Cheapest Car Insurance Quotes in Maine (2026)

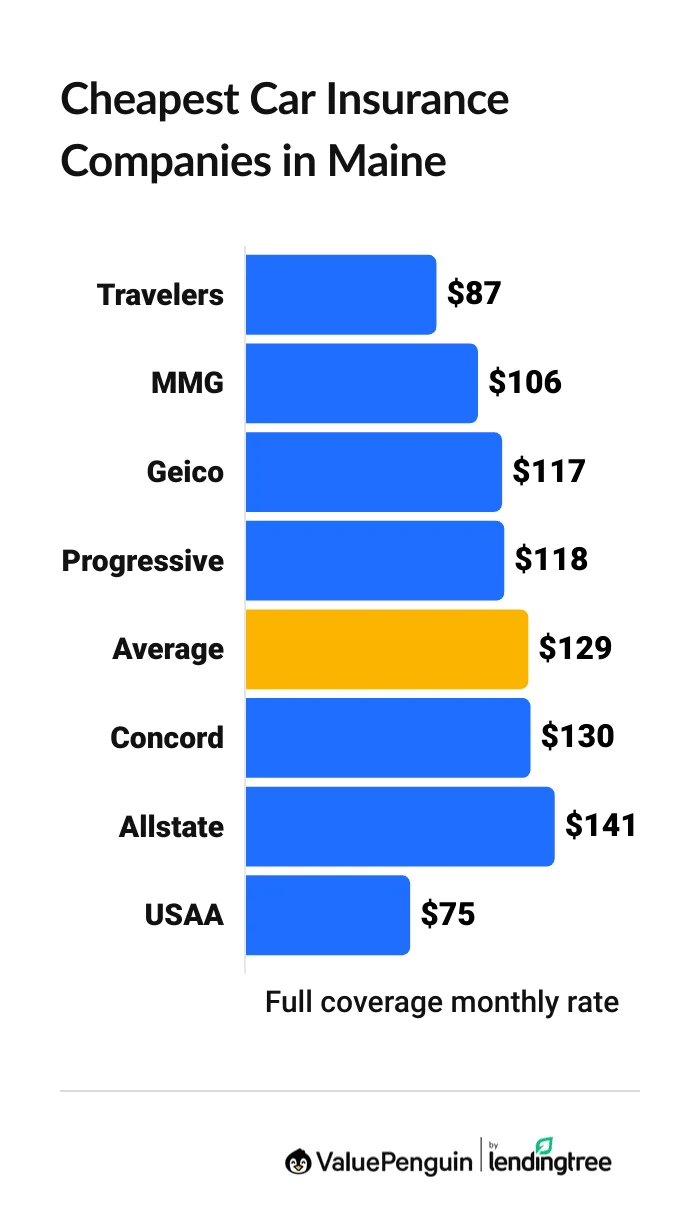

Travelers has the cheapest full coverage car insurance in Maine, at$87 per month. That's $42 per month less than the state average.

Find Cheap Car Insurance Quotes in Maine

Best cheap Maine auto insurance

Best and cheapest car insurance in Maine

- Cheapest full coverage: Travelers, $87/mo

- Cheapest minimum liability: MMG, $35/mo

- Cheapest for young drivers: Travelers, $103/mo

- Cheapest after a ticket: Travelers, $116/mo

- Cheapest after an accident: MMG, $129/mo

- Cheapest for teens after a ticket: Travelers, $132/mo

- Cheapest after a DUI: Travelers, $134/mo

- Cheapest for poor credit: Travelers, $142/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Travelers, Geico and MMG offer lower-than-average rates in Maine. MMG, a regional company, is the cheapest if you’re looking for minimum coverage or insurance after an accident. But its customer service scores aren’t very good.

State Farm has high customer satisfaction scores. If you don’t mind paying a higher monthly rate, State Farm has one of the best customer service ratings in Maine.

USAA is the best choice for Maine drivers with military ties. The company has some of the cheapest rates and excellent customer service. However, it's only available to active-duty military, veterans and some of their family members.

Cheapest car insurance in Maine: Travelers

Travelers has the most affordable full coverage car insurance in Maine.

Find Cheap Car Insurance Quotes in Maine

- Travelers and MMG offer the cheapest full coverage rates in the Pine Tree State. But their customer service reviews aren’t very good.

- Geico offers rates that are cheaper than average in Maine. Its average full coverage rate is $117 per month; $12 lower than the state average. And it has better customer service reviews than the two cheapest companies, Travelers and MMG.

- USAA has the lowest rates overall, at $75 per month. But only military members, veterans and some of their family members can get car insurance from USAA.

Cheapest full coverage car insurance in Maine

Company | Monthly rate | |

|---|---|---|

| Travelers | $87 | |

| MMG | $106 |

| Geico | $117 | |

| Progressive | $118 | |

| Concord | $130 |

*USAA is only available to current and former military members and their families.

