Erie Home & Auto Insurance Review: Great Rates and Commendable Service

Erie is a top insurance company with great prices, but it's only available in a handful of states.

Find Cheap Homeowners Insurance Quotes in Your Area

Erie Insurance is a great option for people living in one of the 12 states where it is offered. Erie's rates are among the best available, and its customer service is widely praised. One drawback of Erie's auto and home insurance is the company's lack of online tools.

Pros and cons

Pros

Low prices

Lots of local agents

Offers the option to lock in your rates

Cons

Only available in 12 states and D.C.

Can't buy or manage your policies online

Erie Insurance: Our thoughts

Home insurance bottom line: Erie homeowners insurance is priced competitively and has highly regarded customer service. Erie also offers a discount for those who bundle their auto and home insurance policies.

Auto insurance bottom line: Erie's fantastic auto insurance rates and customer support make it an excellent option. The main downsides are its limited geographic availability and its lack of online tools.

Erie's rates for auto and home insurance are up to 35% cheaper than average rates.

Erie sells insurance exclusively through its network of independent agents. This means that Erie customers will primarily interact with the company through agents, including when buying insurance, making claims and managing their policies. Aside from glass repair claims, all other claims must be filed through an agent or the Erie claims hotline.

Erie Insurance offers coverage options that match or exceed what is available from other insurers.

One of the biggest perks of Erie's auto insurance in particular is its "Rate Lock" offering.

If you qualify and add Rate Lock to your policy, Erie will not raise your rates year over year unless you change the drivers or cars on your policy, or you move from your current address. Your rate will stay the same even if you get in an accident or make a claim.

Erie's online tools are not as robust as those of some of its competitors. For example, there's no way to get a homeowners insurance quote online — you must request one from an agent.

While auto quotes are available over the internet, online customization options are limited, and you must buy a policy through an agent.

Compare Erie to other top auto insurance companies | |

|---|---|

| |

| Read review |

| Read review |

| Read review |

| Read review |

Erie homeowners insurance rates and coverages

Erie homeowners quote comparison

Erie's home insurance is consistently among the cheapest available to homeowners, with rates 15% cheaper than the national average . Erie has the lowest average rate among the largest home insurers in the country.

Find Cheap Homeowners Insurance Quotes in Your Area

Erie annual home insurance rates vs. competitors

Insurer | Average annual rate |

|---|---|

| Erie | $1,244 |

| State Farm | $1,363 |

| Allstate | $1,369 |

| Nationwide | $1,390 |

| Farmers | $1,475 |

| American Family | $1,495 |

Erie home insurance coverage

Homeowners insurance from Erie provides all the typical coverages for your home. This includes coverage for your "dwelling," or the structure of your home, your personal property inside it, liability protection in case someone is injured on your property, and additional living expenses if you're unable to occupy your home.

Erie's standard homeowner policy, which it calls ErieSecure, offers a few benefits that you might not find at other insurers:

- Guaranteed replacement cost coverage is included in a standard policy for no extra fee

- Theft coverage includes coverage for mysterious disappearances/lost belongings

- Pets are covered up to $500

- Cash and precious metals are covered up to $500

- Valuables coverage includes items like firearms, watches and jewelry

In addition, you can supplement your Erie homeowners policy with several custom options, including:

- Service line and sewer protection

- Extended personal liability coverage

- Identity theft protection

Erie homeowners insurance discounts

Erie provides a few opportunities for homeowners to reduce their rates for insurance, though the discounts it offers are fairly typical for insurance companies.

