Subaru WRX Insurance: Average Cost and Cheapest Quotes

The average insurance cost for a 2022 Subaru WRX is $244 per month for a full-coverage policy.

Find Cheap Subaru WRX Insurance Quotes

However, the price depends on whether you opt for the WRX, the high-performance WRX STI or the base-model Impreza.

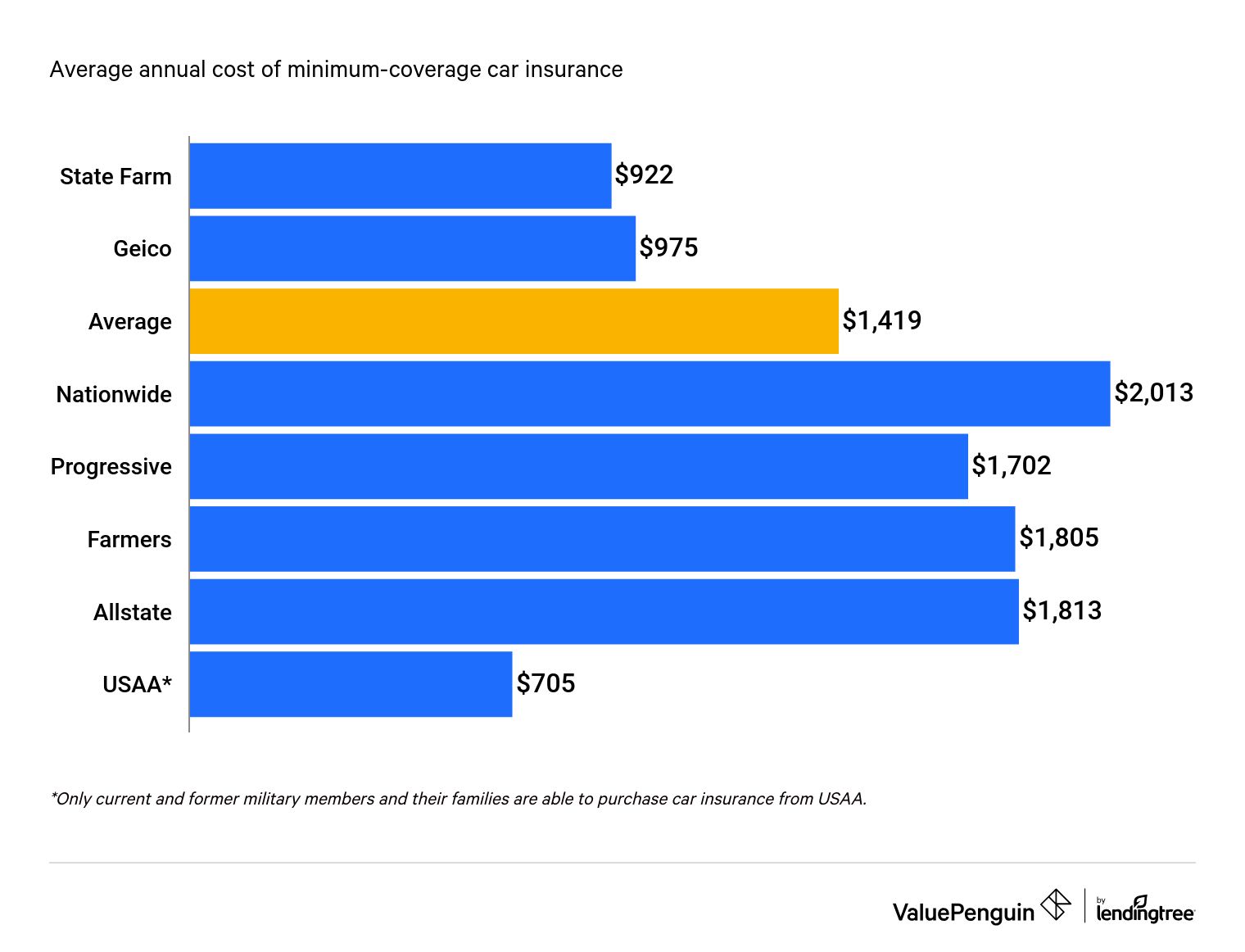

Drivers can save an average of 49% on Subaru WRX insurance by choosing the cheapest company, State Farm.

