SR-22 Insurance in Tennessee

Find Cheap SR-22 Auto Insurance Quotes in Tennessee

In Tennessee, drivers who have been convicted of a serious violation, such as a DUI or driving without insurance, may be required to get SR-22 insurance. You request SR-22 insurance from your insurer or start a policy with a new insurer. Your insurer will submit the SR-22 certificate to the Tennessee Department of Safety (DOS). This proves you have auto insurance that can cover another driver's injuries or damages if you're at fault in an accident.

An SR-22 certificate isn't expensive. But insurance companies tend to increase policy rates for a driver who requires an SR-22, as, statistically, they are riskier to insure.

Which companies offer the cheapest SR-22 rates in Tennessee?

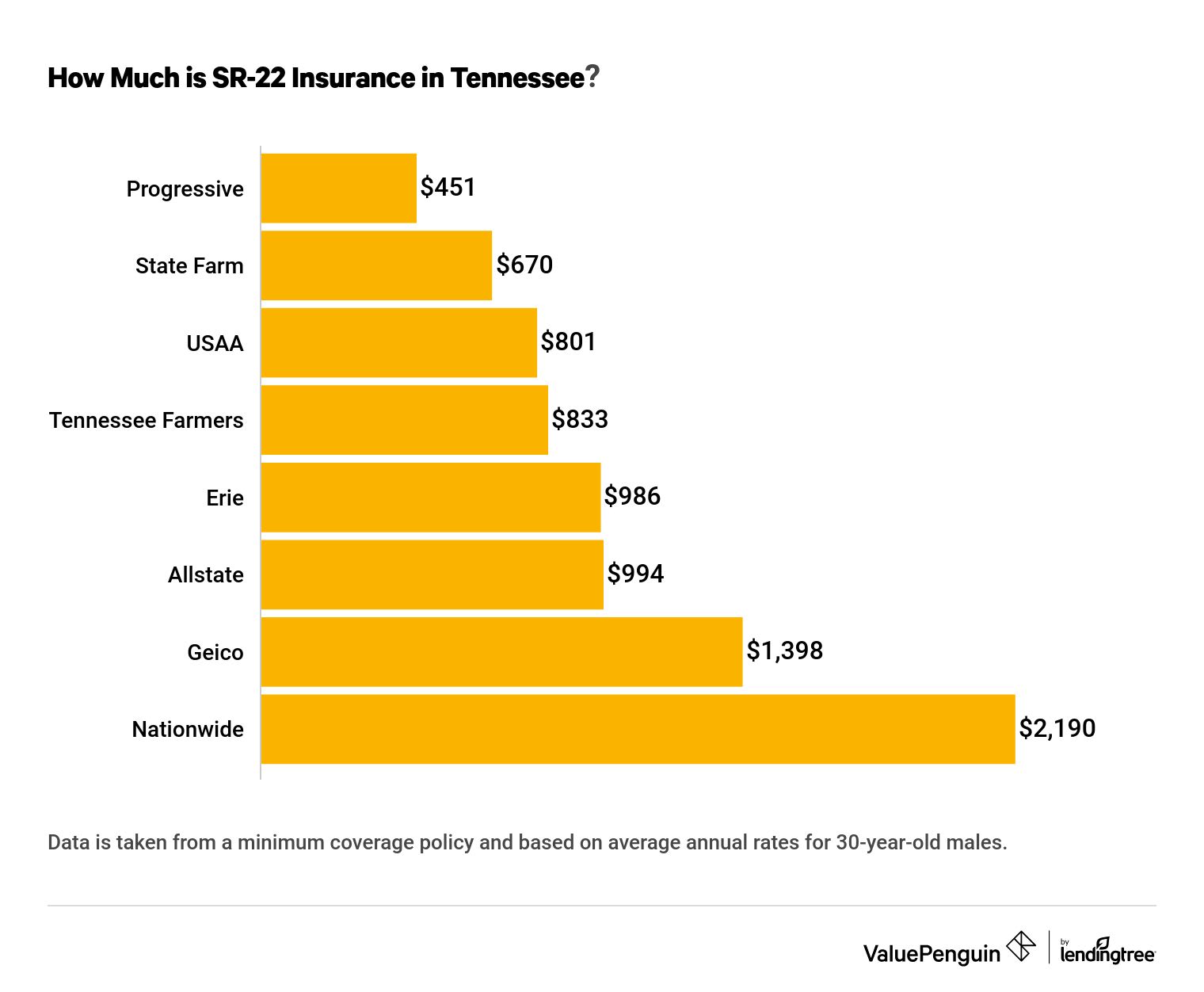

SR-22 insurance rates in Tennessee vary by insurer. The cheapest option is Progressive, which charges an average of $451 per year for a driver with an SR-22 certificate. The most expensive option is Nationwide, which costs an average of $2,190 per year.

