The Cheapest (and Best) Full Coverage Car Insurance of 2026

State Farm, Auto-Owners, Travelers and USAA have the cheapest full coverage car insurance in 2026.

State Farm, Auto-Owners, Travelers and USAA are the cheapest companies for full coverage car insurance in 2026.

Find Cheap Auto Insurance Quotes in Your Area

Cheapest full coverage insurance

- Affordable: These are the cheapest major companies for full coverage, based on millions of full coverage quotes across every ZIP code in the U.S. With car insurance, you don't always get more by paying more, and choosing a cheap company could help you save money.

- High quality: These are also the best companies for full coverage. Plus, they have helpful coverage options and are also reliable companies. They are easy to deal with when you make a claim, which means you don't have to sacrifice quality for price.

- Good coverage: Rates are for full coverage policies with good coverage. Quotes are for a 50/100/25 policy with a $500 deductible for damage to your car. Quotes also include coverage to protect you from uninsured and underinsured drivers on the road.

Read the full methodology to learn more.

Affordable full coverage car insurance

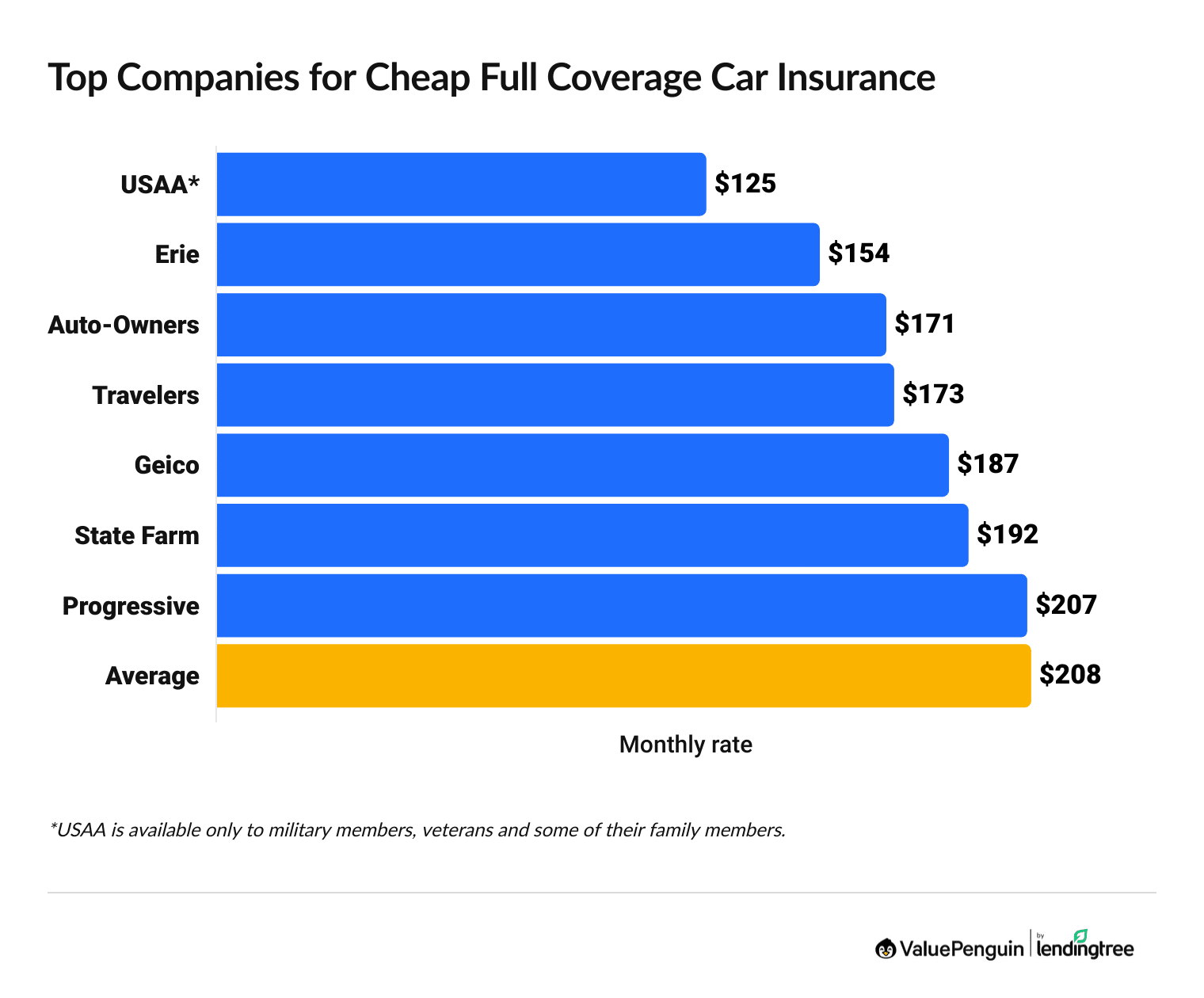

Travelers, Erie, Auto-Owners, and USAA have the cheapest full coverage car insurance.

Find the Cheapest Full Coverage Quotes in Your Area

At $173 per month, Travelers has the cheapest full coverage insurance for most drivers. Erie and Auto-Owners cost less, but are available in only a handful of states.

USAA is actually the cheapest, at an average of $125 per month. However, you can only get USAA as a member of the military, a veteran or a family member of someone who's had a USAA policy in the past.

Cheapest and best full coverage car insurance quotes

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $154 | ||

| Auto-Owners | $171 | ||

| Travelers | $173 | ||

| Geico | $187 | ||

| State Farm | $192 | ||

*Only current and former military members and their families are eligible for a USAA policy.

Company | Monthly rate | |

|---|---|---|

| Erie | $154 | |

| Auto-Owners | $171 | |

| title="Cheapest for most people: Travelers"Travelers | $173 | |

| Geico | $187 | |

| State Farm | $192 | |

*Only current and former military members and their families are eligible for a USAA policy.

Full coverage car insurance is the best choice for most people.

It helps you pay to repair your car after an accident you cause because it includes comprehensive and collision as well as liability coverage.