For example, customers can save money by:

- Buying multiple policies from Erie

- Equipping their homes with safety features like sprinklers or burglar alarms

- Getting a quote seven to 60 days before renewing their policy

Erie automobile insurance rates and coverages

Erie auto insurance quote comparison

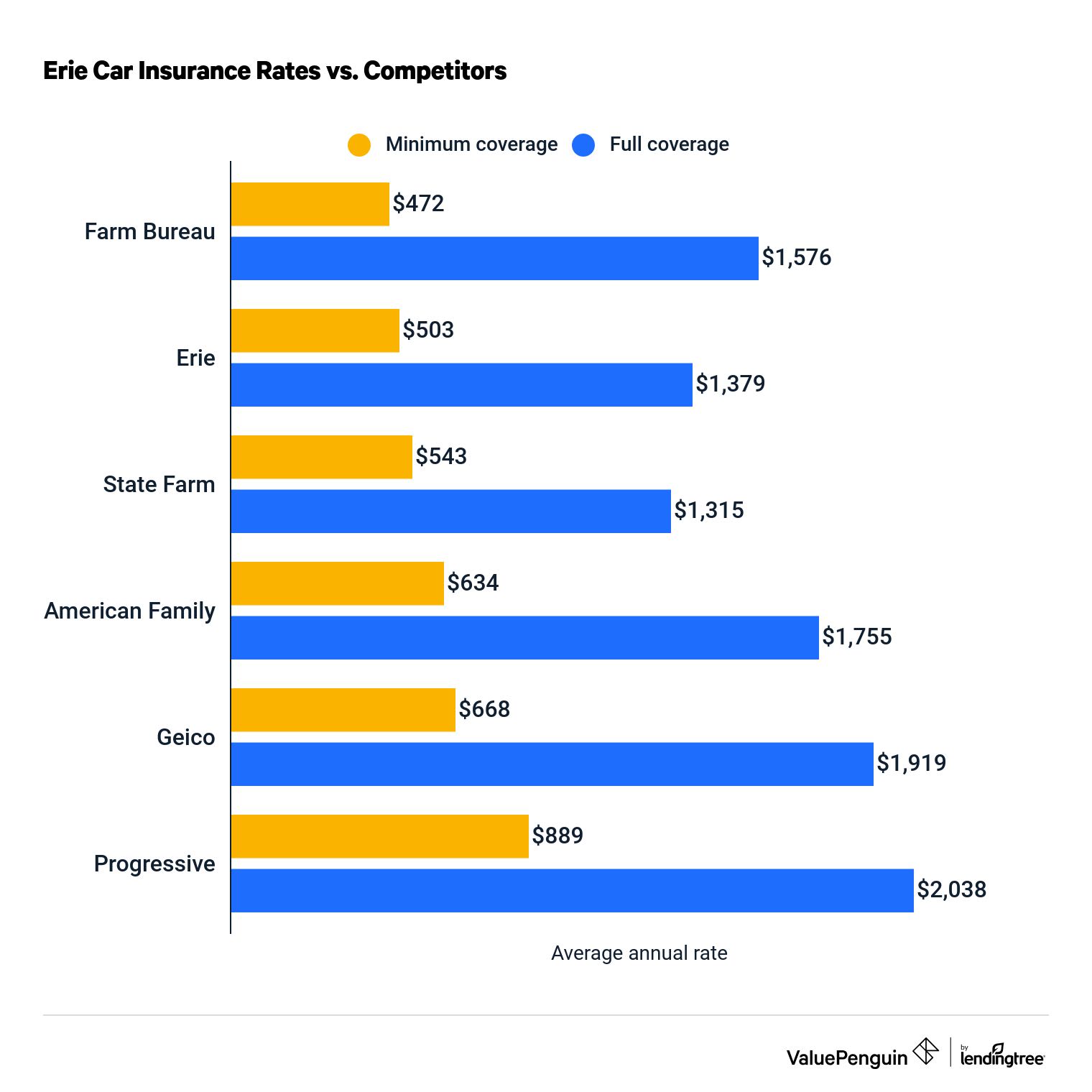

Erie's insurance rates are cheaper than most of its major competitors. We compared car insurance rates from nine of the largest insurance companies, collecting rates from every state in the country.

Erie's rates are 38% cheaper than average for full coverage and 43% cheaper than average for minimum coverage.