How much is insurance for my Subaru WRX?

Who has the cheapest insurance for a Subaru WRX?

State Farm offers the cheapest car insurance for Subaru WRX drivers. Across the five model years studied, a minimum coverage policy from State Farm cost $36 per month, on average. That's $27 cheaper than the average for a Subaru WRX.

Find Cheap Subaru WRX Insurance Quotes

Drivers shopping for full coverage can also find the cheapest quotes from State Farm. A policy costs $121 per month — 50% cheaper than average.

Cost of Subaru WRX insurance by company

Company | Minimum coverage | Full coverage | |

|---|---|---|---|

| State Farm | $37 | $121 | |

| Allstate | $59 | $354 | |

| Geico | $61 | $178 | |

| Progressive | $71 | $293 | |

| Nationwide | $87 | $252 |

*Only military members and their families can buy car insurance through USAA.

Is it cheaper to insure an older Subaru WRX?

The price of insuring a WRX doesn't change much over time. Full coverage for a 2022 WRX is only 5% less than for a 2018 model.

The most expensive WRX model year to insure is the 2021 edition, which costs an average of $254 per month to insure.

To reduce your rate, one method is to increase your deductible for comprehensive and collision coverages. A higher deductible means a lower premium, because it means the company pays less if you have an accident.

You could also consider removing comprehensive and collision from your policy altogether, as these become less important as your car loses value over time.

2022 Subaru WRX insurance

State Farm has the cheapest rates for 2022 Subaru WRX owners. Full coverage costs $115 per month, which is $42 per month less than the next-cheapest company, Geico.

State Farm | $36 | $115 |

|---|---|---|

| Geico | $61 | $156 |

| Allstate | $64 | $331 |

| Progressive | $69 | $322 |

*USAA car insurance is only available for members of the military and their families

Average insurance cost for a 2022 Subaru WRX

Minimum coverage: $63 per month

Full coverage: $224 per month

2021 Subaru WRX insurance

Owners of the 2021 Subaru WRX can find the cheapest quotes from State Farm. Full coverage car insurance costs $128 per month, which is half as expensive as the average.

Company | Minimum coverage | Full coverage |

|---|---|---|

| State Farm | $38 | $128 |

| Allstate | $49 | $390 |

| Geico | $61 | $191 |

*USAA car insurance is only available for members of the military and their families

Average insurance cost for a 2021 Subaru WRX

Minimum coverage: $59 per month

Full coverage: $254 per month

2020 Subaru WRX insurance

The cheapest rates for 2020 Subaru WRX insurance come from State Farm. A full coverage policy costs $124 per month — $129 per month cheaper than average.

Company | Minimum coverage | Full coverage |

|---|---|---|

| State Farm | $38 | $124 |

| Allstate | $58 | $374 |

| Geico | $61 | $184 |

*USAA car insurance is only available for members of the military and their families

Average insurance cost for a 2020 Subaru WRX

Minimum coverage: $64 per month

Full coverage: $253 per month

2019 Subaru WRX insurance

State Farm has the cheapest insurance rates for people who drive a 2019 Subaru WRX. Full coverage costs $120 per month — 51% cheaper than average.

Company | Minimum coverage | Full coverage |

|---|---|---|

| State Farm | $38 | $120 |

| Allstate | $58 | $352 |

| Geico | $62 | $182 |

*USAA car insurance is only available for members of the military and their families

Average insurance cost for a 2019 Subaru WRX

Minimum coverage: $65 per month

Full coverage: $246 per month

2018 Subaru WRX insurance

The most affordable quotes for a 2018 Subaru WRX come from State Farm, where a full coverage policy costs $117 per month. That's $119 per month cheaper than average for that model year.

