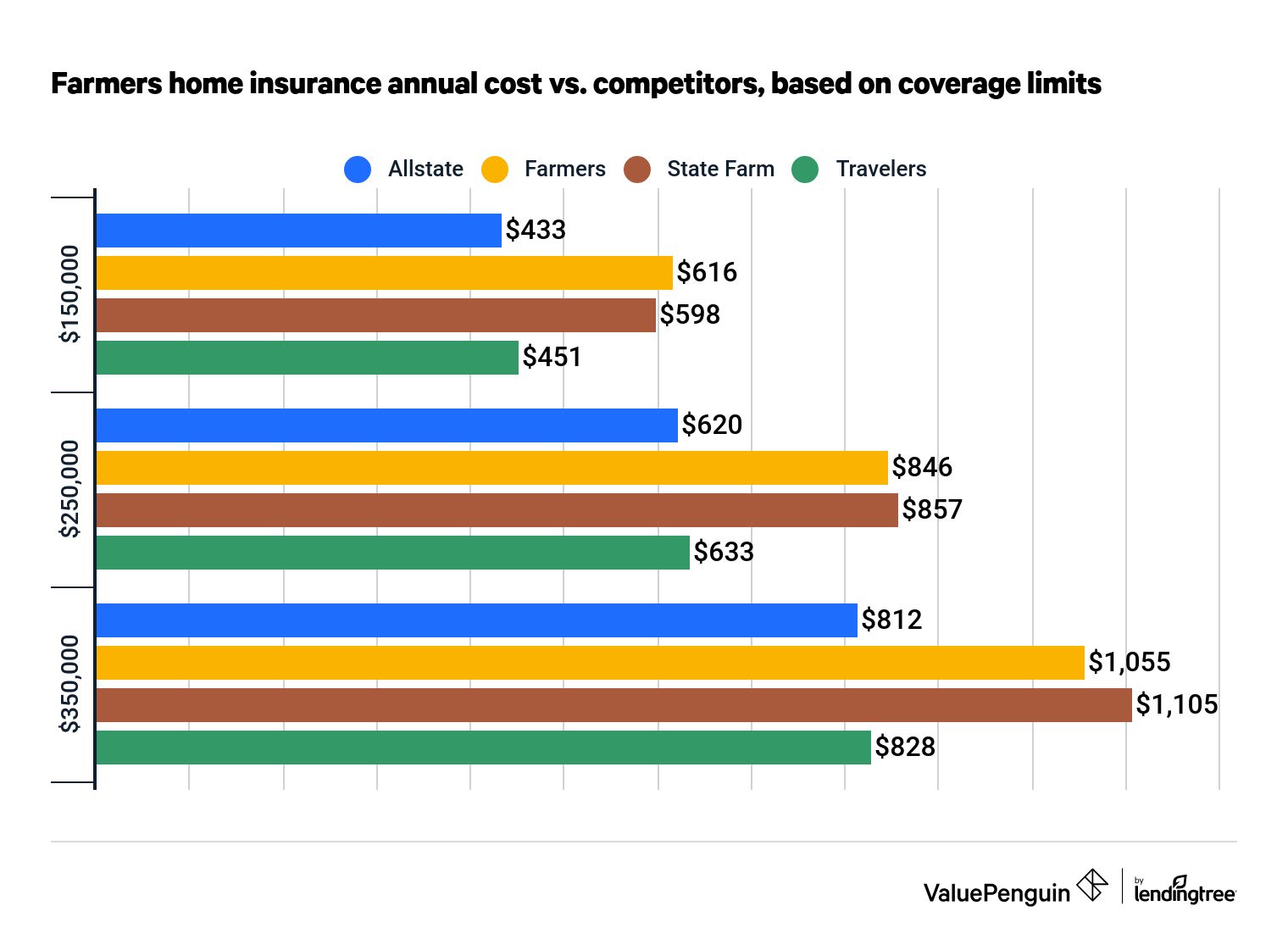

Farmers offers higher-than-average home insurance rates across several home insurance policy limits. For a home insurance policy with a $250,000 limit, Farmers offered an annual rate that was higher than the average of the insurers in this study by $107.

The other insurers in our study — Allstate, State Farm and Travelers — all offered lower rates than Farmers. The insurer with the lowest rates was Allstate.

Find Cheap Homeowners Insurance Quotes in Your Area

Farmer's homeowners insurance rates vs. competitors

Insurer | $150,000 policy | $250,000 policy | $350,000 policy |

|---|---|---|---|

| Farmers | $616 | $846 | $1,055 |

| Allstate | $433 | $620 | $812 |

| State Farm | $598 | $857 | $1,105 |

| Travelers | $451 | $633 | $828 |

Farmers home insurance coverage options and discounts

Farmers offers its signature Smart Plan homeowners insurance policies at three different tiers: Standard, Enhanced and Premier. Each tier comes with certain coverages and limits that policyholders can customize to meet their unique needs.

