Best Car Insurance for Veterans and Military Families

USAA, Geico and State Farm are the best car insurance companies for military members and their families.

Find Cheap Auto Insurance for Military Families

ValuePenguin studied top national companies based on car insurance discounts offered to military members and veterans. Comparisons also included car insurance coverage options for current and former service members and rates for drivers currently in the military.

What is the best military car insurance company?

USAA has the best cheap insurance for military members. Rates cost an average of $88 per month. USAA offers both cheap rates and great service tailored to the military lifestyle.

Geico has the best car insurance for veterans. Its cheap rates averaging $96 per month are reduced to $82 per month after the military discount of up to 15%.

Find Cheap Auto Insurance for Military Families

Rates

Discounts

Company | Monthly cost | |

|---|---|---|

| USAA | $88 | |

| Geico | $96 | |

| State Farm | $98 | |

| Allstate | $218 |

USAA is only available to current and former military members and their families.

Car insurance quotes are for 30-year-old male drivers in the military across five states: Georgia, Ohio, Pennsylvania, Texas and Virginia.

USAA: best discounts and cheap rates for military members

Editor's rating

Annual rate $1,053 ?

Pros and cons

Since USAA only offers insurance to people associated with the military, you can't get a discount for being in the military. However, USAA's car insurance rates are among the cheapest available to military families.

If you plan to store your car while deployed, USAA is the clear winner. USAA offers discounts of up to 15% if you keep your vehicle on a military base. There's a 60% discount if you're deployed and store your vehicle in a safe location.

If you qualify for these discounts, you may only have to pay as little as $250 per year for car insurance. That's cheaper than the alternative of letting your car insurance lapse.

These discounts on top of cheap rates mean USAA is the best deal for deployed and active service members.