Cheap full coverage car insurance by state

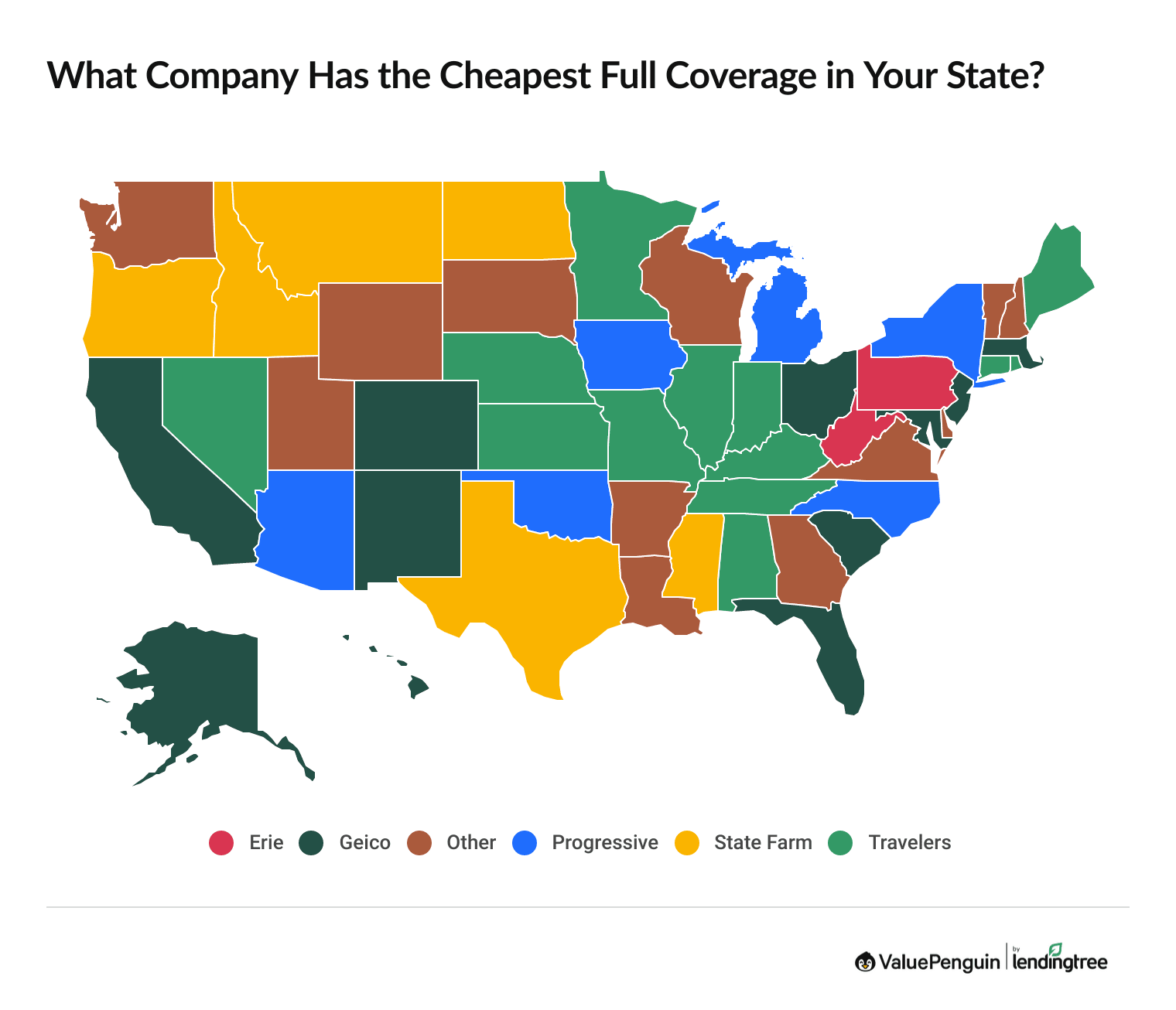

Travelers has the cheapest full coverage insurance in 12 states.

Geico isn’t too far behind, being the lowest in 11 states. Progressive and State Farm charge the lowest full coverage rates in six states each. By choosing the cheapest car insurance company in your state, you can save about one-third off of average rates.

Find the Cheapest Full Coverage Quotes in Your Area

It's important to get personalized quotes because companies that are expensive nationally could have very good deals in your area, and cheap rates can also be found at small or regional companies.

For example, State Farm costs more than average nationally. But, it has the lowest full coverage car insurance quotes in Idaho, Mississippi, Montana, North Dakota, Oregon and Texas.

Cheapest full coverage insurance quotes in each state

Cheapest for most people: Travelers

- Full coverage: $173/mo

-

Editor rating

Travelers has the cheapest full coverage auto rates that are available nationally.

| Full coverage is $35/mo cheaper than average ? | |

| Lots of discounts to help you save ? |

| Difficult claims process after a crash ? | |

| Not the cheapest option in some states ? |

Cheap with good service: Erie

- Full coverage: $154/mo

-

Editor rating

Erie offers very cheap rates and great customer service, but is available in only 12 states.

| Full coverage from Erie is $53/mo cheaper than avg. ? | |

| Great for bundling with home policies ? |

| Helpful customer service after a crash ? | |

| Available in only 12 states ? |

Cheapest car insurance for full coverage with policy extras: Auto-Owners

- Full coverage: $171/mo

-

Editor rating

Auto-Owners has the best cheap full coverage auto insurance if you need extra protection.

| Full coverage is $37/mo cheaper than average ? | |

