Best Cheap Health Insurance in Arizona (2026)

Blue Cross Blue Shield (BCBS) of Arizona has the best health insurance in AZ. The cheapest Silver plan from BCBS costs $501 per month before discounts.

Find Cheap Health Insurance Quotes in Arizona

Best and cheapest health insurance in Arizona

Cheapest health insurance companies in Arizona

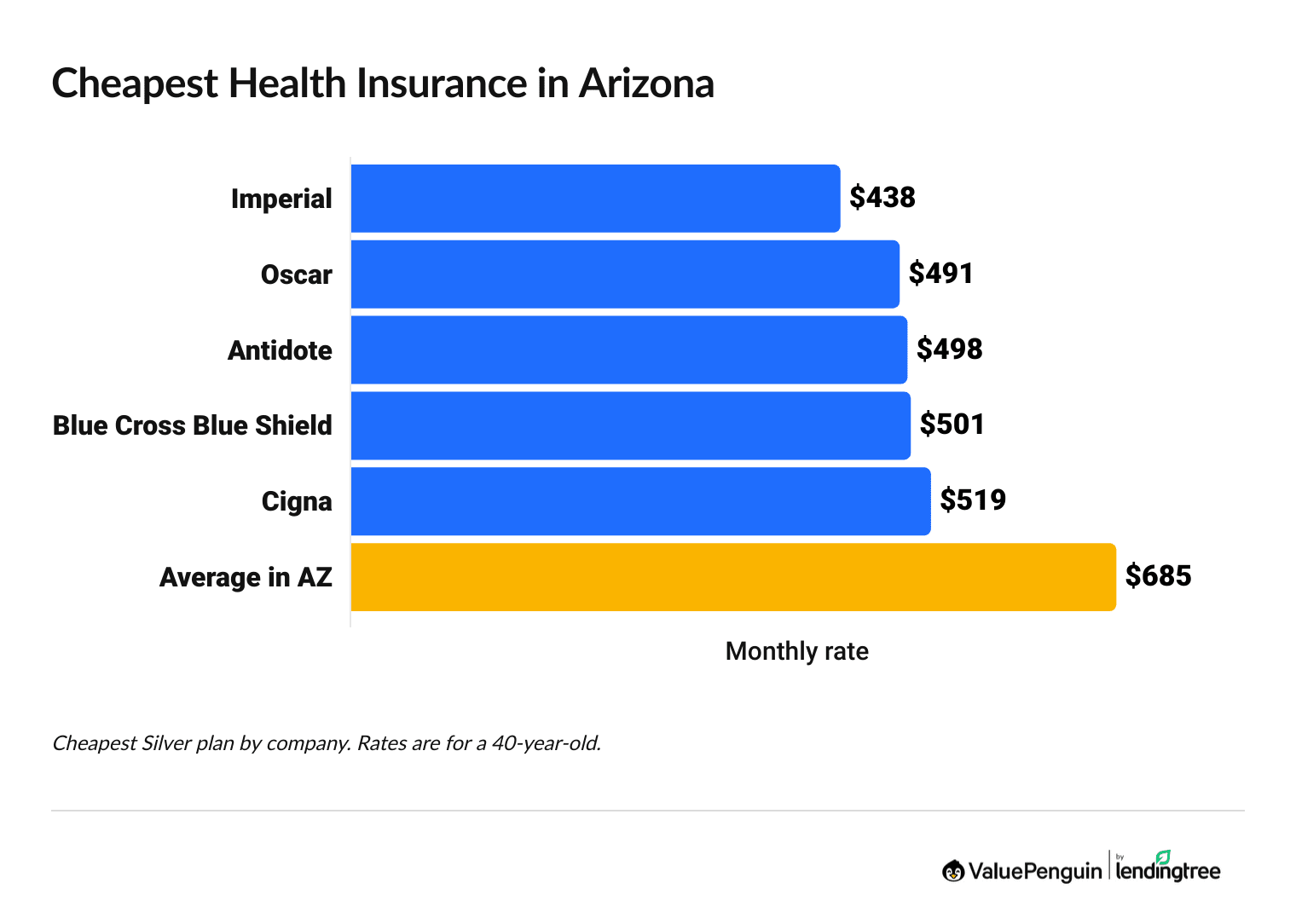

Imperial, Oscar and Antidote have the cheapest health insurance in AZ, with Silver plans starting at $438 per month before discounts, called subsidies.

