How Much Is Car Insurance for a Chevrolet Camaro?

Find Cheap Chevrolet Camaro Auto Insurance Quotes

We collected quotes for eight model years and found that, on average, it costs $2,294 per year to insure a Camaro. Progressive offered the cheapest car insurance quotes for our sample Chevy Camaro driver, with an average annual rate of $1,875.

Cheapest insurance for the Chevrolet Camaro: Progressive

Progressive has the cheapest insurance for Camaro owners. A 30-year-old's rates are 18% cheaper than average. That's $447 per year less than average.

Find Cheap Chevrolet Camaro Auto Insurance Quotes

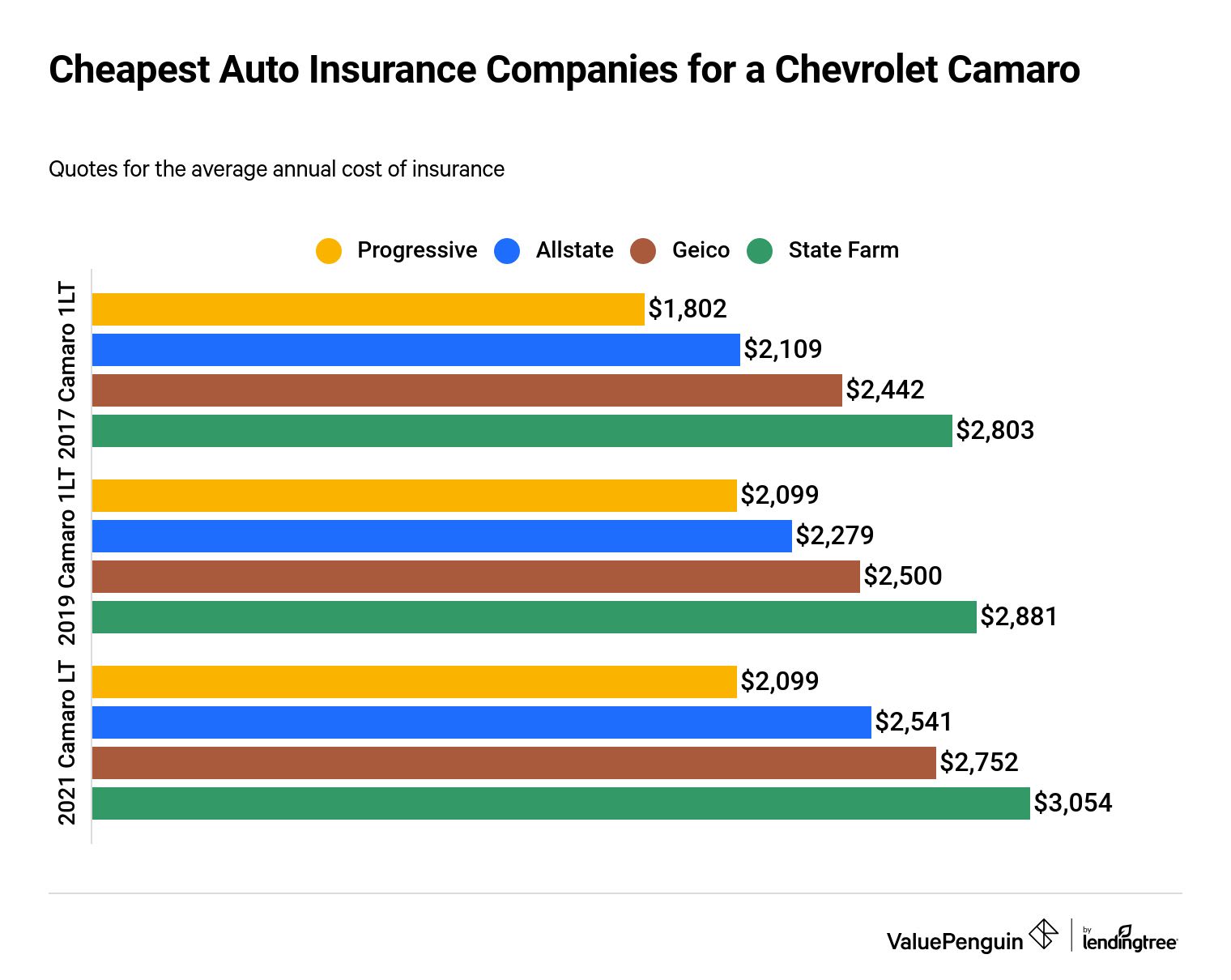

Allstate has the second-cheapest insurance for a Camaro. A policy for a 2017 Camaro costs $2,109 per year. That's 14% less than average. Plus, Geico's car insurance rates were, on average, 21% less than the most expensive company we surveyed, State Farm.

Average cost of Camaro insurance by year model

Company | 2017 Camaro | 2019 Camaro | 2021 Camaro |

|---|---|---|---|

| Progressive | $1,802 | $2,099 | $2,099 |

| Allstate | $2,109 | $2,279 | $2,541 |

| Geico | $2,442 | $2,500 | $2,752 |

| State Farm | $2,803 | $2,881 | $3,054 |

Average cost of Chevy Camaro insurance

Camaro vehicle value and insurance rates are closely related. New and expensive models from 2018 to 2021 usually have higher rates than older vehicles.

The 2014 Chevy Camaro has the cheapest quotes, $1,954 per year. This is 25% less than the cost to insure a 2021 Camaro — the model with the highest insurance costs.

