Average Health Insurance Cost in 2026

A Silver health insurance plan from the ACA marketplace costs an average of $752 per month for 2026. That's 21% more than in 2025.

Find Cheap Health Insurance Quotes in Your Area

How much does health insurance cost?

How much does health insurance cost per month for 2026?

In 2026, a Silver health plan costs $752 per month, on average, for a 40-year-old.

Rates depend on things like your age, the plan tier you choose and where you live.

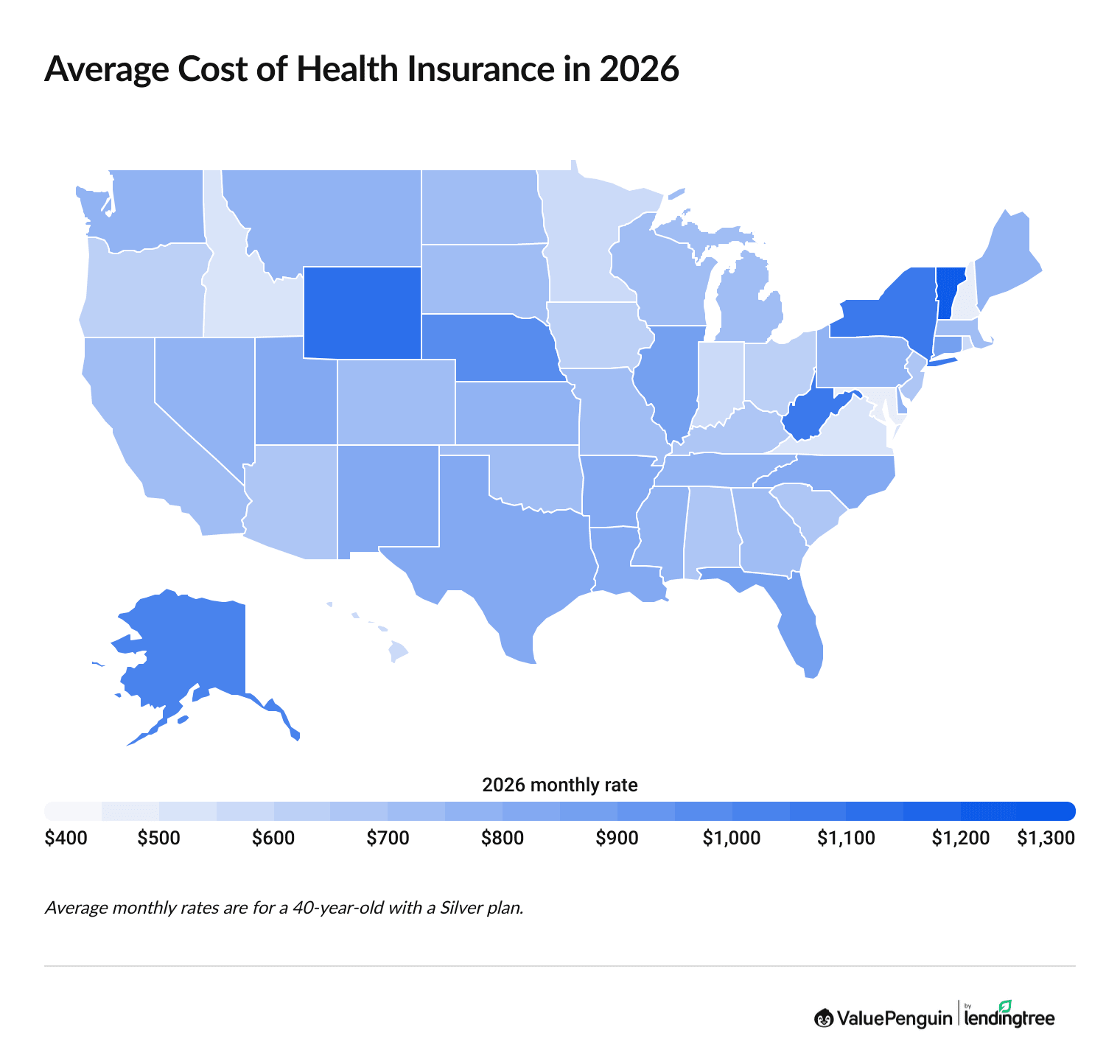

For example, people in Vermont pay $1,224 per month for a Silver plan, on average.

In Maryland, the same tier of coverage costs an average of just $480 per month.

How much is health insurance in my state?

Find Cheap Health Insurance in Your Area

How much did monthly health insurance costs change for 2026?

From 2025 to 2026, the average health insurance premium, or monthly rate, went up by 21% nationwide. Arkansas saw the largest jump, at 67%.

