Dirt Bike Insurance

Dirt bikes are typically covered by motorcycle insurance and should have their own policy, especially if they are street legal.

Best cheap motorcycle insurance for dirt bikes

Find Cheap Motorcycle Insurance Quotes in Your Area

Although there are differences between dirt bikes and motorcycles, like engine size and off-road capability, they're similar enough that the same coverage and discounts apply to both types.

Do you need insurance on a dirt bike?

Dirt bike owners should consider purchasing insurance even if it isn't legally required where they live.

Dirt bike insurance requirements depend on where you live and ride. Some states, like New Jersey, require dirt bikes and all-terrain vehicles (ATVs) to be insured if you plan to drive on public roads. Low-speed bikes that aren't street legal may still need proof of insurance to be used in certain areas, like commercial properties designated for off-road vehicles.

We always recommend dirt bike insurance because dirt bikes can be dangerous, especially for inexperienced riders. Liability insurance can help protect you if you hurt someone or damage their property while riding, and medical coverage can pay for some of your own injuries.

Full coverage insurance can also help pay for damage to your bike, regardless of whose fault an accident is.

Is a dirt bike the same as a motorcycle?

Dirt bikes have two wheels and an engine, which makes them motorcycles for the purposes of insurance and registration.

What makes dirt bikes different from other types of motorbikes is that dirt bikes are lightweight and designed for off-road riding. Many dirt bikes may not have enough engine power or safety equipment to be street legal. In fact, some states have laws against riding a dirt bike on public roads.

Regardless of whether your dirt bike is street legal, companies typically offer dirt bike insurance as a motorcycle insurance policy. However, some companies sell insurance specifically for off-roading bikes and ATVs.

How much is dirt bike insurance?

Dirt bike insurance policies cost $13 per month for minimum coverage and $66 per month for full coverage, on average.

Find Cheap Motorcycle Insurance Quotes in Your Area

Dirt bike insurance is typically cheaper than motorcycle insurance. Dirt bikes may not be legally allowed on public roads or highways, which means there are fewer chances for accidents. This is because dirt bikes that are much less powerful than motorcycles can't drive for long periods of time at highway-safe speeds.

The difference in engines between motorcycles and dirt bikes also has an impact on the cost of insurance. Dirt bikes designed for the average rider are usually equipped with an engine size between 250cc and 450cc, while most motorcycles have an engine size between 400cc and 1,000cc.