Find Cheap Health Insurance Quotes in Arizona

Affordable health insurance in Arizona

Company |

Cost

| |

|---|---|---|

| Imperial | $438-$924 | |

| Oscar | $491-$591 | |

| Antidote | $498-$585 | |

| BCBS of AZ | $501-$1,073 | |

-

Imperial has the cheapest Silver plans for nearly everyone in Arizona. But if you live in Apache, Cochise, Coconino, Greenlee, Mohave or Pinal counties, Blue Cross Blue Shield, Antidote or Ambetter will have cheaper plans.

- If you're young and generally healthy, you may get a better deal by choosing a plan tier with less coverage, even if you have to pay more at the doctor. In Arizona, the cheapest Bronze plan is from Imperial, and the cheapest — and only — Catastrophic plan in Arizona is from Antidote.

Aetna will no longer sell plans on the Arizona health exchange in 2026. If you had Aetna health insurance, consider Blue Cross Blue Shield of Arizona for high-quality coverage or Imperial for the cheapest quotes in Arizona.

Best health insurance companies in Arizona

Blue Cross Blue Shield of Arizona has the best health insurance in AZ for both individuals and families.

Blue Cross Blue Shield (BCBS) has a perfect 5-star rating in Arizona for member experience. This means most customers have good experiences with their health coverage from BCBS of AZ. Overall, Blue Cross Blue Shield of AZ has a good rating of 3.5 out of 5 stars from HealthCare.gov because of its high-quality plans. The company also stands out for its affordable quotes.

Find Cheap Health Insurance Quotes in Arizona

Best-rated health insurance companies in Arizona

Company |

ACA rating

|

VP rating

|

|---|---|---|

| Blue Cross Blue Shield of Arizona | ||

| Ambetter from Arizona Complete Health | ||

| UnitedHealthcare | ||

| Imperial | N/A | |

| Cigna |

Cigna and Ambetter also have highly rated plans in Arizona. However, Blue Cross Blue Shield is still a better option for most people because its plans are usually cheaper. Additionally, most doctors take Blue Cross Blue Shield coverage, which means you'll have more options for where to get medical care.

UnitedHealthcare: Best health insurance plan in Arizona for fast coverage

UnitedHealthcare is a good choice if you want to pay less before your coverage starts. That's because UnitedHealthcare has the lowest deductibles for Silver health plans, on average, in Arizona, at $3,900. That's about $3,000 less than what you'd pay with an average Blue Cross Blue Shield Silver plan.

How much does a health insurance plan cost in Arizona?

