The Cheapest Cars to Insure in 2026

The Subaru Crosstrek is the cheapest cars to insure, on average.

Find Cheap Auto Insurance Quotes in Your Area

In general, smaller pickups and small SUVs cost less to cover than electric cars and full-size SUVs and trucks.

Car insurance rates are higher for certain cars for different reasons. A car that's expensive to repair, a poor safety record or few anti-theft features will likely cost more to cover.

What's the cheapest car to insure?

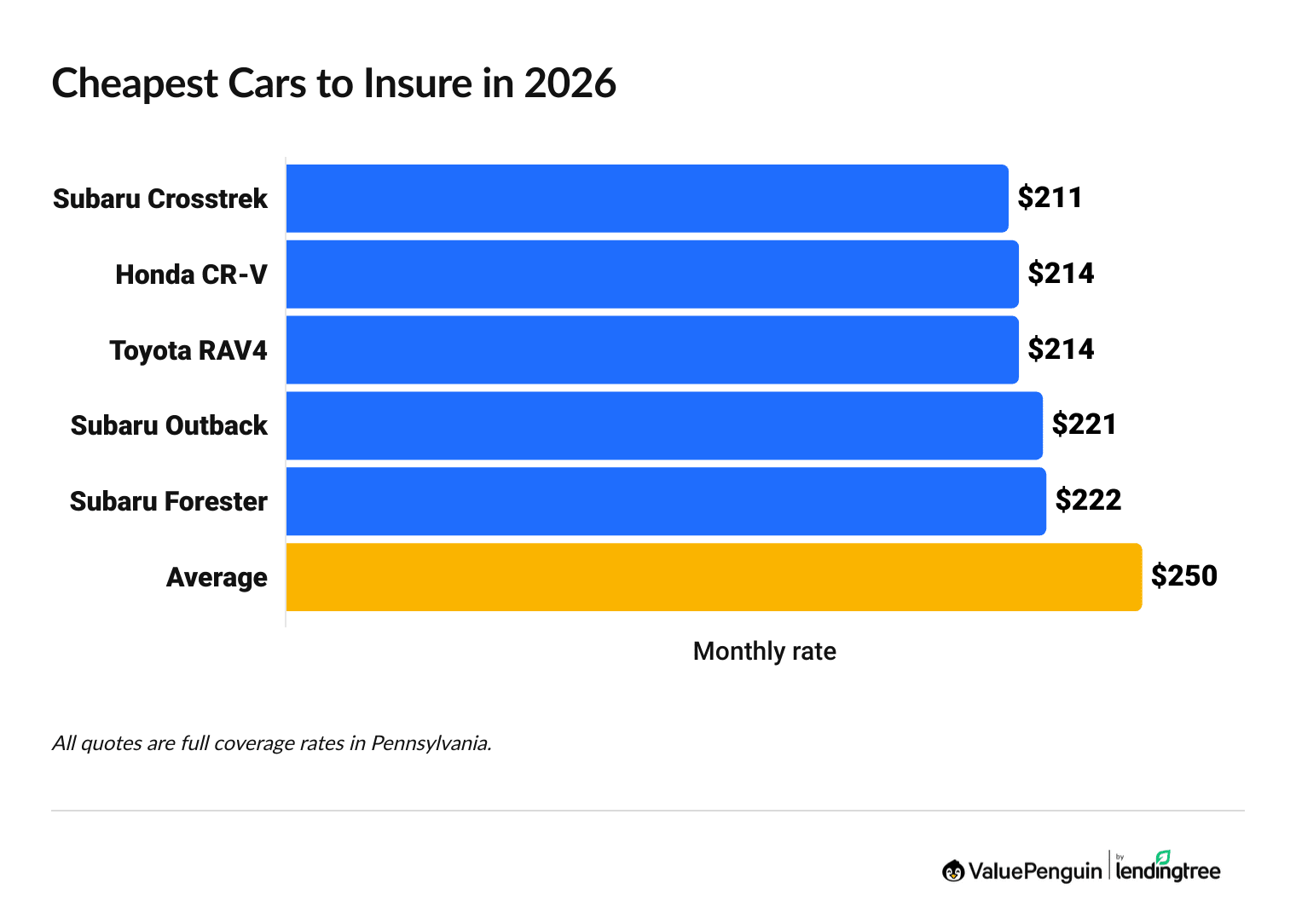

The Subaru Crosstrek is the cheapest car to insure among top-selling vehicles nationally .

At $211 per month, full coverage insurance for a small SUV like the Subaru Crosstrek costs about 16% less than the average across top-selling cars. Subaru Crosstrek insurance costs $147 less per month than coverage for the Tesla Model 3, which is the most expensive popular car to insure.