Average car insurance cost of Chevrolet Camaro LT by year

Model | Price | Average car insurance cost |

|---|---|---|

| 2021 Chevrolet Camaro LT | $25,500 | $2,612 |

| 2020 Chevrolet Camaro LT | $25,500 | $2,526 |

| 2019 Chevrolet Camaro 1LT | $25,500 | $2,440 |

| 2018 Chevrolet Camaro LT | $26,700 | $2,362 |

| 2017 Chevrolet Camaro LT | $26,600 | $2,289 |

| 2016 Chevrolet Camaro 1LT | $25,700 | $2,154 |

| 2015 Chevrolet Camaro LT | $26,005 | $2,011 |

| 2014 Chevrolet Camaro LT | $25,855 | $1,954 |

Insurance rates represent the annual cost of a full coverage policy for a 30-year-old male driver.

Trim level also affects Camaro insurance rates. Higher trim levels usually mean higher rates. Trim level can strongly influence a vehicle's value. The value of your car affects how much your insurance company will have to pay out if you have a comprehensive or collision insurance claim.

For example, the 2021 Chevy Camaro SS costs $37,500. That's more than 47% more expensive than the 2021 Camaro LT, a cheaper trim level. Because of this value difference, Camaro SS owners will likely pay more for insurance than Camaro LT owners.

Another factor that affects how much it costs to insure a Camaro is your age. In general, younger drivers can expect to pay much more for car insurance than older drivers. Camaro insurance for a 21-year-old driver is 32% more expensive, on average, than it is for a 30-year-old.

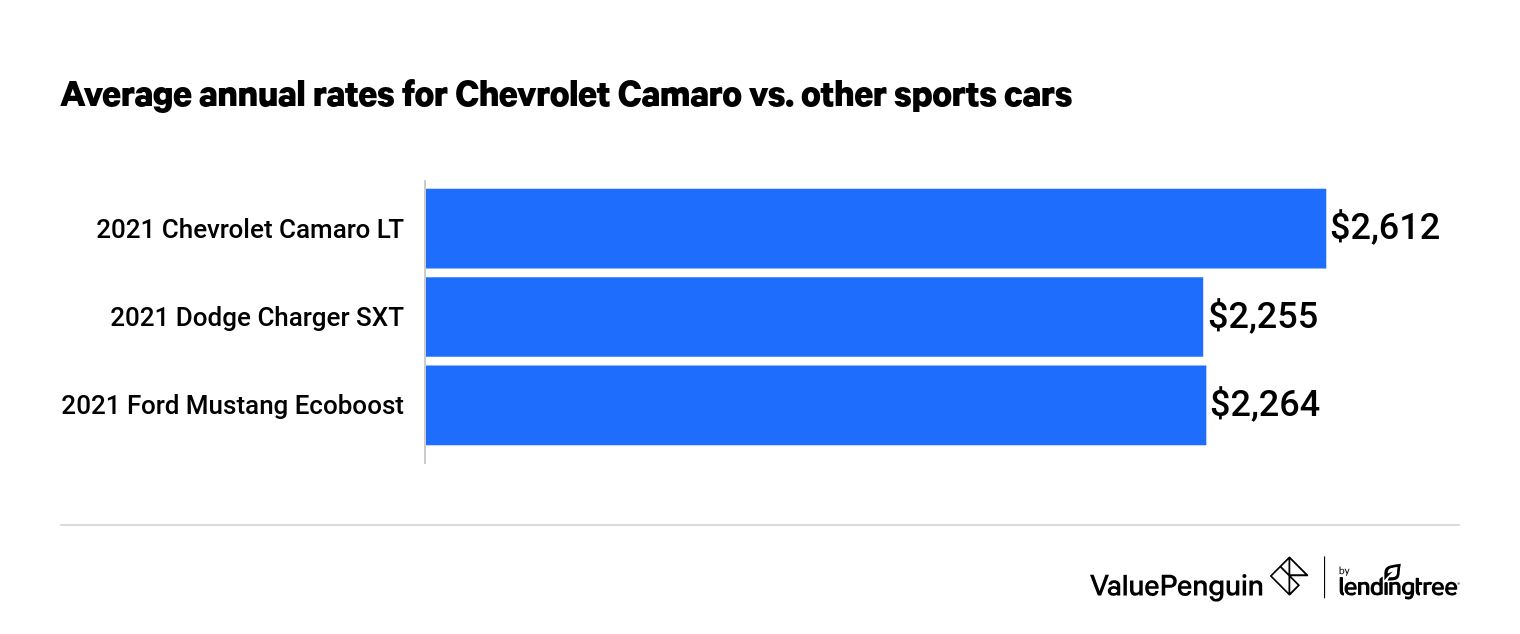

How Camaro insurance costs compare to other vehicles

The Chevy Camaro is more expensive to insure than other muscle cars like the Ford Mustang and Dodge Charger.

Insuring a 2021 Camaro costs $2,612 per year. That's 14% more expensive than the 2021 Dodge Charger and 13% more expensive than the 2021 Ford Mustang. But the 2013 Chevrolet Camaro ZL1 is the second-cheapest muscle car to insure for young drivers.

Methodology

We gathered quotes from the largest auto insurance companies— State Farm, Progressive, Geico and Allstate — across dozens of ZIP codes in California. Quotes are for a 30-year-old male driver with a clean record. We gave him the following coverage limits:

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person; $100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person; $100,000 per accident |

| Comprehensive and collision | $500 deductible |

Car prices were obtained from Cars.com.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.