Company | Minimum coverage | Full coverage |

|---|---|---|

| State Farm | $38 | $117 |

| Geico | $62 | $178 |

| Allstate | $64 | $322 |

*USAA car insurance is only available for members of the military and their families

Average insurance cost for a 2018 Subaru WRX

Minimum coverage: $66 per month

Full coverage: $236 per month

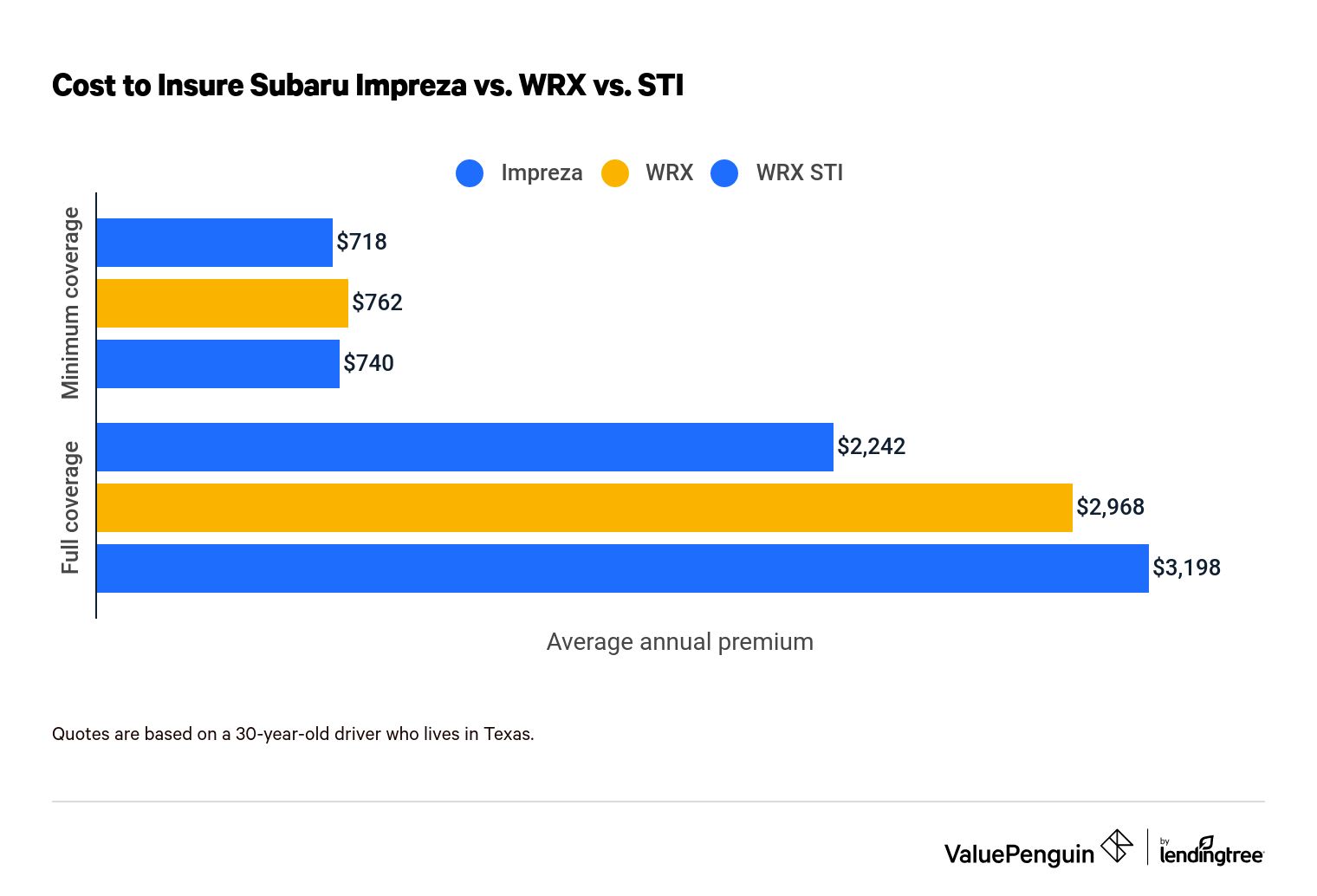

How do insurance costs for WRX, STI and Impreza compare?