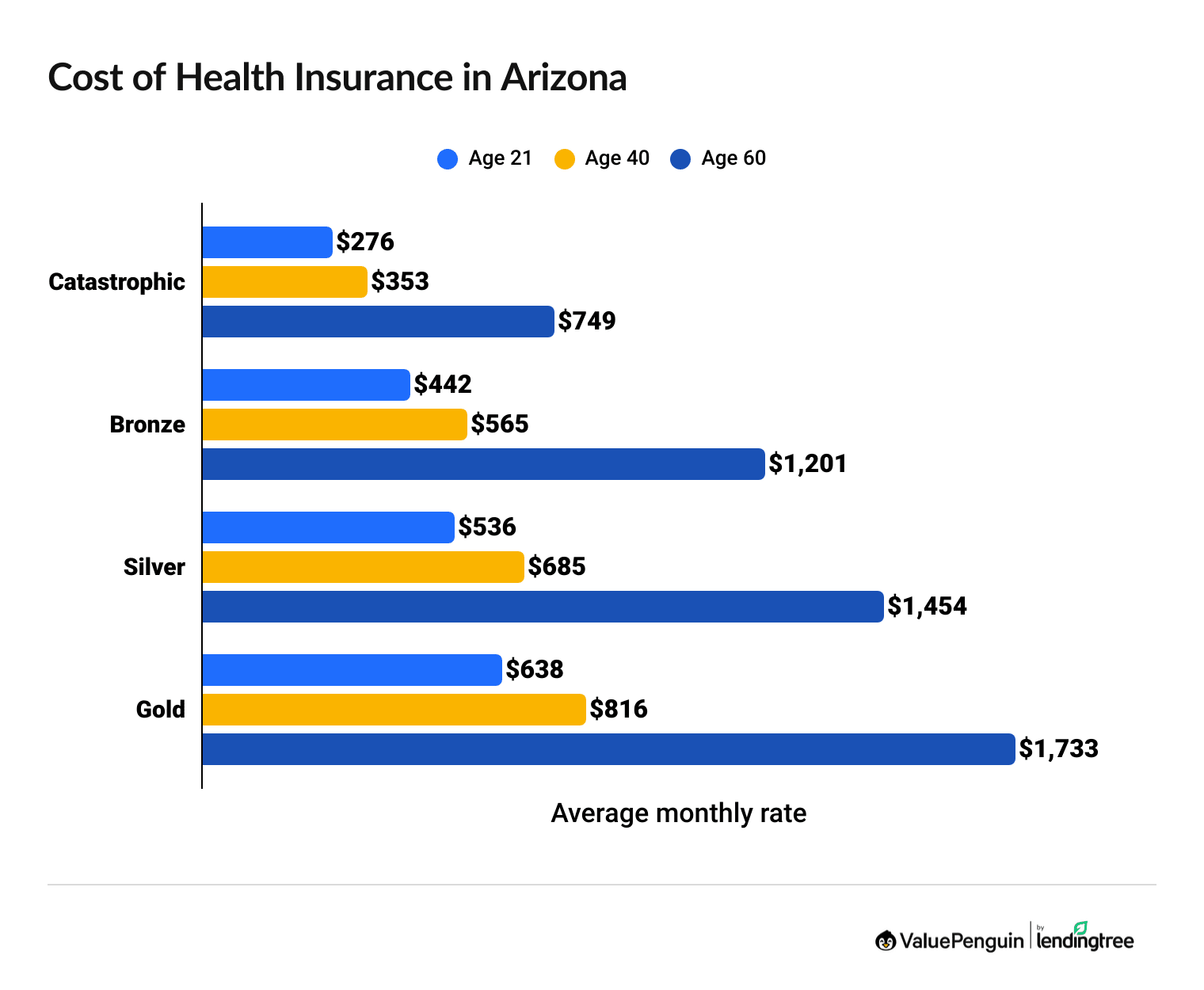

An individual medical insurance plan in Arizona costs an average of $685 per month if you pay full price or might be about $190 per month if you qualify for discounts based on your income.

Find Cheap Health Insurance Quotes in Arizona

- The plan level you buy has a big impact on how much you pay for health insurance. Plans with less coverage, like Catastrophic and Bronze plans, have lower monthly costs, but you'll pay more when you go to the doctor.

- Your age affects health insurance rates, too. Typically, insurance companies charge younger people less because they tend to need less health care. For example, a 60-year-old pays more than twice as much as a 40-year-old for the same medical insurance plan in Arizona.

Health insurance discount changes in Arizona for 2026

Arizona health insurance plans are expected to cost around $190 per month for those who qualify for subsidies.

That's more than $100 per month higher than in 2025, when the average rate after discounts was about $89 per month. Discounts likely won't be as good in 2026 because the extra savings that have been in place since 2021 are expiring at the end of 2025. Unless Congress renews these "enhanced subsidies," you'll pay quite a bit more even if you get discounts.

Health insurance rates in Arizona after subsidies (2025 vs. 2026)

Income | 2025 rate | 2026 rate | Difference |

|---|---|---|---|

| $30,000 | $49 | $155 | 216% |

| $40,000 | $154 | $287 | 86% |

| $50,000 | $283 | $415 | 47% |

| $60,000+ | $410 | $498 | 21% |

Average cost after subsidies for a single 40-year-old with a Benchmark Silver plan.

- What are subsidies? Subsidies are discounts that lower the cost of your monthly health insurance rate when you buy a plan from HealthCare.gov.

- Who can get subsidies? You can get discounts if you earn between $15,650 and $62,600 for the year as an individual or between $32,150 and $128,600 as a family of four. You can't get subsidies if you qualify for Medicaid. However, laws around subsidies could change rapidly by the end of the year, which means eligibility could change, too.

- How do you get subsidies? When you fill out an application on HealthCare.gov and put in your income and other personal info, the site will automatically check if you are eligible to get discounts.

- How do you use subsidies? In Arizona, you can use subsidies to make any Bronze, Silver or Gold plan cheaper. And you can use subsidies to help pay for plans from any company you choose. But you cannot use subsidies on Catastrophic plans.

