Acceptance High-Risk Auto Insurance Review With Rates

Expensive rates and a concerning financial future make Acceptance a poor choice for drivers who can find coverage elsewhere.

Find Cheap Auto Insurance Quotes in Your Area

Acceptance Insurance specializes in auto insurance for people who need high-risk, SR-22 or FR-44 insurance. But its rates are often much more expensive than its competitors', even for higher-risk drivers.

Drivers who find competitive rates from Acceptance should still consider other companies. Acceptance isn't the most financially stable insurance company, according to AM Best. It may struggle to pay claims if you're in an accident.

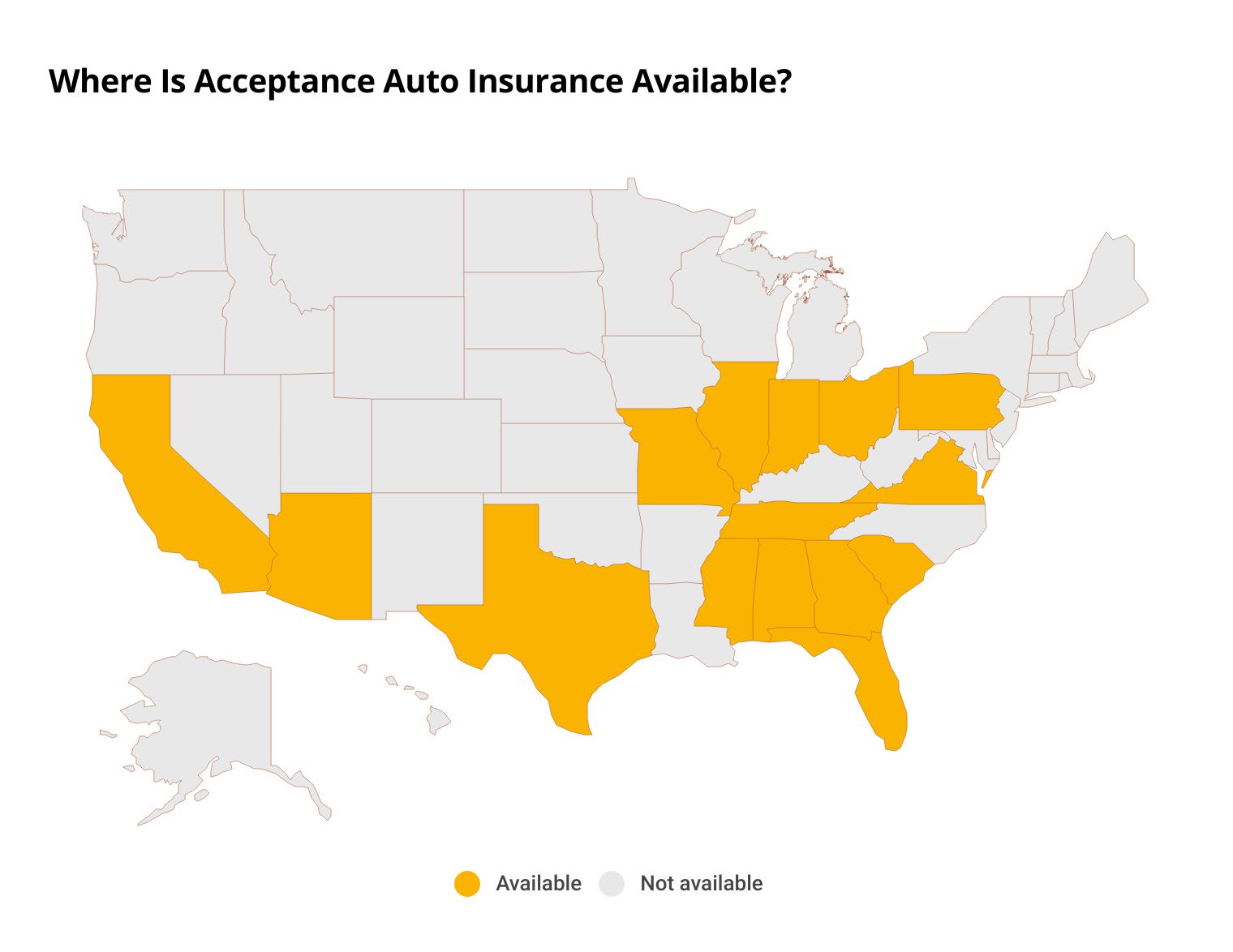

In addition, Acceptance is only available in 15 states, so most drivers can't get a policy.

