Cheapest Car Insurance in Texas (Best Rates in 2026)

State Farm is the cheapest car insurance company in Texas at $140 per month for full coverage. That's $106 per month cheaper than the Texas average.

Find Cheap Auto Insurance Quotes in Texas

Cheapest and best car insurance in Texas

- Cheapest full coverage: State Farm, $140/mo

- Cheapest minimum liability: State Farm, $56/mo

- Cheapest for young drivers: Geico, $161/mo

- Cheapest after a ticket: State Farm, $140/mo

- Cheapest after an accident: State Farm, $163/mo

- Cheapest for teens after a ticket: State Farm, $187/mo

- Cheapest after a DUI: State Farm, $142/mo

- Cheapest for poor credit: AAA, $337/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

State Farm has the best mix of great customer service and cheap rates in Texas. USAA is also an excellent option, but only military members, veterans and some of their family members can buy a policy.

If rising rivers or lakes, heavy rainfall or storm surge damage your car, your insurance company will pay to fix or replace it only if you have comprehensive coverage.

Comprehensive coverage pays for damage outside of your control, also called "acts of God." This includes flooding — like the Texas Hill Country floods — fallen tree branches, theft or an accident with an animal.

Full coverage policies typically include comprehensive coverage, along with collision coverage. While it's not required by the state of Texas, you usually have to get comprehensive coverage if you have a car loan or lease.

Best cheap auto insurance in Texas: State Farm

State Farm and USAA have the cheapest full coverage car insurance in Texas.

Find Cheap Auto Insurance Quotes in Texas

- State Farm is the best choice for most people because it has cheap quotes and great customer service. Its full coverage rates of $140 per month are 43% cheaper than the Texas average. The average cost in TX cities may vary.

- USAA has even cheaper rates, at $124 per month on average. But it's only available if you're in the military, you're a veteran or one of your family members had USAA at some point.

Best cheap full coverage car insurance in Texas

Company | Monthly rate | |

|---|---|---|

| State Farm | $140 | |

| Geico | $176 | |

| AAA | $202 | |

| Progressive | $283 | |

| Allstate | $556 |

*USAA is only available to current and former military members and their families.

Cheapest liability car insurance in Texas: State Farm

State Farm has the cheapest liability-only insurance in Texas, at $56 per month.

That's around two-thirds of the average cost of minimum liability coverage in Texas, which is $87 per month.

USAA also has very cheap rates for liability-only car insurance, at $46 per month. But USAA is only available to current and former military members and their families.

Cheapest quotes for liability car insurance in Texas

Company | Monthly rate |

|---|---|

| State Farm | $56 |

| Geico | $65 |

| AAA | $72 |

| Progressive | $102 |

| Allstate | $184 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Texas

Find the best cheap Texas car insurance near you

Cheapest car insurance in Texas for teens: Geico

Geico offers the most affordable car insurance rates for young drivers in Texas.

A minimum liability policy from Geico costs $161 per month for an 18-year-old, and full coverage costs $390 per month. That's around one-third less than the average for teens in Texas.

Most affordable car insurance in Texas for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $161 | $390 |

| State Farm | $187 | $397 |

| AAA | $189 | $420 |

| Progressive | $352 | $1,247 |

| Allstate | $387 | $927 |

*USAA is only available to current and former military members and their families.

Young drivers should get full coverage insurance if they drive a newer car and can afford it.

Teens are more likely to get into accidents than drivers with more experience. So a full coverage policy could be worth it because it pays for damage to your car, no matter who caused the crash.

The best way for young drivers to save money on their car insurance is by sharing a policy with their parents or an older relative.

Discounts can also help you save. For example, Geico and most other companies offer a good student discount if you earn a B average or better in school.

Cheap TX car insurance after a ticket: State Farm

State Farm has the cheapest full coverage insurance in Texas for drivers with a speeding ticket. The company charges an average of $140 per month for full coverage, which is less than half the state average of $297 per month. It's also nearly $100 per month less than the second-cheapest company, Geico.

Best TX car insurance quotes after a ticket

Company | Monthly rate |

|---|---|

| State Farm | $140 |

| Geico | $233 |

| AAA | $343 |

| Progressive | $366 |

| Allstate | $556 |

*USAA is only available to current and former military members and their families.

Auto insurance quotes in Texas go up by 20%, on average, after a single speeding ticket. But companies raise rates by different amounts. You may not see an increase with State Farm or Allstate.

