How Much Does Car Insurance Cost for a Subaru BRZ?

Find Cheap Subaru Auto Insurance Quotes

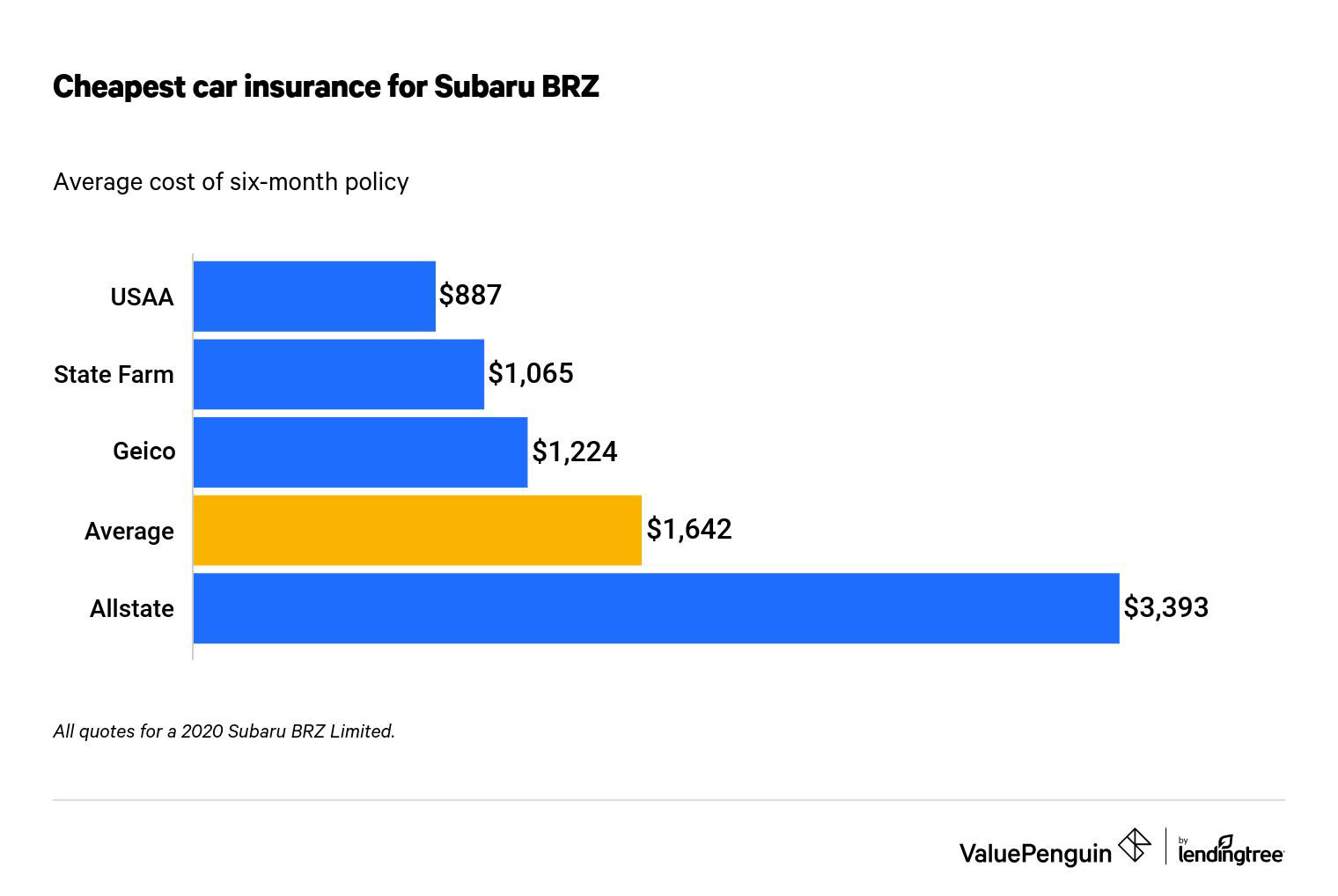

The average cost of car insurance for a 2020 Subaru BRZ is $1,642 for a six-month policy. How much you pay for insurance depends on which company you work with, the year and make of your car and your driver profile and record.

USAA offers the cheapest insurance for this two-door sports car, charging 46% less than the average for a six-month policy. State Farm comes in second place, offering rates that are 35% cheaper than average.

Who has the cheapest car insurance for a Subaru BRZ?

Research pulling auto insurance quotes from four widely available insurers found that USAA offers the best deal for a Subaru BRZ. A six-month, full coverage policy from USAA costs only $887 — just about half of what it costs to insure a 2020 BRZ.

Find Cheap Subaru Auto Insurance Quotes

State Farm offers the second-most-affordable rates after USAA. A six-month, full coverage policy for a 2020 Subaru BRZ from State Farm costs $1,065, which is 35% cheaper than average. USAA only offers insurance to members of the military community, so if that doesn't describe you, consider buying a policy from State Farm.

Cheapest car insurance for a Subaru BRZ

Company | Average cost of a six-month policy | |

|---|---|---|

| USAA | $887 | |

| State Farm | $1,065 | |

| Geico | $1,224 | |

| Allstate | $3,393 | |

| Average | $1,642 |

All quotes for a 2020 Subaru BRZ Limited.

Allstate quoted the highest prices for the sample driver: A six-month policy costs $3,393. That's more than double (an increase of 107%) the average and almost three times (283%) more costly than what USAA charges.