- How much can you save? The lower your income, the more you'll save on health insurance. Use ValuePenguin's subsidy calculator to see how much you could save if you get discounts.

Cheap Arizona health insurance plans by city

Imperial has the most affordable medical insurance in Phoenix, with individual coverage starting at $472 per month for a Silver plan.

In fact, Imperial has the cheapest rates for nearly everyone in Arizona, including Phoenix's large suburbs like Mesa and Scottsdale and other large cities like Tucson.

Cheapest health insurance by AZ county

County | Cheapest plan | Monthly rates |

|---|---|---|

| Apache | BCBS of AZ AdvanceHealth Silver Neighborhood | $1,029 |

| Cochise | Ambetter Standard Silver | $706 |

| Coconino | BCBS of AZ StandardHealth Silver with Health Choice | $751 |

| Gila | Imperial Standard Silver | $501 |

| Graham | Imperial Standard Silver | $654 |

Cheapest Silver plan with rates for a 40-year-old

Find Cheap Health Insurance Quotes in Arizona

Rates are cheaper in counties where there are more people. Maricopa and Pima counties have some of the cheapest average rates for health insurance. This is likely because there are more medical offices and hospitals in these areas, which makes it easier and faster to get medical care.

Best health insurance plan by level of coverage

For most people, a Silver medical insurance plan is the best level of coverage because it balances how much you pay each month with the cost of medical care.

However, the best coverage tier for you depends on both your medical needs and whether your income qualifies you for special programs.

Gold plans: Best if you need surgery or expensive treatment

| Gold plans pay for about 80% of your medical care. |

Gold plans cost an average of $816 per month in Arizona.

A Gold plan can be worth it if you need expensive or complex medical care or if you go to the doctor often. That's because Gold plans let you pay less for your health care bills. Your deductible, coinsurance, copays and out-of-pocket maximum will usually be lower than with other plan levels.

Silver plans: Best for average health care needs

| Silver plans pay for about 70% of your medical care. |

Silver plans cost an average of $685 per month in Arizona.

Silver plans are the best health insurance tier for most people. They offer a balance between low rates and good coverage.

Silver plans don't pay for as big a share of your medical bills as Gold plans, so you'll have to pay more for medical care and prescriptions. But the cheaper monthly rates can save you money each month. This makes them worth it if you expect to go to the doctor for routine care but don't plan to need expensive medical care such as surgery or childbirth.

Bronze plans: Best if you're young and generally healthy

| Bronze plans pay for about 60% of your medical care. |

Bronze plans cost an average of $565 per month in Arizona.

Bronze plans are a good choice if you don't go to the doctor very often. You'll have to pay more when you do go to the doctor, but you'll still save overall if you only go to the doctor a few times a year.

It's a good idea to make sure you have enough savings to cover the deductible, coinsurance and copays and out-of-pocket maximum in case something severe happens, like a serious illness or injury.

Catastrophic plans: Best to prevent financial disaster

Catastrophic plans cost an average of $353 per month in Arizona.

Catastrophic plans can be good if you only want coverage for a sudden and serious health problem, like a car accident or major illness.

Catastrophic plans are cheap, but they usually don't start paying for medical care until after you have paid $10,600 of doctor bills yourself. So be sure that you have enough emergency savings if you choose a Catastrophic plan.

Also, keep in mind that Catastrophic plans are not eligible for subsidies. So if you have a low or moderate income, a discounted Bronze plan after subsidies could be cheaper than paying full price for a Catastrophic plan.

Cheap or free health insurance in Arizona if you have a low income

Consider Medicaid or a Silver health plan with what are called cost-sharing reductions (CSRs) if you live in Arizona and earn a low income.

Medicaid: Free health insurance in AZ if you have a low income

Medicaid is the best health insurance if you have a low income. You're usually eligible for Medicaid in Arizona if you make less than about $22,000 as an individual or $44,000 as a family of four.

You can make more and still qualify if you're under 19 or if you're pregnant. If you have breast or cervical cancer, are 64 or younger and don't qualify for another Medicaid program, you can get Arizona Medicaid benefits without an income requirement.

Silver plans with cost-sharing reductions: Best if you have a low income but don't qualify for Medicaid

| Silver plans will pay 73% to 94% of your medical costs if you have a low income. |

If you have a low income but don't qualify for Medicaid, a Silver plan is the best choice for affordable coverage because you can save on medical care through cost-sharing reductions.

