Jump to: Get car insurance | Register a car | Buy a car | Rent a car

How to Get Car Insurance With a Suspended License

If your driver's license is suspended, it may be difficult to get auto insurance. Insurers generally won't offer coverage if you are not legally able to drive or if you drive illegally while your license is suspended. If you do get car insurance eventually, your rates may also increase.

Find Cheap Auto Insurance Quotes in Your Area

However, drivers with suspended licenses can still find car insurance — depending on the terms of their license suspension — if they first get a restricted license or SR-22 insurance.

How to get car insurance with a suspended license

Often, when you have a suspended license, the best course of action is to get a restricted license from your state's department of motor vehicles, which may conditionally reinstate your driving privileges. In some cases, getting SR-22 insurance may be the only way to get car insurance coverage and regain driving privileges after your license is suspended.

Apply for a restricted or conditional license

Certain insurers may offer you insurance coverage if you can obtain a restricted license. To find a car insurance policy with a restricted license, you will likely be limited to non-standard insurance, which is an insurance tier that covers high-risk drivers. Non-standard insurers include:

A restricted license, also known as a hardship license, conditionally reinstates your driving privileges if your license was previously suspended for a traffic ticket. Eligibility and the specific terms for restricted licenses vary by state. However, you may be ineligible to apply for a restricted license if you have had a previous suspension. A restricted license may only allow you to drive during the day or only for designated purposes, such as getting to work or school.

In some states, you can apply for a conditional license instead of a restricted license. A conditional license reinstates your ability to drive — usually under the condition that you complete a DMV-sponsored driving program.

In New York, for example, drivers whose licenses have been suspended for a drinking and driving ticket could get a conditional license if they attend a DMV-approved Impaired Driver Program.

Get SR-22 insurance

Suppose your license was suspended because of a serious traffic ticket, such as driving while intoxicated or without insurance. In that case, your state may require you to get an SR-22 insurance policy before your license can be reinstated. SR-22 insurance is a type of policy in which your insurer files a form with the DMV that attests you have the required auto insurance coverage in your state.

Find Cheap Auto Insurance Quotes for SR-22

Though most insurers can offer you SR-22 coverage, some standard insurers may not give you a quote because they consider you a high-risk driver. Instead, non-standard car insurance companies — such as The General, Acceptance and Titan — may be your best options to insure your vehicle.

How to get cheap car insurance with a suspended license

Though it might be tempting to stick with your current insurer, the best way to get cheap car insurance rates is to compare quotes from multiple companies. This is because insurers weigh traffic tickets differently when setting rates, so you will have to shop around to find the cheapest car insurance company if your license is suspended.

Why you should have car insurance while your license is suspended

If you are in the middle of your insurance policy's term and your license is suspended, you should not cancel your coverage. A gap in coverage, which happens when you cancel a policy with no other coverage in place, can cause rates to skyrocket whenever you next shop for auto insurance.

