Travelers Insurance Review: Home & Auto

Travelers home and auto insurance is good if you want extensive coverage options, but it can be expensive.

Find Cheap Auto Insurance Quotes in Your Area

Is Travelers a good insurance company?

Travelers offers a wide range of auto insurance discounts, which may help lower the company's high rates. Home coverage offers a lot of options but few discounts.

Travelers also has very few complaints, and many customers find it easy to get their claims settled quickly. Those looking for an expanded policy should look at Travelers, but you should look elsewhere if you want cheap prices.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value | |

Pros and cons

Pros

Wide range of auto insurance discounts

Flexible home coverage with many add-ons

Few customer complaints

Fast claims process

Cons

Auto and home rates are more expensive than other companies

Not available in every state

Travelers auto insurance review

Travelers rates are higher than average, but you can make it a lot cheaper if you can get some of its main discounts. The company offers the standard coverages you'd expect from an auto insurance company, with a few unique perks.

The company’s IntelliDrive program alone can lower your insurance rates by as much as 30% if you have good driving habits, making Travelers more affordable. However, if you can’t qualify for any discounts or discount programs, Travelers may be expensive.

Travelers auto insurance rates

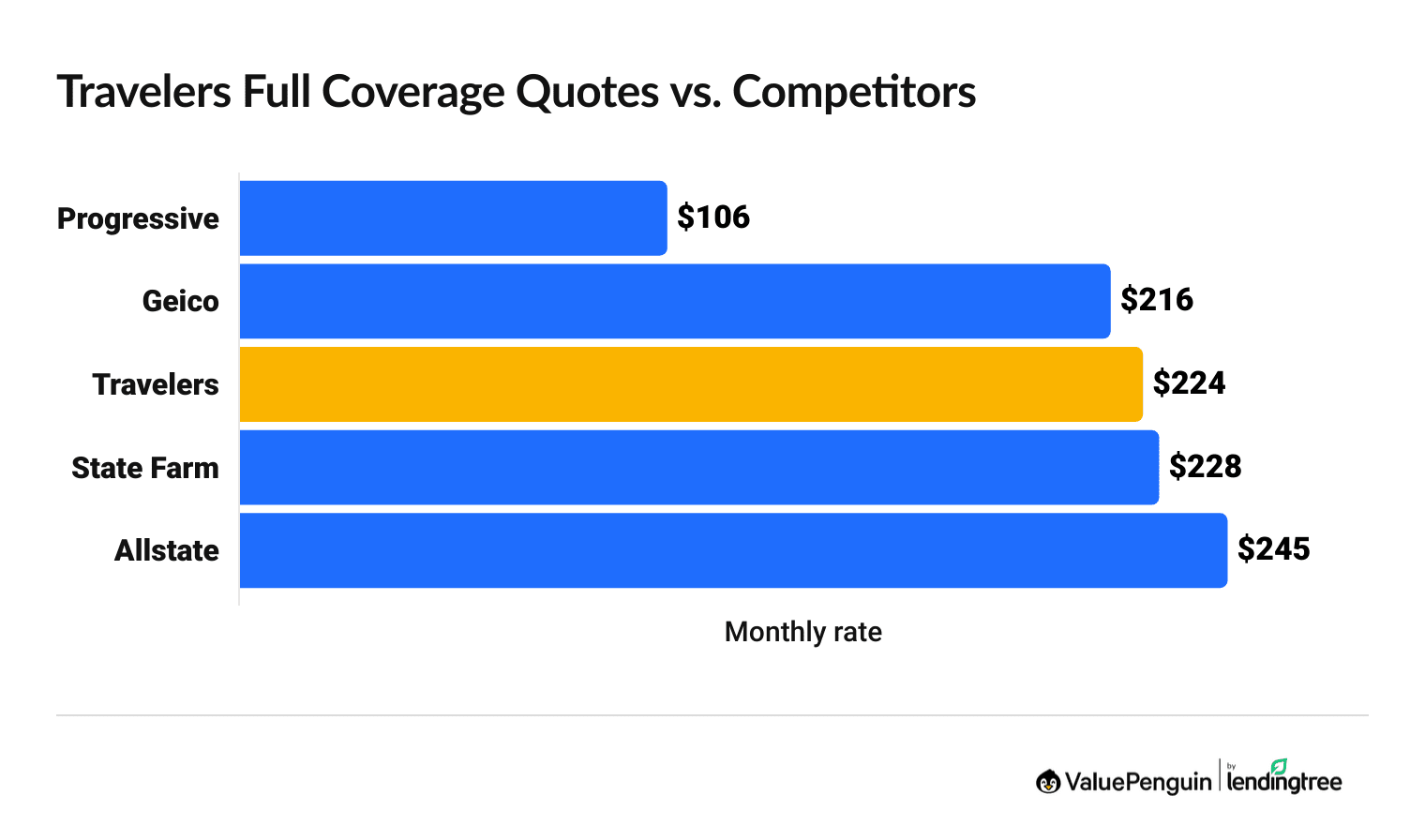

Travelers has higher-than-average rates for full and minimum coverage.

The company’s rates average $224 per month for full coverage, which is roughly $20 per month more than average.

Find Cheap Auto Insurance Quotes in Your Area

Travelers car insurance rates vs. competitors

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $106 | ||

| Geico | $216 | ||

| Travelers | $224 | ||

| State Farm | $228 | ||

| Allstate | $245 | ||

Surprisingly, Travelers rates for drivers with a speeding ticket or DUI on their records are on the cheaper side. On average, you'll pay $224 per month for full coverage with a speeding ticket and $280 per month if you have a DUI, which is $47 per month less than average.

Travelers auto insurance discounts

Travelers offers customers a wide range of discounts. The list doesn't include many unusual discounts compared to most car insurance companies, but the sheer number means you could likely benefit from them.

