Liberty Mutual vs Geico: Car Insurance Rates and Coverage

Geico has lower car insurance rates for both full coverage and minimum coverage and better customer support. But Liberty Mutual has lots of discounts and coverage add-ons.

Find Cheap Auto Insurance Quotes in Your Area

Liberty Mutual vs. Geico

Best for | Liberty Mutual | Geico |

|---|---|---|

| Price | ||

| Discounts | ||

| Coverage | ||

| Customer service | ||

| Availability | ||

| Editor's rating | ||

| ValuePenguin's full review | Liberty Mutual review | Geico review |

Liberty Mutual vs. Geico car insurance rates

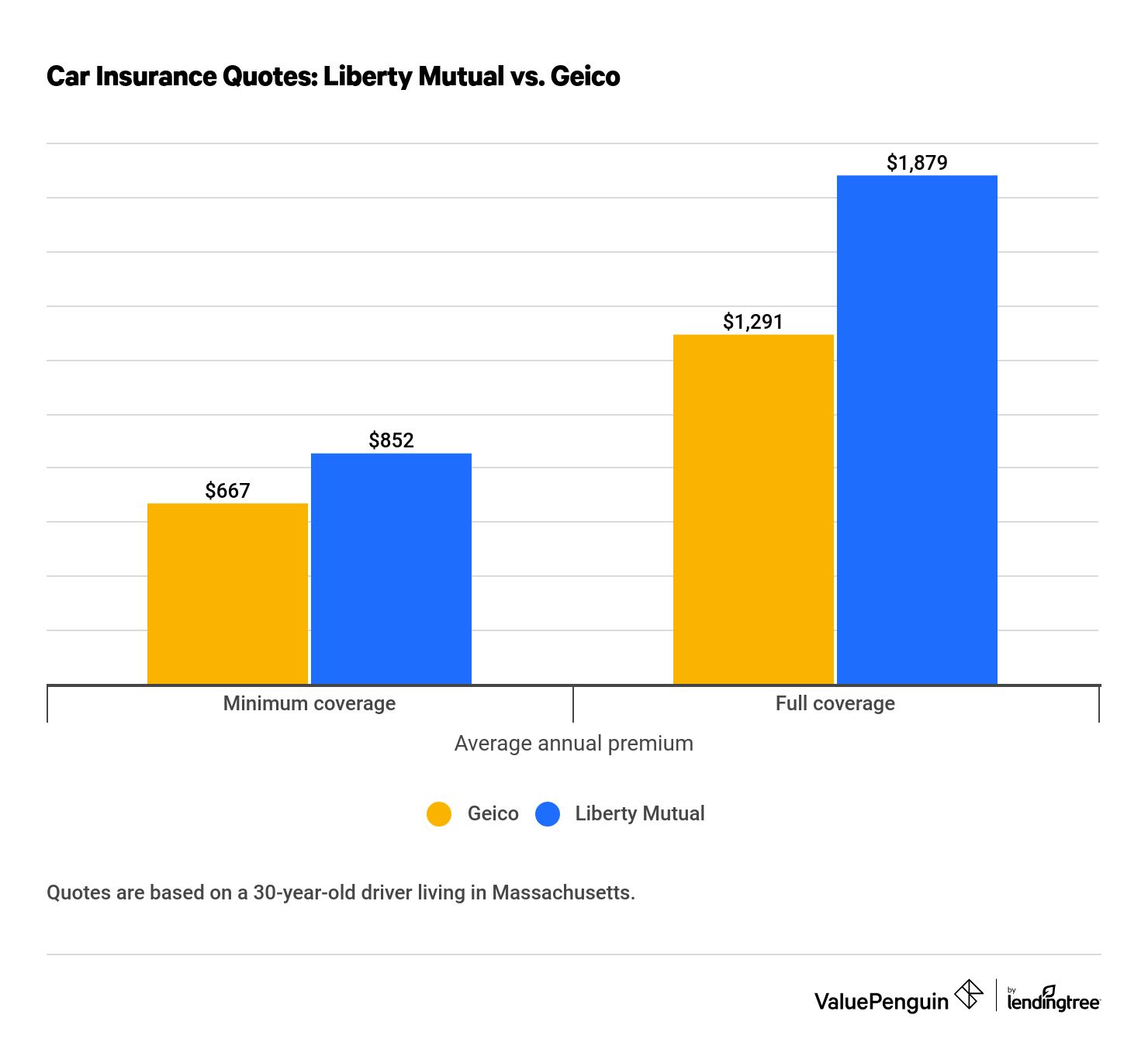

Geico is the clear winner when it comes to affordable car insurance rates.