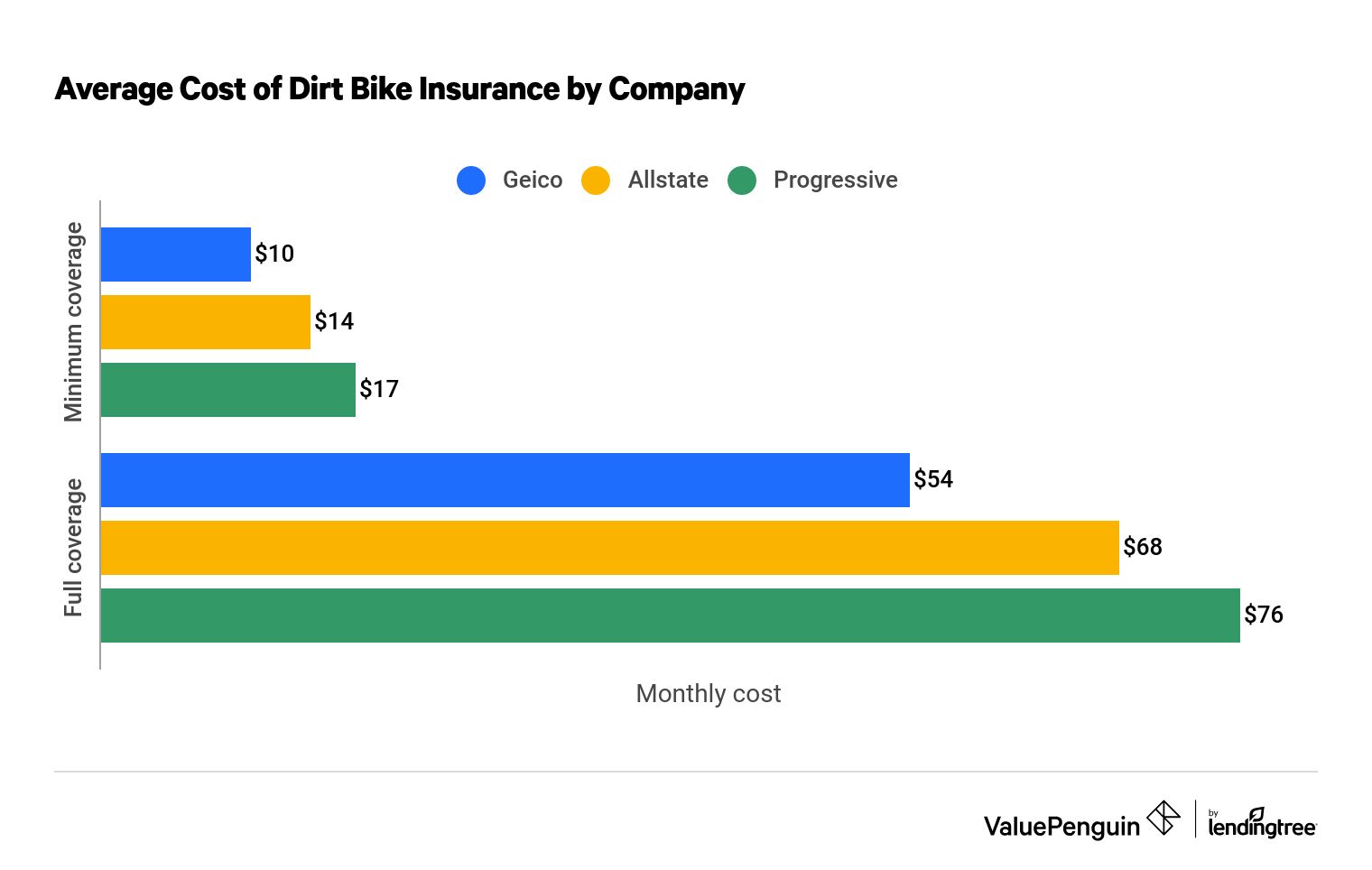

Cheap dirt bike insurance quotes by company

Minimum coverage

Full coverage

Company | Monthly rate | |

|---|---|---|

| Geico | $10 | |

| Progressive | $14 | |

| Allstate | $17 |

Minimum coverage

Company | Monthly rate | |

|---|---|---|

| Geico | $10 | |

| Progressive | $14 | |

| Allstate | $17 |

Full coverage

Company | Monthly rate | |

|---|---|---|

| Geico | $54 | |

| Progressive | $68 | |

| Allstate | $76 |

Dirt bike insurance discounts

There are a number of ways that dirt bike riders can save on insurance.

- Multipolicy discount

- Multivehicle discount

- Anti-theft device discount

- Safe driver discount

- Motorcycle safety course discount

Although it is highly recommended that all riders wear a helmet while on a dirt bike, helmets aren't often required by law and do not qualify you for a discount on dirt bike insurance.

Best cheap dirt bike insurance: Geico

-

Editor rating

- Minimum coverage: $10/mo

- Full coverage: $54/mo

Pros and cons

Geico has some of the cheapest dirt bike insurance rates available.

A minimum coverage policy from Geico costs around $115 per year for liability-only coverage, and full coverage costs an average of $644 per year. Geico offers motorcycle insurance payment plans, which is a great feature for riders who are on a tight budget and would rather not make one large lump-sum payment.

In addition to cheap dirt bike insurance policies, Geico also offers one of the best mobile apps for an insurance company. It can save you time on simple tasks like paying your bill, getting ID cards or making changes to your motorcycle insurance policy.

Best for custom dirt bikes: Progressive

-

Editor rating

- Minimum coverage: $17/mo

- Full coverage: $76/mo

Pros and cons

Progressive has the best dirt bike insurance for anyone who enjoys customizing their dirt bike.

Progressive's standard motorcycle policy comes with $3,000 of custom-parts coverage, and riders can purchase up to $30,000 of additional custom-parts coverage.

Its policy also includes full replacement cost coverage and no depreciation for parts. That means if you're in an accident and your bike is damaged, Progressive will pay for it to be fixed with brand new parts, regardless of wear and tear. Very few other dirt bike insurance companies offer such extensive coverage for custom dirt bikes.

Although coverage from Progressive is more expensive than Geico, riders can take advantage of a range of discounts to lower dirt bike insurance rates. You could save money if you have a clean driving history, sign up for automatic payments or get a quote at least one day before your policy starts.