| Lots of coverage add-ons to customize your policy ? |

| Available in about half of the states ? | |

| Usually not good for bundling with home insurance ? |

Cheapest for drivers with poor credit: Geico

- Cheap rates for poor credit: $305/mo

-

Editor rating

Geico offers teens affordable full coverage insurance for drivers with poor credit.

| Geico’s poor credit coverage is 26% cheaper than the average cost ? | |

| Cheapest rates in 11 states ? |

| Discounts and coverage options may vary by state ? | |

| Not the best customer service ? |

Cheapest full coverage after an accident: State Farm

- Full coverage: $218/mo

-

Editor rating

State Farm offers the cheapest full coverage rates after an accident.

| Full coverage from State Farm is $92/mo cheaper than avg. ? | |

| Great for bundling with home, renters or other policies ? |

| Helpful customer service after a crash ? | |

| Cheap rates after a ticket ? |

Affordable full coverage auto insurance after a DUI: Progressive

- Full coverage w/ a DUI: $268/mo

-

Editor rating

Progressive offers the cheapest full coverage most people can get after a DUI, and you can quickly get SR-22 coverage online .

| $122/mo cheaper than average after a DUI ? | |

| Quick and easy online quotes, even if you need an SR-22 ? |

| Poor customer service after a crash ? | |

| Not the cheapest for safe drivers and teens ? |

Cheapest full coverage auto insurance for military families: USAA

- Full coverage: $125/mo

-

Editor rating

USAA's cheap rates and good customer support make it the best full coverage car insurance company for military families.

| Full coverage is $97/mo cheaper than average ? | |

| Available discounts and helpful coverage options ? |

| Only available to drivers with military ties ? | |

| Friendly customer service and high customer satisfaction ? |

Do I need full coverage insurance?

