The Best Motorcycle Insurance Companies in Florida (2026)

Dairyland has the cheapest motorcycle insurance in Florida, at $24 per month.

Find Cheap Motorcycle Insurance Quotes in Florida

Best cheap motorcycle insurance in Florida

How we chose the top companies

You need to have insurance or show proof of what's called financial responsibility if: You must have a minimum of $10,000 in medical protection if you’re at least 21 and choose not to wear a helmet You need motorcycle liability insurance if you were at-fault for an accident within the last three years Lenders often require you to have full coverage insurance if you finance or lease your bike

However, without insurance, you’re personally responsible for any repair or medical bills from an accident when you’re at fault.

Having motorcycle insurance is the best way to protect yourself and your bike.

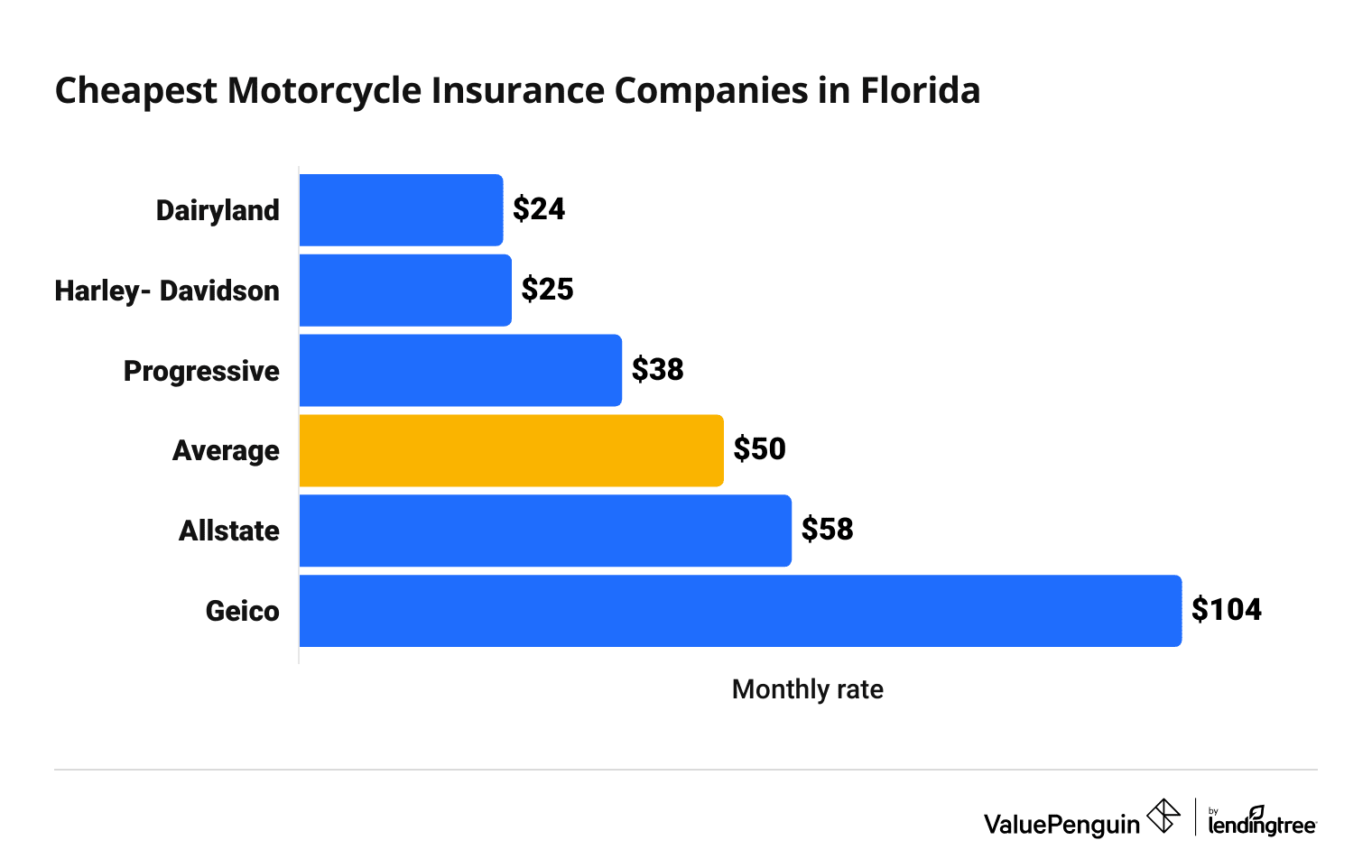

Cheapest motorcycle insurance in Florida

Dairyland has the most affordable motorcycle insurance in Florida.

Full coverage insurance from Dairyland costs $24 per month. That's less than half the Florida state average.

Compare Motorcycle Insurance Quotes in Florida

Motorcycle insurance in Florida costs an average of $50 per month for a full coverage policy, which is 55% higher than the national average.