You're eligible if you make between $15,650 and $39,125 per year as an individual or between $32,150 and $80,375 per year as a family of four. And Silver plans are the only level where you can use the program to lower your deductible, copays, coinsurance and out-of-pocket maximum.

Are health insurance rates going up in AZ in 2026?

The cost of health insurance in AZ rose by 25%, on average, between 2025 and 2026.

Bronze plans saw the largest increase, costing 33% more in 2026 compared to 2025. Silver plans went up by 29%, while Gold plans had a 20% increase. Catastrophic plans had the smallest increase but are still 19% more expensive in 2026.

Silver plans, the most popular plan level in Arizona, are up 19% in price since 2022.

Catastrophic

Bronze

Silver

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $259 | – |

| 2023 | $274 | 6% |

| 2024 | $272 | -1% |

| 2025 | $296 | 9% |

| 2026 | $353 | 19% |

Monthly costs are for a 40-year-old.

Catastrophic

Year | Cost | Change |

|---|---|---|

| 2022 | $259 | – |

| 2023 | $274 | 6% |

| 2024 | $272 | -1% |

| 2025 | $296 | 9% |

| 2026 | $353 | 19% |

Monthly costs are for a 40-year-old.

Bronze

Year | Cost | Change |

|---|---|---|

| 2022 | $530 | – |

| 2023 | $471 | -11% |

| 2024 | $429 | -9% |

| 2025 | $426 | -1% |

| 2026 | $565 | 33% |

Monthly costs are for a 40-year-old. Expanded Bronze plans are included in 2024, 2025 and 2026 averages, when they're offered.

Silver

Year | Cost | Change |

|---|---|---|

| 2022 | $577 | – |

| 2023 | $569 | -1% |

| 2024 | $517 | -9% |

| 2025 | $529 | 2% |

| 2026 | $685 | 29% |

Monthly costs are for a 40-year-old.

Gold

Year | Cost | Change |

|---|---|---|

| 2022 | $690 | – |

| 2023 | $708 | 3% |

| 2024 | $652 | -8% |

| 2025 | $680 | 4% |

| 2026 | $816 | 20% |

Monthly costs are for a 40-year-old.

Why is health insurance expensive in AZ in 2026?

Increasing health care costs are the main reason why health insurance rates are going up in 2026.

Lower federal funding, expiring tax credits, general inflation and greater use of more expensive prescription drugs such as Wegovy and Ozempic are also contributing to higher prices.

How to save on Arizona health insurance in 2026

- Shop around and get rates from several companies to find the cheapest quotes in your area.

- Get a high-deductible health plan (HDHP) to save on your monthly rate. These plans aren't right for everyone because they require you to spend a lot toward your medical bills before your coverage starts.

- Open a health savings account (HSA) to save for health care expenses like your deductible and copays. You have to buy a high-deductible health plan to get an HSA.

- Look into Medicaid if you earn a low income and live in Arizona.

Affordable Care Act (ACA) essential health benefits

Obamacare health insurance plans give you important medical benefits, no matter what level of coverage you choose.

- Free checkups and preventive care as soon as the plan starts

- Won't be denied a plan or pay more if you have an existing health condition

- Helps you avoid medical debt after a major illness or injury because your costs are capped

Cost of Arizona health insurance by family size

Health insurance costs depend on the size of your family. Adding a child under the age of 15 to a Silver plan adds about $410 per month to your rate. That means the average cost of medical insurance for a family of four on a Silver plan is $2,189 per month.

Family size | Average monthly cost |

|---|---|

| Individual | $685 |

| Individual and child | $1,094 |

| Couple | $1,369 |

| Family of three | $1,779 |

| Family of four | $2,189 |

Averages based on a Silver plan for 40-year-old adults and children who are under age 15.

Short-term health insurance plans in Arizona

At the start of 2025, the Trump administration rolled back a new rule that would have limited the length of a short-term health policy to three months. Although there isn't a publicly available timeline for when this change will happen, short-term health insurance could be available in Arizona for up to 364 days sometime soon.

Short-term health insurance can help you fill a short coverage gap. However, you can almost always get better coverage from a marketplace plan.

