How Much Will My Car Insurance Rates Go Up After a Crash in 2026?

Car insurance rates go up by an average of 49% if you cause an accident.

Your rates usually won't go up if the accident wasn't your fault or if your policy includes accident forgiveness. And not every car insurance company or state handles an accident on your driving record the same way.

Find Cheap Auto Insurance Quotes After an Accident

How much does insurance go up after an accident?

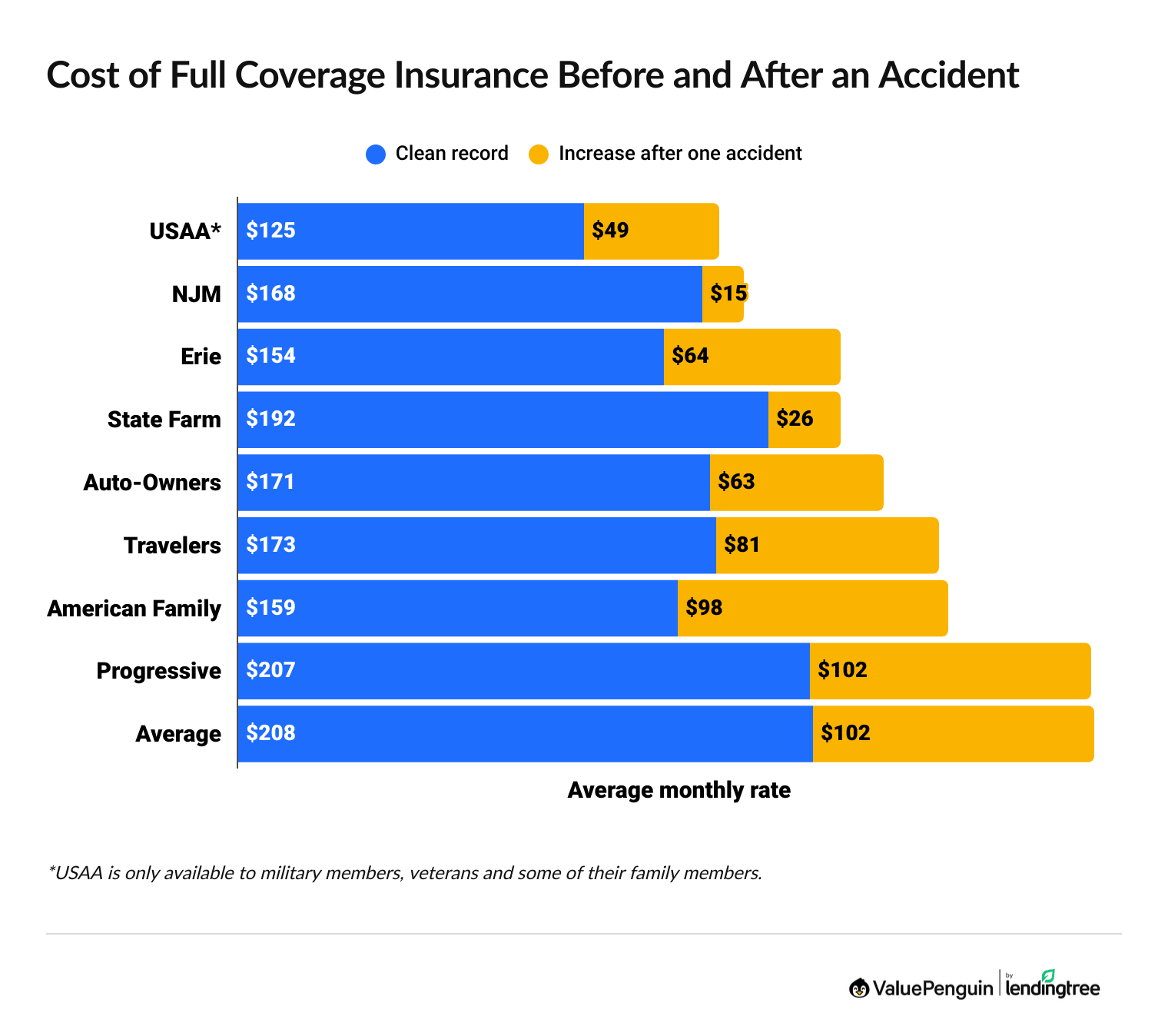

If you cause a car accident, your insurance rates will go up by an average of $102 per month for full coverage.

