Ambetter Health Insurance Review: Good for Affordable Coverage

Ambetter stands out for its cheap coverage, and customers are generally happy with their doctors and their ability to get care.

Find Cheap Health Insurance Quotes in Your Area

Ambetter customers also have access to a broad set of extra benefits, including a 24/7 nurse phone line, rewards for engaging in healthy behaviors and extra help for expecting parents.

Ambetter has a few downsides. The company has a poor reputation when it comes to creating good health outcomes for its customers. Plus, some Ambetter customers have reported difficulties finding in-network doctors, and the company has been the subject of several class-action lawsuits.

Pros and cons

Pros

- Cheap rates

- Extra benefits like a 24/7 nurse line

- Customers are typically happy with their doctors

Cons

- Can be hard to find covered doctors

- Poor average health outcomes for customers

Ambetter health insurance costs and plan options

Ambetter health insurance is cheap, making it a good option if you are on a budget.

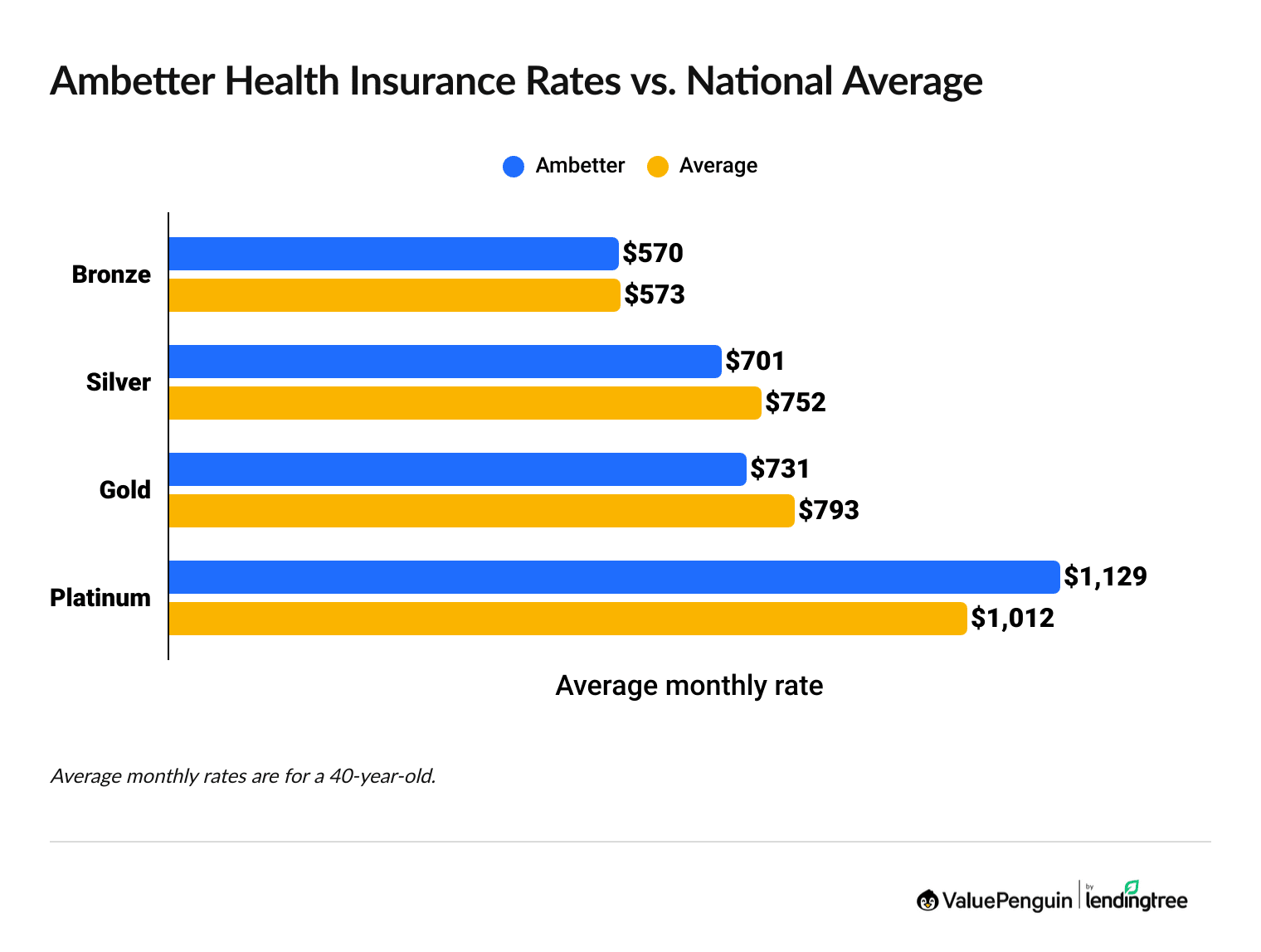

Ambetter is one of the cheapest health insurance companies for most plan options. However, its Platinum plans cost more than the national average.

Find Cheap Health Insurance in Your Area

Ambetter has cheaper-than-average Silver health plans in 26 of the 28 states where it sells exchange plans.

Before you choose an Ambetter plan, make sure to call your doctor and ask if they’re in the company’s network. That’s because some Ambetter customers have reported having a difficult time finding in-network doctors in their area.

Average monthly cost of Ambetter vs. top competitors

Company | Bronze | Silver | Gold |

|---|---|---|---|

| Kaiser Permanente | $463 | $595 | $606 |

| Oscar | $529 | $673 | $698 |

| Ambetter | $570 | $701 | $731 |

| National average | $573 | $752 | $793 |

| BCBS | $587 | $793 | $835 |

Based on the average cost for a 40-year-old.

Ambetter plan options

Ambetter sells a variety of plan options, but availability differs by state.

In most states, you can choose between an HMO (health maintenance organization) plan and an EPO (exclusive provider organization) plan. Both plan options restrict you to a network of doctors, but HMOs typically require you to get a referral before you see a specialist, while EPO plans let you see specialists without a referral.

Ambetter sells PPO (preferred provider organization) plans in California, Arkansas and Oklahoma. These plans give you more freedom when it comes to choosing your doctor. You don’t need to get a referral before seeing a specialist with a PPO, and you can go outside your plan’s network for a higher cost.