Editor's rating breakdown | |

|---|---|

| Price | |

| Coverage | |

| Customer service | |

| Unique value | |

Pros and cons

Pros

Offer insurance to high-risk drivers who struggle to get insurance elsewhere

Cons

Expensive car insurance

Few coverage options

Poor financial strength score

Acceptance Insurance quotes

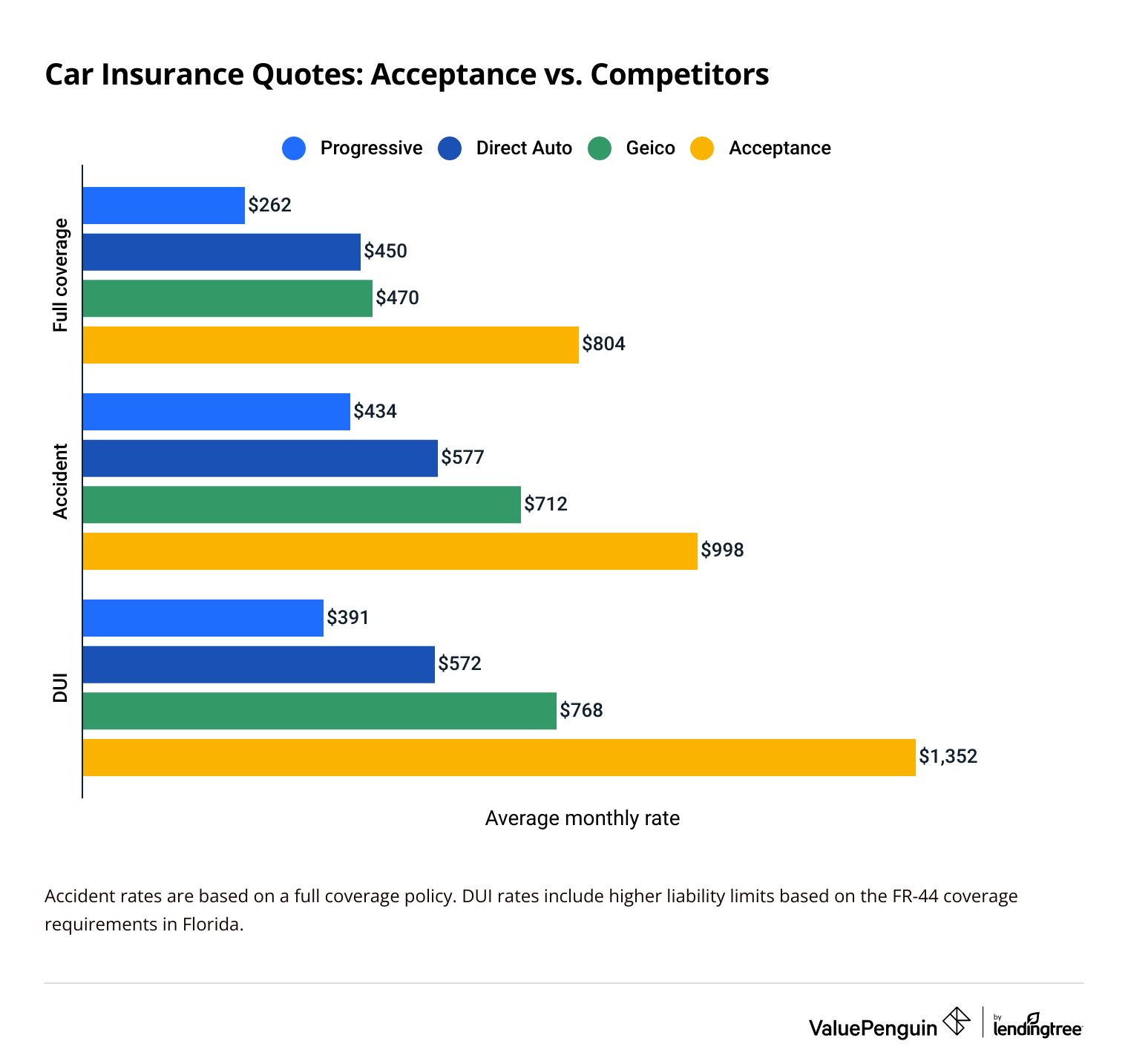

Acceptance auto insurance tends to be much more expensive than other companies, even for high-risk drivers.

For example, Acceptance charges around $1,352 per month for a full coverage policy with a DUI and FR-44 filing. That's 75% more expensive than average. It also costs more than three times as much as the cheapest company, Progressive.

Find Cheap Auto Insurance Quotes in Your Area

Drivers with multiple tickets or accidents may not be able to get coverage from popular companies like Progressive or Geico.

But Direct Auto, another company geared toward high-risk drivers, is also much cheaper than Acceptance. A full coverage policy from Direct Auto costs about half as much as coverage from Acceptance, on average.

Acceptance car insurance rates vs. competitors

Full coverage

Full coverage after an accident

Full coverage after a DUI

Company | Monthly rate | ||

|---|---|---|---|

| Progressive | $262 | ||

| Direct Auto | $450 | ||

| Geico | $470 | ||

| Acceptance | $804 | ||

In addition, Acceptance doesn't give some high-risk drivers the option to make monthly payments.

A driver with a DUI may have to pay for six months of coverage up front. That could cost more than $8,000.

Acceptance auto insurance discounts

Acceptance offers very few discounts compared to other car insurance companies. You can save money with Acceptance if you:

- Insure multiple cars with Acceptance

- Have been insured within the last 30 days

- Complete an approved driving safety course

Acceptance auto insurance coverage

Acceptance offers a few optional coverages that you can buy to add extra protection to your policy. But it's missing popular options like gap insurance, new car replacement and accident forgiveness. So, there are better choices for drivers who want extra protection.