But there are lots of factors that affect how much your car insurance will go up after a crash, including your insurance company, where you live, your age, credit score and any prior accidents or tickets.

Which companies have the best cheap insurance after an accident?

State Farm has the cheapest car insurance after an accident, compared to other national companies.

The average cost of full coverage insurance from State Farm is $218 per month after an at-fault accident. That's an increase of just 14% after an accident, compared to the national average of 49%.

NJM is the best midsize insurance company after a crash. Full coverage from NJM costs $183 per month after an at-fault accident — only 9% more than drivers with a clean record pay for the same coverage. However, NJM is only available in

5 states.

Find Cheap Auto Insurance Quotes After an Accident

In comparison, Geico raises rates by 73%, on average. That's the biggest increase of any major car insurance company in the U.S.

Cheap full coverage quotes after an accident

Some companies won't raise rates for minor accidents.

For example, Progressive typically doesn't raise your rates after a minor accident. That's because most Progressive policies come with small-accident forgiveness, so your rates won't go up after your first accident claim if the total damage is less than $500.

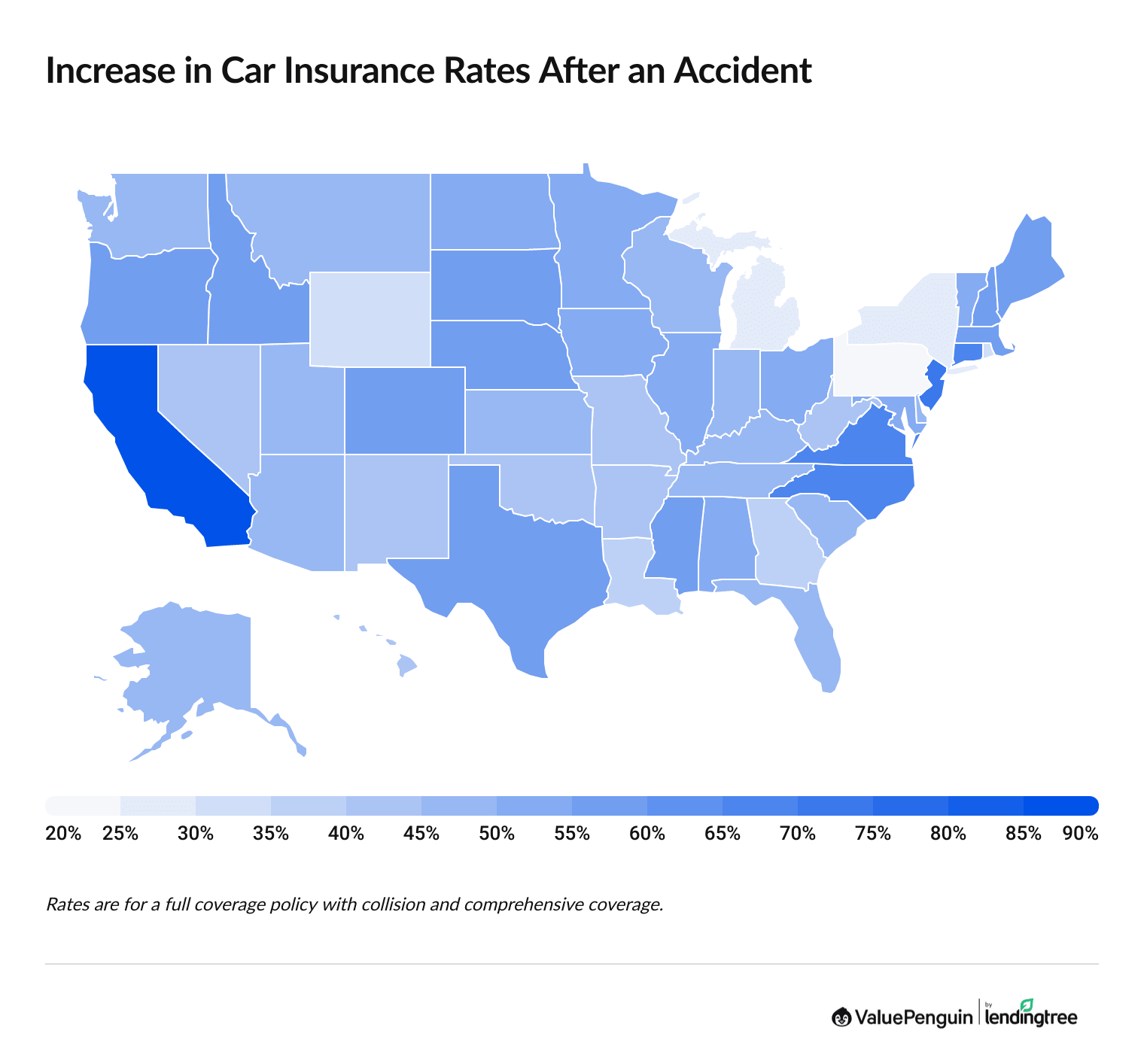

How much does car insurance go up after an accident near me?

California has the largest rate increase after an accident — full coverage quotes nearly double after a crash. In comparison, an accident in Pennsylvania only increases rates by 13%.

Full coverage car insurance quotes after an accident

State | Monthly rate | Increase |

|---|---|---|

| Alabama | $277 | 53% |

| Alaska | $246 | 45% |

| Arizona | $343 | 45% |

| Arkansas | $324 | 44% |

| California | $437 | 98% |

What if I have accident forgiveness?

If you have accident forgiveness, your first accident typically won't cause your rates to go up. However, you could still see an increase in rates if you had a safe driver or claim-free discount prior to your accident.

Does my insurance go up if someone hits me?

Your insurance rates probably won't go up after an accident caused by another driver.

That's because the other driver's insurance should pay for any damage or injuries after an accident that wasn't your fault.

But some companies raise rates slightly, even if you're not at fault. Your rates are also more likely to go up if you've filed multiple claims over the past few years. That's because your insurance company may consider you a risky driver.

Your rates could also go up if you had a claim-free discount prior to the accident. This is more likely if you have to make an uninsured or underinsured motorist claim, or a collision claim after a hit-and-run.

When does car insurance go down after an accident?

