SafeAuto Insurance Review

SafeAuto is now a part of Direct Auto, an Allstate company. SafeAuto no longer sells policies to new customers. Existing customers have been transfered to other companies.

Find Cheap Auto Insurance Quotes in Your Area

SafeAuto became a part of Direct Auto in 2023, after the Allstate Corp. acquired the company in 2021.

SafeAuto no longer offers insurance to new customers. If you go to its website, you'll be sent to Direct Auto to get a quote and buy a policy.

SafeAuto specializes in working with drivers who have incidents on their records and might struggle to find coverage elsewhere, including those who have multiple accidents or DUIs.

However, it has a poor customer service reputation, limited add-on coverages and is only available in 20 states. Given these drawbacks, we recommend going with another, more reliable insurer if you can find better rates.

Pros and cons

Pros

Competitive rates

Offers coverage to high-risk drivers

Cons

Few coverage upgrades

Poor customer service

Can't bundle with home or renters insurance

Our thoughts: SafeAuto Insurance

SafeAuto Insurance has average rates compared to major national insurers like Allstate and Geico. However, their fair prices don't make up for their poor customer service and limited coverage options.

If you have incidents on your driving record that make it difficult to get coverage elsewhere, SafeAuto might be an affordable second choice. If you have a clean record and can readily get coverage from another, more reliable company, we recommend doing so.

Shoppers should also note that SafeAuto is only available in 20 states. If you live outside SafeAuto's coverage area, you'll need to identify another insurer. States where SafeAuto sells car insurance include:

- Alabama

- Arizona

- California

- Colorado

- Georgia

- Illinois

- Indiana

- Kansas

- Kentucky

- Louisiana

- Maryland

- Mississippi

- Missouri

- Ohio

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Virginia

Is SafeAuto car insurance cheap?