- Roadside assistance helps schedule and pay for towing, a flat tire change, lockout services or fuel delivery if your car breaks down on the side of the road.

- Rental car coverage pays for a rental vehicle while your car is in the shop after an accident.

Acceptance also offers a couple of options that are rare among car insurance companies.

Hospital indemnity

If you get hurt in a car accident and have to visit the hospital, Acceptance hospital indemnity will pay you up to $125 per day. This money doesn't have to go toward your medical bills. That means it can help replace your income if you're hurt and can't work.

Hospital indemnity is sometimes available as an add-on to a health insurance policy. But it's not typically offered by car insurance companies.

TeleMed

With TeleMed coverage, you can talk to a doctor from home using a telehealth system. Most health insurance plans cover virtual telehealth visits.

You should check your health plan to see if you have telehealth coverage before adding TeleMed. That way, you can ensure you're not paying for coverage you already have.

Standard coverages available

Acceptance also offers more commonly available auto insurance coverages. Some of these are required to meet state insurance requirements. But exactly which ones you need depends on the state you live in.

- Liability coverage pays for damage to the other driver's car and their medical expenses when you cause an accident.

- Collision coverage pays for damage to your car if you hit another vehicle or structure.

- Comprehensive coverage pays for repairs to your car after damage due to something other than a collision, like hail or vandalism.

- Uninsured motorist bodily injury and property damage coverage pays for damage to your car and your medical bills if another driver crashes into you and doesn't have enough insurance.

- Medical payments covers your medical expenses in an accident regardless of who is at fault.

- Personal injury protection (PIP) covers your medical bills and lost wages if you're hurt in a crash, regardless of fault.

Acceptance customer service

Acceptance customers should be concerned about the company's ability to pay out many claims at once.

Acceptance Insurance has a financial strength rating of C++, or "marginal," from AM Best. This should be a serious red flag for potential customers. It means you may not be able to count on Acceptance to pay your repair or medical bills after an accident.

We recommend getting insurance from a company with an AM Best rating of A or better, like State Farm, Geico or Progressive.

Acceptance Insurance also gets two and a half times more complaints than other insurance companies of a similar size, according to the National Association of Insurance Commissioners (NAIC). While that could be better, it's typical for insurance companies that specialize in covering high-risk drivers to have poor reviews.

Acceptance customer service complaints

Company | Complaints |

|---|---|

| Direct Auto | 2.02 times more than average |

| Acceptance | 2.63 times more than average |

| SafeAuto | 6.65 times more than average |

| UAIC | 24.16 times more than average |

Most complaints are about the Acceptance Insurance claims process. Customers are typically unhappy with how long it takes to get paid after an accident. Some people complain about Acceptance denying claims altogether.

Acceptance Insurance locations

Acceptance sells auto insurance in 15 states.

Acceptance has physical locations and agents in every state where it's available except Missouri and Virginia. You can find a location near you at the Acceptance website.

Contact Acceptance Insurance

Acceptance offers customers a few different ways to interact with the company. Current or potential customers can get quotes, make claims or pay bills over the phone, on the Acceptance website or at an in-person location.

Acceptance Insurance phone numbers

- Acceptance sales department: 866-637-0197

- Acceptance customer service number: 800-321-0899

- Acceptance Insurance claims number: 800-779-2103

- Acceptance Insurance roadside assistance: 866-936-0485

Unfortunately, Acceptance does not offer 24-hour customer service. Its customer service department is available 6 a.m. to 8 p.m. Central Monday through Friday, and 8 a.m. to 5 p.m. Central on Saturdays.

The Acceptance claims department is only available 7 a.m. to 8 p.m. Central Monday through Friday, and 8 a.m. to 5 p.m. Central on weekends.

Frequently asked questions

Is Acceptance Insurance good?

Acceptance is not a good car insurance option for most people. Its rates are expensive, and its financial situation is concerning. However, if you can't get coverage elsewhere, Acceptance may be more likely to offer you an insurance policy than other companies.

Is Acceptance Insurance legitimate?

Yes, Acceptance Insurance is a legitimate company. It's owned by First Acceptance Corp., a Tennessee-based company founded in 1996. However, it has a C++ financial strength rating from AM Best, which means it's not on strong financial footing.

Does Acceptance Insurance have a grace period?

Acceptance doesn't share whether it has a grace period. You may have a brief grace period if you're just behind on your payments, but don't count on it. In addition, if you let your policy lapse, you may have to pay the full balance up front.

Does Acceptance Insurance have an app for the iPhone?

No, Acceptance does not have an app for iPhone or Android users. However, you can manage your policy on its website.

Methodology

To compare Acceptance car insurance quotes, ValuePenguin gathered rates from Quotes are for a 30-year-old man who owns a Honda Civic EX.

Full coverage rates include higher liability limits than the Florida state requirement and comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Comprehensive and collision deductibles: $500

FR-44 rates for a driver with a DUI have higher liability limits due to Florida state requirements.

- Bodily injury liability: $100,000 per person and $300,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist coverage: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Comprehensive and collision deductibles: $500

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.