Insurance for the more powerful Subaru WRX STI costs $267 per month for a full coverage policy — 8% more expensive than the same coverage for a standard WRX. The STI's upgraded engine, sport-tuned suspension and other design upgrades account for the higher insurance prices.

On the other hand, the cost to insure a Subaru Impreza, the base model upon which the WRX was designed, is just $187 per month — 24% cheaper than the WRX.

Cost of Subaru car insurance by model

Model | Minimum coverage | Full coverage |

|---|---|---|

| Impreza | $60 | $187 |

| WRX | $64 | $247 |

| WRX STI | $62 | $267 |

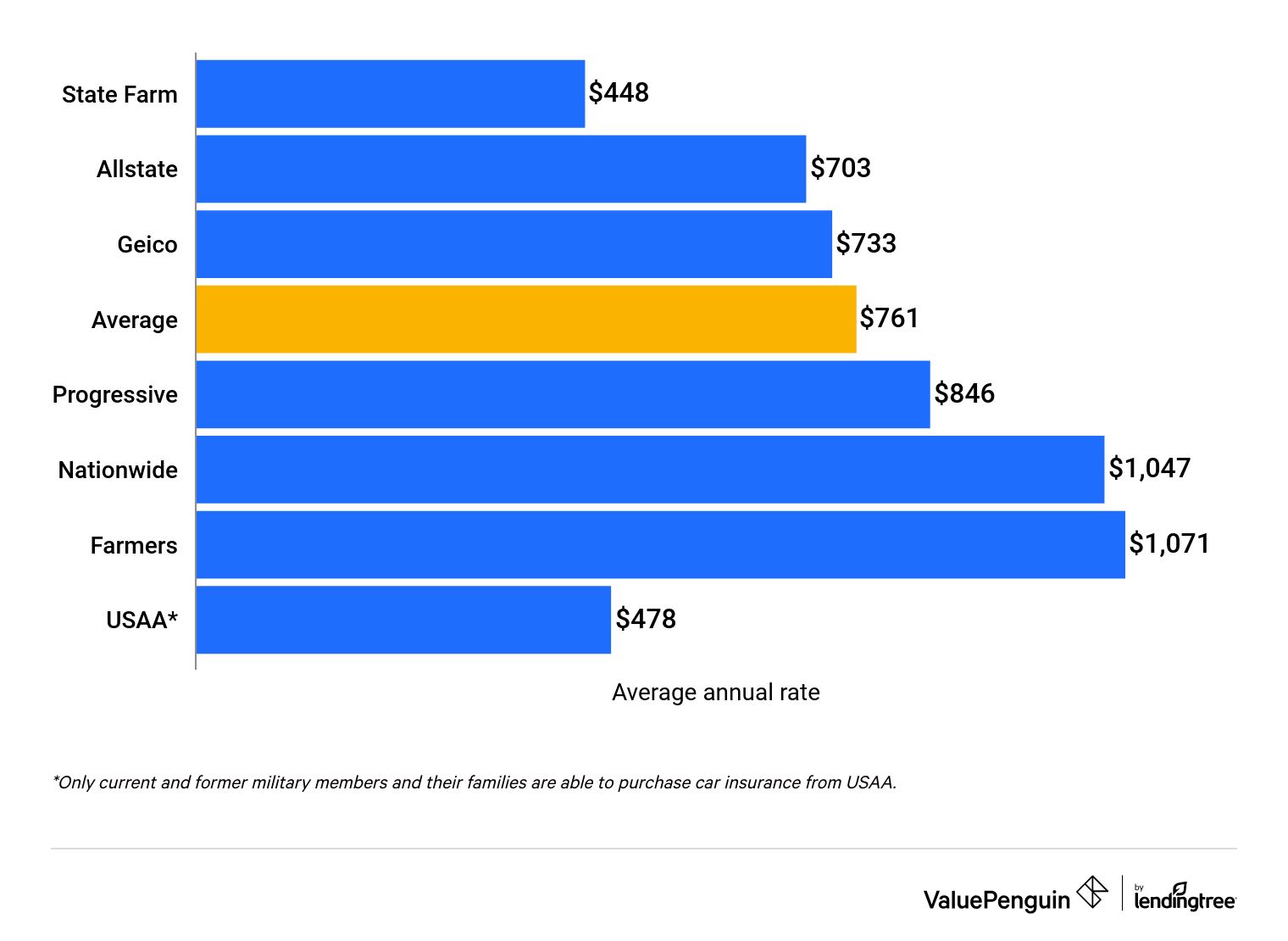

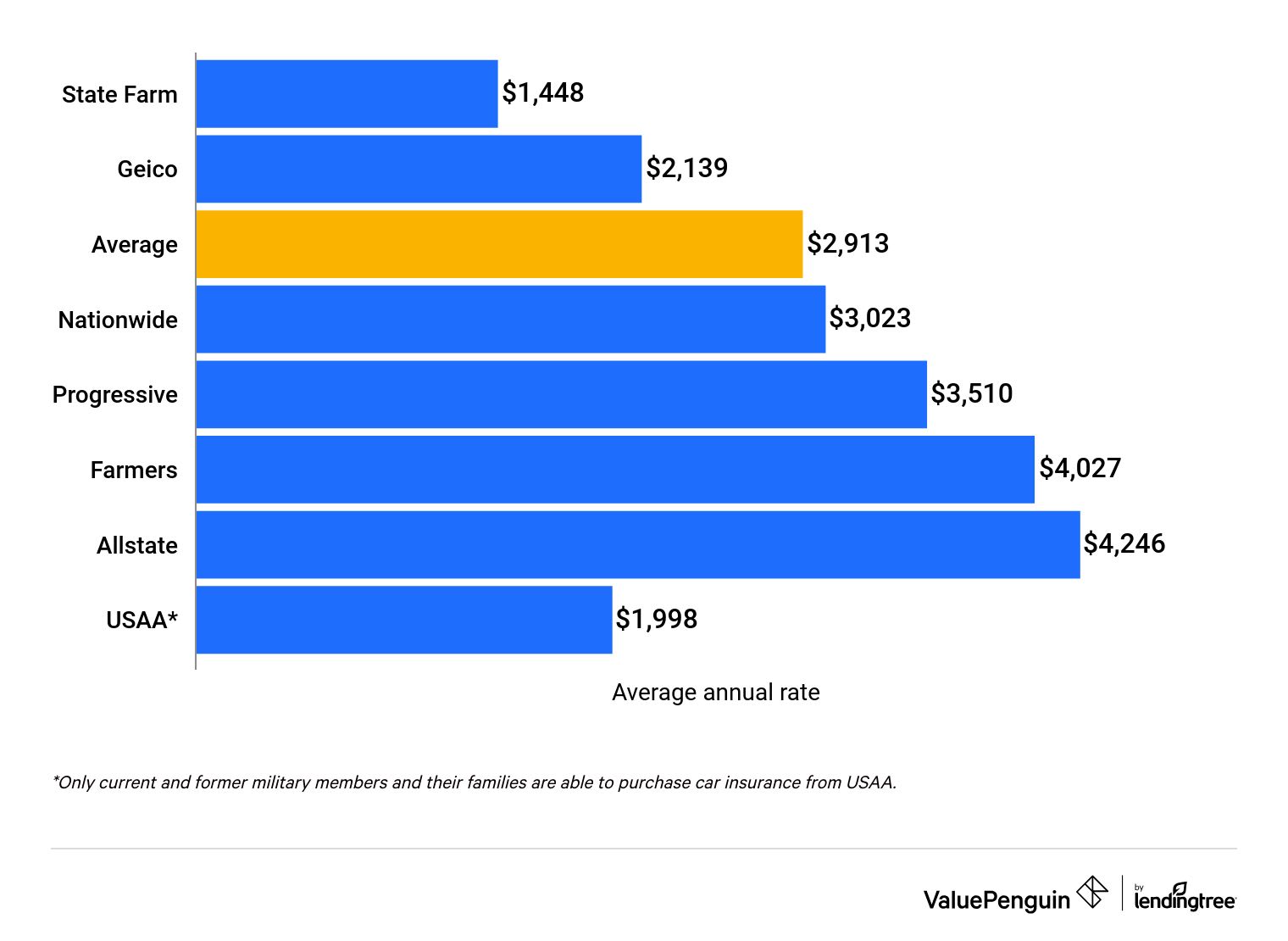

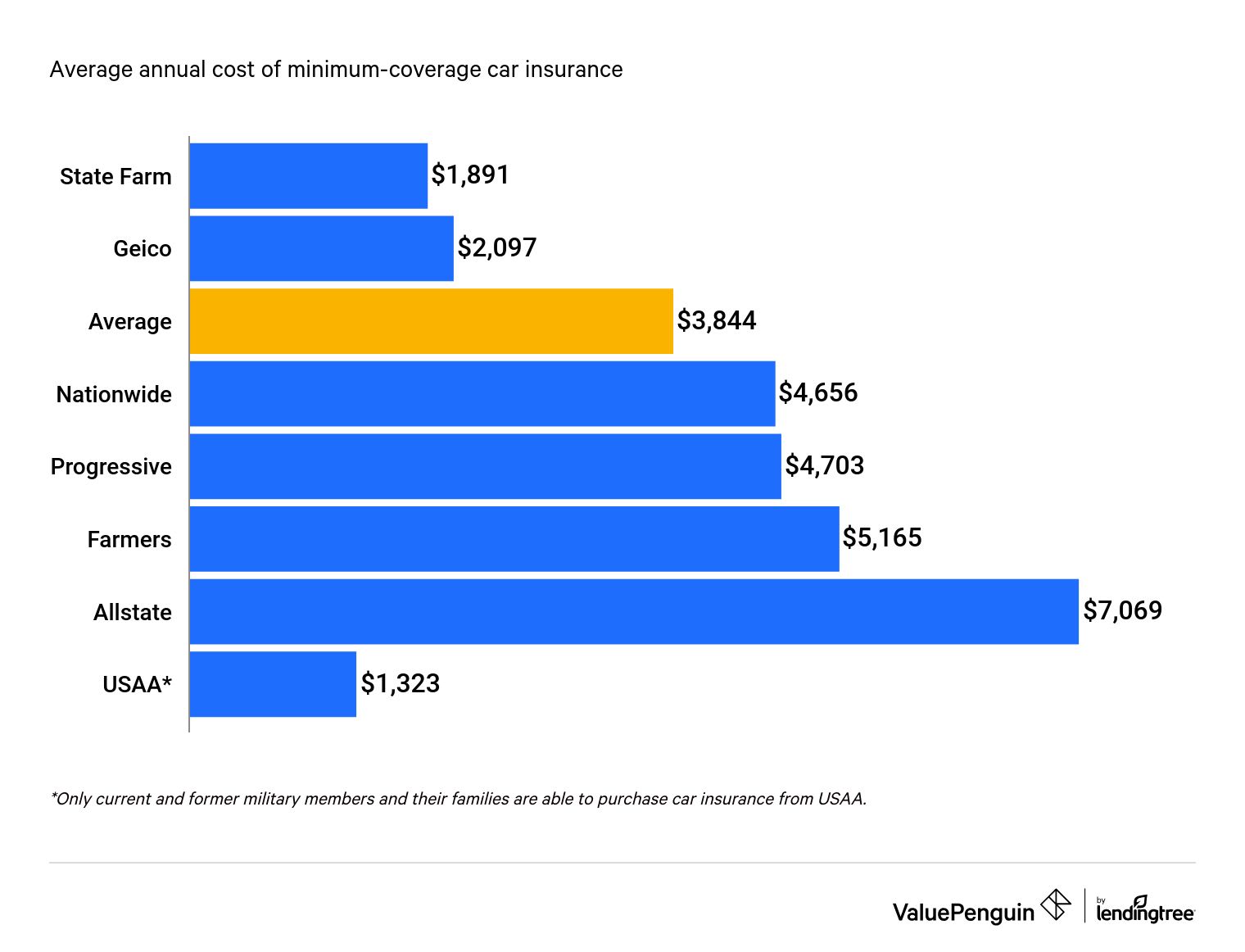

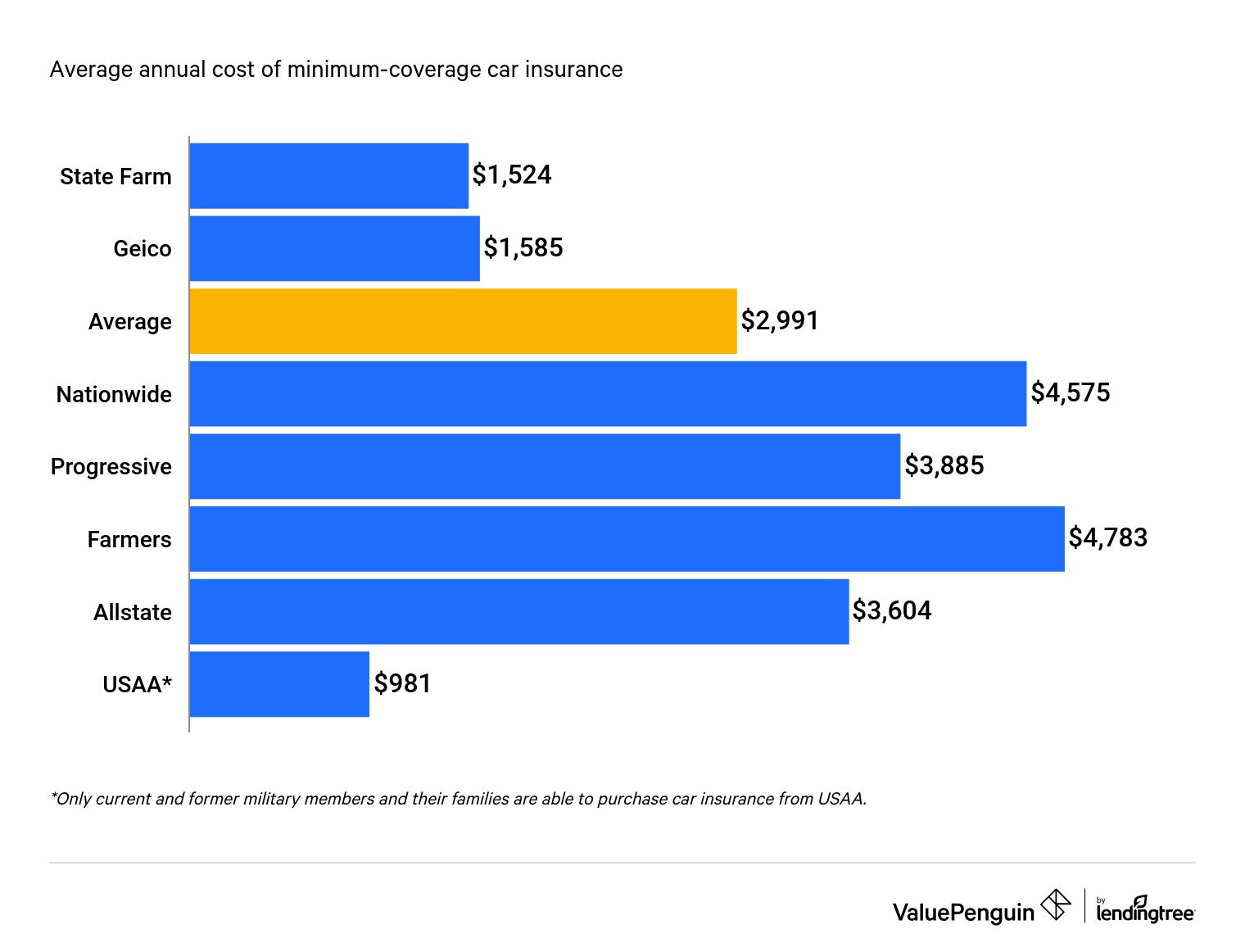

Subaru WRX insurance for young drivers

Young drivers generally pay much more for car insurance, and WRX drivers are no exception. Subaru WRX insurance for a 16-year-old costs $320 per month for minimum coverage — that's four times as expensive as the same coverage for a 30-year-old driver.