Average annual car insurance cost by state for military personnel

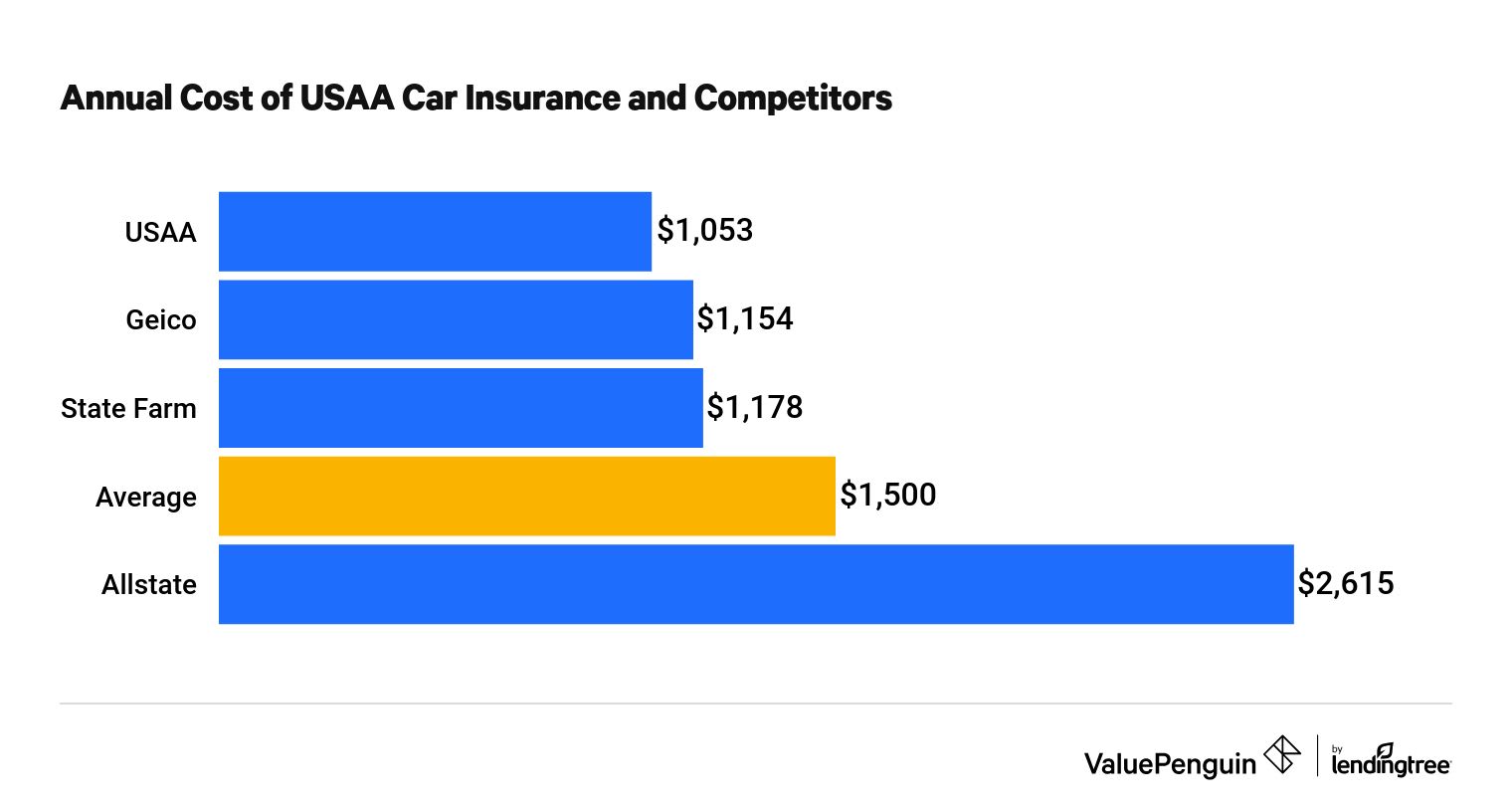

State | USAA | Geico | State Farm | Allstate |

|---|---|---|---|---|

| Georgia | $1,148 | $1,257 | $1,259 | $2,039 |

| Ohio | $897 | $990 | $1,093 | $2,241 |

| Pennsylvania | $851 | $1,221 | $1,371 | $2,857 |

| Texas | $1,367 | $1,439 | $1,193 | $3,434 |

| Virginia | $1,002 | $862 | $973 | $2,502 |

| Average | $1,053 | $1,154 | $1,178 | $2,615 |

USAA is 30% cheaper than the average cost of insurance from top companies. However, there are states where Geico and State Farm offer the cheapest rates.

USAA car insurance also has great customer satisfaction

In J.D. Power's survey of car insurance companies, USAA scored a perfect five out of five for shopping experience, claims processing and overall satisfaction. It's consistently among the top rated car insurance companies in the U.S.

According to USAA insurance reviews, it's easy to file a claim, and customers are satisfied with claim payouts after an accident.

USAA members also say the website is easy to use, and they're happy with the flexibility of policies. Plus, the company's services and perks are all geared toward veterans, military members and their families.

Geico: good rates for retired service members and those not deployed

Editor's rating

Annual rate $1,154 ?

Pros and cons

Geico may ultimately be the cheapest company if you are not deployed or are retired from the military. Geico provides military auto insurance rates similar to USAA's rates.

Overall, Geico is among the cheapest insurance companies in the U.S. Geico offers up to a 15% discount for those who have served in the military, regardless of their active status. Compare that to USAA, which doesn't allow membership for people who were dishonorably discharged.

When you factor in Geico's 15% savings for people in the Army, Navy, Air Force, Marines or Coast Guard, it may offer the best rates overall.

You're eligible for Geico's military discounts if you are a member of any of the following organizations:

- Association of the U.S. Army (AUSA)

- Fleet Reserve Association (FRA)

- National Infantry Association (NIA)

- U.S. National Guard

- U.S. Army Reserve

Geico's biggest downside versus USAA is its discount for soldiers who are deployed. Both companies reduce your bill when you're overseas and your car is in storage. However, Geico's discount is substantially smaller: only 25% off your rates, compared to USAA's 60% discount.

Also, unlike with USAA, the discount is only available if you are deployed to an "imminent danger pay" area. That's only about 42 countries, as defined by the Department of Defense.

When contacting the company, use the Geico Military Center number at 1-800-MILITARY. This line is staffed by former military personnel who can help you understand your rates, discounts and savings during deployment.

USAA vs. Geico auto insurance for military members

Both USAA and Geico are great companies for former or current members of the military and their dependents.

USAA has a slight advantage — especially if you are serving active duty. It has cheap rates, good discounts and great customer satisfaction.

Geico has much lower customer satisfaction. In the J.D. Power ratings, Geico scored four out of five for claims handling and and three out of five for customer satisfaction.

If you or a family member is an active or former military member, get quotes from both USAA and Geico. While USAA tends to be cheaper, there are some states where Geico's discount makes it the cheapest option. And Geico's online quote form is a lot quicker to complete,

State Farm: cheap rates and discounts for military

Editor's rating

Annual rate $1,178 ?

Pros and cons

Although State Farm does not have a nationwide discount for military members, its low rates make it the cheapest option in some areas.

For example, State Farm has lower rates than USAA and Geico in Texas. There are many other State Farm discounts that you might qualify for, such as bundling your auto and home insurance.

State Farm offers a good driver discount for drivers who haven't had any tickets or at-fault accidents for three years. Also, the company offers a program called Steer Clear for drivers under the age of 25. This online course in driving skills can help you save up to 20%.

Recap of the best car insurance for military members and their families

- Best rates and customer service: USAA

- Best for veterans and those not deployed: Geico

- Competitive rates: State Farm

Frequently asked questions

What's the best car insurance for veterans?

Is USAA for the military only?

USAA insurance is available to current or former members of the military. It's also available to spouses and children of those who have had USAA insurance in the past. So if your dad was in the Army and had USAA insurance, you can have it, too. But if he never had USAA, you aren't eligible.

How do I qualify for Geico's military discount?

Geico's military discount of up to 15% is available if you are on active duty, a veteran, or a member of the National Guard or Reserves. You may also qualify for a bigger discount if you're being deployed to an active combat zone. Call Geico at 1-800-MILITARY to sign up.

Methodology

To compare car insurance for military members, we collected sample quotes from four insurers (USAA, Geico, State Farm and Allstate).

Average rates are for a full coverage policy for a 30-year-old man who is currently serving in the military. Quotes included thousands of ZIP codes from Georgia, Ohio, Pennsylvania, Texas and Virginia.

Insurance quote data is from Quadrant Information Services. The quotes used were publicly sourced from insurer filings and should only be used for comparison purposes. The actual cost of insurance for military members and their families may differ from the estimates provided.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.