Best for multiple dirt bikes: Allstate

-

Editor rating

- Minimum coverage: $14/mo

- Full coverage: $68/mo

Pros and cons

Allstate is great for riders who have multiple dirt bikes, ATVs and utility task vehicles (UTVs) because of its multi-motorcycle discount. In addition, Allstate offers transport trailer coverage for riders with full coverage, which protects your trailer and any bikes you're transporting.

Riders with a loan on their bike should also consider Allstate because it offers gap coverage. This coverage will pay the difference between what your bike is worth and the amount of your loan if it's stolen or totaled in an accident.

What dirt bike insurance covers

Basic dirt bike insurance policies include bodily injury and property damage liability coverage, but there are a number of optional coverages dirt bike owners should consider purchasing.

Most motorcycle insurance policies cover dirt bikes (as well as mopeds and scooters), so the same coverage is available for all-terrain vehicles.

Liability insurance

Bodily injury and property damage liability coverage are required for street-legal vehicles and included in every dirt bike insurance policy. They cover any injuries or damage a rider causes to others while operating their dirt bike.

Dirt bikes are typically not allowed on streets, so while property damage claims might seem less likely, they can still happen. A dirt biker might crash into another biker or accidentally ride somewhere they aren't permitted and damage a trail, lawn or crop they are then responsible for repairing.

Medical payments or PIP

Personal injury protection (PIP) or medical payments coverage may be required in some states and optional in others. These types of coverage help pay your medical bills if you're injured while riding your dirt bike, regardless of whose fault it is.

Comprehensive and collision

Collision and comprehensive coverage help pay for damage to your bike, regardless of whose fault it is.

- Collision coverage helps pay for damage if you crash into another vehicle, an object or a rough patch of terrain.

- Comprehensive coverage will pay for damage outside of your control, like theft, vandalism or weather damage.

If a rider purchases collision and comprehensive coverages, they choose a deductible for each one.

Every rider should consider collision and comprehensive coverage if they use their bike for more than leisurely activity. For example, if you're a farmer who uses a dirt bike to cross your own property, or you're a kid who rides your dirt bike to school, it's important that your bike is repaired or replaced as quickly as possible.

Uninsured/underinsured motorist

Uninsured/underinsured motorist coverage (UM/UIM) protects riders and their dirt bikes from other riders who don't have enough insurance.

If an uninsured or underinsured motorist causes an accident and cannot pay for damage to a rider or their bike, this coverage can help pay for medical and property damage expenses.

Not covered: Motocross/racing

A standard dirt bike insurance policy will not cover bikes used for motocross or organized racing events. That's because racing is more dangerous than casual riding.

Typically, racetracks offer a special motocross insurance policy or coverage participants can purchase.

Frequently asked questions

Should you get insurance on a dirt bike?

Dirt bike riders should always buy an insurance policy, even if it's not required in their state. Dirt bike insurance will help pay for any damage or injuries you cause while riding your bike. Full coverage insurance can also protect against dirt bike theft and damage.

What does insurance cover on a dirt bike?

At a minimum, dirt bike insurance covers injuries to other people and damage to their property that you cause while riding your bike.

Riders can also buy extra protection. Some of the most common add-ons are comprehensive and collision coverage, which will help pay to replace your bike if it's stolen or cover the cost of repairs after damage, and medical payments coverage, which pays your medical bills if you're injured while riding. Many companies also offer extra protection for custom parts and roadside assistance.

How much does dirt bike insurance cost?

Dirt bike insurance costs $13 per month, on average, for minimum coverage insurance. Full coverage insurance costs around $66 per month, and it protects your bike against damage or theft.

Are dirt bikes covered by homeowners insurance?

Your dirt bike is most likely not covered by your homeowners insurance policy, and neither is a motorcycle or ATV. Even if your dirt bike is stored inside your home, garage or shed on your property, it will most likely not be covered if it is damaged or stolen.

Methodology

To find the best cheap dirt bike insurance, ValuePenguin gathered quotes for addresses in five of the largest cities across California. We compared rates from three of the top insurance companies that offer online motorcycle insurance quotes: Allstate, Progressive and Geico.

Quotes are for a 30-year-old single man with 10 years of riding experience and a clean driving record who owns a 2023 Honda CRF250F.

Minimum coverage rates are based on the California state requirements. Full coverage rates include higher liability limits, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist coverage: $50,000 per person/$100,000 per accident

- Medical payments: $5,000

- Comprehensive and collision deductible: $500

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.