Most drivers should consider full coverage insurance, especially if you have a newer car. But it’s not required unless your lender says so.

If you have a car loan or lease, your lender probably requires you to have a full coverage policy. That's because full coverage comes with collision and comprehensive insurance. These coverages pay to fix or replace your car after an accident, theft, flooding and other types of damage.

Collision coverage pays for damage to your car after a crash with another vehicle or structure, regardless of whose fault it is.

- Hitting another car

- Crashing into a pole or fence

- Driving over a big pothole

Comprehensive coverage pays for damage to your car that's not strictly related to driving.

- Weather, including hail or storms

- Theft or vandalism

- Hitting animals like deer on the road

- Broken window or slashed tires

If your car is worth more than $5,000 or is newer than eight years old, it's usually worth it to have full coverage, even if you own the car outright. Collision and comprehensive coverage typically cost less than your repairs after a serious accident.

There are a lot of factors that go into the cost of collision and comprehensive insurance, including the age and type of car you drive, accident and theft rates in your area and your personal driving history.

One of the most important factors is your deductible. Policies with higher deductibles usually cost less because insurance companies won't pay as much after a crash.

Monthly collision and comprehensive rates by deductible

Deductible | Collision | Comprehensive | Total monthly cost |

|---|---|---|---|

| $250 | $79 | $38 | $117 |

| $500 | $67 | $31 | $98 |

| $1,000 | $53 | $24 | $78 |

| $1,500 | $47 | $21 | $68 |

Deductible | Collision | Comprehensive |

|---|---|---|

| $250 | $79 | $38 |

| $500 | $67 | $31 |

| $1,000 | $53 | $24 |

| $1,500 | $47 | $21 |

Consider dropping your comprehensive and collision insurance when you can reasonably afford to replace your car. Your car insurance costs will drop. But you'll need to pay for a new car out of pocket if you cause an accident that totals your car.

In addition to protecting your car, full coverage typically includes higher liability limits than minimum coverage. Many states require very low liability limits that don't provide enough protection to cover the cost of a major accident.

A full coverage policy with higher limits means you'll pay less out of pocket if you cause a major accident.

How much liability coverage do I need?

You should get as much liability coverage as you can afford, so you're protected if you cause a major accident.

Coverage: 25/50/20

-

Monthly rate: $179/month

-

Is it enough coverage? It might cover a very minor fender bender, but this isn't enough protection for a serious accident.

- Example crash: You have a fender bender with a small SUV at 25 mph. Two passengers suffer whiplash and one has a minor concussion.

- Claim total: $30k in medical bills and $25k in vehicle damage

- Would 25/50/20 be enough? No, you'll end up paying around $10k out of pocket, $5k for medical bills and $5k for the other driver's vehicle repairs.

Coverage: 100/300/50

-

Monthly rate: $198/month

-

Is it enough coverage? In most cases, this is enough coverage. But it might fall short if you cause a very serious accident.

- Example crash: You rear-end a Tesla Cybertruck at 40 mph. One passenger has a fractured pelvis, another has severe whiplash, needing an MRI and specialist care.

- Claim total: $60k in medical bills and $40k in vehicle damage

-

Would 100/300/50 be enough? Yes, your insurance will pay up to $300k to cover medical bills for all three passengers, well above the cost of their injuries.

You also have up to $50k for damage to the Tesla, so you won't have to pay anything out of pocket.

Coverage: 50/100/25

-

Monthly rate: $189/month

-

Is it enough coverage? It's enough to cover most common crashes. But it's not enough for a major accident.

- Example crash: You crash into a family minivan at 30 mph. Two family members suffer back injuries.