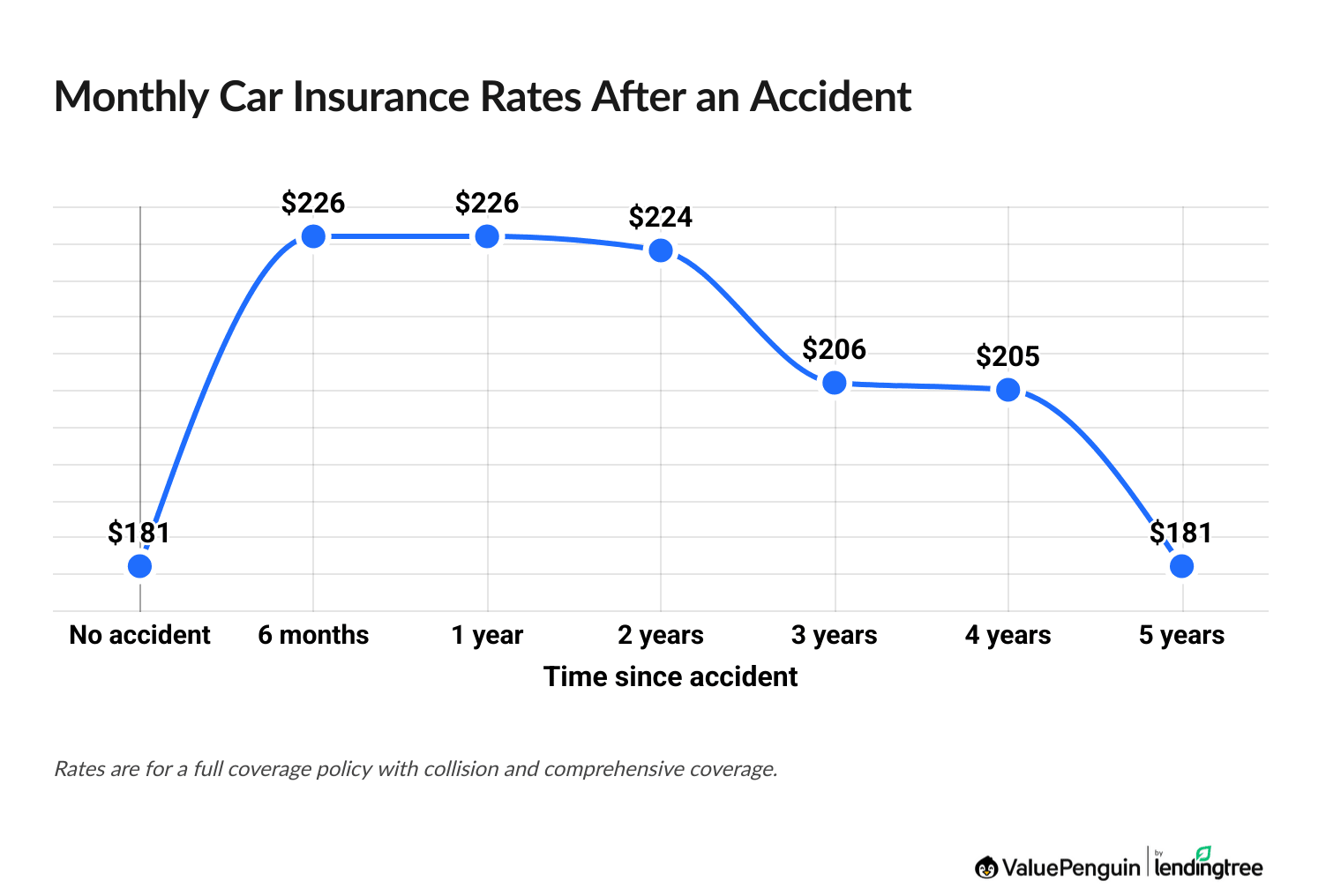

An accident will usually affect your insurance rates for three to four years.

Your rates will go up the most at your first renewal after the crash, then return to normal after three to five years. The more time that has passed since the accident, the less it will affect your insurance rates.

Full coverage quotes after an accident

Time since accident | Monthly rate |

|---|---|

| No accident | $181 |

| 6 months | $226 |

| 1 year | $226 |

| 2 years | $224 |

| 3 years | $206 |

| 4 years | $205 |

| 5 years | $181 |

Rates are for a 30-year-old man in Pennsylvania.

However, some companies remove your accident surcharge quicker than others. At Erie, Progressive and USAA, rates return to normal after just three years. But you'll continue to pay more with Allstate, Travelers and Geico through your fourth year.

For that reason, you should compare quotes from multiple companies each year until your rates return to normal. The cheapest company right after your crash may not be the best choice a few years later.

How much does insurance go up after a minor accident?

The severity of your accident also affects how much your insurance rates go up. If you cause an accident that results in less than $500 of property damage, your rates may only go up by a few dollars per month. You'll pay more if there are thousands of dollars worth of damage or you hurt someone.