Highlighted discount: IntelliDrive and IntelliDrivePlus usage-based app

IntelliDrive program: Get up to a 30% discount when you enroll in Travelers IntelliDrive, a 90-day program that tracks how you drive. The mobile app scores your driving behaviors and assigns appropriate discounts (or increases) to your annual insurance cost, the size of which can vary based upon where you live.

The driving score is made up of several factors, like:

- The time of day you drive most often

- Your speed

- Your acceleration

- Your braking habits

- How much you use your phone behind the wheel

IntelliDrivePlus is nearly the same but includes miles driven as a factor. It offers a slightly higher immediate discount — 12% versus 10% — and monitors your driving through the full life of a policy.

Travelers car insurance discounts

Discount | How to get it |

|---|---|

| Multipolicy discount | Bundle your car insurance with another Travelers insurance policy and save. |

| Multicar discount | Cover two or more cars with Travelers and you'll save on your rates. |

| Homeowner discount | If you own a home, you could save on your car insurance. You may be able to get the discount even if your home isn’t insured with Travelers. |

| Safe driver discount | Drivers who avoid accidents can get money off on their rates. |

| Continuous insurance discount | Drivers without gaps in their coverage are eligible for a discount. |

Travelers auto insurance coverage

Travelers offers a wider set of add-on coverages than most insurance companies, along with the standard options (such as liability, comprehensive and collision coverage). The company also offers a few rare optional coverages, such as Premier New Car Replacement coverage and two accident forgiveness plans.

Travelers add-on coverage

Loan or lease gap insurance pays for the difference between the insurance payout and what you still have to pay on your loan or lease. For example, say you bought or leased a 2015 Toyota Camry that’s now worth $10,000, but you still owe $13,000 on the car. Loan or lease gap insurance would pay for the $3,000 difference. Without the coverage, you’d have to pay the $3,000 yourself.

Premier new-car replacement coverage bundles loan or lease gap coverage and auto glass coverage, along with new-car replacement coverage. The latter is the standout feature of this bundle, covering the cost of a new car if your vehicle is totaled in a covered loss . However, the coverage doesn't protect you from losses caused by fire, theft, larceny and flood.