The cost to insure a Subaru BRZ changes with every company, which shows why it's important to contact multiple insurance companies to find the best deal.

How does driver age impact auto insurance costs for a Subaru BRZ?

Subaru BRZ insurance for an 18-year-old costs much more than a similar insurance policy for an older driver.

Auto insurers charge young Subaru BRZ drivers, on average, $3,983 for a six-month policy. That's 2.4 times more than the average rate for a 30-year-old.

Average cost for Subaru BRZ car insurance for an 18-year-old

Insurer | six-month rate |

|---|---|

| USAA | $1,580 |

| Geico | $2,666 |

| State Farm | $3,169 |

| Average | $3,983 |

| Allstate | $8,518 |

All quotes for a 2020 Subaru BRZ Limited.

Eighteen-year-old drivers who need insurance for a Subaru BRZ should consider getting a policy from either USAA or Geico. While State Farm offers the second-cheapest rates to a 30-year-old driver, Geico offers the second-cheapest rates to an 18-year-old driver, charging an average of $2,666 for a six-month policy.

USAA offers the cheapest rates overall to an 18-year-old driver, with an average six-month policy cost of $1,580.

Insurance companies typically raise rates for younger drivers because they lack driving experience and pose a greater risk on the roads. The best way for young drivers to reduce their car insurance costs is to join a parent's or guardian's policy.

How does car age impact car insurance costs for a Subaru BRZ?

The age of your Subaru BRZ will only moderately impact your insurance rates. It costs $1,218 on average to insure a 2013 Subaru BRZ for six months — 29% less than a 2020 Subaru BRZ.

Model year | Average cost of six-month policy | Percent decrease vs. 2020 Subaru BRZ |

|---|---|---|

| 2013 | $1,161 | 29% |

| 2015 | $1,253 | 24% |

| 2016 | $1,296 | 21% |

| 2017 | $1,378 | 16% |

| 2018 | $1,415 | 14% |

| 2019 | $1,573 | 4% |

The difference is even smaller when comparing Subaru BRZ models after 2013.

If you drive an older Subaru BRZ, don't expect to see too much of a difference on your monthly auto insurance rates.

USAA offers the most competitive prices for most older Subaru BRZ models. However, drivers of the 2017 Subaru BRZ should note that State Farm offers better prices than USAA. A six-month State Farm policy costs $956 on average, while a USAA policy of the same duration costs $997.

How much is car insurance for a Subaru BRZ vs. other two-door sports cars?

Insurance for a 2020 Subaru BRZ is moderately affordable compared to similar cars from competitors. For example, a six-month insurance policy for the 2020 Mazda MX-5 Miata Sport, a two-door convertible, averages $455 less than an insurance policy for a 2020 Subaru BRZ.

Car model | Average cost of six-month policy | 2020 MSRP* | Years available |

|---|---|---|---|

| Subaru BRZ Limited | $1,642 | $28,845 | 2013-2023 |

| Toyota 86 | $1,806 | $27,060 | 2017-2023 |

| Mazda MX-5 Miata Sport | $1,187 | $26,580 | 2017-2022 |

| Nissan 370Z | $1,838 | $30,090 | 2009-2021 |

| Scion FR-S | $1,377 | $23,000 | 2013-2016 |

*MSRP is the manufacturer's original suggested retail price for the 2020 model of the car, except for the Scion FR-S, which was only manufactured until 2016.

The Scion FR-S, another popular competitor to the Subaru BRZ, also boasts lower insurance costs. The average cost of a six-month policy for an FR-S is $1,377 — $265 cheaper than an insurance policy for a 2020 Subaru BRZ Limited. This may be due in part to the fact that it's an older car.

However, some other two-door sports cars do cost more to insure than the Subaru BRZ. The Toyota 86, for instance, costs $1,806 for a six-month policy, and the Nissan 370Z costs $1,838 for a policy of the same duration. Shoppers looking to buy one of these cars should factor the cost of insurance into their considerations, as rates vary a lot even among very similar cars.

The Subaru BRZ has similar insurance rates to the Subaru WRX.

Methodology

This article analyzes quotes from four major national insurers, looking at the average insurance costs for the Subaru BRZ Limited in model years 2013, 2015, 2016, 2017, 2018, 2019 and 2020. Quotes were also considered for the 2020 base models of several competitor cars, including the Toyota 86, the Mazda MX-5 Miata Sport and the Nissan 370Z. Toyota discontinued the Scion line starting with the 2017 model year, so quote and MSRP data reflect numbers from that year.

The sample driver was a 30-year-old man who started driving at age 16. He has a clean driving record and a fair credit score. Quotes were drawn from all available ZIP codes in Texas. For the purposes of age comparison, quotes for an 18-year-old driver of a 2020 Subaru BRZ Limited were also pulled.

All car insurance quotes include the following coverages:

Coverage | Limit |

|---|---|

| Liability, bodily injury | $50,000 per person/$100,000 per accident |

| Liability, property damage | $25,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Uninsured/underinsured motorist property damage | Not included |

| Comprehensive | $500 deductible |

| Collision | $500 |

| Personal injury protection (PIP)/medical payments | Not included |

| All other coverages (e.g., towing and loss of use) | Not included |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Insurance Writer

Nancy is a former Technical Writer at ValuePenguin, focusing primarily on auto insurance. Prior to joining the ValuePenguin team, she worked as a public relations professional, helping clients develop and publish op-eds in outlets such as CNN, U.S. News and USA Today. She holds a master's degree in English from Georgetown University.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.