USAA vs. State Farm: Compare Car Insurance Rates and Coverage

USAA offers cheaper rates than State Farm but is only available to drivers with military connections.

Find Cheap Auto Insurance Quotes in Your Area

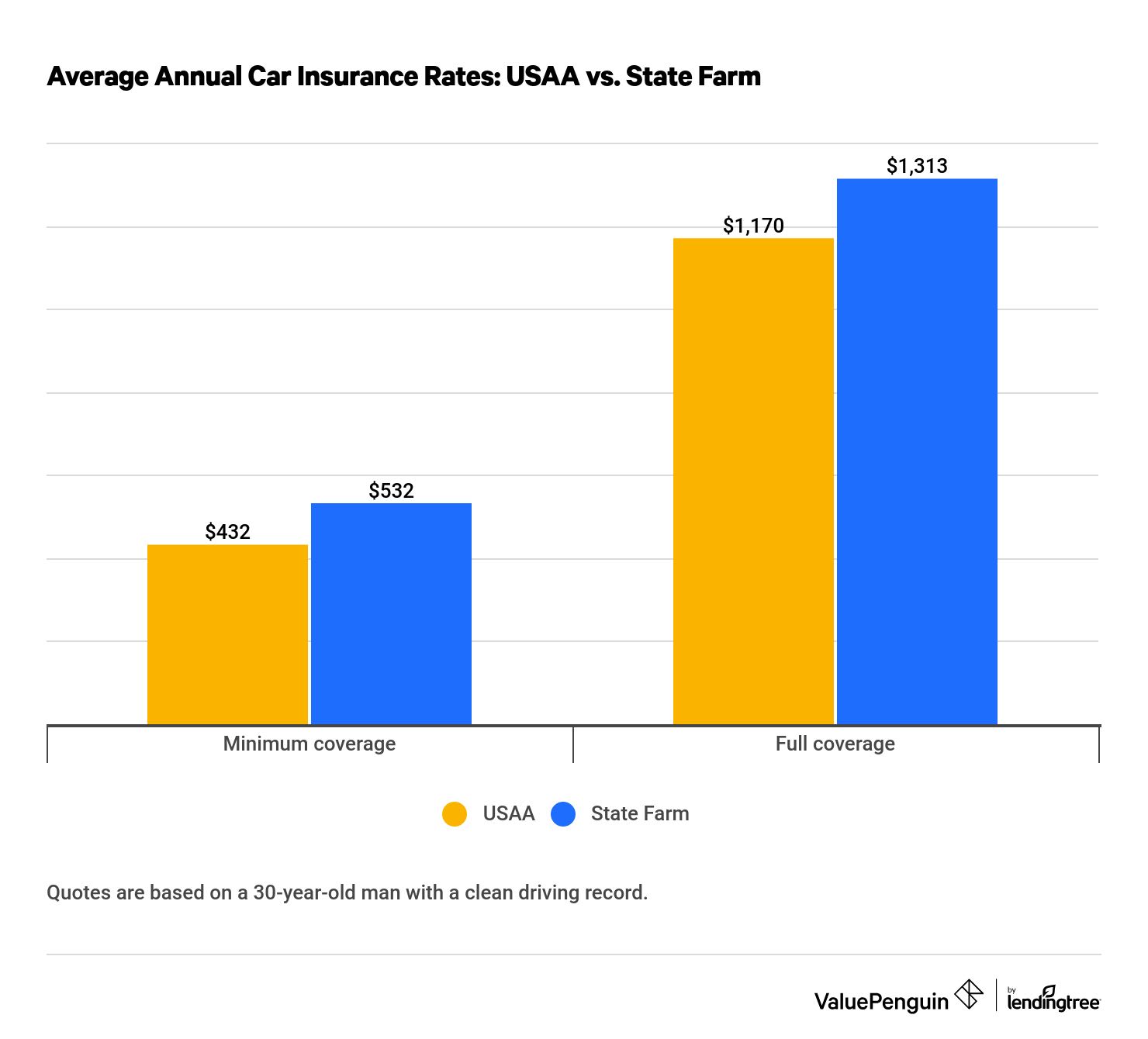

USAA and State Farm are both known for affordable prices and dependable customer service. USAA is the slightly better choice, with lower rates for most drivers and top customer satisfaction ratings. A full-coverage policy from USAA costs an average of $1,170 per year — 11% less than State Farm.