- Claim total: $30k in medical bills and $25k in vehicle damage

-

Would 50/100/25 be enough? Yes, you have up to $100k to cover the medical bills of the two passengers. Your insurance will also pay up to $25k for damage to the minivan, which is right on target.

That means you're fully covered after this minor crash. But that may not be the case if more passengers in the other car were hurt, there were severe injuries or you crashed into an expensive new car.

Coverage: 250/500/100

-

Monthly rate: $217/month

-

Is it enough coverage? Yes, this should cover most accidents, including a very serious or multi-car crash.

-

Example crash: You rear-end a line of stopped vehicles going 55 mph, resulting in a three-car pileup.

A BMW X5 is totaled and the other cars need major repairs. Four people are injured in the crash — one with a broken leg, one with a traumatic brain injury and two others with back and neck injuries.

- Claim total: $120k in medical bills and $90k in vehicle damage

-

Would 250/500/100 be enough? Yes, you have up to $500k to cover medical bills for all four passengers, which easily covers $120k in injuries.

You also have up to $100k for damage to the other driver's cars: $67k to pay for a replacement BMW and up to $33k for repairs to the other vehicles. That exceeds the total amount of property damage.

Coverage: 25/50/20

-

Monthly rate: $179/month

-

Is it enough coverage? It might cover a very minor fender bender, but this isn't enough protection for a serious accident.

- Example crash: You have a fender bender with a small SUV at 25 mph. Two passengers suffer whiplash and one has a minor concussion.

- Claim total: $30k in medical bills and $25k in vehicle damage

- Would 25/50/20 be enough? No, you'll end up paying around $10k out of pocket, $5k for medical bills and $5k for the other driver's vehicle repairs.

Coverage: 50/100/25

-

Monthly rate: $189/month

-

Is it enough coverage? It's enough to cover most common crashes. But it's not enough for a major accident, especially if you hit a new or expensive car.

- Example crash: You crash into a family minivan at 30 mph. Two family members suffer back injuries.

- Claim total: $30k in medical bills and $25k in vehicle damage

-

Would 50/100/25 be enough? Yes, you have up to $100k to cover the medical bills of the two passengers. Your insurance will also pay up to $25k for damage to the minivan, which is right on target.

That means you're fully covered after this minor crash. But that may not be the case if more passengers in the other car were hurt, there were severe injuries or you crashed into an expensive new car.

Coverage: 100/300/50

-

Monthly rate: $198/month

-

Is it enough coverage? In most cases, this is enough coverage. But it might fall short if you cause a very serious accident with multiple cars and severe injuries or total an expensive vehicle.

- Example crash: You rear-end a Tesla Cybertruck at 40 mph. One passenger has a fractured pelvis, another has severe whiplash, needing an MRI and specialist care.

- Claim total: $60k in medical bills and $40k in vehicle damage

-

Would 100/300/50 be enough? Yes, your insurance will pay up to $300k to cover medical bills for all three passengers, well above the cost of their injuries.

You also have up to $50k for damage to the Tesla, so you won't have to pay anything out of pocket.

Coverage: 250/500/100

-

Monthly rate: $217/month

-

Is it enough coverage? Yes, this should cover most accidents, including a very serious or multi-car crash.

-

Example crash: You rear-end a line of stopped vehicles going 55 mph, resulting in a three-car pileup.

A BMW X5 is totaled and the other cars need major repairs. Four people are injured in the crash: one with a broken leg, one with a traumatic brain injury and two others with back and neck injuries.

- Claim total: $120k in medical bills and $90k in vehicle damage

-

Would 250/500/100 be enough? Yes, you have up to $500k to cover medical bills for all four passengers, which easily covers $120k in injuries.

You also have up to $100k for damage to the other driver's cars — $67k to pay for a replacement BMW and up to $33k for repairs to the other vehicles. That exceeds the total amount of property damage.

How much is full coverage insurance?