Data-powered research on Maine car insurance

Data-powered research on ME car insurance |

|---|

Cheapest liability insurance quotes in Maine: MMG

MMG, a smaller regional company, offers the cheapest minimum liability car insurance quotes in Maine.

At $35 per month, liability-only coverage from MMG costs $12 per month less than the Maine state average.

Cheapest minimum coverage car insurance in Maine

Company | Monthly rate | |

|---|---|---|

| MMG | MMG | $35 |

| Progressive | Progressive | $36 |

| Travelers | Travelers | $37 |

| Geico | Geico | $45 |

| Concord | Concord | $55 |

*USAA is only available to current and former military members and their families.

Active military members, veterans and their families may find cheaper rates through USAA, at $28 per month.

Find Cheap Car Insurance Quotes in Maine

Cheap insurance in Maine for young drivers: Travelers

Travelers has the cheapest minimum liability and full coverage car insurance in Maine for teen drivers.

A liability-only policy from Travelers costs $103 per month for an 18-year-old driver. That's $50 per month less than the Maine average.

At $250 per month, full coverage from Travelers costs $156 per month less than the state average.

Best Maine car insurance quotes for teens

Company | Liability only | Full coverage |

|---|---|---|

| Travelers | $103 | $250 |

| Concord | $124 | $257 |

| MMG | $126 | $339 |

| Allstate | $150 | $383 |

| Geico | $159 | $397 |

*USAA is only available to current and former military members and their families.

USAA has even cheaper rates for young drivers. However, it's only available to people affiliated with the military.

The best way for teen drivers in Maine to get cheaper insurance rates is by sharing a policy with their parents or an older relative. A shared policy typically costs less than buying two separate policies.

Maine teens can also save money by choosing a car that's cheaper to insure, getting good grades in school and avoiding tickets and accidents.

Cheapest auto insurance in Maine after a speeding ticket: Travelers

Travelers has the best quotes for Maine drivers with a recent speeding ticket. A full coverage policy from Travelers costs $116 per month after one ticket, which is $49 per month cheaper than average.

Geico also has affordable rates after a speeding ticket, at $123 per month for full coverage. Geico’s customer service reviews are better than Travelers, so it could be a better choice for most people.

Affordable Maine auto insurance quotes after a speeding ticket

Company | Monthly rate |

|---|---|

| Travelers | $116 |

| Geico | $123 |

| MMG | $140 |

| Progressive | $165 |

| State Farm | $167 |

*USAA is only available to current and former military members and their families.

In Maine, car insurance rates go up by an average of 28% after a single speeding ticket. That's because insurance companies believe that drivers who speed are more likely to cause a future accident.

Cheapest Maine car insurance rates after an accident: MMG and Travelers

MMG has the cheapest rates for drivers in Maine after an accident, at $129 per month. Travelers' rates are only $1 more at $130 per month. That's $72 per month less than the state average.

Company | Monthly rate |

|---|---|

| MMG | $129 |

| Travelers | $130 |

| State Farm | $155 |

| Progressive | $190 |

| Concord | $204 |

*USAA is only available to current and former military members and their families.

Having a single accident on your driving record will increase your rates by an average of 57% in Maine.

You don't have to stress about your rates going up right after an accident. That's because your rates won't increase until your current policy comes up for renewal.

You should get a notice in the mail with your new rates a few weeks to one month before your policy renews. That's a good time to get quotes from multiple companies so you can find the best price for you.

Cheapest quotes in Maine for teens with a ticket or accident: Travelers

Travelers offers the cheapest rates for young drivers in Maine with a speeding ticket or accident on their records. With Travelers, an 18-year-old pays just $132 per month for a minimum liability policy after a ticket. That's $57 per month less than the Maine average. After an accident, a teen pays $156 at Travelers — that’s 31% less than the Maine average.

Low-cost car insurance for Maine teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Travelers | $132 | $156 |

| MMG | $159 | $163 |

| Concord | $161 | $198 |

| Geico | $177 | $241 |

| Allstate | $202 | $295 |

*USAA is only available to current and former military members and their families.

Just like older drivers, younger drivers pay more for car insurance after they get a speeding ticket or cause a crash. But teens are already treated as higher-risk drivers, so their rates don't go up as much — just 24% after a speeding ticket and 48% for a crash.

Cheap auto insurance in Maine after a DUI: Travelers

Travelers has the most affordable insurance quotes in Maine for drivers with a DUI. Full coverage from Travelers costs an average of $134 per month, which is $172 per month cheaper than the Maine average.

Best auto insurance rates in Maine after a DUI

Company | Monthly rate |

|---|---|

| Travelers | $134 |

| Progressive | $152 |

| MMG | $178 |

| Allstate | $194 |

| Concord | $219 |

*USAA is only available to current and former military members and their families.