Unfortunately, most drivers can't get coverage from USAA. Only active-duty military members, veterans and their families can purchase a policy.

Best for | State Farm | USAA |

|---|---|---|

| Price | ||

| Discounts | ||

| Coverage | ||

| Customer service | ||

| Availability | ||

| Editor's rating | ||

| Full review | State Farm review | USAA review |

USAA vs. State Farm car insurance quotes

USAA offers cheaper car insurance policies than State Farm. In fact, out of the major insurance companies, USAA's rates are the lowest in the country.

Cheapest for most drivers: USAA

Both full- and minimum-coverage prices are lower at USAA than at State Farm. But State Farm is stillcheaper than the national average.

Full coverage from USAA costs $1,170 per year, or $98 per month, on average. That's $143 per year less than the same coverage from State Farm and 53% less expensive than the national average.

Find Cheap Auto Insurance Quotes in Your Area

Minimum coverage is also less at USAA, at $432 per year, or $36 per month, on average. That's $100 per year less than State Farm and 55% cheaper than the national average.

USAA vs. State Farm annual car insurance rates

Coverage | State Farm | USAA |

|---|---|---|

| Full coverage | $1,313 | $1,170 |

| Minimum coverage | $532 | $432 |

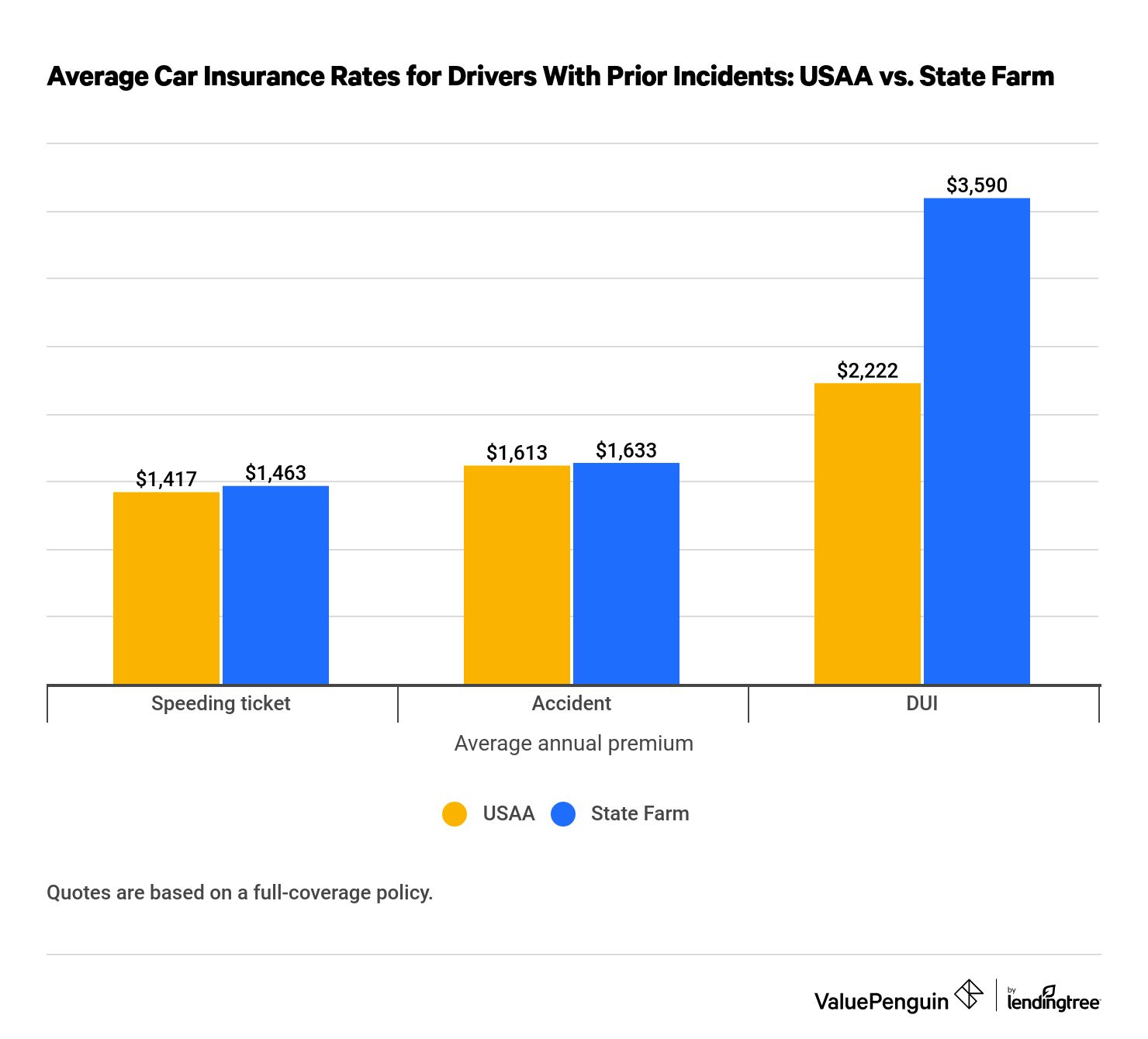

Cheapest for drivers with prior incidents: USAA

Drivers who have a speeding ticket, at-fault accident or DUI on their record also pay less at USAA than at State Farm.

Auto insurance from USAA is much cheaper for drivers with a DUI. A full-coverage policy costs $2,222 per year, which is 38% less expensive than State Farm.

Quotes from USAA and State Farm are about the same after a single speeding ticket or accident. The difference between the companies' rates is about 3% after a ticket and only 1% after an accident.