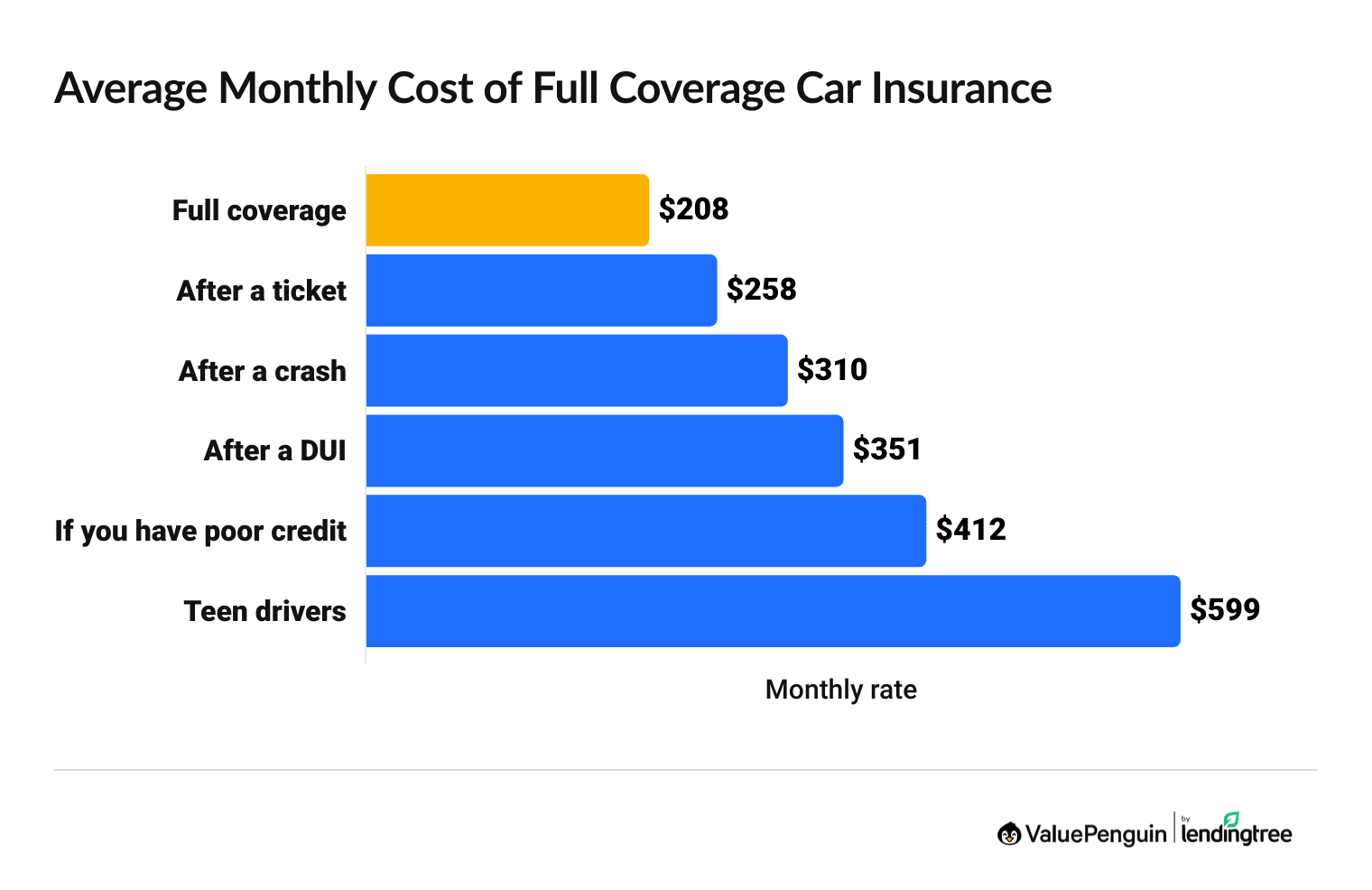

The average cost of full coverage car insurance is $208 per month for a typical safe driver.

In contrast, liability-only insurance is 65% less, at $76. Rates can vary widely based on factors such as where you live and the company you choose.

You'll pay more for car insurance if you're a new or young driver, have any tickets or have poor credit. Insurance companies use these factors as a way to predict how likely you are to file a claim.

Average cost of full coverage car insurance

Monthly rate | |

|---|---|

| Full coverage | $208 |

| Speeding ticket | $258 |

| Accident | $310 |

| Poor credit | $412 |

| DUI | $391 |

| Teen buying their own policy | $599 |

All rates are for a full coverage policy unless otherwise noted.

- If you've caused a car accident, insurance rates will double. But they'll return to normal in about three years, when the accident goes off your record.