Best cheap Florida motorcycle insurance

Company | Monthly rate | ||

|---|---|---|---|

| Dairyland | $24 | ||

| Harley-Davidson | $25 | ||

| Progressive | $38 | ||

| Allstate | $58 | ||

| Geico | $104 | ||

Do you have to have motorcycle insurance in Florida?

Motorcycle insurance is not required by law for most riders in Florida.

However, motorcycle insurance can save you a lot of money if you cause a serious accident. Without insurance, you'll have to pay for any damage or injuries you cause.

Best motorcycle insurance in Florida for most people: Dairyland

-

Editor's rating

-

Cost: $24/month

Overview

Pros/cons

Dairyland has the cheapest rates in Florida, along with reliable customer service.

Overview

Dairyland has the cheapest rates in Florida, along with reliable customer service.

Pros/cons

Pros:

-

Cheapest quotes in Florida

-

Offers good coverage for daily riders

-

Discounts available

Cons:

-

Bad customer service

-

Not enough coverage for riders who travel long distances with their bike

Dairyland has the cheapest rates in Florida.

Pros:

-

Cheapest quotes in Florida

-

Offers good coverage for daily riders

-

Discounts available

Cons:

-

Bad customer service

-

Not enough coverage for riders who travel long distances with their bike

Dairyland is the cheapest option for Florida riders, at $24 per month for full coverage insurance. That's less than half the state average.

Dairyland has helpful add-ons if a motorcycle is your main vehicle.

You can add roadside assistance and rental car reimbursement, which can help you get around if something happens to your bike.

However, Dairyland doesn't offer trip interruption coverage or protection for trailered bikes. People who take regular road trips should consider a company with these options, like Progressive.

But Dairyland customers typically aren’t happy with the company's customer service. It gets two to four times more than the complaints of an average company its size.

Best for discounts: Harley-Davidson

-

Editor's rating

-

Cost: $25/month

Overview

Pros/cons

Harley-Davidson offers lots of ways to save on your insurance bill and customize your coverage.

Overview

Harley-Davidson offers lots of ways to save on your insurance bill and customize your coverage.

Pros/cons

Pros:

-

Affordable rates

-

Lots of discounts

-

Many coverage add-ons

Cons:

-

Doesn't offer car or home insurance

-

Lots of customer complaints

Harley-Davidson offers lots of ways to save on your insurance bill and customize your coverage.

Pros:

-

Affordable rates

-

Lots of discounts

-

Many coverage add-ons

Cons:

-

Can’t bundle with car or home insurance

-

Lots of customer complaints

Harley-Davidson's motorcycle insurance rates are cheap. At an average price of $25 per month for full coverage, it’s only $1 per month more than the cheapest option in Florida, Dairyland.

Harley-Davidson also has a lot of ways to get discounts and upgrade your protection.

For example, you can add trip interruption insurance if you take regular road trips, or coverage for custom equipment. Available discounts include:

- Anti-theft

- Bundled protection

- Claim-free renewal

- H-D Riding Academy

- Harley Owners Group

- Homeownership discount

- Experienced rider

- Loyalty

- Military and law enforcement

- Multicycle

- Motorcycle endorsement

- New bike

- Prompt payer

**The main downside of Harley-Davidson Insurance is its high number of customer complaints. ** Most complaints are about low settlement offers. That means it may cost you more to repair or replace your motorcycle after an accident.

Best for military families: USAA

-

Editor's rating

-

Cost: $36/month

Overview

Pros/cons

USAA has the best motorcycle insurance for Floridians with military ties.

Overview

USAA has the best motorcycle insurance for Floridians with military ties.

Pros/cons

Pros:

-

Basic policy includes extra coverage

-

Lots of coverage add-ons and discounts

-

Few customer complaints

Cons:

-

Only available to military members, veterans and their families

-

Not the cheapest option

USAA has the best motorcycle insurance for Floridians with military ties.

Pros:

-

Great coverage with a basic policy

-

Lots of coverage add-ons and discounts

-

Few customer complaints

Cons:

-

Only available to military members, veterans and their families

-

Not the cheapest option

USAA doesn't sell its own motorcycle insurance.

Instead, USAA members get a 5% discount on coverage from Progressive.

You must be a USAA member to get this discount, so it's only available to military members, veterans and some family members.

A full coverage policy from Progressive costs $38 per month. That means USAA members can expect to pay around $36 per month. Although that's not the cheapest rate in Florida, it's still 24% less than the state average.

It may cost more, but Progressive’s basic motorcycle insurance includes more protection than most companies include.

For example, a full coverage policy from Progressive includes full replacement cost coverage for parts. This means your bike will be fixed with brand-new parts after a crash. Most companies charge extra for this coverage.

Florida motorcycle insurance rates by city

Deltona has the cheapest motorcycle rates among Florida's larger cities, at around $36 per month.