Package | Details |

|---|---|

| Standard | The most basic package, a Standard policy includes basic coverages such dwelling, separate structures, home contents, loss of use and liability coverage. |

| Enhanced | The Enhanced package increases policy limits and adds other features, including coverage that pays for the cost of replacing your roof or the contents of your home without depreciation. |

| Premier | The Premier package includes the highest possible policy limits. Policyholders can also add Guaranteed Replacement Coverage, which pays 100% of the cost of rebuilding, no matter what your policy limits are. |

Farmers also offers a few unique endorsements, such as Identity Shield, Eco-Rebuild, contents replacement cost and trees and shrubs coverage.

Identity Shield: This endorsement provides coverage for $28,500 in expenses, such as legal fees, and $1,500 in indemnity should you become a victim of identity theft. Although other insurance companies offer identity theft endorsements, Farmers’ coverage includes credit monitoring for two people, annual identity reports and advisory services if you become a victim of identity theft.

Eco-Rebuild: This endorsement provides you with up to $25,000 to rebuild, repair or replace with green materials in the event that you experience a covered loss. We consider this a great endorsement since it helps policyholders qualify for discounts, such as the home safety discount, which can potentially offset the cost of the endorsement in the long run.

Contents replacement cost: The contents replacement cost endorsement covers the full replacement cost of your items in the event of a covered loss. The replacement cost is based on the cost of a new item with comparable features. Standard home insurance policies typically provide reimbursement for an item’s depreciated value, meaning that you receive less compensation from your insurance company than what you paid for your items.

Another benefit of Farmers home insurance is its Guaranteed Repair Program. Policyholders who select one of the contractors in Farmers' Guaranteed Repair Program network for their covered home repairs will receive a five-year warranty on the work.

What’s covered by a Farmers policy? | Details |

|---|---|

| Your property | Covers you for damage to your home if it’s caused by a covered accident. |

| Your possessions | Covers damage, destruction and theft of possessions (subject to exclusions) anywhere in the world. |

| Liability | Pays when you’re legally liable for another person’s injury or for property damage caused by an accident. |

| Medical payments | Covers medical costs associated with injuries on the premises of your residence, regardless of fault. |

| Additional living expenses | Also called "loss of use," this homeowners insurance coverage means that Farmers reimburses you for up to 24 months of living expenses if you’re unable to stay in your home due to a covered loss. |

Home insurance discounts offered by Farmers

Farmers offers several homeowners insurance discounts, but availability will depend on your policy and your state of residence, among other factors. While none of the discounts below are particularly unique, their low barriers to qualification make them appealing. For instance, the new home discount offers a lenient 14-year period for policyholders to be eligible.

Discount | How do you receive it? |

|---|---|

| Affinity discount | Belong to a group that has partnered with Farmers Insurance, such as an occupational group or professional association. |

| Bundle discounts | Bundle another Farmers Insurance policy with a Farmers homeowners policy. |

| ePolicy | Enroll in ePolicy, Farmers' paperless, electronic document delivery service. |

| UL Approved Roofing Materials | Receive this discount if your roof is constructed from asphalt or fiberglass materials deemed impact-resistant by Underwriters Laboratories. |

| New home | Qualify for this discount if you’re insuring a home that was constructed less than 14 years ago. |

| Protective devices | Qualify if your home has a fire alarm, security system and/or indoor fire sprinkler system. |

| Home safety* | Own a home with windows, walls, a roof or a foundation fortified against natural disasters and that has automatic gas or water shutoffs. |

| Green certifications* | Qualify for this discount if your home is certified by Energy Star, the Environmental Protection Agency (EPA) or Leadership in Energy and Environmental Design (LEED) |

| Claim free | Stay claim-free for three years. Automatically included on all policies. |

| Claim forgiveness | Stay claim-free for five years and your premium will not go up after you make your first claim. Automatically included in all policies. |

| Declining deductible | Receive $50 toward your deductible for every year you maintain a policy with Farmers. Automatically included in all policies. |

| Connected home* | Have a smart home system that allows you to remotely monitor and control your home. |

Can only have one of these four discounts, not multiple.

Additionally, Farmers also offers a handful of discounts available only to residents of specific states, including:

- California Earthquake Discount. California homeowners who have both a California earthquake insurance policy and a Farmers Insurance policy on their house receive a discount.

- Retirement community. Available to Arizona policyholders who live within specific retirement communities.

- HOA gated community. Available to Nevada residents who live within specific gated communities.

- Fortified home. Available to Alabama policyholders whose houses have added protection from natural disasters.

Farmers customer reviews, complaints and financial strength ratings

Overall, online customer reviews of Farmers home and auto insurance tend to be positive. Reviews often cite Farmers' friendly agents who are ready to handle claims with a professional demeanor.

Farmers' J.D. Power ranking backs that up: For both auto and home claim satisfaction, the company scored at or above the industry average.

