The Best Cheap Motorcycle Insurance in Texas

Dairyland has the cheapest motorcycle insurance in Texas, at about $22 per month for full coverage.

Find Cheap Motorcycle Insurance Quotes in Texas

Best cheap Texas motorcycle insurance

How we chose the top companies

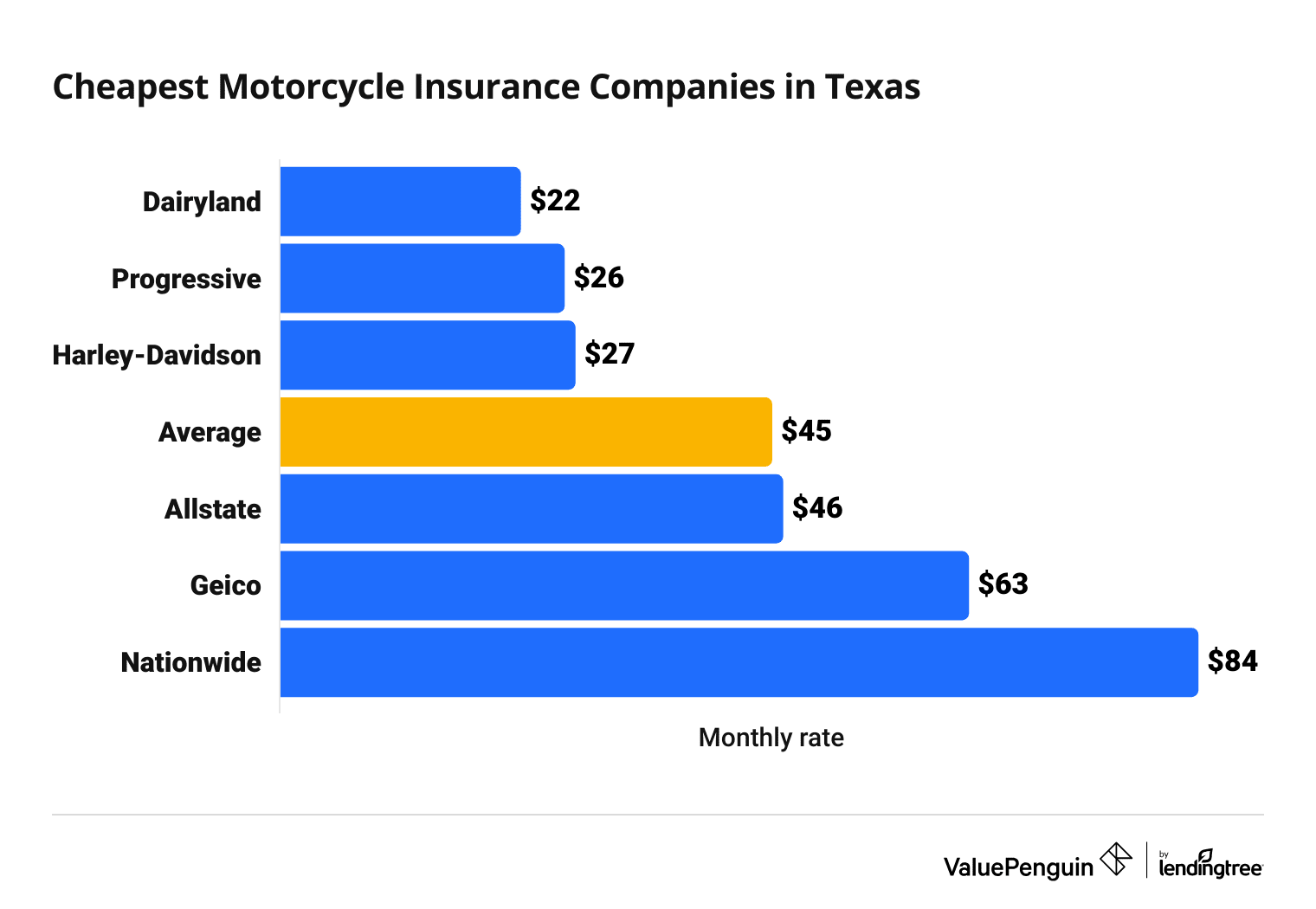

Cheapest motorcycle insurance in Texas

Dairyland has the cheapest motorcycle insurance in Texas.

A full coverage policy from Dairyland costs $22 per month, which is half the statewide average.

Find Cheap Motorcycle Insurance Quotes in Texas

The average cost of motorcycle insurance in Texas is $45 per month. That's 41% more expensive than the national average, making it the fifth-most expensive state.