A DUI in Maine will more than double your auto insurance rates. After a DUI, you’ll pay $177 more per month on average for a full coverage policy.

Cheapest car insurance in Maine for drivers with poor credit: Travelers

Travelers has the cheapest car insurance rate for Maine drivers with bad credit, at $142 per month for a full coverage policy. That's $134 per month less than the state average.

Affordable Maine car insurance for poor credit

Company | Monthly rate |

|---|---|

| Travelers | $142 |

| MMG | $168 |

| Geico | $177 |

| Progressive | $193 |

| Allstate | $213 |

*USAA is only available to current and former military members and their families.

In Maine, a poor credit score can double your insurance rates. Poor credit can mean higher car insurance prices because insurance companies believe drivers with lower credit scores are more likely to file claims.

Best car insurance in Maine

State Farm is the best-rated auto insurance company in Maine for most people.

State Farm offers a great mix of reliable customer service, useful coverage options and affordable rates.

Top Maine auto insurance companies

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| MMG | NR | A | |

| Concord | NR | A+ | |

| Farmers | 622 | A |

USAA is the best company for Maine drivers with military ties. It has a reputation for excellent customer service, and it has some of the cheapest quotes in Maine.

Average car insurance rates in Maine by city

Chebeague Island, located in Casco Bay, has the most affordable auto insurance quotes in Maine.

Drivers on Chebeague Island pay an average of $123 per month for full coverage insurance.

Waldoboro, a town on the coast, has the most expensive rates in Maine. At $148 per month, drivers in Waldoboro pay $25 per month more than those on Chebeague Island.

Cheap ME car insurance near you

City | Monthly rate | % from average |

|---|---|---|

| Abbot | $137 | 5% |

| Acton | $145 | 12% |

| Addison | $142 | 9% |

| Albion | $137 | 5% |

| Alfred | $136 | 5% |

What are the minimum requirements for car insurance in Maine?

Maine drivers must have a minimum amount of liability insurance to drive legally. This requirement is sometimes written as 50/100/25. Maine drivers also need matching uninsured and underinsured motorist liability coverage and medical payment coverage. This is more coverage than most states require.

- Bodily injury (BI) liability: $50,000 per person and $100,000 per accident

- Property damage (PD) liability: $25,000 per accident

- Uninsured and underinsured motorist (UM/UIM) liability: $50,000 per person and $100,000 per accident

- Medical payments: $2,000 per person

Drivers can also get a combined liability limit of $125,000, instead of separate personal injury and property damage limits.

What's the best car insurance coverage for ME drivers?

Full coverage car insurance is the best choice for most drivers in Maine.

Full coverage pays for most types of damage to your car because it includes comprehensive and collision coverage. For that reason, most lenders require you to have full coverage if you have a car loan or lease. It's also a good idea if your car is less than eight years old or worth more than $5,000.

Full coverage usually has higher liability limits than the state requirement as well. This is important because the minimum insurance required in Maine may not be enough to cover the cost of a serious accident.

For example, if you hit and total a brand-new car, $25,000 of property damage liability coverage may not be enough to replace it. That means you'll have to pay the difference out of pocket.

Frequently asked questions

Who has the cheapest auto insurance in Maine?

Travelers has the cheapest full coverage quotes in Maine in 2026. At $87 per month, full coverage from Travelers costs $42 per month less than the Maine average. The cheapest minimum liability rates come from MMG, where a policy costs just $35 per month.

What is the average cost of car insurance in Maine?

The average cost of car insurance in Maine is $129 per month for a full coverage policy. Minimum liability coverage in Maine costs an average of $47 per month.

How much is car insurance in Bangor, Maine?

The average cost of car insurance in Bangor is $134 per month for a full coverage policy. That's $5 more per month than the state average.

Is car insurance cheaper in Maine or Massachusetts?

Full coverage car insurance in Maine is $52 per month less than a policy in Massachusetts. Minimum liability insurance in Maine is also cheaper than a Massachusetts policy by $26 per month.

How do I find cheaper insurance in Maine?

The easier way to get the cheapest rates is by comparing quotes from multiple companies. You should also ask about discounts and get rid of any coverage you no longer need.

Methodology

ValuePenguin collected thousands of car insurance quotes from ZIP codes across Maine for the state's largest insurance companies. Rates are for a 30-year-old man who owns a 2018 Honda Civic EX with a good credit score.

Quotes are for a full coverage policy with comprehensive and collision coverage.

- $50,000 of bodily injury liability coverage per person, and $100,000 per accident

- $50,000 of property damage liability

- $50,000 of bodily injury uninsured motorist coverage per person, and $100,000 per accident

-

$2,000 of medical payments coverage per person

- Collision and comprehensive coverage with a $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.