HMOs are typically the cheapest plan option because they have the most restrictions on who you’re able to see. EPO and PPO plans tend to have higher monthly rates because these plan options give you more freedom.

Ambetter sells POS (point of service) plans in Arkansas. These plans combine elements of HMO and PPO plans. For example, you need to get a referral from your primary care doctor before you can see a specialist with a POS, but you can also go out of network for care.

Ambetter also sells supplemental insurance, including dental and vision insurance plans.

Centene, the company that owns Ambetter, sells Medicare Advantage and Part D plans through Wellcare.

Other Ambetter plan options

Depending on where you live, you may also have a second set of choices to make when it comes to choosing your Ambetter health plan. That’s because Ambetter offers special Premier, Select and Value plans in certain areas.

Choosing one of these plan options may give you access to extra benefits, such as a larger network of doctors or lower costs you’re responsible for paying for certain types of drugs. It’s important to pay close attention to the fine print in your plan details to make sure you’re choosing the right Ambetter plan for your needs.

Consider a Premier plan if you want more freedom when it comes to choosing your doctor.

Ambetter Premier plans give you access to the company’s broadest network of doctors and hospitals. You also won’t need a referral from your primary care doctor before seeing a specialist, even if you have an HMO.

You can get an Ambetter Premier plan in the following states.

- Alabama

- Arizona

- Arkansas

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Michigan

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- North Carolina

- Ohio

- Oklahoma

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Washington

In some states, Ambetter offers Premier plans built for individuals who have specific medical problems. For example, the Premier Silver Comprehensive Diabetes Care Plan has $0 copays for insulin and some drugs used to treat the disease. Ambetter also has a special Premier plan option for those suffering from asthma or COPD (chronic obstructive pulmonary disease).

Select plans use a "selective" group of doctors and medical offices with a history of offering a high level of care. Keep in mind, Select plans limit the number of doctors who will take your Ambetter insurance. Before you choose a Select plan, make sure the doctors you go to are in the network. Select plans are HMOs, but you don't need a referral to see a specialist like you usually do with HMOs.