Geico's quotes are up to 44% cheaper than Liberty Mutual's for both full coverage and liability only.

That said, Liberty Mutual offers an exceptional number of discounts that are easy to earn and available to all drivers. For example, you could get up to 10% off just for buying your policy online.

Cheapest for most drivers: Geico

Geico has cheaper car insurance than Liberty Mutual for many coverage levels. A full-coverage policy from Geico costs $108 per month, on average. That's $49 less than the same coverage from Liberty Mutual.

Find Cheap Auto Insurance Quotes in Your Area

Liability-only car insurance is also lower at Geico. A policy costs $667 per year, or $56 per month, which is $185 less per year than at Liberty Mutual.

Annual car insurance rates by coverage type

Coverage | Liberty Mutual | Geico |

|---|---|---|

| Full coverage | $1,879 | $1,291 |

| Minimum coverage | $852 | $667 |

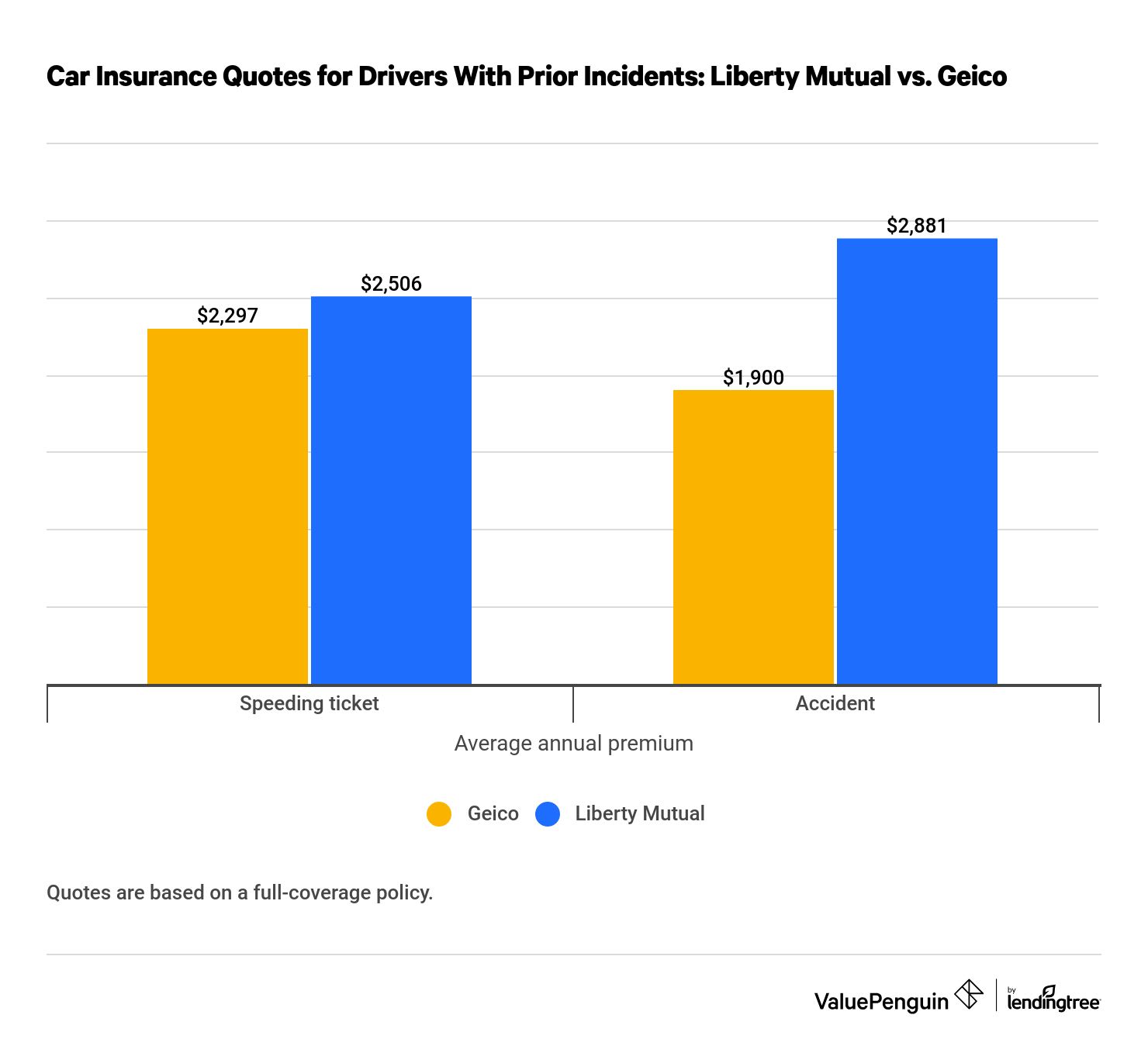

Cheapest for drivers with a prior incident: Geico

For drivers with a recent speeding ticket or accident on their record, Geico remains the cheapest option.

Geico's rates are particularly low for drivers who've been at fault for an accident. A full-coverage policy costs an average of $1,900 per year, or $158 per month. That's $981 cheaper per year than Liberty Mutual.

For drivers with a recent speeding ticket, a full-coverage policy with Geico costs, on average, $2,297 per year — or $209 per year cheaper than Liberty Mutual.

Annual car insurance quotes after a traffic violation

Incident | Liberty Mutual | Geico |

|---|---|---|

| Speeding ticket | $2,506 | $2,297 |

| Accident | $2,881 | $1,900 |

Cheapest for young drivers: Geico

Geico has an even more competitive rate when it comes to young drivers. An 18-year-old driver pays about 43% less for a policy with Geico than with Liberty Mutual. That's a savings of $2,182 per year.

Geico is particularly cheap for young drivers shopping for full coverage. At $3,854 per year, a policy from Geico costs $3,078 less per year than a policy from Liberty Mutual. But both companies are cheaper than the national average for 18-year-olds, which is $7,396 per year.

Annual car insurance quotes for teen drivers

Coverage | Liberty Mutual | Geico |

|---|---|---|