Find Cheap Auto Insurance Quotes in Your Area

Least expensive cars to insure

Make | Model | Vehicle type | Monthly cost |

|---|---|---|---|

| Subaru | Crosstrek | Small SUV | $211 |

| Honda | CR-V | Small SUV | $214 |

| Toyota | RAV4 | Small SUV | $214 |

| Subaru | Outback | Small SUV | $221 |

| Subaru | Forester | Small SUV | $222 |

| Toyota | Tacoma | Small pickup | $222 |

| Chevrolet | Trax | Small SUV | $223 |

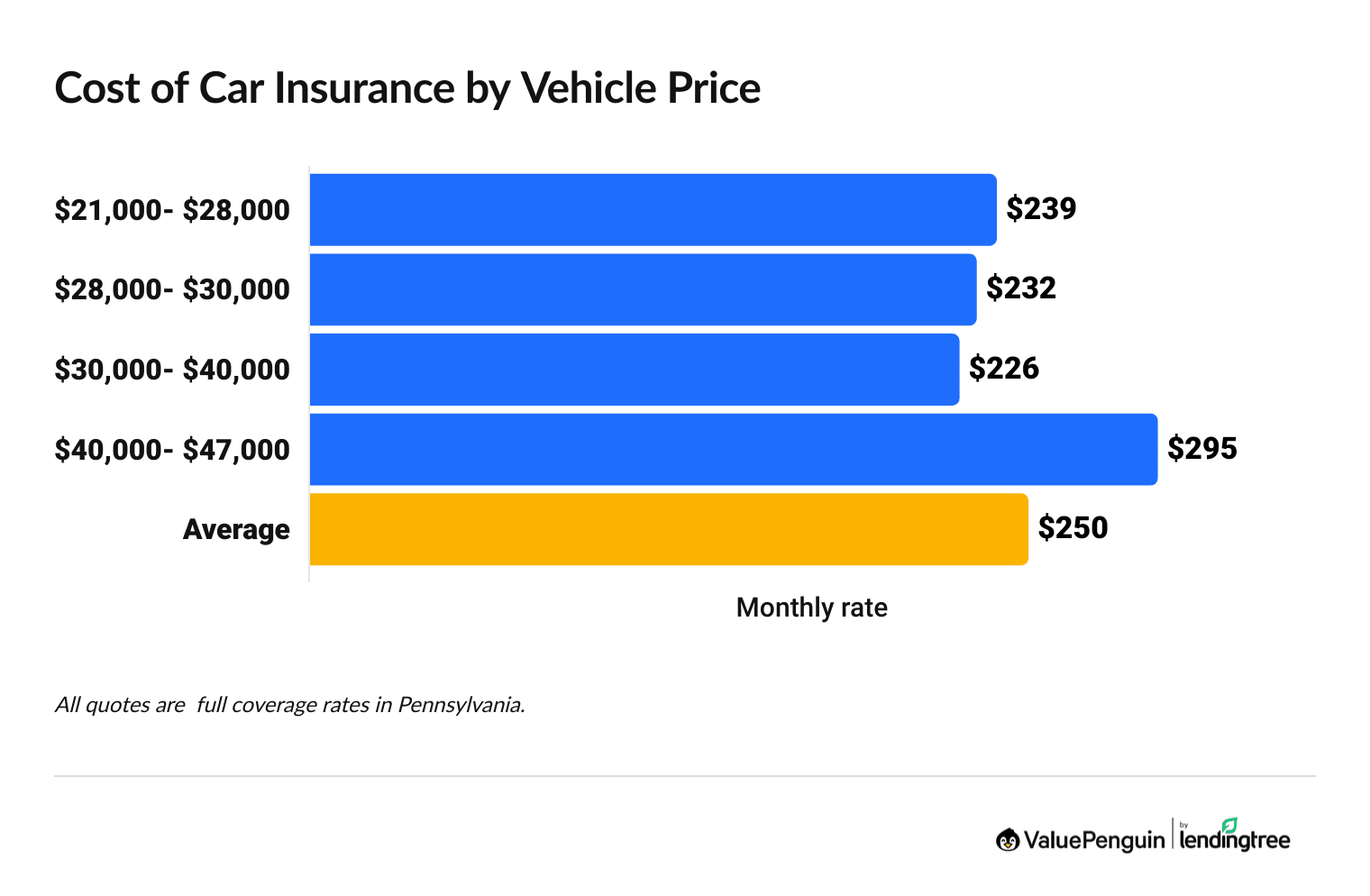

Insurance costs often get more expensive as the price of your car goes up, but the very cheapest cars to buy aren't always the cheapest to insure.

Vehicles that cost between $30,000 and $40,000 have the lowest auto insurance rates. At $226 per month on average, they cost roughly 8% less to insure than the cheapest cars.

By contrast, insurance for more expensive cars — with base prices between $40,000 and $47,000 — costs the most, with an average monthly insurance rate of $295. This group includes the Tesla Model Y and Model 3, which are two of the most expensive cars to cover.

Cheapest types of cars to insure by model

If you're in the market for a new car, it's normal to look for a specific type of vehicle during your search. For example, if you need a vehicle that can hold a lot of passengers, you are more likely to look at SUVs or minivans. But even within a certain car type, some models are cheaper to insure than others.