Car insurance rates after prior incident

Incident | State Farm | USAA |

|---|---|---|

| Speeding ticket | $1,463 | $1,417 |

| Accident | $1,633 | $1,613 |

| DUI | $3,590 | $2,222 |

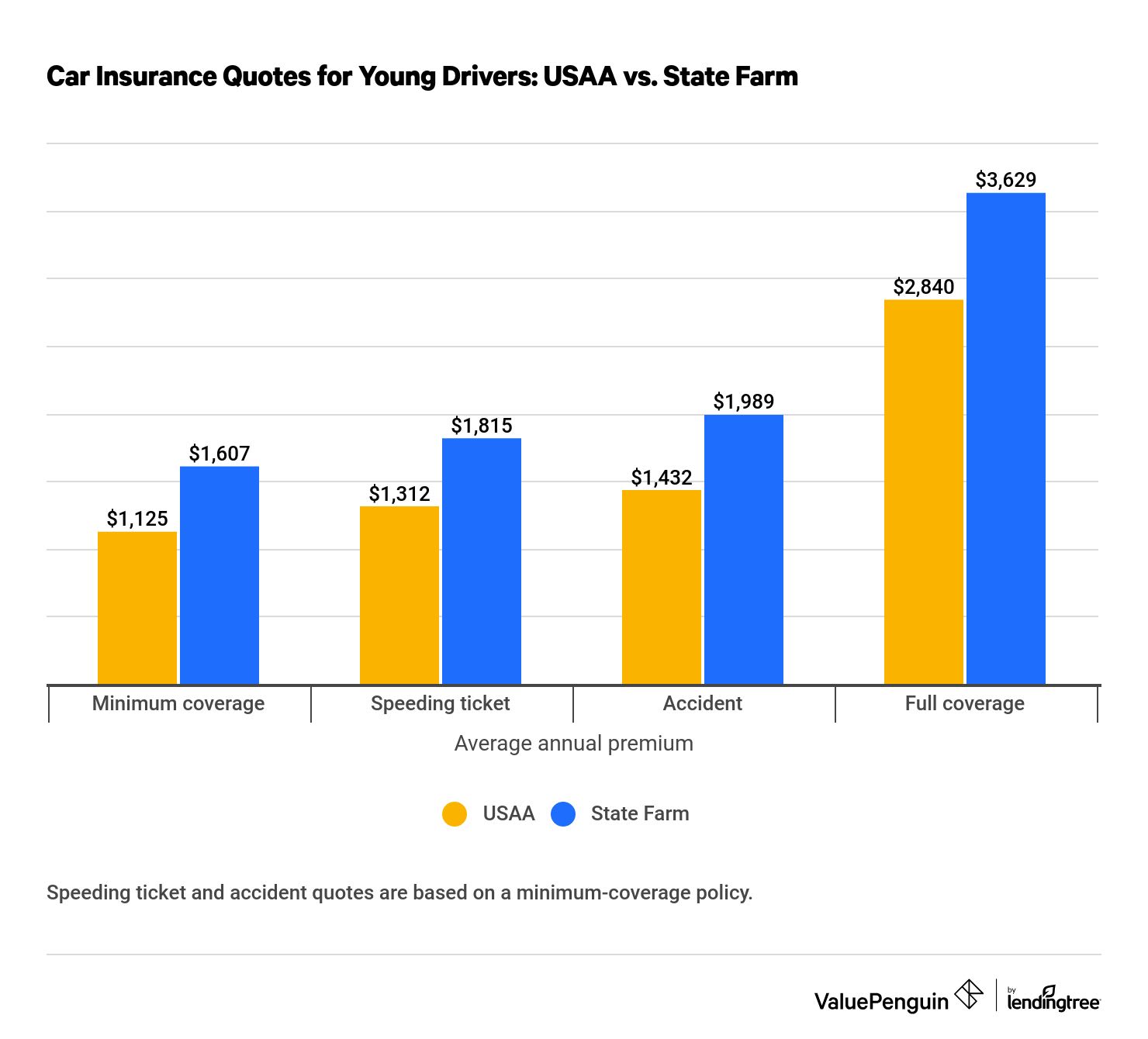

Cheapest for young drivers: USAA

Young drivers also pay less at USAA. On average, an 18-year-old can expect to pay 24% less for coverage from USAA than from State Farm. That's a difference each year of $482 for minimum coverage and $789 for full coverage.

Young drivers who have a speeding ticket or at-fault accident on their record will find cheaper rates with USAA, too. Minimum coverage costs 28% less from USAA than from State Farm in these cases.

USAA vs. State Farm car insurance rates for young drivers

State Farm | USAA | |

|---|---|---|

| Minimum coverage | $1,607 | $1,125 |

| Speeding ticket | $1,815 | $1,312 |

| Accident | $1,989 | $1,432 |

| Full coverage | $3,629 | $2,840 |

State Farm vs. USAA car insurance rates by state

USAA has lower rates than State Farm overall, but not in some states.

Of the 42 states where data was available from both insurance companies, USAA offers cheaper quotes in 26 states and the District of Columbia. State Farm has lower rates in 15.

State | State Farm | USAA |

|---|---|---|

| Alabama | $1,493 | $1,086 |

| Alaska | $1,002 | $974 |

| Arizona | $1,431 | $1,496 |

| Arkansas | $1,258 | $932 |

| California | $2,298 | - |

The largest price difference is in Hawaii, where a full-coverage policy from USAA costs $2,383 less per year than from State Farm. On the other hand, State Farm costs $592 less than USAA per year in Pennsylvania.

USAA vs. State Farm car insurance discounts

USAA and State Farm offer all of the standard discounts.

State Farm's range of discounts is helpful to more customers, which gives it a slight advantage over USAA. But active-duty service members may find USAA's discounts more useful than State Farm's.