Cheapest motorcycle insurance quotes in Texas

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $22 | ||

| Progressive | $26 | ||

| Harley-Davidson | $27 | ||

| Allstate | $46 | ||

| Geico | $63 | ||

| Nationwide | $84 | ||

Best for most people: Dairyland

-

Editor's rating

-

Cost: $22/month

Overview

Pros/Cons

Dairyland's cheap rates and dependable customer service make it the best choice for most Texas riders.

Overview

Dairyland's cheap rates and dependable customer service make it the best choice for most Texas riders.

Pros/Cons

Pros:

-

Cheapest quotes in Texas

-

Reliable customer service

-

Replacement cost for bikes less than 3 years old

Cons:

-

Can't bundle with home or auto

-

Fewer coverage options than other companies

Dairyland's cheap rates and dependable customer service make it the best choice for most Texas riders.

Pros:

-

Cheapest quotes in Texas

-

Replacement cost coverage for bikes less than 3 years old

-

Reliable customer service

Cons:

-

Fewer coverage options than other companies

-

Can't bundle with home or auto

Dairyland offers the cheapest motorcycle insurance in Texas, at $22 per month for a full coverage policy. That's less than half the Texas average of $45 per month.

Dairyland offers a few ways for bikers to upgrade their protection, such as roadside assistance and rental car reimbursement. These coverages are helpful if your motorcycle is your main vehicle, because they'll help keep your life on track if something happens to your bike.

You can also protect your new motorcycle with replacement cost coverage for up to three years. That means if you wreck your bike, Dairyland will help replace it with a new model. Most other companies only offer this coverage for bikes that are less than two years old.

However, Dairyland doesn't offer trip interruption or trailer coverage. If you need these coverages, consider Progressive instead.

Dairyland gets 20% fewer customer complaints than an average company its size. That means you can depend on the company to get your life back to normal quickly after an accident.

Best for extra coverage: Progressive

-

Editor's rating

-

Cost: $26/month

Overview

Pros/Cons

Progressive's motorcycle insurance is very affordable, and its full coverage policy comes with extra protection.

Overview

Progressive's motorcycle insurance is very affordable, and its full coverage policy comes with extra protection.

Pros/Cons

Pros:

-

Full coverage includes extra protection

-

Lots of coverage add-ons and discounts

-

Few customer complaints

Cons:

-

No rental reimbursement

Progressive's motorcycle insurance is very affordable, and its full coverage policy comes with extra protection.

Pros:

-

Full coverage includes extra protection

-

Lots of coverage add-ons and discounts

-

Few customer complaints

Cons:

-

No rental reimbursement

A full coverage policy from Progressive costs $26 per month, which is 44% lower than the average in Texas. That's only $4 per month more expensive than Dairyland, the cheapest company.

A policy from Progressive also comes with more protection than most basic motorcycle policies.

For example, Progressive's policy includes what's called full replacement cost coverage. That means it will pay to fix your bike with new parts, even if there was wear and tear before your accident.

This means you'll potentially get more value out of a Progressive policy, which could make the additional cost worth it.

In addition, Progressive also offers lots of discounts that are easy to earn, including discounts for:

- Getting a quote at least one day before your new policy starts

- Switching to Progressive from another company

- Paying your bill on time, in full or using automatic payments

- Having a valid motorcycle license or endorsement

Progressive gets 42% fewer customer complaints than an average company its size.

That suggests riders are typically happy with the service they get from Progressive.

The main downside to Progressive is that it doesn't offer rental reimbursement. This pays for a rental car while your motorcycle is in the repair shop after an accident. If you worry about paying for a rental car after a crash, you should consider Dairyland instead.

Best for military families: USAA

-

Editor's rating

-

Cost: $25/month

Overview

Pros/Cons

USAA's affordable rates, great coverage and low number of customer complaints make it an excellent choice for military riders.

Overview

USAA's affordable rates, great coverage and low number of customer complaints make it an excellent choice for military riders.

Pros/Cons

Pros:

-

Low rates

-

Many ways to customize your coverage

-

Lots of discounts

-

Minimal customer complaints

Cons:

-

No rental reimbursement

-

Only available to riders with military connections

USAA's affordable rates, great coverage and low number of customer complaints make it an excellent choice for military riders.

Pros:

-

Low rates

-

Many ways to customize your coverage

-

Lots of discounts

-

Minimal customer complaints

Cons:

-

Only available to riders with military ties

-

No rental reimbursement

USAA doesn't sell motorcycle insurance directly.