In comparison, an 18-year-old Subaru WRX driver can expect to pay $249 per month, while minimum coverage costs $118 per month for a 21-year-old driver, on average.

Cost of Subaru WRX insurance by driver age

Age 16

Age 18

Age 21

State Farm offers the cheapest quotes for a 16-year-old Subaru WRX driver. At $158 per month, a minimum-coverage policy from State Farm costs 51% less than average.

Drivers who have a family member in the military should also consider getting a quote from USAA. Their policy costs $110 per month, which is $210 cheaper than average.

Age 16

State Farm offers the cheapest quotes for a 16-year-old Subaru WRX driver. At $158 per month, a minimum-coverage policy from State Farm costs 51% less than average.

Drivers who have a family member in the military should also consider getting a quote from USAA. Their policy costs $110 per month, which is $210 cheaper than average.

Age 18

State Farm offers the most affordable insurance for 18-year-old Subaru WRX drivers at $127 per month for minimum coverage. That's $122 per month less than the average rate.

Drivers who are active-duty military or have a family member who has served should compare quotes from USAA. At $82 per month, a minimum coverage policy is 67% cheaper than average.

Age 21

The cheapest quotes for 21-year-old Subaru WRX drivers come from State Farm, where a minimum coverage policy costs $77 per month. That's 35% cheaper than average.

Active-duty military members and drivers with a family member who has served in the armed forces can find even lower rates from USAA. A minimum coverage policy costs $59 per month, which is $59 per month less expensive than average — exactly half the cost.

Find Cheap Subaru WRX Insurance Quotes

Average annual minimum coverage rates

Company | 16-year-old | 18-year-old | 21-year-old |

|---|---|---|---|

| State Farm | $158 | $127 | $77 |

| Geico | $175 | $132 | $81 |

| Average | $320 | $249 | $118 |

| Nationwide | $388 | $381 | $168 |

| Progressive | $392 | $324 | $142 |

*USAA car insurance is only available to military members, veterans and their families.

Rates for young drivers vary greatly between companies. There's a difference of $479 per month between the most and least expensive insurance companies for 16-year-old drivers, which is why it's so important to compare car insurance rates from multiple companies before choosing a policy.

Frequently asked questions

How much does it cost to insure a Subaru WRX?

The average cost of full coverage car insurance for a Subaru WRX is $247 per month over the five model years studied. Minimum coverage costs $64 per month, on average.

How much is insurance for a Subaru Impreza?

Full coverage car insurance rates for a are $187 per month, on average. In comparison, a minimum coverage policy costs $60 per month.

How much is insurance on a Subaru WRX STI?

Subaru STI insurance costs $267 per month for a full coverage policy and $62 per month for minimum coverage, on average.

Is WRX insurance expensive?

Yes, Subaru WRX insurance is expensive compared with insurance for other sports cars. The average cost of full coverage for a car with a zero-to-60 time of less than five seconds is $241 per month. In comparison, the WRX has a zero-to-60 speed of 5.2 seconds, and insurance costs $6 more per month, on average.

Methodology

Quotes were collected for the Subaru WRX, WRX STI and Impreza for the 2018–22 model years. Rates were gathered for ZIP codes across Texas from seven major insurance companies: Allstate, Farmers, Geico, Nationwide, Progressive, State Farm and USAA.

Quotes are based on a 30-year-old male driver with a clean driving record and average credit score, except where noted. All insurance quotes include the following coverages:

Coverage | Minimum coverage | Full coverage |

|---|---|---|

| Bodily injury liability (BI) | $30,000 and $60,000 | $50,000 and $100,000 |

| Property damage liability (PD) | $25,000 | $25,000 |

| Uninsured motorist and underinsured motorist BI | Waived | $50,000 and $100,000 |

| Comprehensive | Waived | $500 deductible |

| Collision | Waived | $500 deductible |

Quadrant Information Services supplied the rate data used in this analysis. Quotes were publicly sourced from insurance company filings and are intended for comparative purposes only. Your own quotes will likely differ.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.