The loan or lease gap coverage works the same way as the stand-alone option. The glass coverage option lowers your deductible when replacing your windshield, windows, exterior lights or mirrors.

Travelers offers accident forgiveness through two hybrid plans: the Responsible Driver Plan and the Premier Responsible Driver Plan. Accident forgiveness programs cancel the increase in a driver’s rates after an at-fault accident, which can save you hundreds of dollars over the term of your policy. However, this add-on is expensive, so be sure you're comfortable with the higher rate before you buy coverage.

Rideshare drivers in Colorado and Illinois have the option to add coverage when driving for Uber, Lyft or other ridesharing apps. If you don’t have similar coverage, you’re probably not fully covered when driving for a ridesharing app. This add-on gives you coverage after opening your mobile app but before picking up a passenger. Once you pick someone up, the ridesharing company’s insurance covers you.

Rental car coverage reimburses you for some of the cost of a rental vehicle if your car is involved in a covered accident and you need another vehicle. Coverage starts at $30 per day, with the maximum available at $900 per day. The cost will differ depending on your vehicle, but you can expect to pay around $20 per year for the lower end of coverage and around $50 per year for the maximum coverage. To use Travelers’ rental car coverage, your vehicle must be out of commission for at least 24 hours.

Roadside assistance coverage helps if you want roadside services, like jump starts, tire changes, fuel delivery or lockout assistance. Travelers offers two tiers of roadside assistance: basic roadside assistance and premier roadside assistance. Basic roadside assistance provides a towing service up to 15 miles, while the Premier package provides the service up to 100 miles. Premier roadside assistance also includes trip interruption coverage, which provides $600 (maximum of $200 per day) of reimbursement for food and lodging if your vehicle breaks down.

To request roadside assistance, Travelers customers can dial 800-252-4633, option 3.

Traditional coverage options

When you buy car insurance from Travelers, you'll get the protection you'd expect from any major car insurance company.

- Liability coverage

- Comprehensive coverage

- Collision coverage

- Personal injury protection

- Uninsured and underinsured motorist coverage

- Medical payments coverage

Travelers home insurance

Travelers home insurance offers shoppers a wide range of options to add coverage to their policies, but the company has high rates compared to other major companies. Unlike its auto insurance offerings, Travelers' home insurance provides few opportunities to save through discounts.