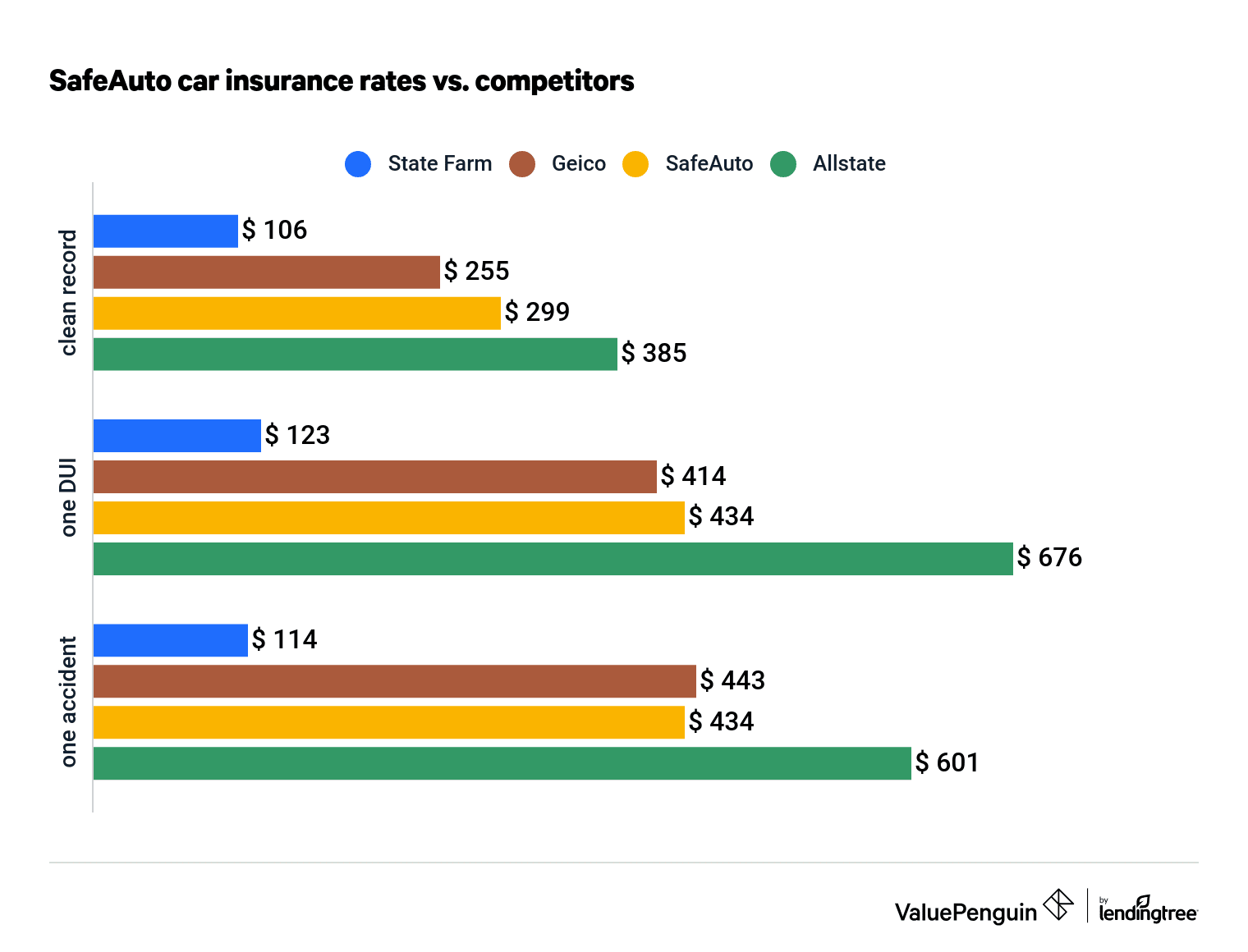

Though not the cheapest insurance company in our study, SafeAuto offered higher than average rates when compared to other companies— particularly for drivers with clean records.

Find Cheap Auto Insurance Quotes in Your Area

SafeAuto auto insurance rates vs. competitors

Company | Clean record | One DUI | One accident |

|---|---|---|---|

| State Farm | $106 | $123 | $114 |

| Geico | $255 | $414 | $443 |

| SafeAuto | $299 | $434 | $434 |

| Allstate | $385 | $676 | $601 |

While these rates aren't nearly as cheap as what State Farm offers, they're cheaper than the rates charged by Allstate, and around the same as Geico’s rates. Given SafeAuto's poor customer service reputation, we can’t recommend it, but if you have enough incidents on your driving history that you can't find a major insurer willing to offer you coverage, it could serve as a backup.

What discounts does SafeAuto offer?

SafeAuto discounts vary depending on which state you live in. We reviewed an Illinois insurer filing and found that the company offered the following discounts:

Discount | Description |

|---|---|

| Driver improvement course | available only to drivers age 55 or older. |

| Policy business transfer | for drivers who switch from another insurer to SafeAuto. |

| Homeowner | for policyholders who also own a home. |

| Multi-vehicle | for policyholders who insure more than one car. |

| Non-owner | for those purchasing insurance without owning a car. |

This is a relatively short list of discounts, and other insurers offer far more opportunities for drivers to lower their rates. However, because SafeAuto already offers competitive quotes, it may be possible for drivers to score a solid deal on car insurance if they're eligible for one or more of these discounts.

What coverages does SafeAuto offer?

SafeAuto specializes in high-risk drivers who require SR-22 coverage. If your state requires your insurer to file an SR-22 on your behalf, SafeAuto can help you.

However, if you're looking for add-on coverages like accident forgiveness or gap insurance, SafeAuto is not the best fit. In addition to the minimum liability insurance required by each state, full coverage — which includes collision and comprehensive insurance — is also available from SafeAuto.

Apart from these standard coverages, however, SafeAuto's list of add-ons is limited. We reviewed an Illinois insurer filing and found that SafeAuto customers can add accidental death benefit, roadside assistance, towing and labor, and rental reimbursement coverage to their insurance policies. Other insurers offer a far more extensive array of coverages to choose from. Available auto insurance coverages from SafeAuto include:

- Bodily injury liability coverage

- Property damage

- Medical payments

- Personal injury protection

- Uninsured/underinsured bodily injury coverage

- Uninsured/underinsured property damage coverage

- Accidental death benefit

- Rental reimbursement

- Roadside assistance

- Towing and labor

Customers who want more protection can purchase a ForeverCar service plan. ForeverCar is one of SafeAuto's insurance partners, and it administers service plans that can fill the coverages that SafeAuto lacks. ForeverCar offers discounts of up to 44% on its Vehicle Service Plans for SafeAuto policyholders. Coverage includes the following benefits:

- Emergency roadside assistance

- Mechanical breakdown coverage that begins 30 days after you sign up

- Rental car reimbursement

- Emergency travel expense reimbursement

Unlike many other insurers, SafeAuto does not sell homeowners, renters, health or motorcycle insurance. Instead, the company partners with third-party providers that underwrite and/or administer your policy. If you want to insure your home, motorcycle, business or rental, you'll work with the following SafeAuto partners:

Insurance type | Partner |

|---|---|

| Motorcycle insurance | Dairyland |

| Home insurance | Hippo |

| Health insurance | Augeo |

| Business insurance | CoverWallet |

| Renters insurance | MSI |

This means that while you can bundle your home or motorcycle insurance with Safe Auto to get a discount on your rates, it could be very difficult to manage all your policies. This is mainly because different companies will hold each one, so you may need to reach out to each of them separately to answer any questions you have.

