What Is Nonstandard Auto Insurance?

Nonstandard auto insurance is car insurance for risky drivers or drivers who need special coverage, such as a nonowners policy.

Find Cheap Auto Insurance Quotes in Your Area

In most cases, it's the same as standard coverage, but the rates are higher. You can get nonstandard car insurance from some major insurance companies or companies that specialize in nonstandard or high-risk auto insurance.

Where do I get nonstandard auto insurance?

Depending on your driving record, you might have to get nonstandard insurance from a high-risk company.

Some larger companies will sell you a policy if you have a few tickets or accidents, but if you have a DUI or several accidents, you might need to go with a nonstandard company. These are companies that specialize in selling coverage to high-risk drivers.

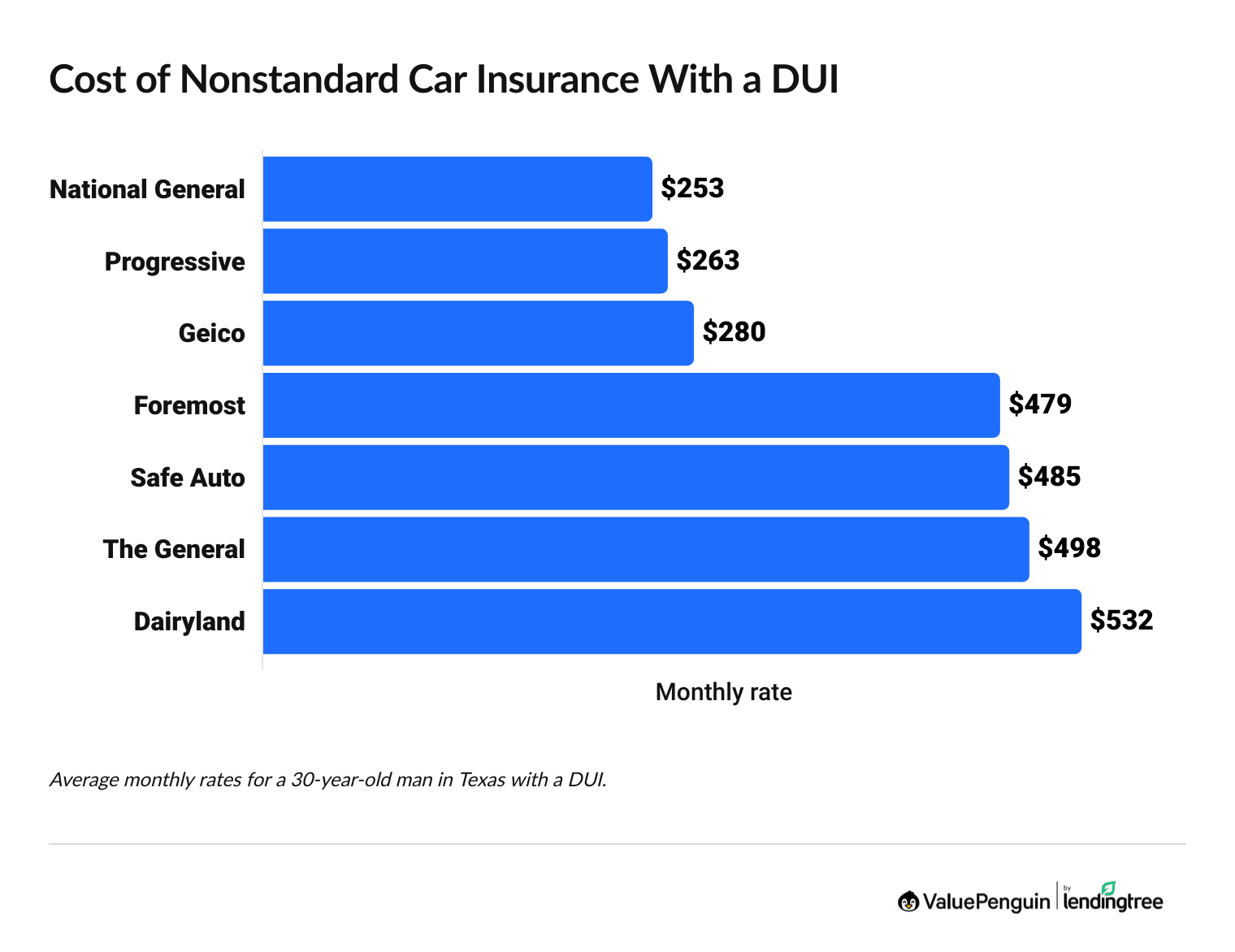

Rates for nonstandard insurance are typically high. For example, if you have a DUI, you can expect to pay almost twice as much monthly for car insurance compared to a driver with a clean record.

Find Cheap Auto Insurance Quotes in Your Area

You can buy nonstandard or high-risk auto insurance the same way you would any other policy. If your state requires an SR-22 from you, your insurance company will need to file the form to prove to your state that you have enough auto insurance. You'll have to pay a filing fee, and your rates will probably go up a lot.