Find Cheap Auto Insurance Quotes in Your Area

Erie annual auto insurance rates vs. competitors

Company | Full coverage | Minimum liability |

|---|---|---|

| Farm Bureau | $1,576 | $472 |

| Erie | $1,379 | $503 |

| State Farm | $1,315 | $543 |

| American Family | $1,755 | $634 |

| Geico | $1,919 | $668 |

| Progressive | $2,038 | $889 |

| Nationwide | $2,127 | $916 |

| Allstate | $2,354 | $918 |

| Farmers | $2,527 | $959 |

| Travelers | $2,238 | $1,028 |

Drivers with incidents like an accident, a DUI or speeding ticket on their records can also find low rates with Erie. Among major insurers, only State Farm has cheaper rates. However, if you have poor credit, Erie's prices are only middle-of-the-pack.

Ticket

Accident

DUI

Poor credit

Company | Annual cost |

|---|---|

| State Farm | $1,465 |

| Erie | $1,469 |

| Farm Bureau | $1,774 |

| American Family | $2,055 |

| Geico | $2,336 |

| Progressive | $2,625 |

| Travelers | $2,693 |

| Nationwide | $2,709 |

| Allstate | $2,788 |

| Farmers | $3,355 |

Ticket

Company | Annual cost |

|---|---|

| State Farm | $1,465 |

| Erie | $1,469 |

| Farm Bureau | $1,774 |

| American Family | $2,055 |

| Geico | $2,336 |

| Progressive | $2,625 |

| Travelers | $2,693 |

| Nationwide | $2,709 |

| Allstate | $2,788 |

| Farmers | $3,355 |

Accident

Company | Annual cost |

|---|---|

| State Farm | $1,636 |

| Erie | $1,721 |

| Farm Bureau | $2,110 |

| American Family | $2,706 |

| Travelers | $3,144 |

| Progressive | $3,166 |

| Geico | $3,171 |

| Nationwide | $3,208 |

| Farmers | $3,513 |

| Allstate | $3,622 |

DUI

Company | Annual cost |

|---|---|

| Erie | $2,257 |

| Progressive | $2,565 |

| Farm Bureau | $2,813 |

| American Family | $2,832 |

| Travelers | $3,214 |

| Allstate | $3,564 |

| State Farm | $3,598 |

| Farmers | $3,599 |

| Nationwide | $4,120 |

| Geico | $4,460 |

Poor credit

Company | Annual cost |

|---|---|

| Farm Bureau | $2,555 |

| Geico | $2,620 |

| Nationwide | $2,698 |

| American Family | $2,707 |

| Erie | $2,846 |

| State Farm | $2,862 |

| Progressive | $3,213 |

| Travelers | $3,423 |

| Allstate | $3,432 |

| Farmers | $3,650 |

Erie auto insurance coverages

Erie provides wide-ranging coverages and benefits to its customers. It offers all the most common car insurance coverages, including liability, collision, comprehensive, uninsured/underinsured motorist and medical payments/personal injury protection.

In addition, Erie provides several notable coverages that customers might not find elsewhere. Note that some of these coverages are bundled with other more common options, while you have to buy others separately.

Highlighted benefit: Rate Lock

One of the most notable optional benefits Erie provides is its "Rate Lock" offering. If you have a safe driving history and add Rate Lock to your policy, Erie will only increase your auto insurance rates if you add or remove a car or driver, or change your address.

Otherwise, your rates will stay the same year after year, even if you get in an accident or make a claim to your insurance. However, if you get in an accident, a rate increase could catch up with you at a later time when you move or you add/remove a car/driver.

Accident Forgiveness

Your rates won't increase after your first at-fault accident after three years of safe driving with Erie. This feature is included with a standard policy.

Windshield Repair

If your windshield can be repaired instead of replaced, Erie will waive the deductible to fix it.

Pet Injury

Pays for up to $500 of expenses per pet (up to $1,000 total) if your dog or cat is injured in a car accident. This coverage is included with a standard policy.

Gap Coverage

If your car is a total loss, gap coverage pays the difference between your vehicle's replacement cost and what you have left on your lease or loan.

Roadside Assistance

Erie's roadside assistance coverage pays for lockouts, towing and other help you might need while driving.

