The 10 Best Car Insurance Companies (2026)

American Family is the best car insurance company for most people. It costs around $159 per month. | ||

Erie typically has the best car insurance rates, at $154 per month. But it's only available in 12 states and D.C. | ||

Amica has some of the best customer service reviews, But it's not cheap, at around $285 per month. |

Find the Best Cheap Auto Insurance Quotes in Your Area

Top 10 best car insurance companies

Find the Best Cheap Auto Insurance Quotes in Your Area

Data-powered research on the best car insurance

- American Family is the best major company. It offers a mix of affordable rates and great customer service.

- NJM is the top-rated company in the Mid-Atlantic, with excellent customer reviews.

- Erie is consistently one of the cheapest insurance companies in the Mid-Atlantic, Midwest and parts of the Southeast.

- Amica has the best-rated customer service among national companies.

- Shelter has the best coverage, because its basic full coverage policy includes extra protection.

- State Farm is the best choice after a crash, because it won't raise your rates much after your first accident.

- Auto-Owners has the best rates and discounts for teens and families with multiple cars.

- Geico is the best choice for tech-savvy drivers because it has great online tools to help manage your policy.

- Nationwide has the best discounts, including safe driving and mileage-based discounts.

- USAA offers the best rates and a top-rated claims experience to military members, veterans and their families.

Watch: How to compare car insurance companies

Best car insurance overall: American Family

-

Editor's rating:

- Full coverage: $159/mo

- Read the full American Family review

American Family has the best car insurance for most drivers because it's cheap, reliable and easy to use.

Best regional car insurance company: NJM

-

Editor's rating:

- Full coverage: $168/mo

- Read the full NJM review

NJM has excellent service, affordable rates and policies that include free extras.

Best company for cheap insurance: Erie

-

Editor's rating:

- Full coverage: $154/mo

-

Erie has the best rates for car insurance if you live in the Southeast, Midwest or East Coast.

Best customer service: Amica

-

Editor's rating:

- Full coverage: $285/mo

- Read the full Amica review

Amica's top-notch customer service makes it a great company if you're willing to pay more for insurance.

Best car insurance coverage: Shelter

-

Editor's rating:

- Full coverage: $192/mo

- Read the full Shelter review

Shelter is the best company if you need extra coverage, such as gap insurance or new car replacement.

Best car insurance after an accident: State Farm

-

Editor's rating:

- Full coverage after a crash: $218/mo

- Read the full State Farm review

State Farm won't raise your rates much after a crash, and its reliable service will come in handy if you're in another accident.

Best company for families with teens: Auto-Owners

-

Editor's rating:

- Full coverage: $171/mo

- Read the full Auto-Owners review

Auto-Owners has the best car insurance rates for families with teen drivers.

Best mobile app: Geico

-

Editor's rating:

- Full coverage: $187/mo

- Read the full Geico review

Geico has an easy-to-use app and website, along with affordable rates.

Best auto insurance discounts: Nationwide

-

Editor's rating:

- Full coverage: $265/mo

- Read the full Nationwide review

Nationwide's car insurance can be cheap if you qualify for multiple discounts.

Best insurance for military members and veterans: USAA

-

Editor's rating:

- Full coverage: $125/mo

- Read the full USAA review

USAA is the best-rated and cheapest car insurance company if you have connections to the military.

How customers rank the top insurance companies

NJM, Amica and Erie are the best all-around car insurance companies, according to customers.

-

NJM is ranked third on J.D. Power's claims satisfaction survey, which polls real customers about their claims experience. It also gets around

one-fifth as many complaints as average.

In addition, Reddit users write they are very happy with NJM's customer service and claims experience. A few customers even mention their body shops’ praise for NJM, saying they tend to pay for original manufacturer parts instead of cheaper aftermarket parts.

-

Amica is an excellent choice if

NJM doesn't sell car insurance near you.

Amica also earned a high score on J.D. Power's claims satisfaction survey, and it only gets around half as many complaints as average.

On Reddit, customers praise Amica for having an outstanding claims process after an accident. And while they admit that Amica can be more expensive than average, Redditors typically agree that its great service is worth the extra cost.

- Erie has the highest score on J.D. Power's claims satisfaction survey and 28% fewer complaints than average. Redditors tend to agree that Erie's combination of great customer service and affordable rates makes it a great choice. Many report staying with Erie for years due to its smooth claims process and great prices.

Highest-rated insurance companies according to customers

Company | Overall | Reddit | JD Power |

Complaints

|

|---|---|---|---|---|

| NJM | ||||

| Amica | ||||

| Erie | ||||

| USAA | ||||

| Auto-Owners |

NR stands for not rated.