Cheapest auto insurance in Texas after an accident: State Farm

State Farm has the cheapest auto insurance if you have an accident in Texas. A full coverage policy from State Farm costs $163 per month. That's around half as much as the second-cheapest company, Geico.

Low-cost auto insurance in Texas after an accident

Company | Monthly rate |

|---|---|

| State Farm | $163 |

| Geico | $307 |

| AAA | $343 |

| Progressive | $423 |

| Allstate | $875 |

*USAA is only available to current and former military members and their families.

Car insurance quotes in Texas go up by around 55% after an at-fault accident. That's a difference of around $136 per month for a full coverage policy.

Don't worry about switching car insurance companies right after your accident. Your current company won't raise your rates until your policy renews.

Instead, wait until you get your renewal offer in the mail or by email. Then, you should shop around for multiple quotes to make sure you're getting the best price.

Cheapest for Texas teens with a ticket or accident: State Farm

State Farm has the cheapest liability insurance in Texas for young drivers with a speeding ticket or accident on their record.

A minimum liability policy from State Farm costs around $187 per month for an 18-year-old with one speeding ticket. That's one-third cheaper than the state average.

Teen drivers pay an average of $210 per month for minimum coverage from State Farm after an at-fault accident. That's $137 per month less than the state average.

Cheap liability car insurance in Texas for teens with a bad record

Company | Ticket | Accident |

|---|---|---|

| State Farm | $187 | $210 |

| Geico | $198 | $260 |

| AAA | $321 | $321 |

| Progressive | $361 | $368 |

| Allstate | $387 | $711 |

*USAA is only available to current and former military members and their families.

Young drivers in Texas can expect minimum liability rates to increase by 16% after a speeding ticket and 49% after an accident.

It can be hard for Texas teens to find affordable insurance after a ticket or accident.

When shopping for insurance, make sure you're taking advantage of every discount you can qualify for. For example, State Farm's Drive Safe & Save program offers a discount to young drivers who complete an online safety course and practice driving with an older mentor.

Best cheap insurance in Texas after a DUI: State Farm

State Farm has the most affordable auto insurance in Texas after a DUI. Full coverage from State Farm costs $142 per month after a DUI, which is two-thirds cheaper than the state average. It's also less than half the cost of the second-cheapest company, Geico.

Cheap Texas car insurance rates after a DUI

Company | Monthly rate |

|---|---|

| State Farm | $142 |

| Geico | $317 |

| Progressive | $324 |

| AAA | $519 |

| Allstate | $854 |

*USAA is only available to current and former military members and their families.

In Texas, full coverage car insurance rates go up by an average of 62% after a DUI.

Drivers with a DUI may need SR-22 insurance in Texas. It typically costs between $15 and $50 for an insurance company to file an SR-22 form on your behalf, on top of any increase in your insurance rates.

Cheapest insurance in Texas for drivers with poor credit: AAA

AAA Insurance is the cheapest company in Texas for drivers with poor credit. A full coverage policy from AAA costs an average of $337 per month for a driver with a bad credit score. That's around one-third less than the Texas average of $536 per month.

Low-cost auto insurance in Texas if you have poor credit

Company | Monthly rate |

|---|---|

| AAA | $337 |

| Progressive | $398 |

| Geico | $457 |

| Allstate | $793 |

| State Farm | $1,035 |

*USAA is only available to current and former military members and their families.

Texas drivers with low credit scores pay twice as much for car insurance as those with good credit.

Your credit score doesn't reflect your driving ability. But insurance companies believe that drivers with poor credit are more likely to file a claim. This means you usually pay more if you have poor credit.

Best car insurance in Texas

USAA is the best auto insurance company in Texas, thanks to cheap rates and top customer service ratings.

However, USAA is only available to members of the military, veterans and some of their family members.

State Farm is the best choice for Texans not eligible for USAA. It has reliable customer service along with affordable rates.

Top-rated insurance companies in Texas

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA* | 735 | A++ | |

| State Farm | 650 | A++ | |

| AAA | 652 | ||

| Geico | 645 | A++ | |

| Progressive | 621 | A+ |

Average Texas car insurance cost by city

Marfa, a small city in West Texas, has the cheapest car insurance in Texas.

Drivers in Marfa pay an average of $191 per month for full coverage insurance.