Ambetter Select plans are only available in Georgia. Remember, plan availability differs by county, so you may not have access to a Select plan depending on the part of Georgia where you live.

Ambetter Value plans are cheaper than other similar plans. They are also HMOs, and unlike with Select plans, you do need to get a referral from your primary care doctor to see a specialist.

Value plans are sold in parts of Florida and Texas.

Where can I buy Ambetter plans?

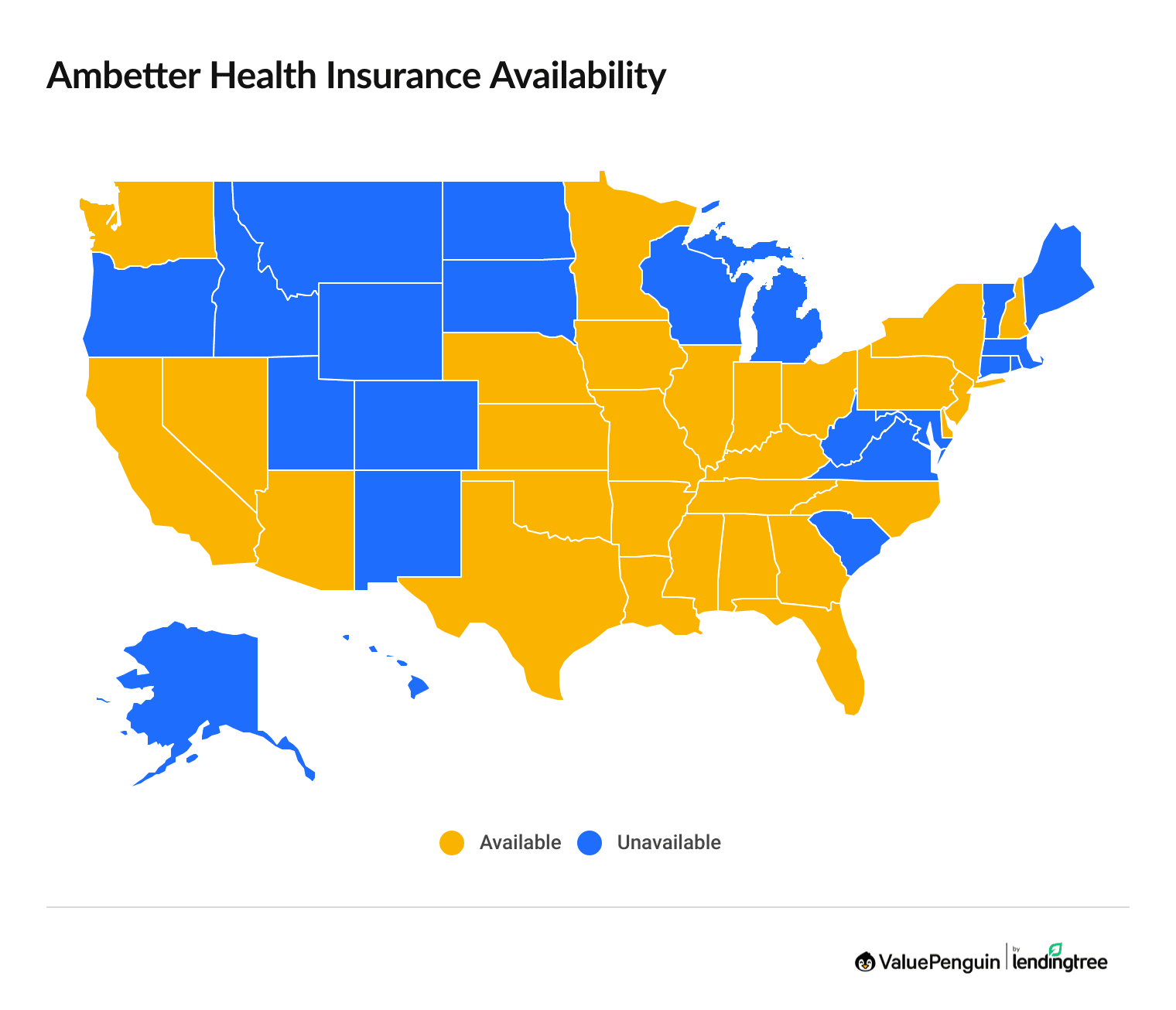

Ambetter sells marketplace health insurance in 28 states.