Nonstandard auto insurance companies

Company | Editor's rating | Monthly DUI rate | |

|---|---|---|---|

| National General | $253 | ||

| Progressive | $263 | ||

| Geico | $280 | ||

| Foremost | $479 | |

| SafeAuto | $485 | ||

Average monthly rates are for a 30-year-old in Texas who has a DUI and a full coverage policy.

Other companies that sell nonstandard auto insurance

What if I can't get a policy from any company?

If you can't get car insurance from a high-risk auto insurance company, you may be able to get coverage from your state.

Some states have what's called an "assigned-risk pool." These programs provide insurance to high-risk drivers who can't get coverage otherwise.

This should only be used as a last resort, though. Most states' assigned-risk programs tend to be more expensive than coverage offered by nonstandard insurance companies.

How much does nonstandard auto insurance cost?

The cost of nonstandard auto insurance depends on the reason you have to get it and where you live.

A speeding ticket won't raise your rates as much as a DUI, for example. And you'll pay more for insurance if you live in an expensive state like Florida.

Age had the largest influence on rates in most states. Teenage drivers tend to pay more than drivers guilty of DUI-related accidents.

Car insurance rates by state and driver profile

Ticket

Accident

DUI

How does nonstandard auto insurance work?

Nonstandard auto insurance works just like other car insurance, except that it's for drivers who are more likely to file claims.

Companies usually break down their coverage into three risk tiers: preferred, standard and nonstandard. Preferred customers pay the least for car insurance, because they're the least risky. Drivers in the nonstandard tier pay the highest rates, because their driving history tends to mean they're more likely to get into accidents. This is why nonstandard insurance is sometimes called "high-risk insurance."

For example, if you've filed multiple accident claims within the past few years, insurance companies worry that you could have more accidents in the future. You'll fall under the nonstandard tier of drivers, and your rates will be much higher than average.

If your driving record is particularly bad, the insurance company might cancel your policy. You'd have to purchase coverage from a company that specializes in nonstandard auto insurance. You could be labeled a high-risk driver if you are younger than 25, are older than 75, lack driving experience or have poor credit.

Reasons you might need nonstandard auto insurance

Nonstandard insurance is a broad term. You may have to get it for a variety of reasons. For example, you may fall into the nonstandard tier if:

- You have multiple tickets or accidents on your driving record. If you’ve had multiple traffic violations and accidents that have resulted in insurance claims, you'll likely be labeled high risk.

- You had a lapse in insurance coverage. Drivers in nearly every state are required to have a car insurance policy, so car insurance companies like to see a consistent record of coverage. Drivers who weren't insured at some point, even for less than 30 days, are considered riskier.

- You are required to file an SR-22. Your state may require you to carry an SR-22 if you've been convicted of a DUI or other form of reckless driving. As long as the form is required, you'll have to pay nonstandard insurance rates to legally drive.

- You need car insurance but don't have a car. Nonowner car insurance is for people who don't own a car but frequently drive. But unlike high-risk drivers, non-owners can also usually find liability insurance through major insurance companies.

- Your car has a salvage title. Some major insurance companies offer liability coverage, but not collision or comprehensive coverage, for rebuilt vehicles. If you can't get liability coverage from a major company, you may need to turn to a nonstandard insurance company.

Frequently asked questions

What is nonstandard auto insurance?

Nonstandard car insurance is a type of policy you get when insurance companies think you're a risky driver. It's also called "high-risk car insurance." The coverage is the same as regular car insurance but the rates are higher. If you need nonstandard car insurance, you'll probably be limited in what companies you can buy coverage from. Not all companies sell high-risk policies.

Is Progressive a nonstandard company?

Yes, Progressive sells nonstandard car insurance, and it's one of the best companies if you need a high-risk policy. But Progressive also sells regular car insurance, so you can get coverage even if you don't have tickets or accidents on your record.

How much is nonstandard car insurance?

The cost for a nonstandard policy depends on your driving record. If you have one ticket, you'll pay an average of $216 per month for full coverage, and your policy might not even be truly considered "high-risk." But if you have a DUI, you'll pay an average of $324 per month. It also depends on the company you choose. State Farm and Progressive are usually the cheapest options. However, State Farm might not sell you a policy if you have a DUI or bad driving record.

Methodology

ValuePenguin calculated the average cost for nonstandard car insurance using rates for a 30-year-old man living in Texas who has a DUI. To get the average cost of nonstandard car insurance in each state, ValuePenguin reviewed quotes from ZIP codes across the country. Rates are for a 30-year-old with good credit and either a clean driving record, one ticket, one accident or a DUI. Young driver rates are for an 18-year-old driver.

All quotes are for full coverage and include the following limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist liability: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

State rates include averages for a variety of companies. Company-specific rates include only nonstandard companies in Texas.

All rates are from Quadrant Information Services, which gets its data from publicly available insurance filings. Rates are for comparison only. Your quotes will depend on your specific circumstances and will likely be different.

Editor ratings are based on a review of each company's costs, customer service, coverages and discounts and unique features.

About the Author

Senior Writer

Cate Deventer is a Senior Writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.