Average Household Budget: How Much Does the Typical American Spend?

American households spend an average of $61,334 per year, or $5,111 per month — 82% of our after-tax income. Most households have the same major expenses: housing, transportation, taxes and food make up 78% of our budgets.

Understanding the average cost of living can help you create a budget and make good financial decisions.

Key budget statistics

- The average income in the U.S. was $84,352 per household in 2020, according to the Consumer Expenditure Survey conducted by the U.S. Bureau of Labor Statistics.

- Housing and household expenses make up the largest portion of our living expenses at $1,784 per month, combined.

- We spend an average of $412 per month on groceries, which is 68% of our monthly budget for food.

- The typical household spends $120 per month on clothing, which accounts for only 2% of our monthly income in the U.S.

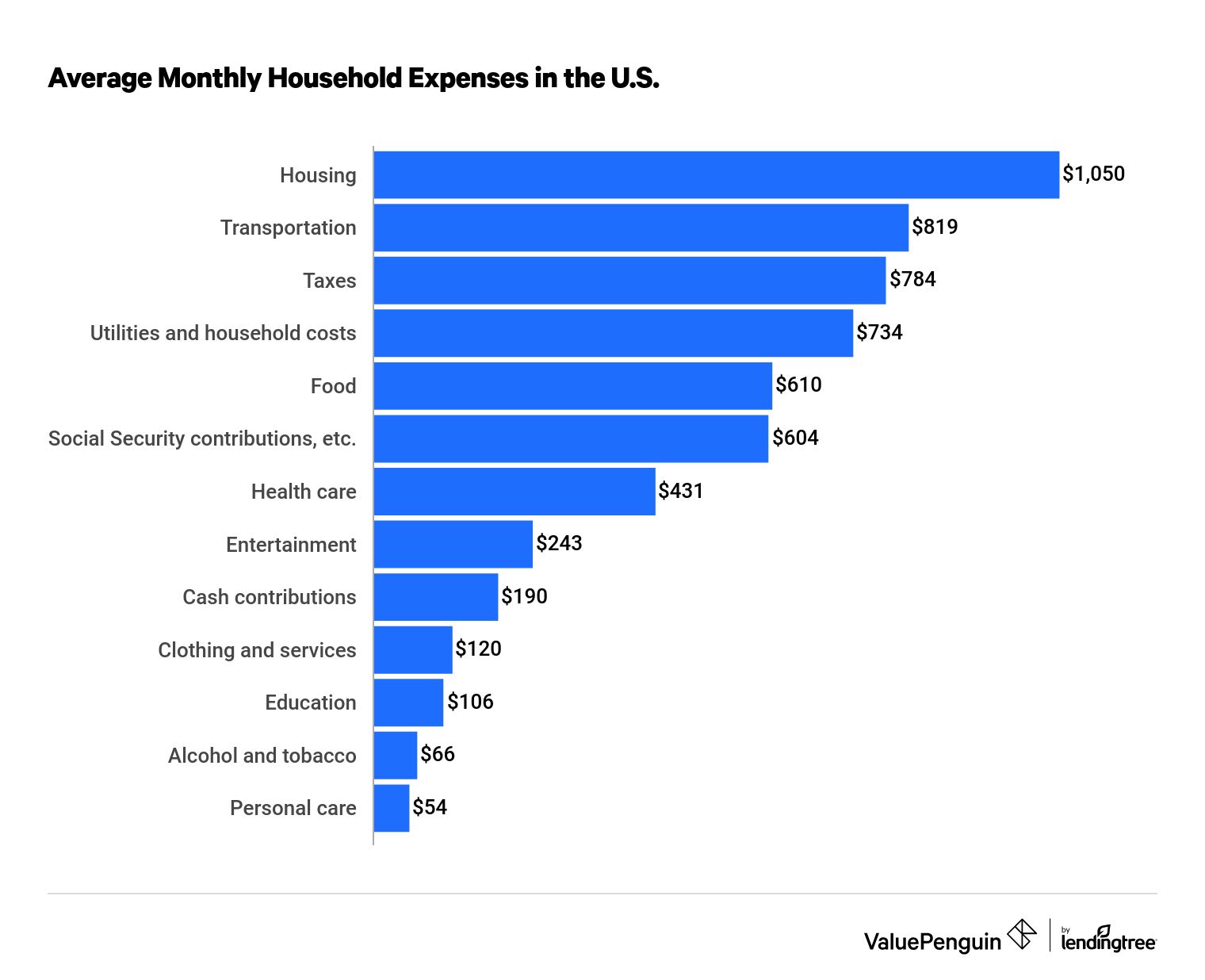

Average household expenses in the U.S.

The typical American household spends $5,111 per month, on average.

The largest expense for most Americans is housing. At $1,050 per month, the cost of having a roof over our heads accounts for 21% of a household's monthly budget.

Expense | Monthly cost | % of income |

|---|---|---|

| Housing | $1,050 | 15% |

| Transportation | $819 | 12% |

| Taxes | $784 | 11% |

| Utilities and other household costs | $734 | 10% |

| Food | $610 | 9% |

Percentage of income is based on after-tax income. Percentages are rounded, and not all categories are included. Therefore, the total does not equal 100%.

Average monthly housing cost: $1,050

Key monthly home costs

- Mortgage interest: $247

- Property taxes: $196

- Maintenance, repairs, and insurance: $180

The average U.S. household spends $21,409 per year, or $1,784 per month, on all things related to housing.

Shelter accounts for $1,050 of our monthly budget. That includes rent or mortgage payments, mortgage interest, property taxes, maintenance, repairs and insurance. The remaining $734 each month covers utilities, household expenses, furniture and equipment.

About 66% of Americans own their home. They pay an average of $623 per month on mortgage interest, property taxes and other expenses like maintenance, repairs and homeowners insurance.