Depending on where you live, Ambetter may sell plans under a different name. For example, in Kentucky and New Jersey, Ambetter offers coverage under the Wellcare brand.

Find Cheap Health Insurance in Your Area

It’s important to remember that cost and customer service depend on where you live. That means Ambetter is a better deal in some states than in others.

For example, an average Silver health plan from Ambetter costs about one-third less than the state average in New York. But the company charges above-average rates in Nevada.

States where Ambetter sells health insurance

State | Company |

|---|---|

| Alabama | Ambetter of Alabama |

| Arizona | Ambetter from Arizona Complete Health |

| Arkansas | Ambetter from Arkansas Health & Wellness |

| California | Ambetter from Health Net |

| Delaware | Ambetter Health of Delaware |

Ambetter sells health insurance in South Carolina, but you can’t buy a plan through the state health exchange. Instead, Ambetter offers certain types of employer coverage.

Member resources and unique benefits

Ambetter's My Health Pays program lets you earn rewards for completing activities, such as going to your annual checkup, getting certain health screenings, watching educational videos and taking part in online health challenges. The rewards get automatically added to your My Health Pays card after you complete each activity.

You can use the reward money for health-related costs and a few other types of bills, such as your utilities, cellphone bill, rent, transportation, education and child care.

Ambetter also has a discount program. You can save on gym memberships, online fitness programs, meal delivery services like Factor and Home Chef, and mental health programs such as BetterHelp and Talkspace.

Most Ambetter plans also include other extra benefits, including:

- 24/7 nurse line: Licensed nurses can answer medical questions, help you understand your treatment and help you decide if you need to go to an urgent care or emergency room.

- Care Management: This benefit helps you coordinate your medical care from different doctors. It can also help you find resources in your community.

- Start Smart for Your Baby: If you're expecting a baby, this program can help you and your little one stay healthy throughout your pregnancy and after birth.

- Health Management Programs: These programs offer personalized advice to help you manage an ongoing or complex health condition.

- Virtual 24/7 care: Gives you round-the-clock access to a variety of medical professionals for nonemergency health problems.

Customer reviews and complaints

Ambetter customers are typically happy with their doctors and their ability to get coverage.

The company has an excellent 4.9-out-of-5 star rating from HealthCare.gov for member experience, which measures important factors relating to customer satisfaction. However, the company has a poor 2.6-out-of-5 star rating for the medical care category, which looks at health outcomes and the quality of services offered.

Ambetter's overall star rating is slightly below average, and the company scores slightly above average for customer service, how easy it is to get needed information and whether doctors give appropriate treatments.

Ambetter has had ongoing legal problems related to its network of doctors. Many customers have reported issues with finding doctors and specialists in their area. Although Ambetter’s high score for member experience suggests the company has improved, it’s still a good idea to check that you’ll have coverage for local doctors before you buy an Ambetter plan.

Frequently asked questions

Is Ambetter a good insurance company?

Ambetter is a good insurance company. Its plans have cheap rates, high customer satisfaction ratings and extra benefits, such as a 24/7 nurse line. But you should call your doctors before buying a plan and make sure they accept the coverage.

Which is better: Ambetter or Blue Cross?

Ambetter has cheaper average rates, but Blue Cross Blue Shield (BCBS) has better average health outcomes for its customers. It’s a good idea to research plans and companies in your area before choosing between Ambetter and BCBS. Both companies differ significantly in cost, quality and plan options depending on where you live.

How much does Ambetter cost?

A Silver health insurance plan from Ambetter costs $701 per month for a 40-year-old. Keep in mind, the amount you’ll pay for an Ambetter plan depends on factors such as your age, where you live and the plan tier and type you choose.

Methodology

Health insurance rates and data are from the Centers for Medicare & Medicaid Services (CMS) public use files (PUFs). Using this data, ValuePenguin calculated average rates for Affordable Care Act (ACA) exchange health plans for Ambetter and other health insurance companies.

Other sources include HealthCare.gov, Centene and Ambetter subsidiary websites.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.