Average rates are going up in 2026 in every state except Alaska. In Alaska, rates are about 5% cheaper, on average, for a 40-year-old with a Silver plan.

Over the last five years, Silver plans have gotten 77% more expensive.

How much does health insurance cost after discounts in 2026?

Nationally, health insurance rates could go from around $84 per month to about $175 per month after discounts.

That's because discounts in 2026 might not be as big. Since 2021, eligible shoppers have gotten significant discounts called "enhanced subsidies." If Congress doesn't extend these subsidies, discounts will be calculated as they were before 2021. If this happens, people with lower incomes will see the biggest increases in their rates.

Health insurance rates in the United States after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000 | $423 | $498 | 18% |

| $70,000+ | $496 | $625 | 26% |

Average cost after federal subsidies for a single 40-year-old with a Benchmark Silver plan. Rates vary by location and assume a rollback of the expanded subsidies to the pre-2021 structure.

It's important to note that subsidies could change entirely before 2026. Congress could restructure the subsidy program, which means eligibility and savings could be different than they were before 2021.

Why is the cost of health insurance going up?

- Rising medical costs: Health insurance is getting more expensive, mostly because health care is getting more expensive. The cost of medical care has more than doubled since 2000. More expensive medical care means health insurance companies have to pay more when you see a doctor or get a prescription. So companies then charge you higher rates to help cover the cost of your care.

- High demand for GLP-1 drugs: The dramatic increased use of expensive GLP-1 drugs, such as Ozempic and Wegovy, has also contributed to rates going up.

- Changes to marketplace discounts: Discounts have been bigger since 2021. These "enhanced subsidies" are expiring at the end of 2025. This means that people who get discounts will see their rates go up. But it also means that full-price plans are getting more expensive as a result. That's because insurance companies anticipate that some healthy people who don't use their insurance as much will likely drop their coverage when they see how much the cost has gone up. The people who decide to keep their insurance will be the ones who are more likely to get sick and need regular care, which ultimately costs the insurance companies more. To make up the difference, rates go up for everyone.