Is SafeAuto a good insurance company?

Customer satisfaction with SafeAuto's insurance service is low. The company receives more than four times as many complaints as would be expected for an insurer of its size, according to its Complaint Index from the National Association of Insurance Commissioners (NAIC). An insurer with an average number of complaints receives a score of 1.0; SafeAuto scored a 4.29. Complaints centered on claims handling, with customers citing delays and denials of claims as common problems.

SafeAuto also offers a mediocre mobile app experience. Customer reviews of the SafeAuto mobile insurance app were largely negative. Android users gave it a 3.5 out of five, and Apple users gave it a 1.7 out of five. Users reported difficulty with basic functionalities like logging into the app and bill pay.

Unless major insurers deny you coverage, we recommend going with another company besides SafeAuto. Rates might be affordable, but you get what you pay for: a poor mobile and customer service experience.

Contact SafeAuto

SafeAuto gives customers several ways to reach out for insurance-related needs. We outline how to contact the company in the below:

To file a claim with SafeAuto insurance, policyholders have several options:

- Log in to your online SafeAuto Insurance account, where you can also view and manage your policy.

- Use the "report a claim" page on the SafeAuto site, which does not require login.

- Call the SafeAuto insurance claims department via its dedicated phone number, which is 1-(800) SAFE AUTO, or (614)-944-7927. The SafeAuto insurance app can also connect you with the claims department. The SafeAuto claims team is available from the hours of 8 a.m. to 8 p.m. during the week and 8 a.m. to 5 p.m. on weekends.

- Mail any relevant documents to the SafeAuto claims address, which is PO Box 182384, Columbus, Ohio, 43218-2384.

To contact customer service, policyholders have several options:

- Call the SafeAuto Insurance customer service telephone number at 1-(800)-723-3288 to speak to the customer service team.

- Email customer service at [email protected].

- Mail any relevant documents to PO Box 182109, Columbus, Ohio, 43218-2109.

- Use the SafeAuto app to contact a representative.

To pay a bill, SafeAuto policyholders can:

- Call the customer service phone number, which also works for payments, at 1-(800)-723-3288.

- Send a check via mail to 4 Easton Oval, Columbus, Ohio, 43219.

- Sign in to their SafeAuto online account.

- Use the SafeAuto mobile app.

- Use the "quick pay" page, which does not require setting up a SafeAuto online account.

To get a free SafeAuto quote, shoppers can:

- Use the online quote form.

- Use the SafeAuto app, even if you're not currently a SafeAuto customer.

- Call the customer service number, which is 1-(800)-723-3288, to speak to a representative.

Frequently asked questions

What happened to SafeAuto?

Allstate bought SafeAuto in 2021. Direct Auto, Allstate's other "high-risk" brand, took over SafeAuto in 2023.

How do you cancel a SafeAuto policy?

To cancel a SafeAuto policy, you can call or write SafeAuto with the date you wish your coverage to end. You will be charged a $25 cancellation fee, though SafeAuto may refund part of your policy premium on a prorated basis.

Where is SafeAuto headquarters?

SafeAuto headquarters are located in Columbus, Ohio, at the following address:

4 Easton Oval, Columbus, OH 43219

Does SafeAuto cover rental cars?

SafeAuto does covers rental cars. Policyholders who select rental reimbursement coverage can either rent a car while their own car receives covered repairs or use their daily limit for ridesharing services like Uber or Lyft.

Does SafeAuto have roadside assistance?

SafeAuto does offers roadside assistance. Roadside assistance from SafeAuto includes towing, winching, flat tire change, dead battery jump start, lock-out services, delivery of gas and other fluids, and labor to restart your car

Methodology

Our sample drivers for this study were two 30-year-old men and two 18-year-old men. All four live in Illinois and drive a 2015 Honda Civic EX. We gave them the following limits for a full coverage policy:

Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Rate data was provided by Quadrant Information Services. Rates were publicly sourced from insurer filings. They should be used from comparative purposes only, since your own rates will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.