Travelers home insurance rates

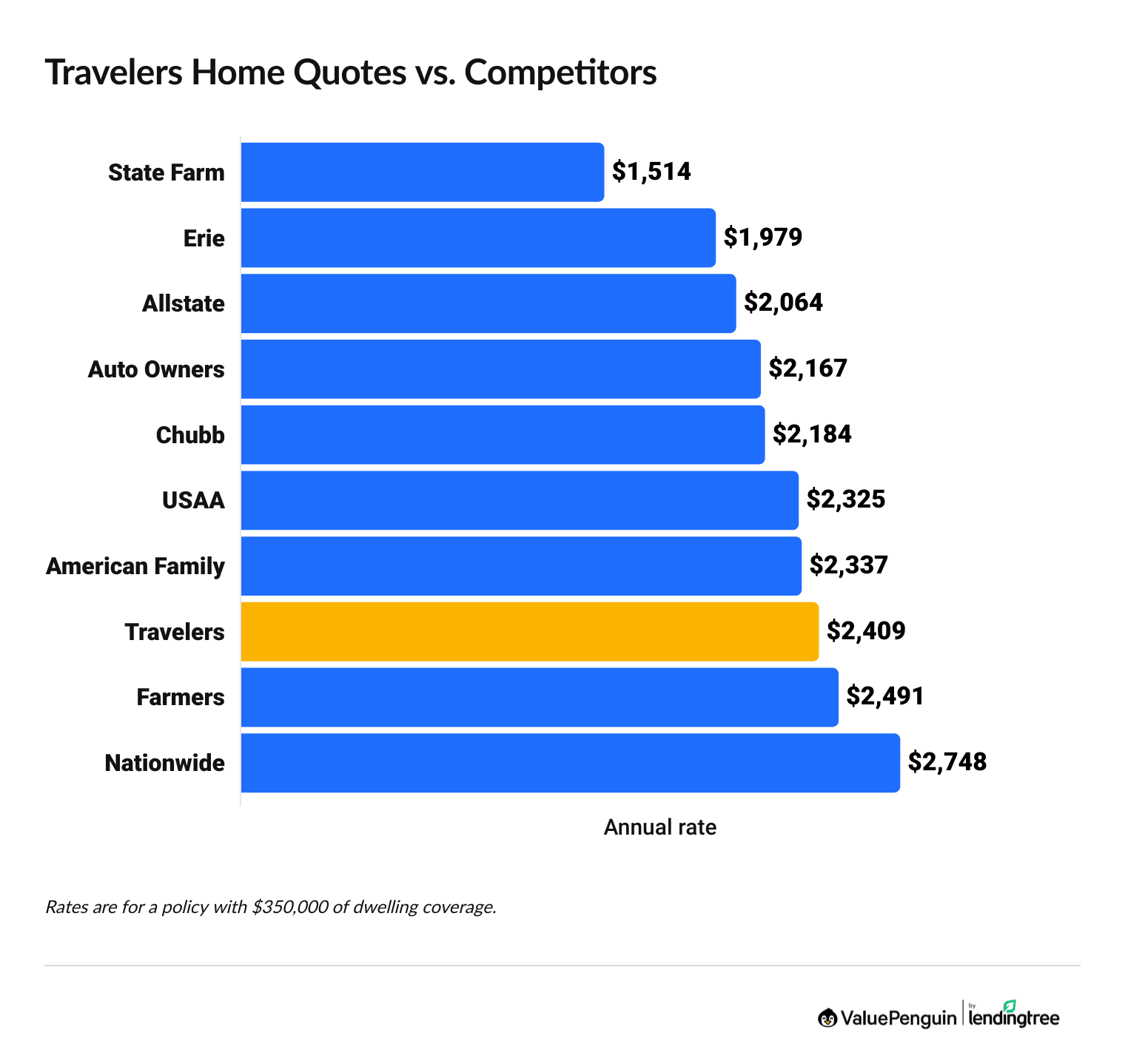

Travelers is one of the most expensive major home insurance companies in the United States, with rates 9% higher than average.

Homeowners with Travelers home insurance pay $208 more per year than the average for coverage.

Find Cheap Homeowners Insurance Quotes in Your Area

Travelers homeowners insurance rates vs. competitors

Company | Average annual rate |

|---|---|

| State Farm | $1,514 |

| Erie | $1,979 |

| Allstate | $2,064 |

| Auto Owners | $2,167 |

| Chubb | $2,184 |

| USAA | $2,325 |

| American Family | $2,337 |

| Travelers | $2,409 |

| Farmers | $2,491 |

| Nationwide | $2,748 |

Rates are for a $350,000 home

Travelers home insurance coverages

As with its auto insurance, Travelers home insurance policies provide complete and customizable protection for your home.

What's covered by a basic Travelers policy? | Details |

|---|---|

| Your dwelling | Covers you for the cost to repair or rebuild your home if damaged by a covered loss. |

| Your personal property | Provides you with coverage for personal items that are damaged or destroyed due to a covered loss. |

| Personal liability | Protects you if you're liable for someone's bodily injury or property damage. |

| Other structures | Covers other structures, like garages and sheds. |

| Loss of use | Pays for the extra costs associated with living away from home if it's due to a covered loss. |

Coverage add-ons

Travelers gives customers all the standard home insurance coverages you'd expect, but also offers tons of add-on options to round out your protection. Remember, though, that these add-ons will cost extra.