Find Cheap SR-22 Auto Insurance Quotes in Tennessee

SR-22 annual car insurance rate increase in Tennessee

Insurer | Average rate | SR-22 rate with DUI | % change | |

|---|---|---|---|---|

| Progressive | $376 | $451 | 19.95% | |

| State Farm | $402 | $670 | 66.67% | |

| USAA | $372 | $801 | 115.32% | |

| Tennessee Farmers | $479 | $833 | 73.90% | |

| Allstate | $687 | $994 | 44.69% | |

| Geico | $492 | $1,398 | 184.15% | |

| Nationwide | $1,116 | $2,190 | 96.24% |

It's important to compare SR-22 rates from multiple insurers, because every company evaluates risk factors and drivers differently. Getting several quotes will help you find the cheapest and most comprehensive option.

It’s also advisable that you ask your current insurer if they offer discounts. You can often find ways to save on Tennessee car insurance, depending on the vehicle you drive or steps you've taken to become a safer driver.

What is an SR-22 in Tennessee?

An SR-22 is a document issued directly from your insurance company to the state of Tennessee. It certifies you have the state-required liability car insurance from that company, and the company is financially responsible if you're at fault in an accident, up to your policy coverage limits. As such, an SR-22 is sometimes referred to as a certificate of future financial responsibility.

These documents are required for Tennessee drivers who have been deemed high-risk, typically after their licenses have been suspended.

Common reasons for a driver's license to be suspended in Tennessee are: a DUI, driving without insurance or being convicted of multiple smaller infractions, such as speeding tickets, over a short period of time.

To get your license reinstated, you'll need to show evidence that you have SR-22 insurance that meets the state's minimum requirements.

Non-owner SR-22 insurance in Tennessee

You may need to file for an SR-22 to reinstate your driving privileges in Tennessee even if you don't own a vehicle or have one registered to you. This could happen if you get a DUI while driving a car that belonged to someone else, or if you sold your car while your license was suspended.

To legally drive a car while you're required to have an SR-22, you can buy a policy called non-owner SR-22 insurance. Quotes for non-owner SR-22 insurance coverage are often cheaper than buying a normal SR-22 policy, since it only protects you — the driver — and not the car you’re driving.

How do I get SR-22 insurance in Tennessee?

SR-22 forms are issued directly from your insurance company to the Tennessee DOS. You won't need to fill out the form yourself; simply notify your insurance company that you need one.

Most major car insurance companies in Tennessee offer SR-22 insurance policies. However, your insurance company may cancel your policy once your license is suspended, and it may not offer to reinstate your coverage once you're considered a high-risk driver.

Even if your current insurer didn't cancel your policy when your license was suspended, you should be thorough and shop around to find the cheapest SR-22 insurance. You may find the best quote at an insurer that specializes in SR-22 policies, like Acceptance Auto Insurance, as opposed to a mainstream insurance company that also offers SR-22 coverage, like Geico or Progressive.

You must wait until the Tennessee DOS has your SR-22 before you can apply to have your license reinstated and you can drive again. You can check the status of your SR-22, as well as your license reinstatement, at the Tennessee DOS website.

Tennessee minimum coverage [#minimum}

If you need an SR-22, you’re held to the same insurance minimums as all other Tennessee drivers:

- $25,000 of bodily injury (BI) liability coverage per person

- $50,000 of BI liability coverage per accident

- $25,000 in personal property liability coverage

However, it’s best to carry more than the minimum amount of coverage, especially if you’re at a higher risk of an accident.

When can I remove my SR-22 in Tennessee?

SR-22 forms are required in Tennessee for up to five years after your license is suspended. However, if you have an SR-22 for a continuous three-year period, you can ask to have the SR-22 requirement removed. At this point, your insurance rates may decrease, although likely not to the same amount you were paying before your license was suspended.

Don't let your SR-22 insurance lapse. If your policy is canceled or lapses, your insurance company will notify the Tennessee DOS, your license will be suspended again and you’ll have to restart the SR-22 process.

Alternatively, you can choose to simply wait out Tennessee's five-year SR-22 requirement period by not reinstating your license, although you would not be able to legally drive a car during that time.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.