The neighborhood of North Houston has the most expensive rate in the state, at $296 per month.

Texas car insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Abbott | $208 | -16% |

| Abernathy | $237 | -4% |

| Abilene | $215 | -13% |

| Abram | $234 | -5% |

| Ace | $233 | -6% |

In the Lone Star State, drivers pay an average of $247 per month for a full coverage policy. But average rates can vary by $105 per month for full coverage, depending on the city where you live.

Cheap car insurance in TX by driver type

State Farm is the cheapest car insurance company for most drivers in Texas.

Driver type | Cheapest company |

Monthly cost

|

|---|---|---|

| Cheapest minimum coverage | State Farm | $56 (36% savings) |

| Cheapest for a safe driver | State Farm | $140 (43% savings) |

| Cheapest after a ticket | State Farm | $140 (53% savings) |

| Cheapest after a DUI | State Farm | $142 (64% savings) |

| Cheapest for teens | Geico | $161 (31% savings) |

| Cheapest after an accident | State Farm | $163 (57% savings) |

| Cheapest for poor credit | AAA | $337 (37% savings) |

Texas minimum car insurance requirements

Texas drivers must have a minimum amount of liability insurance to drive legally. This requirement is sometimes written as 30/60/25.

- Bodily injury (BI) liability insurance: $30,000 per person and $60,000 per accident

- Property damage (PD) liability insurance: $25,000 per accident

Texas does not require personal injury protection (PIP), which pays for medical expenses and lost wages if you or a passenger is injured in an accident. However, you'll have to sign a waiver if you don't want this coverage.

What's the best car insurance coverage for Texas drivers?

Full coverage car insurance is the best choice for most drivers in Texas.

Full coverage car insurance is typically required by your lender if you have a car loan or lease.

It's also a good idea if your car is less than 8 years old or worth more than $5,000. This is because full coverage includes collision and comprehensive coverage, which pay for damage to your car, regardless of whose fault it is.

Full coverage also typically includes higher liability limits than the state requires. This is important because the Texas requirements may not be high enough to cover the cost of a serious accident.

For example, if you hit a brand-new pickup truck going at top speed on the freeway, $25,000 of property damage liability coverage probably won't be enough to fully replace or repair it.

Minimum liability policies are cheap, but they may not give you enough financial protection after an accident.

Minimum liability policies don't cover damage to your car because they don't include comprehensive and collision insurance.

However, minimum coverage may be right for you if you have an older car that you can easily afford to replace after a crash. Even if that's the case, it's a good idea to increase your liability coverage if you can afford it.