People living in Miami and Miami Gardens pay the most expensive rates, averaging $70 per month.

Average full coverage motorcycle quotes by Florida city

City | Monthly cost | % from average |

|---|---|---|

| Boca Raton | $43 | -13% |

| Boynton Beach | $46 | -7% |

| Cape Coral | $40 | -20% |

| Clearwater | $46 | -8% |

| Coral Springs | $55 | 11% |

Full coverage motorcycle insurance rates can differ by $34 per month, or about $400 a year, depending on where you live in Florida. That's because many factors affect motorcycle insurance rates, including accident statistics, crime rates, traffic and weather.

Florida motorcycle insurance laws

Most riders in Florida aren't required to have motorcycle insurance. But you'll have to pay for any property damage or injuries if you cause an accident.

Many Florida riders choose to buy motorcycle insurance so they're not stuck with a big bill after a crash.

If you cause a motorcycle accident in Florida and don't have insurance, you'll need to show proof of financial responsibility to continue riding legally.

You can do this by:

- Buying an insurance policy with at least 10/20/10 of liability coverage. You must keep the policy for at least three years.

- Getting a Financial Responsibility Certificate from the Florida Bureau of Motorist Compliance. To do this, you must get a $30,000 surety bond with a state-licensed company or deposit cash or securities with the Florida Highway Safety and Motor Vehicles Department.

- Providing a self-insurance certificate, which shows you have enough money to pay for damage you cause in a crash. To do this, you must have a notarized statement showing that your net worth is more than $40,000.

Do you need a motorcycle license in Florida?

Riders in Florida need a motorcycle license or endorsement for bikes with an engine larger than 50cc. Riding without a license can result in fines and jail time.

How to get a motorcycle license in Florida

Once you complete the requirements, you can schedule an appointment at any Florida Highway Safety and Motor Vehicles (FLHSMV) office to get a Florida motorcycle license. You'll need to pay at least one of these fees with your application:

- Florida Class E licensing fee: $48

- Florida motorcycle registration fee: $10

- Florida identification card fee: $25

- Florida motor vehicle electronic title fee: Up to $85.25

Penalties for riding without a motorcycle endorsement in Florida

Riding a motorcycle without an endorsement is a second-degree misdemeanor in Florida.

It can lead to serious consequences, including:

- Immediate impounding of your motorcycle

- A fine of $500

- Up to 60 days in jail

- Six months of probation

Getting a motorcycle endorsement in Florida can take some time. But riding without a proper license is never worth the risk to your safety, bike or freedom.

Motorcycle helmet law in Florida

Florida motorcycle laws require riders and passengers to wear helmets that meet the U.S. Department of Transportation Federal Motor Vehicle Safety Standards. In addition, riders must wear eye protection.

There are exceptions to Florida's helmet rule. However, you should wear a helmet at all times for your safety.

Exceptions to Florida's helmet requirement

You aren't required to wear a helmet if you're:

- Riding inside an enclosed cab

- Over 21 years old and have motorcycle insurance with at least $10,000 in medical payments coverage

-

Over 16 years old and ride a motorcycle that can't go faster than 30 mph and either:

- Is not rated over two braking horsepower or

- Has a motor that's 50cc or less

If you're under 16, you must always wear a helmet when on a motorcycle in Florida, no exceptions.

Other Florida motorcycle laws

Frequently asked questions

Who has the best motorcycle insurance in FL?

Dairyland has the best motorcycle insurance for most riders in Florida. Dairyland has the cheapest full coverage motorcycle insurance in the state, at $24 per month. It also has reliable customer service and good coverage add-ons for daily riders.

How much is motorcycle insurance in Florida?

Floridians pay around $50 per month for full coverage motorcycle insurance. The cheapest company, Dairyland, offers coverage for $24 per month, less than half the state average.

Do you need motorcycle insurance in Florida?

You may not need to buy motorcycle insurance in Florida. Liability insurance isrequired if you've caused an accident in the last three years. Medical insurance is required if you’re over 21 and ride without a helmet. Full coverage insurance is almost always required by lenders if you’re financing or leasing a bike. However, you should buy motorcycle insurance so you don't have to pay a lot of money if you're in a serious accident.

How much is motorcycle insurance in Miami, FL?

Riders in Miami pay around $70 per month for full coverage motorcycle insurance. That's 40% more expensive than the Florida average. In comparison, motorcycle insurance in Orlando costs $51 per month.

Methodology

To find the cheapest motorcycle insurance company in Florida, ValuePenguin editors gathered more than 200 quotes across 36 of the largest cities in the state. Rates are for a 45-year-old single man who owns a 2018 Honda CMX500 Rebel.

We collected quotes for a full coverage policy with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $25,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

The ValuePenguin team has a combined total of more than 50 years' experience in the property and casualty insurance industry.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.