Top car insurance companies near you

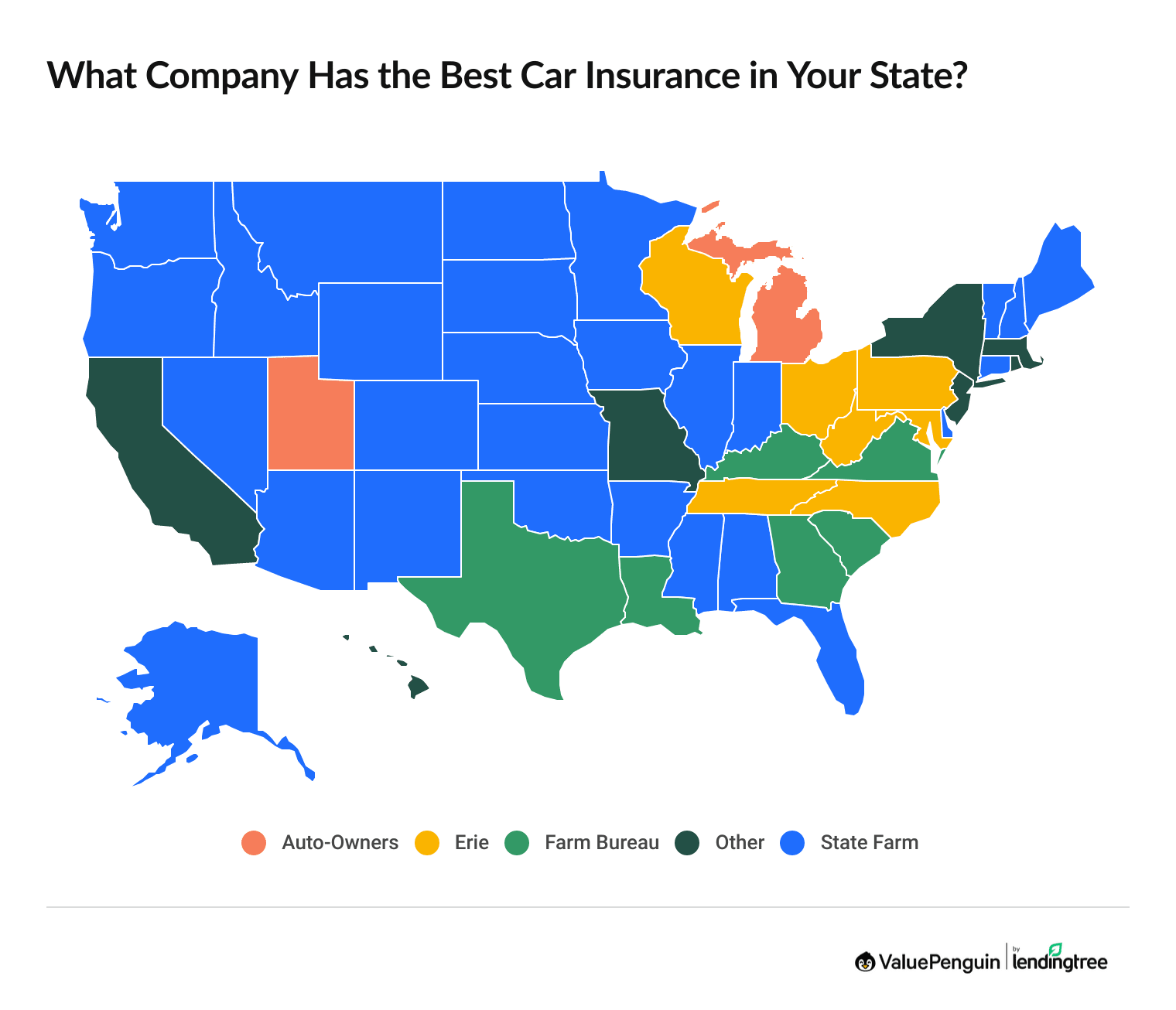

State Farm is the best-rated major company in 22 states.

But the best car insurance for you depends on where you live. Auto-Owners is the top choice in eight states, while Erie is the best company in four states and Washington, D.C.

Find the Best Cheap Auto Insurance Quotes in Your Area

Top auto insurance companies by state

State |

Top pick

| Rating |

Cost

|

|---|---|---|---|

| Alabama | Auto-Owners | $156 | |

| Alaska | State Farm | $179 | |

| Arizona | State Farm | $203 | |

| Arkansas | Shelter | $167 | |

| California | AAA | $176 |

How much does the best car insurance cost?

The best car insurance company doesn't have to be expensive. However, your rates depend on your coverage, age and driving record.