Damage | Monthly rate |

|---|---|

| No accident | $181 |

| $500 property damage | $184 |

| $1k property damage | $216 |

| $2k property damage | $227 |

| Injuries | $228 |

When an accident might not increase car insurance rates

Most insurance companies consider who caused an accident when deciding if your rate will go up.

Some companies only increase your rates if they consider the accident to be more than half your fault. But proving fault in an accident can be difficult, and laws vary by state.

For example, in California you aren't at fault if you were:

- Legally parked

- Rear-ended and didn't get a ticket in connection with the accident

- Didn't get a ticket in connection with the accident, but the other driver did

- In a hit-and-run, if you file a police report

- In an accident caused by animals or falling objects

- The accident didn't involve another vehicle and was the result of a hazardous condition that was unavoidable, like black ice or a child running into the street

How to avoid an insurance increase after an accident

If you caused an accident that resulted in damage or injuries, it's impossible to avoid an increase in your insurance rates.

However, you can lower your car insurance rate after an accident by comparing quotes, looking for discounts and adjusting your coverage.

Shop around for rates: After an accident, it's important to see which company offers the best rates for you. Different companies may treat your accident differently.

For example, full coverage after a crash from Allstate costs twice as much as a policy from State Farm.

Find discounts: Insurance companies offer lots of ways to save on car insurance. For example, you can save money by bundling policies, getting good grades in school and driving safely, as tracked by an app.

Adjust your coverage: Getting less coverage is another way to lower your rates after a crash. This approach could also lead to you spending more money out of pocket after an accident. So, you should only get rid of coverage you don't need. For instance, if you have multiple cars, you may not need to pay extra for rental car reimbursement.

Raise your deductible: A higher deductible will lower your car insurance rates. However, this is a risky approach because you'll pay more for repairs if you have another accident. Always choose a deductible you can easily afford in an emergency.

Improve your credit score: Most states allow insurance companies to use your credit score to determine your insurance rates. Paying off debt, making payments on time and addressing any issues on your credit report can all help lower rates.

Frequently asked questions

How much does insurance go up after an accident?

Full coverage car insurance rates go up by 49% after an accident, on average. State Farm has the smallest rate increase after an accident compared to other major companies, at only 14%.

Can you get car insurance after an accident?

Yes, most of the time you can get car insurance after an accident.

If you have multiple accidents and tickets, you may have trouble finding a company to cover you. In that case, you should consider nonstandard companies like The General and Direct Auto.

Will my insurance go up if I file a claim?

Yes, but how much insurance rates go up depends on the type and severity of the claim, your driving record and your insurance company. For example, an uninsured motorist claim after an accident that's not your fault will typically impact your rates less than a crash you cause.

How long does an accident affect your insurance?

An accident usually affects car insurance rates for at least three years. Some companies factor in an at-fault accident for up to five years or longer in rare cases.

Do insurance rates go up after a no-fault accident?

Your rates may increase after filing a no-fault insurance claim. However, it depends on your insurance company and the state you live in. For example, Washington doesn't allow insurance companies to raise your rates after an accident that's not your fault.

Will my insurance go up if someone hits me?

Your rate usually won't go up after an accident that wasn't your fault. However, some companies may raise your rates in certain situations, even if you're not the at-fault driver. This could happen if the accident was partially your fault, or if you've filed a lot of claims over a short period of time.

Methodology

To find out how much car insurance goes up after an accident, ValuePenguin gathered quotes from all 50 states and Washington, D.C. Quotes are for a 30-year-old man with good credit who owns a 2018 Honda Civic EX.

Rates are based on a full coverage policy with collision and comprehensive coverage and the following limits:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000, in states where available

- Comprehensive and collision: $500 deductible

To determine the effect of an at-fault accident on rates over time and the cost of an accident by severity, ValuePenguin experts gathered quotes from ZIP codes across Pennsylvania.

ValuePenguin used Quadrant Information Services to compile and analyze the insurance rate data. The data was publicly sourced from insurance company filings. Rates should be used for comparative purposes only. Your quote may be different.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.