| Minimum coverage | $3,258 | $1,972 |

| Full coverage | $6,932 | $3,854 |

Companies consider young drivers — especially teenagers — at high risk of getting into an accident. Young people should always compare rates from multiple companies to find the best and cheapest policy.

Young drivers should also consider joining a parent's auto insurance policy. Their rates will go up after adding a teen driver, but the price of a combined policy is usually a lot lower than separate policies.

Liberty Mutual vs. Geico discounts

Liberty Mutual offers more discounts than Geico.

Many of Liberty Mutual's discounts are easy to earn. For example, they have an early shopper discount if you simply get a quote from them before your current policy expires.

Both Geico and Liberty Mutual offer a military discount to active-duty service members, veterans and reservists.

Discount | Liberty Mutual | Geico |

|---|---|---|

| Claim-free | ||

| Early shopper | ||

| Homeowner | ||

| Online purchase | ||

| Paperless |

Liberty Mutual RightTrack vs. Geico DriveEasy

Both of these programs track your driving habits using an app on your phone, earning you a discount for safe driving.

Liberty Mutual RightTrack is a better usage-based program than Geico DriveEasy.

Liberty Mutual offers drivers a discount of 5% to 30% for participating in the RightTrack program. The company monitors your driving for 90 days and then determines your discount.

Geico's DriveEasy program offers a discount of up to 25% and monitors your driving for a full policy period.

There are three major differences between the programs:

- If you exhibit poor driving habits, like speeding or hard braking, Geico may increase your car insurance rate. Liberty Mutual won't up your premium, but you may not get a discount.

- Geico penalizes drivers for handheld phone calls and active phone use. Liberty Mutual does not.

- Liberty Mutual RightTrack is available in 39 states and Geico in 38. You can get either in the District of Columbia.

Liberty Mutual vs. Geico car insurance coverages

Liberty Mutual has a wide range of coverage options available, many of which Geico does not offer.

Some of the most notable are gap insurance, new car replacement, teacher insurance and Mexican insurance.