Instead, it partners with Progressive for coverage and offers members a 5% discount.

Progressive already has very affordable rates, with an average of $26 per month before discounts. USAA's discount means that members can expect to pay around $25 per month for coverage.

USAA members also get all of the perks of a Progressive policy, including the extra coverage the company includes when you get comprehensive and collision coverage.

The main downside of USAA motorcycle insurance is that it's only available to military members, veterans and some of their family members.

Texas has the third-most active military service members of any state, so many people may qualify for USAA. But, if you don't, you can still get a regular policy through Progressive.

Average cost of motorcycle insurance in Texas by city

Midland, a city in west Texas, has the cheapest motorcycle insurance quotes among larger Texas cities.

People in Midland pay an average of $37 per month for full coverage insurance.

Pasadena, a suburb of Houston, has the highest rates in the state, averaging $56 per month.

Average motorcycle insurance cost in TX by city

City | Monthly cost | % from average |

|---|---|---|

| Allen | $40 | -11% |

| Amarillo | $39 | -12% |

| Austin | $44 | -2% |

| Baytown | $53 | 19% |

| Beaumont | $48 | 7% |

Full coverage motorcycle insurance rates can vary by up to $19 per month among larger cities in Texas. Riders who live in big cities with lots of traffic and higher crime rates tend to pay more for motorcycle insurance. That's because they're more likely to file an insurance claim.

Motorcycle laws in Texas

All motorcycle owners in Texas must have insurance with at least 30/60/25 of liability coverage.

Texas motorcycle insurance requirements

- Bodily injury liability coverage: $30,000 per person and $60,000 per accident

- Property damage liability coverage: $25,000

Medical payments, uninsured motorist, comprehensive and collision coverage aren’t required to drive a motorcycle in Texas. But you should consider adding them to your policy. If you’re in an accident, these coverage options will help pay for your injuries or damage to your bike.

Texas helmet law

Texas law requires motorcycle drivers and passengers under 21 to wear a helmet at all times.

If you’re older than 21, you're still required to wear a helmet while riding unless:

- You’ve completed a motorcycle safety course, or

- You have health insurance that will pay for health care services, medical expenses and surgical expenses if you're in a motorcycle accident

Texas doesn’t require you to wear other gear besides a helmet. But you should consider eye protection and clothing tough enough to prevent road rash.

You may have to follow other gear requirements if you're active-duty military.

Motorcycle license requirements in Texas

The requirements to get a Texas motorcycle license, also called a Class M license, vary depending on your age and whether you already have a driver’s license.

However, every applicant must:

- Have a REAL ID

- Complete a motorcycle safety course approved by the Texas Department of Public Safety (DPS)

If you already have a regular driver’s license, you may also need to complete a motorcycle road test. Texas may waive this requirement if you’re over 18.

If you’re applying for your first license and only want a Class M motorcycle license, you'll also need to complete:

- The written test for car drivers

- A motorcycle road test

- Either the classroom segment of a teen driver education course or both the classroom and behind-the-wheel segments of an adult driver education course (if between 18 and 24)

Frequently asked questions

How much is motorcycle insurance in Texas?

The average cost of motorcycle insurance in Texas is $45 per month for a full coverage policy. Riders can find the cheapest rates at Dairyland, where a policy costs around $22 per month.

Is motorcycle insurance required in Texas?

Yes, Texas requires riders to have a minimum of $30,000 of bodily injury liability coverage per person and $60,000 per accident, along with $25,000 of property damage liability coverage.

Which company has the best motorcycle insurance in Texas?

Dairyland has the best motorcycle insurance in Texas for most people, at $22 per month for a full coverage policy. Riders should also compare quotes from Progressive, which has more coverage options and better customer service. A policy from Progressive costs around $26 per month.

How much is motorcycle insurance in Houston, TX?

Houston motorcycle insurance costs an average of $52 per month, which is 17% more expensive than the state average. In comparison, motorcycle insurance in San Antonio costs an average of $51 per month, while Dallas riders pay around $46 per month.

Methodology

To find the best cheap motorcycle insurance in Texas, ValuePenguin gathered rates across more than 50 of the largest cities in the state from six top insurance companies. Rates are for a 45-year-old single man with a clean driving record who owns a 2018 Honda CMX500 Rebel.

Quotes are based on a full coverage policy. It includes higher liability limits than the state requirement and comprehensive and collision coverage.

- Bodily injury liability coverage: $50,000 per person and $100,000 per accident

- Property damage liability coverage: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

The ValuePenguin team has a combined total of more than 50 years' experience in the property and casualty insurance industry.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.