For example, the best liability-only car insurance comes from Auto-Owners, where a policy costs just $52 per month. But Erie has the best price for full coverage, at $154 per month.

Monthly cost of the best car insurance companies

How to find the best car insurance for you

The best car insurance company for you should have great coverage and support at an affordable rate in your area.

If your priority is…

We recommend:

Erie or American Family, because they have the cheapest rates for most drivers.

We recommend:

Geico, American Family or State Farm, because they have highly rated apps and digital tools that make quotes, claims and changes easy.

We recommend:

Auto-Owners, Erie or Shelter, because all three have affordable rates and great discounts for young drivers.

We recommend:

USAA, because it has low rates and consistently high praise from military families.

How to find the best car insurance companies for affordable rates

Shopping around and using discounts are the best ways to lower your car insurance rates.

How to find an insurance company with the best coverage

The best auto insurance companies offer extra protection to make your life easier after a crash along with the basic coverage you need to drive legally.

Popular car insurance coverage add-ons

Beyond these basic coverages, insurance companies may offer add-ons. None of these are required by law, so you can choose what you want.

Coverage | Description |

|---|---|

| Accident forgiveness | Your first at-fault accident won't affect your insurance rates. |

| Vanishing deductible | Your deductible gradually declines for each year you're accident-free. |

| Mechanical breakdown | Covers the cost of repairing wear and tear to your car. |

| Rideshare insurance | Covers you during the rideshare waiting period when Uber and Lyft coverage doesn't apply. |

How to find the best car insurance for customer support

Start by using ValuePenguin editor recommendations to find the best car insurance companies in the country.

Our five-star ratings are a snapshot of a company's overall quality. Our scores are based on customer service ratings from J.D. Power, customer complaint data from the NAIC , cost, coverage options and overall value.

Frequently asked questions

What’s the best car insurance company?

American Family is the best car insurance company overall for its affordable rates, excellent service and helpful coverage options. If you want customized coverage, Shelter is a great choice. If you have a teen driver in your family, choose Auto-Owners. And if you recently caused an accident, consider State Farm.

Who has the best car insurance rates?

American Family has the best car insurance rates compared to other major companies. Minimum coverage from American Family costs around $60 per month, and full coverage rates average $159 per month. Companies like USAA, NJM, Erie and Auto-Owners might have cheaper rates, depending on where you live and whether you qualify for coverage.

How can I find the best car insurance for me?

To find the best car insurance for you, figure out how much and what kind of coverage you need. Then get quotes from several companies available near you for the same level of coverage. Compare each company's quotes, customer support ratings, coverage options and discounts.

Who has the best auto insurance near me?

State Farm has the best combination of cheap rates and dependable customer service in 22 states — more than any other company. But the best car insurance in your state might be a smaller local company like Erie or NJM. That's why it pays to compare quotes from several large and small companies near you.

Which insurance company has the best customer satisfaction?

NJM, Amica and Erie are the top-rated car insurance companies for customer satisfaction. All three companies have high scores on J.D. Power's claims satisfaction survey, great reviews on Reddit and earn fewer complaints than average, according to the NAIC.

Methodology

ValuePenguin chose the top 10 insurance companies based on an unbiased review of 56 major insurance companies. All of our picks offer insurance in at least five states.

How companies are rated

ValuePenguin assigned its editor ratings for insurance companies based on customer service, affordability, coverage options and shopping experience.

In addition to doing independent research about each company, we also used additional third-party sources.

- J.D. Power's customer surveys about overall satisfaction and the claims experience

- AM Best's ratings for a company's financial strength

- The NAIC’s reports on formal complaints about a company

How costs are calculated

Rates are based on full coverage car insurance using quotes from all residential ZIP codes in the country where the company has a large market share.

Quotes have better coverage than what's required by the states and also include comprehensive and collision coverage to protect your car. Averages are for a 30-year-old man who drives a 2018 Honda Civic EX, unless otherwise noted.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision coverage: $500 deductible

Family rates for a parent and teenager were gathered separately for all ZIP codes in Illinois, Pennsylvania and Georgia for a 50-year-old with an 18-year-old on their policy. These quotes include the limits above, plus $50,000 of uninsured and underinsured motorist property damage coverage.

Online experience is based on Apple Store and GooglePlay app ratings, along with ValuePenguin editors' experience using insurance company quote tools.

To find the top car insurance company in each state, ValuePenguin editors chose companies that offer the best combination of cheap rates, reliable customer service, helpful coverage and availability. Customer satisfaction was determined using J.D. Power customer service and claims satisfaction data along with customer complaints as reported by the National Association of Insurance Commissioners (NAIC).

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.