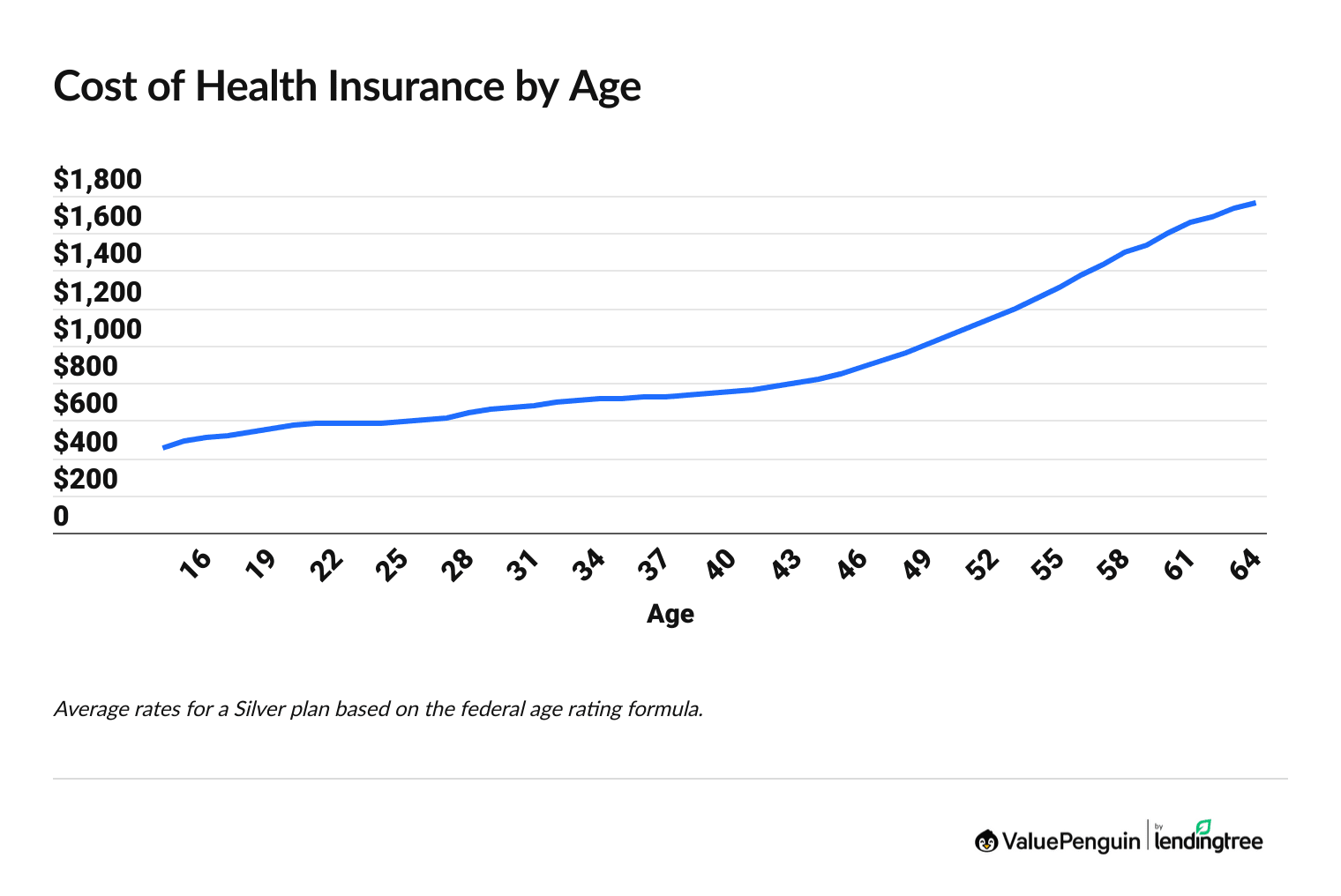

How much does health insurance cost by age?

Health insurance costs more as you get older, with the most significant increases starting when you reach your late 40s. For example, the cost of health insurance nearly doubles between ages 40 and 55.

As you grow older, the likelihood of having health problems increases. This means you'll have to pay more for the same coverage.

Age doesn't affect your health insurance rates in New York or Vermont. And in seven states, age affects rates differently than it does in the rest of the country.

Health insurance cost by age

Age | 2025 cost | 2026 cost | % change |

|---|---|---|---|

| 0-14 | $372 | $450 | 21% |

| 15 | $405 | $490 | 21% |

| 16 | $417 | $506 | 21% |

| 17 | $430 | $521 | 21% |

| 18 | $444 | $538 | 21% |

Average monthly rate for a Silver plan based on the federal age rating formula. Percentages were calculated with rounded dollar amounts.

How much does health insurance cost from different companies?

Health insurance costs between $595 and $819 per month from four of the biggest companies.

Most large companies offer some kind of low-cost medical insurance.

Nationally, Kaiser Permanente has the cheapest health insurance, while UnitedHealthcare (UHC) has the most expensive rates.

But rates depend on where you live. You might find that cheaper health insurance is available from other companies in your area.

The best way to find affordable health insurance plans is to compare quotes on your state's health exchange from different companies.

Find Cheap Health Insurance in Your Area

Average health insurance cost by company

Company | 2025 cost | 2026 cost | % change |

|---|---|---|---|

| Kaiser Permanente | $507 | $595 | 17% |

| Ambetter | $516 | $710 | 38% |

| Blue Cross Blue Shield | $621 | $793 | 28% |

| UnitedHealthcare | $631 | $819 | 30% |

Average monthly cost for a 40-year-old with a Silver plan.