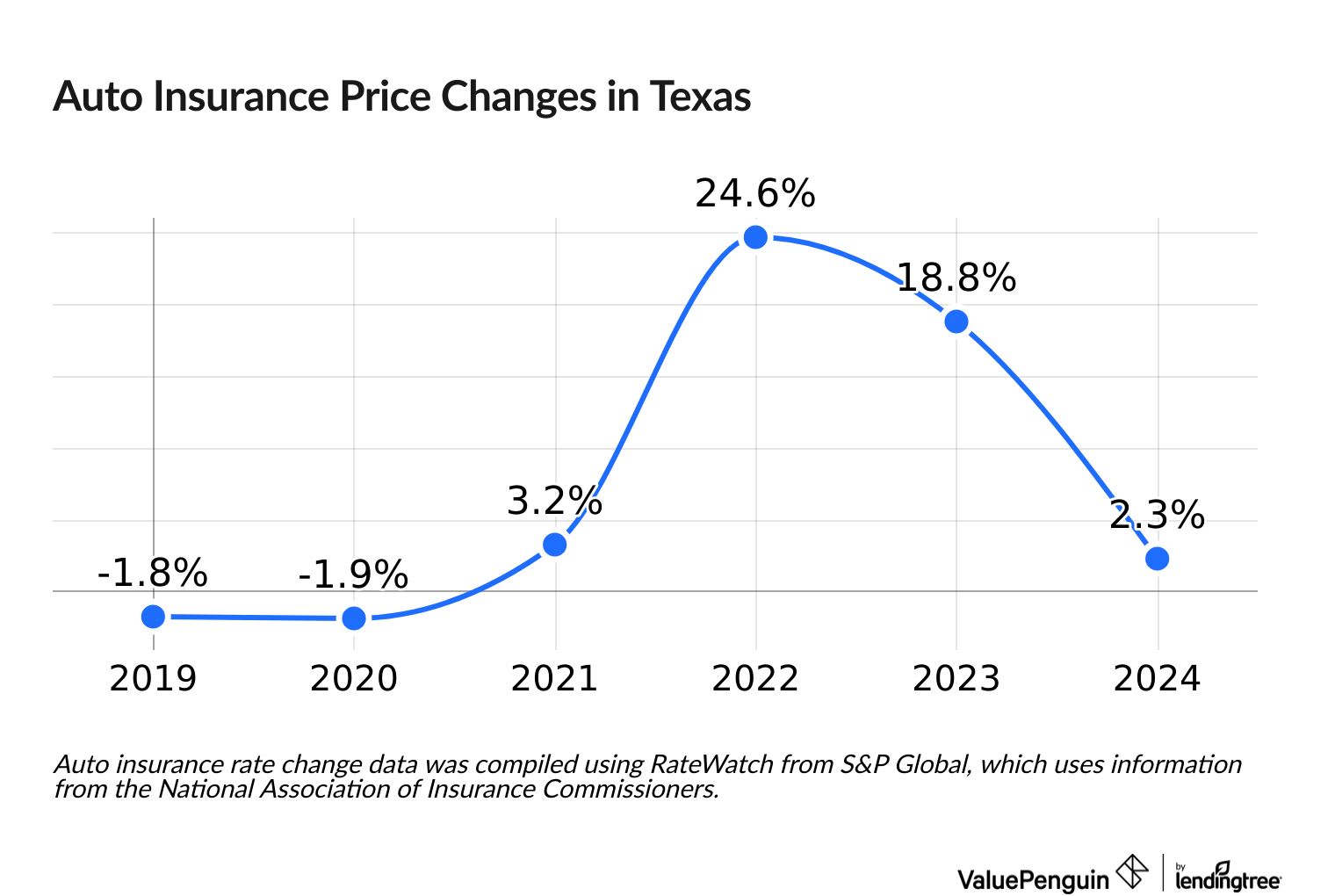

Cost of Texas auto insurance over time

The cost of car insurance in Texas has gone up 45% since 2019.

Rate increases in Texas peaked in 2022 and 2023, when prices went up 25% and 19%, respectively. That came after three years when rates were mostly stable between 2019 and 2021.

The jumps in car insurance rates in 2022 and 2023 were primarily because of higher repair costs after the COVID-19 pandemic. Another major cause was the increase in accidents when people returned to driving after the pandemic.

In 2024, insurance rates only had a modest increase of about 2.3%, and seven of the top 10 insurance companies in the state didn't raise rates at all. Among major Texas insurance companies, Texas Farm Bureau and American Family had the biggest increases in 2024, at nearly 15% each.

Frequently asked questions

What is the cheapest car insurance in Texas?

State Farm is the cheapest car insurance company in TX, at an average cost of $56 per month for liability-only coverage and $140 per month for full coverage in 2026. That's more than one-third cheaper than the average rates in TX.

How much is car insurance in Texas?

The average price of car insurance in Texas is $87 per month for a minimum liability policy, which is $11 per month more than the U.S. average. Rates for full coverage average $247 per month, which is $39 per month more than average.

Why is auto insurance so expensive in Texas?

Car insurance in Texas is expensive because it has several major cities with lots of traffic, which leads to higher risks of car accidents and theft. Drivers living in these areas may have more expensive rates.

Minimum coverage in Texas is 16% more expensive than the national average. A full coverage policy in Texas is 19% more expensive than the national average.

How much car insurance do I need in Texas?

The minimum car insurance required in Texas is often referred to as 30/60/25. That means $30,000 of bodily injury liability per person and $60,000 per incident, plus $25,000 of property damage liability coverage.

What can you do if you have a problem with car insurance in Texas?

If you can't solve your problem by working with the insurance company, you can file an insurance complaint with the Texas Department of Insurance. This can help in situations where insurance is denying your claim, taking too long to pay or paying less than you think it should.

Methodology

ValuePenguin collected thousands of quotes from ZIP codes across Texas for the largest insurance companies. Car insurance premiums in Texas are for a 30-year-old man with good credit who drives a 2018 Honda Civic EX.

Full coverage rates are for a policy that includes collision, comprehensive and liability coverage. Rates are for someone with a clean driving record, unless otherwise specified.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Auto insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.