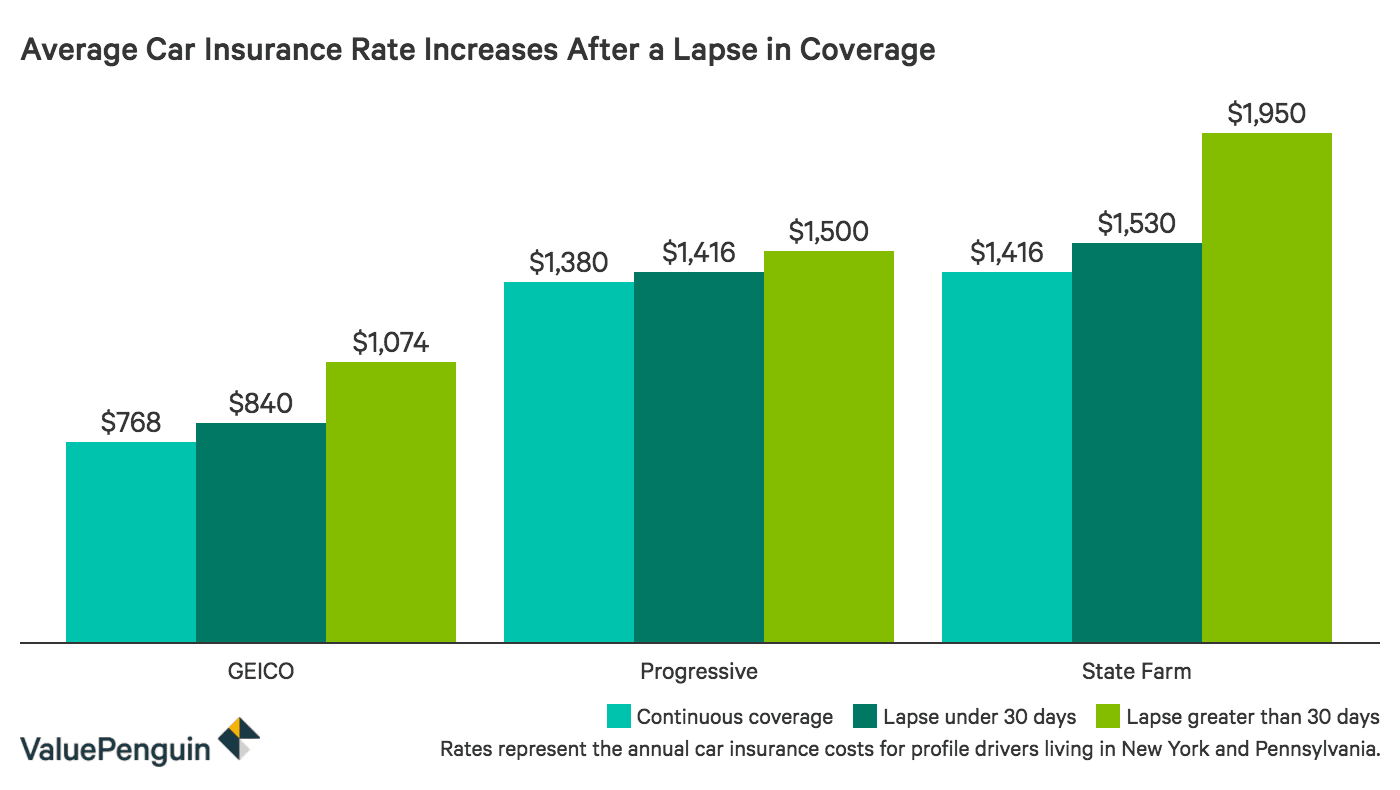

You may be tempted to cancel your policy to save on insurance costs. However, we have found that rates could increase by 29% for drivers with a lapse in coverage. So what you could potentially save on insurance costs will likely not be worth the hike in rates when you buy your next car insurance policy.

Can you rent a car with a suspended license?

Car rental companies will not allow you to rent a car with a suspended license. Many major rental car companies — including Avis, Budget and Dollar — reserve the right to perform an electronic DMV check of your driving record to confirm your license isn't suspended or revoked. Some rental car agencies may reject drivers if they have recent traffic tickets such as DUIs.

Can you buy a car with a suspended license?

There is no specific requirement that you have a valid license when you buy a vehicle, but you'll have to provide proof of insurance when registering your car. So while it's technically possible to buy a car with a suspended license and get a title in your name, you'll have to get insurance before you can register the vehicle.

Financing the purchase of your new car may be especially difficult with suspended driving privileges. The company providing you an auto loan will likely reject you without a valid license.

How to register a car with a suspended license

In most states, a valid license is not required to register a vehicle. However, you will likely be required to provide proof of insurance as well as the proper identifying documents.

To first get insurance, you will have to utilize one of the methods detailed above, such as applying for a hardship license or getting SR-22 insurance. After getting coverage, you can apply for registration through your state's motor vehicle office.

Methodology

To find the typical cost of car insurance after an insurance lapse (which drivers may be tempted to allow after their license is suspended), we collected sample rates for drivers in New York and Pennsylvania from three major insurers at three intervals: no lapse in coverage, a short lapse (less than 30 days) and a long lapse (more than 30 days).

The conditions under which your license is suspended will further impact your rates. If you get a DUI, for example, that would also impact your rates once your license is reinstated.

About the Author

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.