Auto Insurance Companies in New Jersey

Geico sells roughly a quarter of auto insurance policies in New Jersey, making it the most popular company in the Garden State. The 10... Read More

Finding a car insurance company based near you can come with a lot of benefits, like a personal relationship with an agent which can mean better customer service.

Smaller regional companies tend to offer cheap rates and reliable customer service. It can also be easier to work with an agent with an office nearby than someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

State Farm is the best car insurance company in 28 states.

That's because State Farm has great customer service reviews, affordable rates and most people are able to buy insurance from them.

However, the best car insurance near you may be different. Erie and Farm Bureau offer excellent customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age, since these factors affect how much you'll pay for insurance. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Find Cheap Auto Insurance Quotes in Your Area

USAA has the best customer service in many states, along with very affordable rates. But only military members, veterans and some of their family members can get car insurance from USAA.

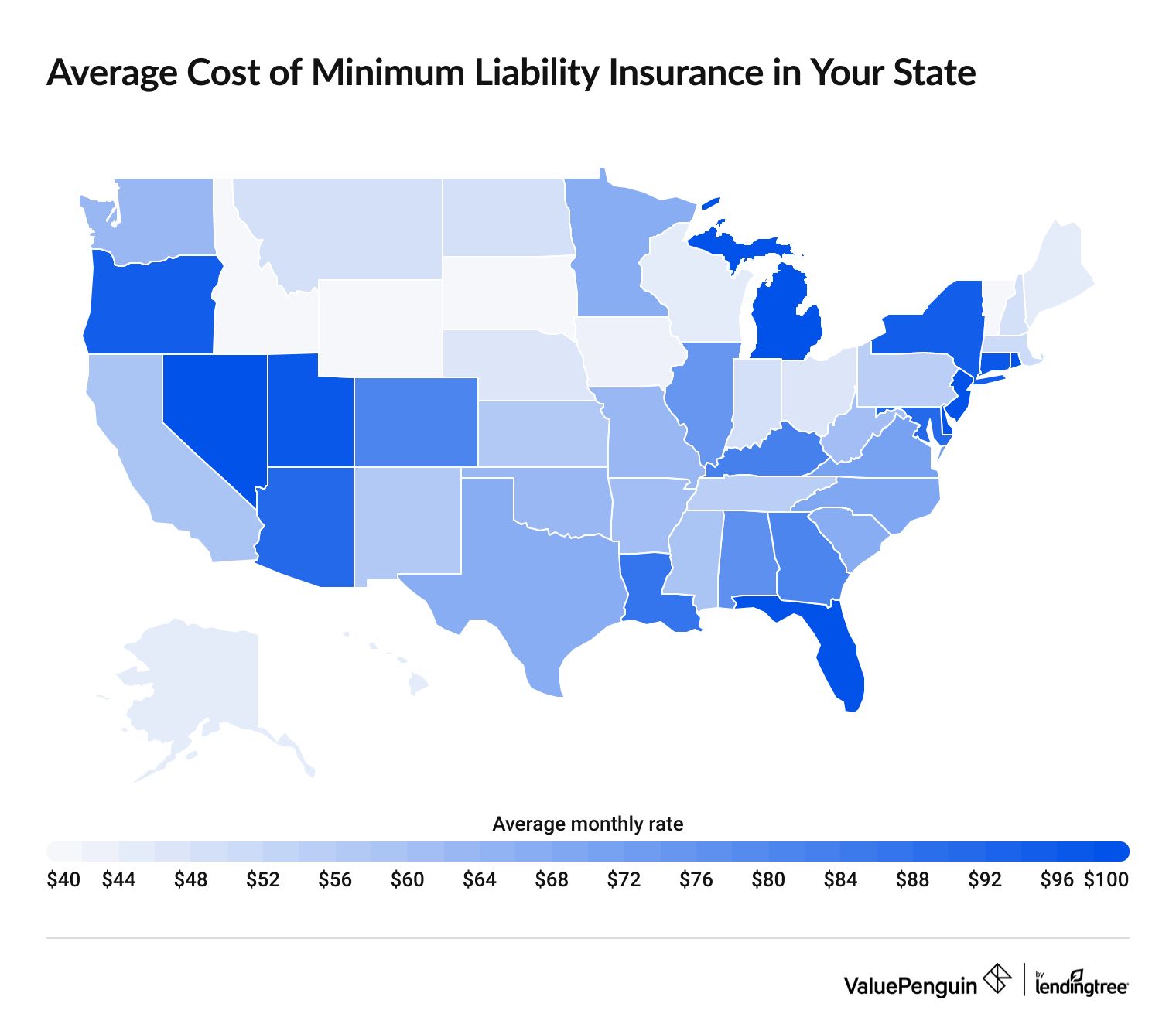

Where you live can have a big impact on your car insurance rates. For example, drivers in Wyoming pay $31 per month for minimum coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $133 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

Geico sells roughly a quarter of auto insurance policies in New Jersey, making it the most popular company in the Garden State. The 10... Read More

Texas Farm Bureau has the cheapest auto insurance in Lubbock, at $87 per month, on average, for a full coverage... Read More

Your relationship status affects how much you pay for car insurance. Married drivers pay an average of $8 less per month than single... Read More

State Farm has the cheapest car insurance in Tucson, Arizona, at $62 per month for a minimum coverage policy and $145 per month for full... Read More

Travelers has the cheapest car insurance in Reno, at an average of $140 per... Read More

The cheapest car insurance in Colorado Springs is State Farm, with an average price of $457 per year for basic coverage.... Read More

State Farm has the best rates for full coverage in Omaha, at $131 per... Read More

American Family has the cheapest car insurance in Milwaukee. Its average rates are $127 per month for full coverage, or $47 for state... Read More

Erie Insurance has the best rates for car insurance in Raleigh. Its average price of $69 per month for full coverage is half the citywide... Read More

State Farm has the cheapest car insurance in Albuquerque, at $56 per month for minimum coverage and $159 per month for full... Read More

American Family has the cheapest car insurance quotes in Kansas City, MO. A full coverage policy from American Family costs $153 per month,... Read More

Erie offers the cheapest car insurance in Charlotte, North Carolina. At $77 per month, full coverage insurance from Erie is less than half... Read More

USAA auto insurance is cheaper than State Farm's. But both companies are less expensive than most competitors and offer quality customer... Read More

Car insurance is cheaper from Geico than Liberty Mutual for most drivers. But Liberty Mutual's long list of available discounts and... Read More

Esurance is a car insurance company owned by Allstate that stopped selling new policies in 2023. But existing Esurance customers can keep... Read More

Auto insurance rates are cheaper with AAA than with Geico. But if customer service is a top priority, Geico may be worth the higher... Read More

Both Esurance and Progressive have cheaper-than-average rates. Getting the lowest rate will depend on whether you're shopping for... Read More

Car insurance quotes at AAA are typically cheaper than those of AARP. When shopping for car insurance, however, you should always compare... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, it might not be the cheapest option near you, especially if you have access to smaller regional companies like Erie, Farm Bureau or Country Financial.

This depends on how you prefer to connect with your insurance company. If you prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you would rather manage your insurance with an app and prefer virtual chat to phone calls, you may not need a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who owns a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

Referenced by

Education