With contents replacement cost coverage, your insurance company will pay you what you need to replace your damaged items with new versions, even if your damaged items are worth less. For example, if you filed a claim for a TV without the add-on coverage, your insurance company might give you $500, because this is what it's worth after depreciation. If a new model costs $700, you'd have to pay the difference out of pocket. With replacement cost coverage, you'll get the $700 to replace your old TV with a new model.

Additional replacement cost coverage lets you get more than your insurance limit if you file a claim. This add-on is great if your dwelling coverage isn't enough to fully cover the repairs for your property when you file a claim. Keep in mind that this add-on only kicks in for damage from events covered by your main home insurance policy.

Valuable items, such as jewelry and fine art, are covered by a standard homeowners policy, but these items tend to cost more than the typical coverage limit. This add-on gives you extra coverage for your valuable items. If you have an item that costs more than $1,500, or several items that cost hundreds of dollars each, you’ll want to consider adding this endorsement to your home insurance policy.

A personal articles floater provides coverage on an item-by-item basis, so you’re required to list the items in the policy for your insurance company to cover them. This extra coverage could be a good idea if you have high-value items like electronics, health-related devices and keepsakes.

This provides you with coverage for sewer or drain water backup. Without it, your standard home insurance policy may not cover the damage. Remember, this add-on only covers water damage from backups — it doesn’t cover water damage from other events like floods or leaky pipes.

Travelers' identity fraud coverage provides up to $25,000 in coverage for certain expenses used to restore your identity. You won't need to pay a deductible to use this coverage.

It also lets you get reimbursed for expenses like:

- Fees related to medical identity fraud

- Travel-related expenses up to $5,000 ($1,000 per week)

- Replacement cost for government-issued identification

- Lost income up to $5,000 ($1,000 per week)

- Legal fees

- Resolution services meant to help you reclaim your identity

The green home coverage endorsement provides you with extra protection to help you restore or rebuild your home using green materials after a covered loss.

Travelers home insurance discounts

Travelers offers discounts similar to what you'll find with other national insurance companies. If you're considering a policy, be sure to ask your insurance agent about any available discounts when you get a quote. They'll be able to explain which ones you may be eligible for and make sure they're applied to your quote.

Discount | How do you get it? |

|---|---|

| Multipolicy discount | Bundling your auto insurance with your Travelers home insurance could save you up to 10% — and even more with additional policies. |

| Homebuyer discount | You're eligible if you bought a home a maximum of 12 months prior to the policy's start date. |

| Loss-free discount | Get this discount after going a certain time without filing a claim. The timing will depend on your state of residence but will typically be after a year or two. |

| Protective device discount | You qualify for this discount if you have any of these devices in your home: smoke detectors and fire alarms, an interior sprinkler system, a home security system, or smart home technology that alerts you to fires or burglars. |

| Green home discount | Save up to 5% if your home is certified "green" by the Leadership in Energy and Environmental Design (LEED) organization. |

Travelers Insurance reviews and complaints

Travelers has positive customer service ratings. The company gets few complaints, so if you file a claim, you'll likely get it settled quickly.

The company gets less than half the auto insurance complaints as an average company it's size. For home insurance, Travelers receives 12% fewer complaints than expected for an average company its size, according to the National Association of Insurance Commissioners (NAIC) . However, the company earned below-average scores for claim satisfaction in the J.D. Power 2025 Auto Insurance Study.

Travelers' insurer ratings

Industry reviewer | Rating |

|---|---|

| J.D. Power rank (home) | 19th of 24 |

| J.D. Power rank (auto) | 5th of 10 |

| NAIC complaint index (home) | 12% fewer complaints than average |

| NAIC complaint index (auto) | 54% fewer complaints than average |

| AM Best financial rating | A++ |

Other Travelers Insurance options

If you're looking to bundle home or auto with another type of coverage, Travelers offers a wide range of insurance products.

Renters insurance

If you rent your home — whether it's a house, duplex or apartment — you can buy renters insurance from Travelers. This coverage provides liability protection, personal property coverage to protect your belongings and housing improvement coverage if your landlord lets you make improvements to the property.