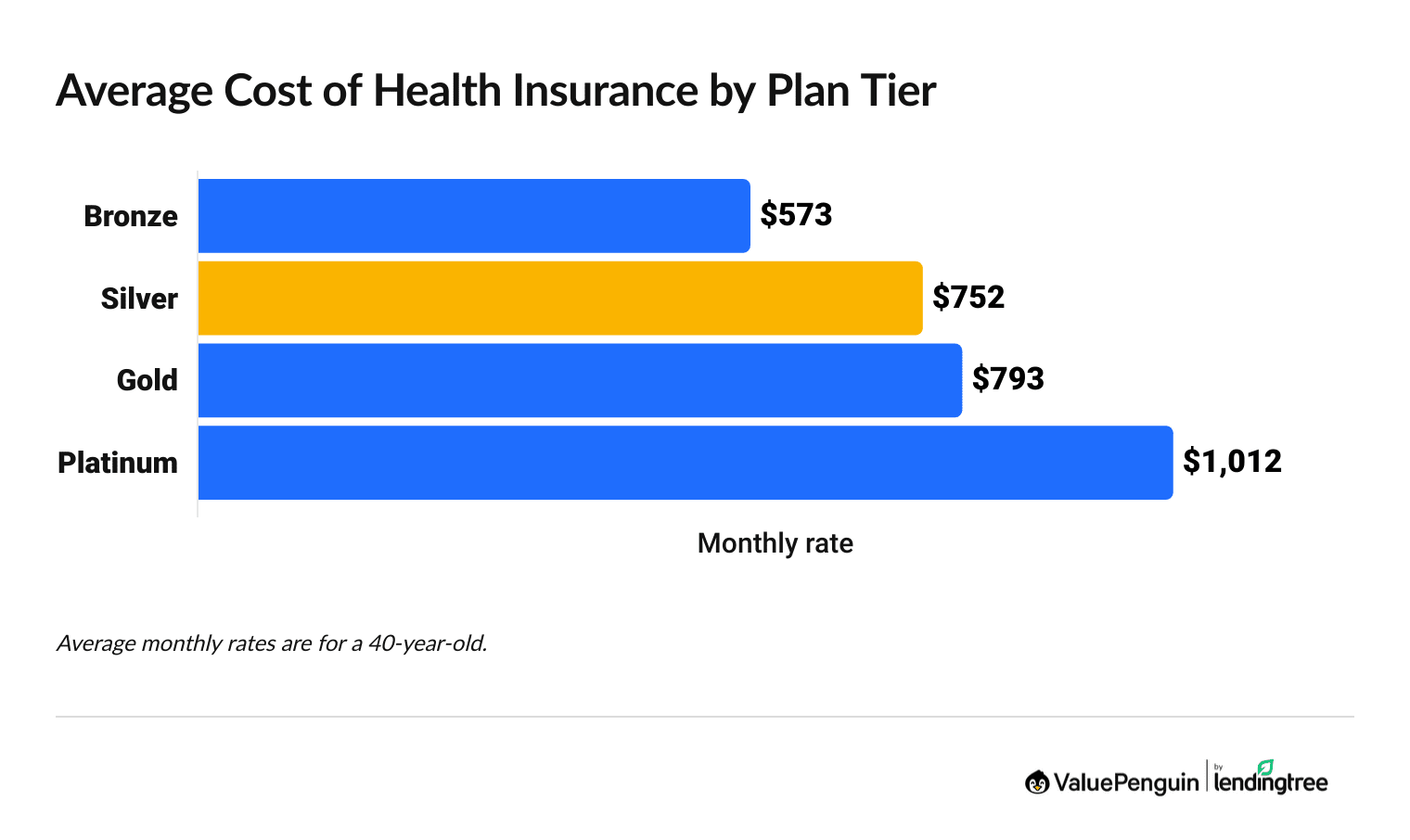

Average health insurance cost by plan tier

Health insurance rates range from $434 per month for a Catastrophic plan to $1,012 per month for a Platinum plan.

- Catastrophic plans are the lowest plan tier. You can typically only get a plan if you're under age 30 or otherwise qualify for what's called a "hardship exemption." However, these plans require you to pay a very high amount for your medical care before they start to split the cost with you. Plus, you can't get discounts, called subsidies, with a Catastrophic plan.

- Bronze plans cost $573 per month, on average. Bronze plans are a good option for cheap health insurance, but you'll have to pay more when you visit the doctor. These plans are best if you're young and generally healthy.

- Silver plans cost $752 per month on average. Silver plans are a good middle-ground option for most people because they have average deductibles, copays and coinsurance. Because they balance good coverage and moderate rates, Silver plans are popular.

- Gold plans are only slightly more expensive than Silver plans, at $793 per month, on average. Consider a Gold plan if you go to the doctor often, because the plan will pay for a higher share of your bills than lower plan tiers.

- Platinum plans are the highest plan tier available. They have the highest monthly rates but pay for the biggest share of your health care bills. Platinum plans may make sense if you have an ongoing condition that requires frequent trips to the hospital.

Bronze vs. Silver health insurance

Silver plans are the best choice for many people because of their middle-of-the-road costs. If you have a Silver plan and earn a low income, you may be able to get discounts called cost-sharing reductions (CSRs). You can only get CSRs with Silver plans. These discounts make your bills cheaper when you go to the doctor or hospital.

If you can't get cost-sharing reductions, a Bronze plan might make more sense for affordable medical insurance if you're in good health and you can easily cover your plan's deductible from your savings.

Monthly health insurance costs (2026) by tier

Tier | 2025 rate | 2026 rate | % change |

|---|---|---|---|

| Catastrophic | $361 | $434 | 20% |

| Bronze | $488 | $573 | 17% |

| Silver | $621 | $752 | 21% |

| Gold | $676 | $793 | 17% |

| Platinum | $913 | $1,012 | 11% |

Monthly rates are for 40-year-olds. Rates are averages for the states where data is available. The average for Bronze plans includes Expanded Bronze plans.