Discount | State Farm | USAA |

|---|---|---|

| Accident-free | ||

| Driver training course | ||

| Passive restraint | ||

| Steer Clear | ||

| Student away at school |

Find Cheap Auto Insurance Quotes in Your Area

This list is not exhaustive. Discounts may depend on where you live. Whether you shop with USAA or State Farm, always talk to your insurance agent about what discounts you could qualify for, and take advantage of them all.

State Farm discounts

State Farm offers six discounts not available from USAA. Three of them can help young drivers and their families save money on car insurance.

- Young drivers under 21 can take a driver training course to receive a discount.

- Drivers under 25 with no moving violations or at-fault accidents can complete the Steer Clear program to earn a discount.

- Families that share a policy with a student away at school can get a discount if the student's car is garaged at home.

USAA discounts

USAA offers four discounts not available at State Farm.

- If you garage your vehicle on a military base, you can save up to 15% on the comprehensive insurance portion of your premium with the vehicle storage discount.

- The deployment discount saves you up to 60% if your car is unused and stored in a secure location.

- If your parents are insured with USAA, you can get a family discount of up to 10%.

- Drivers with a new vehicle (less than 3 years old) receive a discount.

USAA vs. State Farm car insurance coverage options

As two of the biggest insurance companies in the country, USAA and State Farm offer all the basic coverages you'd typically see in an auto insurance policy. Both also have a number of common coverage add-ons, such as roadside assistance, rental car reimbursement and rideshare insurance.