Cheapest model to insure for each body type

Vehicle type | Model | Monthly rate |

|---|---|---|

| Small SUV | Subaru Crosstrek | $211 |

| Small pickup | Toyota Tacoma | $222 |

| Standard SUV | Jeep Wrangler | $225 |

| Compact car | Toyota Corolla | $246 |

| Full-size pickup | Ford F-150 | $258 |

| Midsize car | Toyota Camry | $259 |

Which car brand is the cheapest to insure?

Subarus, Hondas, Toyotas, Chevrolets and Jeeps are the cheapest car brands to insure, with average monthly rates under $240.

Cars from certain companies tend to be more expensive to insure than others. For example, coverage for a Chevy tends to be cheaper than coverage for a luxury brand such as Tesla.

The cheapest car type to insure

Small pickups and small SUVs tend to be the cheapest types of cars to insure.

The size and shape of your car affect how much you pay for insurance. Generally, a car with a more powerful engine and more extras costs more to insure. Electric vehicles, like the Tesla Model 3 and Model Y, also often cost more to insure than cars with gasoline engines.

Best cars for cheap insurance

Body type | Monthly price |

|---|---|

| Small pickup | $224 |

| Small SUV | $236 |

| Standard SUV | $249 |

| Compact car | $254 |

| Full-size pickup | $272 |

| Midsize car | $308 |

Rates are for a full coverage policy with comprehensive and collision coverage.

Why does the car you drive affect your insurance rates?

Insurance companies set their rates based on the chance that a driver of a certain vehicle will file a claim. They also consider what the claim could cost if that vehicle is in an accident.

Drivers should keep in mind, many other factors impact auto insurance rates, such as age and driving record.

Are stick-shift cars cheaper to insure?

Yes, stick-shift cars are slightly cheaper to insure than automatic cars overall. However, the difference is only a few dollars a month. Many insurance companies offer slightly lower rates for manual vehicles since they tend to cost less to repair and are less likely to be stolen.

Best cars to insure for young drivers

The Subaru Crosstrek is the most affordable car to insure for young drivers, with rates under $299 per month on average.

Insurance for the Subaru Crosstrek is about 17% cheaper than the average cost of car insurance for 21-year-olds.

Subaru Crosstrek | $299 |

|---|---|

| Honda CR-V | $304 |

| Toyota RAV4 | $307 |

| Subaru Forester | $310 |

| Subaru Outback | $311 |

| Toyota Tacoma | $321 |

Younger drivers tend to pay a lot more for coverage. On average, a 21-year-old pays 43% more than a 30-year-old driver for car insurance.

The fact that young drivers pay more for coverage means the vehicle you choose could make even more of a difference on your bill. For example, opting for a Subaru Crosstrek instead of a Tesla Model 3 may save a 21-year-old around $218 on their insurance bill each month.

Most expensive vehicles to insure

The Ram 1500, Tesla Model Y and Tesla Model 3 are the most expensive popular cars to insure.

Full coverage insurance for a Ram 1500 costs $292 per month, on average. The Model Y costs $354 per month to insure, while the Model3 costs $358 per month. The most expensive top-selling vehicle, the Ram 1500 truck, is nearly 20% cheaper to insure than either Tesla.

If you want to keep your car insurance rates down, it's a good idea to avoid large sedans and full-size pickup trucks. Those tend to be more expensive to insure than some other vehicle types. You may also want to consider the rate of theft for the make and model you're trying to insure. For example, Honda Civics are more likely to be targets for thieves, and that higher risk can mean you'll pay more for insurance.

Insurance for electric vehicles also tends to be pricier. This is largely because they have more technology on board and are more expensive to repair.

Frequently asked questions

Which vehicles are cheapest to insure?

The Subaru Crosstrek, Honda CR-V and Toyota RAV4 are the cheapest cars to insure. All three have full coverage rates under $220 per month, on average.

What SUV is the cheapest to insure?

The Subaru Crosstrek is the cheapest small SUV to insure, at $211 per month for a full coverage policy, on average. The Jeep Wrangler has the most affordable insurance for full-size SUVs, at $225 per month.

Is insurance cheaper on a car or an SUV?

Car insurance is typically cheaper for small pickup trucks and small SUVs than for cars. This might be because these types of larger vehicles are generally safer, as you could be less likely to be hurt in an accident.

Methodology: How we got our data

ValuePenguin gathered insurance quotes for the 2025 models of 25 of the top-selling cars of 2025 using sales for the first nine months of the year.

Rates are state averages in Pennsylvania for a 30-year-old with good credit and a clean driving record. Rates for young drivers are for a 21-year-old. All quotes are for full coverage, which includes comprehensive and collision coverage along with higher liability limits than the state average. Our editors included rates from six of the largest insurance companies in the country: Allstate, Geico, Nationwide, Progressive, State Farm and USAA.

EPA size categories were collected from fueleconomy.gov. Car MSRPs are from car manufacturer websites.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.