The 34% of Americans who rent pay just a little less than homeowners — an average of $607 per month. Expenses include rent, maintenance costs and renters insurance.

Average monthly cost of household supplies and utilities: $734

Monthly cost of utilities

- Electricity: $126

- Phone services: $120

- Water, other public services: $57

- Natural gas: $35

- Other fuels: $9

U.S. households spend an additional 10% of their annual income on things related to their homes. This is on top of the 15% of take-home pay that goes to mortgage or rent costs.

We spend most of this on recurring bills for electricity, heating and cooking fuels, water/sewer/septic, trash collection and phone service (including cellphones). The typical cost of utilities per month is about $347.

In addition, we spend an average of $122 per month on things like babysitting or elder care, house cleaning or landscaping, dry cleaning, pest control, and security systems. These services are categorized as household operations.

American households spend $196 per month, or $2,346 annually, to furnish homes. This includes everything from bath towels to a new dining table or refrigerator.

The remaining $70 per month goes toward laundry and cleaning supplies and other household products.

Average transportation cost per month: $819

Monthly cost of transportation

- Vehicle purchases: $377

- Gas, motor oil, other fuel: $131

- Car insurance: $131

- Maintenance and repairs: $73

- Finance charges: $22

- Public, other transportation: $22

The second-largest spending category for the typical U.S. family is transportation.

The average cost of transportation for a household is $9,826 per year, or $819 per month — 12% of the average household income.

The majority of our transit budgets go toward car payments, which cost around $4,523 per year. In addition, we spend an average of $1,575 per year on car insurance.

Gasoline accounts for 16% of transportation costs — the average amount spent on gas per month is $131. This category also includes vacation transportation like plane, bus and train tickets and even ship fares.

Average monthly taxes paid by U.S. households: $784

Monthly tax expenses

- Federal income taxes: $734

- State, local income taxes: $203

- Other taxes: $6

The typical household pays $9,402 per year in personal taxes — 11% of our total income.

This doesn't include property taxes, sales taxes, Social Security or Medicare payments.

In 2020, we paid less in federal taxes than normal because of the stimulus checks many Americans received during the COVID-19 pandemic. The average household received $1,911 in stimulus payments from the government.

Average spending on food per month: $610

Monthly cost of groceries: $412

- Meats, poultry, fish, eggs: $90

- Fruits, vegetables: $81

- Cereal, baked goods: $53

- Dairy products: $40

The typical U.S. household spends 9% of its income on food — $7,316 per year.

The average cost of groceries per month is $412, which makes up about 68% of our food budgets. The remaining $198 per month is spent dining out.

While food is a necessity, the amount spent on food varies based on household income. People earning less than $15,000 per year spend $352 per month on food — $272 of which goes toward groceries.

In comparison, those earning between $70,000 and $90,000 per year spend nearly twice as much on food ($623 per month).

Average monthly Social Security contributions, personal insurance and pensions: $604

Monthly retirement and insurance costs

- Pensions, Social Security: $563

- Life, personal insurance: $41

The typical U.S. household spends $7,246 per year on Social Security or pension contributions and personal insurance.

The majority of this expense comes from contributions to Social Security and pensions, which total $6,760 per year (this may cover more than one worker). In addition, some households make payments into government, railroad or private retirement plans.

In 2020, Americans saved about 18% of their income after taxes to meet financial goals including retirement, new home purchases and vacation savings.

Overall, we contribute about $1,135 per month into savings accounts, emergency funds and personal investments.

Average cost of health care monthly: $431

Monthly health care expenses

- Health insurance: $306

- Medical services: $72

- Drugs: $40

- Medical supplies: $14

About 6% of U.S. household income goes to health care expenses — $5,177 per year.

That includes health insurance premiums and out-of-pocket costs for doctors, prescriptions and medical supplies.

The average spending on health insurance premiums was $306 per month — 5% of our annual income after tax.

The Affordable Care Act says that the cost of health insurance is reasonable if it makes up less than 8.5% of a household’s modified adjusted gross income. Above that level, people become eligible for subsidies if they purchase insurance on the federal or a state health insurance exchange. You are also eligible if your household income is between 100% and 400% of the federal poverty level.

Average entertainment cost per month: $243

Monthly entertainment cost

- Fees and admissions: $87

- Pets: $58

- toys, hobbies: $35

- Audio, visual equipment and services: $14

The average American household spends $2,912 per year on entertainment.

That represents only 3% of our total income. However, the lack of spending on entertainment in 2020 can be partially attributed to COVID-19. The pandemic shut down movie theaters, caused concert cancellations and generally kept people in their homes.

Average clothing cost per month: $120

Monthly cost of clothing

- Women, girls: $45

- Men, boys: $27

- Footwear: $26

The average household's cost for clothing per month is about $120 (that’s $1,434 per year).

That number includes clothing products, and services like tailoring.

We spend an additional $54 per month for personal products like cosmetics and shaving cream, and services like haircuts and manicures.

Frequently asked questions

How much does the average American save a month?

The average U.S. household saves $1,135 per month, which is about 18% of its monthly income.

How much do household items cost per month?

American households spend an average of $196 per month on household furnishings and equipment, like appliances, furniture and rugs. We spend an additional $70 on housekeeping supplies each month.

How much does the average American spend on food?

The average household spends $7,316 annually on food. Of that, $4,942 per year is spent on groceries.

How much do clothes cost per month?

In the United States, households spend an average of about $120 per month on clothes. That comes out to $1,434 per year.

How much does the average American spend per month?

The average American household spends $5,111 per month. That's 82% of our income, after taxes.

Source

U.S. Bureau of Labor Statistics Consumer Expenditure Survey data for 2020

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.