Rating system | Industry average | Farmers score |

|---|---|---|

| J.D. Power - Auto claim satisfaction | 872 | 872 |

| J.D. Power - Property claim satisfaction | 883 | 884 |

| NAIC complaint index - Auto | 1.0 (lower is better) | 1.09 |

| NAIC complaint index - Home | 1.0 (lower is better) | 0.57 |

| AM Best financial strength rating | A++ (maximum) | A |

| Apple App Store | 5.0 (maximum) | 4.8 |

| Google Play Store | 5.0 (maximum) | 4.7 |

Customer complaint data suggests that Farmers home insurance might have a slight edge over Farmers auto insurance in terms of service. Farmers auto insurance had more customer complaints than average, according to its 1.09 score on the National Association of Insurance Commissioners (NAIC) complaint index. By contrast, Farmers received a 0.57 score for homeowners insurance, indicating fewer complaints than average.

Farmers’ excellent financial health means that policyholders don’t have to worry about the company’s ability to pay out claims. AM Best assigns letter grades to insurance companies based on their ability to meet their financial obligations, and Farmers was assigned a letter grade of A. This grade represents "excellent" health and is the third-highest rating available, after the A+ and the A++ scores.

App ratings

In addition to its reliable claim processing and solid financial strength, Farmers also offers a top-notch mobile app. Both Apple and Android customers reviewed the app very well, praising its convenience and helpful features, which include:

- Pay your bill and change payment methods.

- Access your digital Farmers proof of insurance card.

- Get contact information for your Farmers agent.

- Begin filing a claim and track a claim's status.

- Call roadside assistance.

- Get quotes for different insurance products, such as auto, home, renters and condo coverage.

Contact Farmers Insurance: Claims and customer service

Farmers policyholders may reach out to the company for a variety of reasons. Below, we outline how to contact the company for coverage and customer service.

Farmers Insurance claims

As with most insurers, your claim experience with Farmers will depend on where you live. Farmers is available in every state; however, it operates through subsidiaries, such as 21st Century and Bristol West Insurance Group, in a few states. If you need to file an insurance claim with Farmers, you can do so by calling 800-435-7764. Alternatively, you can file a claim through Farmers' online portal.

To file a claim with Farmers, customers have several options:

- Contact the Farmers Insurance claims department. The phone number for the Farmers claims department is the same for auto and home insurance: 1-800-435-7764.

- Use the Farmers mobile app. The Farmers mobile app allows you to start the process of filing a claim.

- File a claim online. To file an auto, home or other insurance claim, log in to your Farmers Insurance account or if you are not a Farmers homeowners insurance customer, use the online "report a claim" website tool that does not require you to log in.

- Reach out to your agent directly. Your Farmers Insurance agent will know your policy best and can help you determine next steps.

Farmers Insurance customer service

If you're part of the Farmers insurance customer community and have a customer service question, you can contact the care center at 1-888-327-6335. The office is open from 7 a.m. to 11 p.m. CST during the week and 8 a.m. to 8 p.m. during the weekend.

Alternatively, auto, home and umbrella customers can log in to their Farmers account to send a message to the company.

About Farmers Insurance Company

Farmers Insurance has been in business for 93 years. The history of Farmers Insurance began in 1928, when the company was founded by John C. Tyler and Thomas E. Leavey. Farmers operates out of several subsidiaries across the country, with the topmost property and casualty entity being Farmers Insurance Group of Companies.

In addition to homeowners and auto insurance, Farmers sells a variety of other types of insurance, including:

- Flood insurance coverage

- Renters insurance

- Condo insurance

- Landlord and rental properties insurance

- Life insurance

- Business/commercial insurance

- Boat insurance

- ATV and off-road insurance

- RV and motor home insurance

- Mobile home insurance

- Pet insurance (from a third-party partner)

- Umbrella insurance

Frequently Asked Questions

Does Farmers Insurance offer an extended auto warranty?

No, Farmers does not offer an extended car warranty. It recommends that you purchase one of these from the car manufacturer or an independent third party.

Does a Farmers Insurance policy cover rental cars?

A Farmers auto insurance policy does cover rental cars. Your coverage will apply across the United States, Puerto Rico, U.S. territories and Canada. If you plan to take your car outside these areas, you may need to consider other options. Additionally, if you plan to drive a recreational vehicle (RV), you will need to purchase RV coverage.

What states does Farmers Insurance cover?

Farmers Insurance covers all 50 states. However, it does not sell insurance in the District of Columbia. Shoppers who live in Washington, D.C., will need to find another company.

Methodology

For car insurance costs, we compared quotes for Farmers vs top competing car insurance companies for a 21-year-old woman, 35-year old man and a 55-year-old woman with clean driving records, as well as a 35-year-old man with an at-fault accident.

For home insurance quotes, we collected rates with Farmers and similar home insurance competitors for a policy with dwelling coverage limits of $150,000, $250,000 and $350,000.

ValuePenguin's analysis used insurance quote data from Quadrant Information Services. These quotes were publicly sourced from insurance ompany filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.