Coverage | Liberty Mutual | Geico |

|---|---|---|

| Gap insurance | ||

| Better car replacement | ||

| Lifetime replacement guarantee | ||

| Mexican car insurance | ||

| New car replacement |

Geico offers the standard coverage options you'd expect and a few basic add-ons, such as roadside assistance and rental car reimbursement.

Some drivers can also get mechanical breakdown coverage, which covers mechanical repairs. However, the program is only available for cars that are 15 months old or newer and have fewer than 15,000 miles. So most people aren't eligible.

Geico vs. Liberty Mutual customer service

More drivers are satisfied with Geico's customer service experience than Liberty Mutual's.

Geico gets fewer customer complaints than Liberty Mutual and 21% fewer complaints than similar-size companies. Liberty Mutual gets 14% more complaints than expected, according to the National Association of Insurance Commissioners (NAIC).

Customer service ratings

Reviewer | Liberty Mutual | Geico |

|---|---|---|

| Editor's rating | ||

| J.D. Power | 876 | 881 |

| NAIC | 1.14 | 0.79 |

| AM Best | A | A++ |

J.D. Power awarded Geico a higher score on its annual auto insurance claims satisfaction survey. But Geico scored only one point above average and Liberty Mutual fell four points below average. In other words, according to J.D. Power, neither company's customer service is particularly outstanding.

Geico did earn the best possible financial stability score from the credit rating agency AM Best: an A++, or "Superior." Liberty Mutual earned an A, or "Excellent." These high marks mean that both companies can pay out claims, even in difficult economic times.

Frequently asked questions

Is Liberty Mutual cheaper than Geico?

No, Liberty Mutual is not cheaper than Geico for car insurance. A policy from Liberty Mutual costs 30% more than one from Geico, on average. In fact, Liberty Mutual is more expensive than many major insurance companies. Their minimum-coverage policy typically costs 20% more than the national average.

How much is Liberty Mutual car insurance a month?

On average, a minimum-coverage policy from Liberty Mutual costs $71 per month. Full coverage costs $157 per month.

Are Geico and Liberty Mutual the same company?

No, Liberty Mutual and Geico are not the same company. But Liberty Mutual does underwrite some of Geico's homeowners insurance policies.

Does Geico's full coverage include towing?

Towing is included in Geico's roadside assistance coverage, which can be added on to full coverage. A full-coverage policy is typically one that has comprehensive and collision coverage. Roadside assistance is not usually included.

Does Geico offer a multipolicy discount?

Yes, Geico offers a bundling discount when you combine home, condo, renters or mobile home policies.

Does Liberty Mutual have motorcycle insurance?

Yes, Liberty Mutual offers motorcycle insurance. You can't get a quote online, though. So you'll have to speak with an agent to get a quote and buy a policy.

Methodology

For this study, ValuePenguin gathered car insurance quotes from 10 of the largest cities in Massachusetts. Our sample driver is a 30-year-old man with a clean record driving a 2015 Honda Civic EX unless otherwise noted. For example, the section on young drivers used an 18-year-old man, but all other factors remained unchanged.

Coverage levels are listed below and are slightly higher than the state's minimum coverage requirements due to limits offered by the insurers:

Minimum coverage

Full coverage

Coverage | Limit |

|---|---|

| Bodily injury liability | $20,000/$40,000 |

| Property damage liability | $10,000 |

| Uninsured/underinsured motorist bodily injury | $20,000/$40,000 |

| Personal injury protection (PIP) | $8,000 |

| Comprehensive and collision deductible | Waived |

| Glass deductible | Waived |

Minimum coverage

Coverage | Limit |

|---|---|

| Bodily injury liability | $20,000/$40,000 |

| Property damage liability | $10,000 |

| Uninsured/underinsured motorist bodily injury | $20,000/$40,000 |

| Personal injury protection (PIP) | $8,000 |

| Comprehensive and collision deductible | Waived |

| Glass deductible | Waived |

Full coverage

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000/$100,000 |

| Property damage liability | $25,000 |

| Uninsured/underinsured motorist bodily injury | $50,000/$100,000 |

| Personal injury protection (PIP) | $8,000 |

| Comprehensive and collision deductible | $500 |

| Glass deductible | $100 |

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.