Coverage | State Farm | USAA |

|---|---|---|

| Roadside assistance | ||

| Rental reimbursement | ||

| Rideshare insurance | ||

| Accident forgiveness | Limited availability | |

| Funeral expenses coverage |

State Farm auto insurance features

State Farm only offers one type of coverage not available from USAA: nonowners insurance. This protects drivers who don't own a vehicle but often drive a borrowed car and drivers without a vehicle who need to file an SR-22.

Although State Farm doesn't have individual coverage add-ons for essential services expenses, funeral expenses and work loss benefits, they're all a standard part of personal injury protection (PIP insurance), which is available. So buying PIP from State Farm gives the same protections as USAA. (Funeral expenses benefits are also available if you buy medical payments coverage, or MedPay.)

But PIP insurance isn't available in every state. Also, it may be cheaper for some drivers to buy these coverages separately.

State Farm's rideshare coverage for drivers who work for a company like Uber or Lyft is more comprehensive than USAA's.

With State Farm rideshare insurance, you'll be covered:

- When your rideshare app is on and you're available to pick up customers

- When you're matched with a customer who needs a ride

- While you're transporting a customer

In comparison, USAA offers rideshare gap protection, which only covers the first stage listed above: the time when you're on duty and waiting to pick up customers. But USAA does not cover you after you've accepted a rideshare request.

USAA auto insurance features

USAA has a few coverage options that State Farm doesn't. The most useful one is car replacement. This coverage helps replace your car after a total loss by paying an extra 20% over than the actual cash value of your vehicle. This is unusual, because it's not limited to new cars. Drivers can add the coverage to any vehicle that has comprehensive and collision coverage.

USAA also offers essential services expenses coverage, funeral expenses coverage and work loss coverage. PIP already includes these coverages. But they may be useful for drivers who live in a state where you can't buy PIP insurance.

USAA vs. State Farm availability

State Farm and USAA are the largest and fifth-largest auto insurance companies in the U.S., respectively. And both offer coverage in all 50 states.

But auto insurance from USAA is not available to all drivers.

To purchase a USAA policy, you have to be an active-duty military member, a veteran or a family member of a policyholder.

For that reason, State Farm auto insurance is more obtainable for drivers than USAA.

USAA vs. State Farm customer service

Both State Farm and USAA provide an excellent customer experience. But USAA received slightly higher scores from industry reviewers.

Industry reviewer | State Farm | USAA |

|---|---|---|

| Editor's rating | ||

| J.D. Power | 892 | 909 |

| NAIC complaint index | 0.97 | 0.85 |

| AM Best financial strength rating | A++ | A++ |

USAA earned top marks on J.D. Power's car claims satisfaction study. That means drivers are happy with their claims process. USAA also receives fewer customer complaints than insurance companies of a similar size, according to the National Association of Insurance Commissioners (NAIC).

Though State Farm's scores aren't as high as USAA's, they're still excellent. The company was ranked above average by J.D. Power's satisfaction study. State Farm also gets fewer complaints than most of its competitors.

Both companies earned an A++ financial stability rating from AM Best, indicating they have the ability to pay out claims, even in difficult economic situations.

Frequently asked questions

Is USAA insurance better than State Farm's?

USAA is an excellent choice for auto insurance. It offers cheaper rates than State Farm for eligible drivers and has excellent customer service. But most drivers don't qualify, because availability is limited to active-duty military members, veterans and their families.

Does State Farm give military discounts?

State Farm does not offer a military discount. But they have a number of discounts available to help lower your premium.

Does USAA have local agents?

USAA does not have local insurance agents. You can contact customer service by calling 800-531-8722 or using the website's chat function.

What insurance does State Farm offer?

State Farm offers many types of insurance, including car, home, renters, motorcycle, liability, boat, small business, life, health and disability.

What does USAA stand for?

USAA is an acronym for United Services Automobile Association.

Methodology

ValuePenguin researched thousands of car insurance quotes from across the country for all the states in which data for USAA or State Farm was available.

Quotes are for a 30-year-old man who drives a 2015 Honda Civic EX and has a clean driving record, except where noted. Minimum-coverage insurance levels are based on the legal requirements of each state. Full-coverage policy levels are:

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person and $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured and underinsured motorist bodily injury | $50,000 per person and $100,000 per accident |

| Comprehensive and collision | $500 deductible |

| Personal injury protection (PIP) | Minimum when required by state |

This analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.