Condo insurance

Travelers condo insurance protects your condo from damage, theft and other hazards. You'll also get liability protection if anyone is injured while visiting your home. The policy can help pay for costs from medical bills, legal fees and other similar expenses.

Boat and yacht insurance

Boat and yacht insurance gives you coverage against loss and damage to your boat or yacht, as well as liability coverage if anyone is injured while on board. You can also buy supplemental coverage like uninsured boater insurance and replacement value coverage to fully protect yourself and your watercraft.

Landlord insurance

If you rent your home out to tenants, landlord insurance can protect you from liability and give you added coverage if your tenants damage the property. This coverage is meant for properties with no more than four units.

Umbrella insurance

Umbrella insurance is designed to give you peace of mind and added protection if someone sues you for injuries they suffer at your home, in your car or on your boat. If their claim is greater than your policy's base limit, umbrella coverage can help cover the difference. With this coverage, you'll be able to get up to $5 million of additional liability coverage.

Wedding and events insurance

Wedding and events coverage protects your big day from unexpected issues and hazards. If your event gets canceled or a vendor doesn't show up, this coverage will help compensate you for those inconveniences. This coverage can be used for events like baby showers, bar or bat mitzvahs, birthday celebrations, engagement parties and more.

Valuable items coverage

Certain valuable items may be worth more than your home insurance policy can pay for on its own. Stand-alone valuable items coverage lets you buy extra coverage for the items you're most worried about. This add-on policy can cover valuables like artwork, electronics, instruments and collectibles.

Travel insurance

Travel insurance helps you protect your trips from unexpected cancellation, delays and other frustrations. You'll need to buy travel insurance for each trip you want to insure.

Pet insurance

Pet insurance from Travelers helps you pay for your pet's medical expenses and health care needs. There are no more age restrictions once the pet is eight months old, health screenings aren’t required and you can use the coverage at any licensed veterinary practice or clinic.

Motorcycle insurance

Travelers doesn't offer motorcycle insurance directly. Instead, they partner with Dairyland, one of the biggest motorcycle insurance companies in the U.S.

Frequently asked questions

Is Travelers a good insurance company?

Overall, Travelers is an above-average insurance company. It offers a lot of opportunities for auto insurance discounts, but its home insurance tends to be more expensive than policies with other companies. If you're worried about price, it's a good idea to shop around and get quotes from a few other insurance companies.

Is Travelers expensive?

Travelers is often more expensive than other companies for both home and auto insurance. However, you may be able to lower your costs with different discounts. Talk to your insurance agent when you get your quote to see if you qualify for any discounts. If coverage is still more expensive than you'd like, you may want to shop around.

Is Travelers good at paying claims?

Yes. Travelers has a very low complaint rating with the NAIC for auto and home insurance. Customers tend to be satisfied with their service overall. Further, Travelers has an A++ score from AM Best, meaning it has a "superior" ability to pay claims.

Who is better, State Farm or Travelers?

Both State Farm and Travelers offer quality insurance coverage, but State Farm is usually cheaper for both car and home insurance. If you're looking for a policy that's affordable, State Farm will likely be a better choice. But if you're interested in adding on tons of optional coverage, or if you have a history of speeding tickets on your record, Travelers could fit your situation better.

Methodology

To compare the cost of Travelers auto and homeowners insurance policies, ValuePenguin collected thousands of quotes for representative drivers and homes.

Auto insurance methodology

Full coverage quotes include higher liability limits than required in each state, along with collision and comprehensive coverage.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $25,000 per person and $50,000 per accident

- Comprehensive deductible: $500

- Collision deductible: $500

Home insurance methodology

Editor's rating

ValuePenguin derives its star rating from a set of weighted factors to provide an all-around metric.

Factor | Weight in rating |

|---|---|

| Price | 30% |

| Coverage options | 30% |

| Customer service | 30% |

| Unique offerings | 10% |

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.