Rental Car/Transportation Expenses

This feature covers the cost of a rental car or other transportation expenses while your car is being repaired after an accident. It is included with comprehensive coverage.

New/Better Car Replacement

If your car is totaled in an accident, Erie will pay the difference for you to upgrade to a model up to two years newer.

Auto Plus

Erie offers a package that includes a diminishing deductible, 10 extra days of transportation expenses after you're offered a settlement, a $10,000 death benefit and increased coverage for things like sound equipment, personal items and emergency travel costs.

Erie auto insurance discounts

Beyond its already affordable rates, Erie Insurance offers several discounts to its customers to lower their costs even more, though the discounts offered are about consistent with its competitors.

Drivers can get discounts for:

- Buying policies for multiple cars or bundling home and auto insurance

- Safe driving

- Paying for a year's insurance up front

- Using their car little or not at all

- Owning a car with safety equipment, like air bags

- Being a young driver who lives with their parents or is a good student

Other Erie Insurance offerings

Erie offers a wide range of coverage options that you can pair with your home or auto coverage. You will be able to get a discount if you bundle policies.

- Renters insurance

- Motorcycle insurance

- Condo insurance

- Mobile home insurance

- RV insurance

- Boat insurance

- Collector and classic car insurance

- ATV, snowmobile, golf cart insurance

- Flood insurance

- Life insurance

- Business insurance

Erie Insurance reviews, ratings and availability

Erie consistently gets good reviews for its customer service. The company is widely commended for many aspects of its business, including during the shopping process and while making claims.

Erie's home insurance arm has a low rate of complaints from customers, just 12% of what's expected from a company its size according to the National Association of Insurance Commissioners (NAIC). It also has an above-average score in J.D. Power's home insurance study.

Erie auto insurance is the top-rated option in multiple regions of the U.S. in J.D. Power's auto insurance study. It did, however, get more customer complaints than you'd expect for a company of its size, as its NAIC complaint ratio rating is 1.27.

Erie Insurance is also on excellent financial footing. It has one of the highest possible rating from AM Best (A+/Superior), indicating that the company has a very strong ability to pay out customer claims; financial stability should not be a concern for potential Erie Insurance customers.

Erie Insurance availability

Erie Insurance's biggest shortcoming is its limited coverage area. The company only sells insurance in 12 states, plus the District of Columbia. People who live outside of these places will have to look elsewhere for coverage.

- Illinois

- Indiana

- Kentucky

- Maryland

- New York

- North Carolina

- Ohio

- Pennsylvania

- Tennessee

- Virginia

- Washington, D.C.

- West Virginia

- Wisconsin

About Erie Insurance

Erie has been selling insurance since 1925. Founded in Erie Pennsylvania, it now has more than 6 million policies in force and 6,000 employees. The company only sold auto insurance at first but eventually expanded its offerings.

The company primarily works through agents, so you'll likely have to speak to one to get a quote.

Frequently asked questions

Is Erie Insurance good?

Yes. Erie's insurance prices are very competitive, and customers tend to be very happy with the company's service. The only downsides are few online tools and limited geographical availability.

Where can I get Erie Insurance?

Erie Insurance is available in the following places: the District of Columbia, Illinois, Indiana, Kentucky, Maryland, New York, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and Wisconsin.

Is Erie Insurance cheaper than Geico?

Yes, average prices for car insurance from Erie are cheaper than those at Geico. But every driver's price for insurance will vary, so the only way to be sure is to compare your own quotes.

What is Erie's phone number?

Erie's phone number is 800-458-0811.

Methodology

ValuePenguin rates insurance companies based on rates, coverage options, customer service and unique value to customers. We input those in a multifactor formula to deliver a rating out of five stars.

Home and auto insurance rates were collected from thousands of ZIP codes across every state in which Erie is one of the 15 largest insurers.

Quadrant Information Services was used to gather insurance rate quotes. These were publicly sourced from insurer filings and should be used for comparative purposes only — your own rates may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.