- If you have poor credit, improving your credit score over time could cut your car insurance rates in half.

7 ways to get the best full coverage car insurance quotes

1. Shop around

2. Use car insurance discounts

3. Get rid of coverage you don't need

4. Increase your deductible

5. Increase your coverage limits

6. Bundle your policies

7. Pay by credit card to earn cash back

Shopping tips for comparing full coverage quotes

| Getting car insurance quotes won't hurt your credit score so it's OK to get multiple quotes. | |

| It's free to get car insurance quotes from any reputable car insurance company. |

| Use the same coverage limits and add-ons for each quote to get the best comparison. | |

| Pay attention to the plan details. Lots of factors can affect which company is cheapest. |

What's included with full coverage car insurance quotes?

Full coverage auto insurance includes collision and comprehensive coverage, which offer more protection than a minimum liability policy.

Comprehensive and collision coverage pay for damage to your car. Full coverage typically also has higher liability limits than the minimums required by your state. This protects you if you cause an expensive accident.

What else does a full coverage policy cover?

A full coverage policy also includes any other coverage your state requires. This could include uninsured motorist coverage or personal injury protection.

- Uninsured motorist coverage pays for your injuries and damage to your car if an uninsured driver hits you. Some states require this coverage.

- Underinsured motorist coverage pays for your expenses if you're hit by a driver who doesn't have enough car insurance to cover your costs.

- Personal injury protection (PIP) pays your medical bills if you’re injured in a crash, regardless of who caused it. PIP can also reimburse you for lost wages if you miss work while recovering. "No-fault" states may require PIP.

Frequently asked questions

How much is full coverage insurance?

Which company is the cheapest option for full coverage?

Travelers is the cheapest widely available option for full coverage auto insurance, at $173 per month. You should also get quotes from Erie, Auto-Owners or USAA if you’re eligible because of where you live or a military connection.

What does full coverage car insurance cover?

Full coverage pays for damages to your car as well as any damages or injuries you cause to others. The main benefit of full coverage is that it includes collision and comprehensive coverage, which protects your car. Full coverage also usually includes more liability coverage than your state's minimum requirements, so you'll be protected if you cause an expensive accident.

If your state requires uninsured and underinsured motorist coverage and PIP, these coverages may be included in your full coverage policy. But the definition of full coverage varies by company.

Do I need full coverage on a financed car?

Yes, lenders require a full coverage policy with collision and comprehensive if you have a new car loan or lease. Once you pay off your loan, you're free to decide if you still need a full coverage policy.

Does full coverage car insurance replace your car?

Yes, a full coverage policy's collision coverage will pay for a new car or fix your vehicle, minus your deductible, if you cause an accident. If another driver causes the accident, their liability coverage will pay to repair or replace your car.

Keep in mind that most car insurance only pays out the value of your car after considering its age and mileage. This is usually lower than the price to buy a similar car, so you'll have to pay some of the cost yourself. And if your car isn't worth a lot, it's likely that insurance will consider it totaled after an accident because the cost of repairs could be more than the car is worth.

Methodology

How we chose the top companies

- ValuePenguin's top picks for full coverage consider major insurance companies that have a large market share in at least 10 states. Our experts excluded companies where cost data wasn't available, such as Liberty Mutual. Companies were sorted by their average rates for full coverage car insurance to find which options had the cheapest rates. Then they were compared for their quality to find the cheap companies that are also reliable.

- The cheapest companies per state include the companies that have large market shares in that state. This includes national brands as well as small or regional companies to help you find the best deal in your area, no matter how well-known the insurance company is. We excluded companies where cost data wasn't available.

- ValuePenguin's editor ratings are based on a company's overall quality and performance. The ratings consider coverage options (30% of score), customer service (30% of score), price (30% of score) and unique offerings (10% of score).

How rates are calculated

ValuePenguin's rates are based on millions of quotes gathered from every ZIP code in 50 states and Washington, D.C. Rates are collected for the top insurance companies in each state for a 30-year-old man with good credit, with a clean driving record and who drives a 2018 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement and include uninsured and underinsured motorist bodily injury coverage. Comprehensive and collision insurance each have a $500 deductible.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury liability: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible for comprehensive and $500 deductible for collision

- Personal injury protection: Minimum, when required by state

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.