Catastrophic plans are only available if you're under 30 or otherwise qualify. These plans cost an average of $335 per month for a 21-year-old. That's 20% more than in 2025, when a Catastrophic plan for a 21-year-old cost $279 per month, on average.

Average health insurance rates by plan type

Your monthly rate also depends on the plan type you choose.

For example, PPOs (preferred provider organizations) tend to cost more than HMOs (health maintenance organizations). PPOs give you more flexibility when it comes to the doctors you see, so they cost more.

Find Cheap Health Insurance in Your Area

HMO health insurance plans tend to have cheap rates. But you can't see doctors outside your network, and you typically need a referral to visit a specialist.

Monthly health insurance cost by plan type

Cost of private health insurance

Private health insurance through the Affordable Care Act (ACA) marketplace costs $752 per month, on average, for a 40-year-old with a Silver health plan. What you pay for a private health insurance plan will depend on factors such as your age, plan tier, the type of insurance you choose and where you live.

Private health insurance includes plans you buy on your own, often called individual health plans, and plans through your workplace, sometimes called group health plans.

If you're not enrolling in a government-backed plan like Medicare or Medicaid, you're buying private health insurance.

Private health plans bought through a state or federal exchange are eligible for government subsidies (except Catastrophic plans). These subsidies can lower your monthly rate.

Twenty states and Washington, D.C., run their own health insurance marketplaces. If your state is not one of those on the list, you can buy a private health insurance plan through HealthCare.gov.

States with health marketplaces

- California

- Colorado

- Connecticut

- Georgia

- Idaho

- Illinois

- Kentucky

- Maine

- Maryland

- Massachusetts

- Minnesota

- Nevada

- New Jersey

- New Mexico

- New York

- Pennsylvania

- Rhode Island

- Vermont

- Virginia

- Washington

- Washington, D.C.

You can also buy private health insurance directly from an insurance company, or through an agent or a broker. These plans are sometimes called "off-exchange" policies.

Off-exchange plans don't qualify for cost-saving subsidies. Before you buy, it's a good idea to compare on- and off-exchange plans to see which can save you more money.

Factors that impact health insurance rates

- Age: Generally speaking, your health insurance rates will increase as you get older until you reach age 65 and become eligible for Medicare.

- Where you live: Your rate also depends on the state and county you live in. For example, health insurance costs more than twice as much in Alaska compared to Indiana, on average.

- Smoking/tobacco use: Smokers may pay up to 50% more than nonsmokers in some states.

- Number of people covered: Health insurance costs increase as you add more people to your plan. For example, a family of three will pay more for coverage than a single person.

Your insurance company, your plan tier and whether you have an HMO or a PPO also impact your monthly rate.

Frequently asked questions

For 2026, the average cost of health insurance is $752 per month for a Silver plan. Remember, the cost you pay will depend on where you live, your age, the plan tier and other factors.

The average cost of health insurance increased by 21% between 2025 and 2026. Silver plans went from $621 per month to $752 per month, on average, for a 40-year-old.

Private health insurance is any type of medical insurance sold by a company. This includes workplace coverage — often called group health insurance — and individual coverage.

Government health insurance plans like Medicare and Medicaid aren't considered private health insurance.

A Silver health insurance plan costs an average of $752 per month on the health insurance marketplace. People making a low income may qualify for subsidies, which could lower their monthly costs. Rates depend on the plan tier you choose, among other things. For example, Bronze plans cost $573 per month, on average, and Platinum plans cost an average of $1,012 per month.

Private health insurance for 2026 costs an average of $752 per month if you pay full price on the ACA marketplace.

If you get health insurance through your job, you'll pay an average of $120 per month for an individual plan. Your employer will pay the remaining $630 per month, on average, for your coverage.

Methodology

Health insurance rates and plans are from public use files (PUFs) on the Centers for Medicare & Medicaid Services (CMS) government website. Separately, data came from the websites of state-run marketplaces that don't use the federal marketplace.

Using the rates for each plan, ValuePenguin determined averages for different variables. Average costs per state are for Silver plans for 40-year-olds unless another age or plan tier is specifically noted. Rates for all plan tiers and network types depend on where data is available. Not all plan tiers or network types are available in every state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in each state uses calculated rates by income, which are weighted using CMS data on the incomes of those who purchased plans during 2024-2025 open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively.

Other sources

Info about health and aging is from the World Health Organization (WHO). ValuePenguin determined the rates for various ages based on the rating guidelines from CMS.

Research on rising health insurance costs comes from the Peterson-KFF Health System Tracker report on medical inflation and the report on 2026 rate increases.

The cost of health insurance for employees is from KFF's 2025 Annual Employer Health Benefits Survey.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.