Pros of short-term health insurance plans in AZ

Cons of short-term health insurance plans in AZ

Health insurance enrollment by income level in Arizona

More than 6 in 10 people in AZ who have Obamacare coverage make less than $30,120 per year.

People with low incomes are more affected by rate increases and changes to discounts than people with higher incomes. This population has a much tighter budget, which means any changes in rates can be devastating.

Enrollment by income

Income | % of total enrollment |

|---|---|

| Less than $15,060 | 1% |

| $15,060 to $20,783 | 8% |

| $20,784 to $22,590 | 31% |

| $22,591 to $30,120 | 21% |

| $30,121 to $37,650 | 12% |

Enrollment in 2025 marketplace plans made during the 2024-2025 open enrollment period. Total may not be 100% due to rounding.

Frequently asked questions

Is $200 a month expensive for health insurance in Arizona?

No, $200 per month for health insurance is quite affordable in Arizona. Even the cheapest plan tier, Catastrophic, typically costs more than $200 per month in AZ. You might be able to get health insurance for $200 or less if you get discounts based on your income.

What is the best cheap health insurance in Arizona?

Blue Cross Blue Shield (BCBS) has the best cheap health insurance plan for most people in Arizona. Silver plans from BCBS of AZ start at $501 per month. Blue Cross Blue Shield has good rates and great customer service.

How do I get health insurance in Arizona?

The best way to get health insurance in Arizona is to shop on HealthCare.gov. You can easily compare multiple plan options at once. Plus, HealthCare.gov automatically tells you how much you can expect to pay per month after applying discounts, called subsidies or premium tax credits.

How much is health insurance in Arizona?

The average cost of health insurance in Arizona is $685 per month for a 40-year-old buying a Silver plan. If you have a low-to-average income, you may qualify for health insurance subsidies that lower the monthly cost of insurance based on your income.

How do I get free health insurance in Arizona?

You may qualify for free or low-cost health insurance in Arizona through Medicaid. Medicaid plans provide coverage for things like doctor visits, vaccines, prescriptions and other essential health care needs. For eligibility and application info, Arizona's Medicaid agency explains the many ways you can qualify.

What will happen to ACA subsidies in 2026?

We don't yet know exactly what will happen to marketplace discounts in 2026. If Congress doesn't renew the enhanced discounts that have been in place since 2021, discounts won't be as good in 2026 as they have been in past years. However, it's possible that Congress will restructure the subsidy program entirely, with new requirements and discount levels.

Methodology

Arizona health insurance rate data for 2026 is from the Centers for Medicare & Medicaid Services (CMS) website. ValuePenguin used the CMS public use files (PUFs) to find average rates for different plan tiers, geographic locations and family sizes.

Rates

Rates are based on a 40-year-old with a Silver plan, unless otherwise noted. Rates for Bronze plans include regular and Expanded Bronze plans for 2024, 2025 and 2026, when the plans are available. Your costs and plan options will vary; plans aren't always available in all parts of a state or county.

Subsidies

Rates after subsidies are estimates for a 40-year-old with a Benchmark Silver plan and are based on how subsidies were structured before 2021. Prices are calculated using KFF's rates for full-price Benchmark plans, federal poverty levels (FPLs), IRS rules about premium tax credits and Congressional reports about expanded tax credits. The total cost in the state uses calculated rates by income, which are weighted using CMS data on the incomes of those who purchased plans during 2024-2025 open enrollment. The median was used for each income range. Unknown incomes were excluded from the calculations. Incomes of 100% of the federal poverty line and 500% of the federal poverty line were assumed for enrollees who earn less than 100% FPL and more than 500% FPL, respectively. Information about state subsidies, when available, was sourced from state marketplaces.

Ratings

ValuePenguin's experts rank companies based on cost, coverage options, customer satisfaction and unique value. Ratings are out of 100 possible points. ACA ratings show how the company performs in Arizona for medical care, member experience and plan administration. The 2026 plan quality data from CMS is based on data from the previous year. Ratings are not available for new plans or plans with low enrollment.

More sources

Enrollment trends, including plan selections by tier and enrollment by income, are from CMS data for the 2024-2025 open enrollment period.

Data about the causes for rate increases in 2026 is from the Peterson-KFF Health System Tracker. Other sources include the Arizona Department of Insurance, the National Association of Insurance Commissioners (NAIC) and S&P Global Capital IQ.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.