Liberty Mutual Insurance Review: Car, Home and Renters

Liberty Mutual has low home and renters insurance rates. But its car insurance is expensive if you don't qualify for discounts, and its customer service isn't great.

Find Cheap Auto Insurance Quotes in Your Area

Is Liberty Mutual a good insurance company?

Liberty Mutual is a good insurance choice for property insurance, people who plan to bundle policies and owners of newer vehicles.

Liberty Mutual's car insurance rates are higher than average, but home and renters insurance are affordable. But, it may be a good choice if you're planning to bundle your home and auto insurance and can qualify for a few other discounts.

The main benefit of choosing Liberty Mutual for auto insurance is its coverage add-ons. Its new and better car replacement, original parts replacement and gap insurance make it an excellent choice for people with newer vehicles.

Liberty Mutual's customer service isn't great. However, its well-rated app makes it a good option if you prefer to manage your policy online.

Editor's rating | |

|---|---|

| Car insurance | |

| Home insurance | |

| Renters insurance |

Liberty Mutual pros and cons

Pros

Cheap home and renters insurance

Lots of discounts

Extra coverage for newer cars

Cons

Expensive auto insurance

Lengthy claims process

Limited coverage for renters

Liberty Mutual car insurance

Liberty Mutual auto insurance is more expensive than other major companies.

It also has poor customer service reviews. However, LiMu may be a good deal if you qualify for one of its many discounts or need extra protection, like gap insurance or new car replacement.

Alternatives to Liberty Mutual car insurance

Liberty Mutual auto insurance quotes

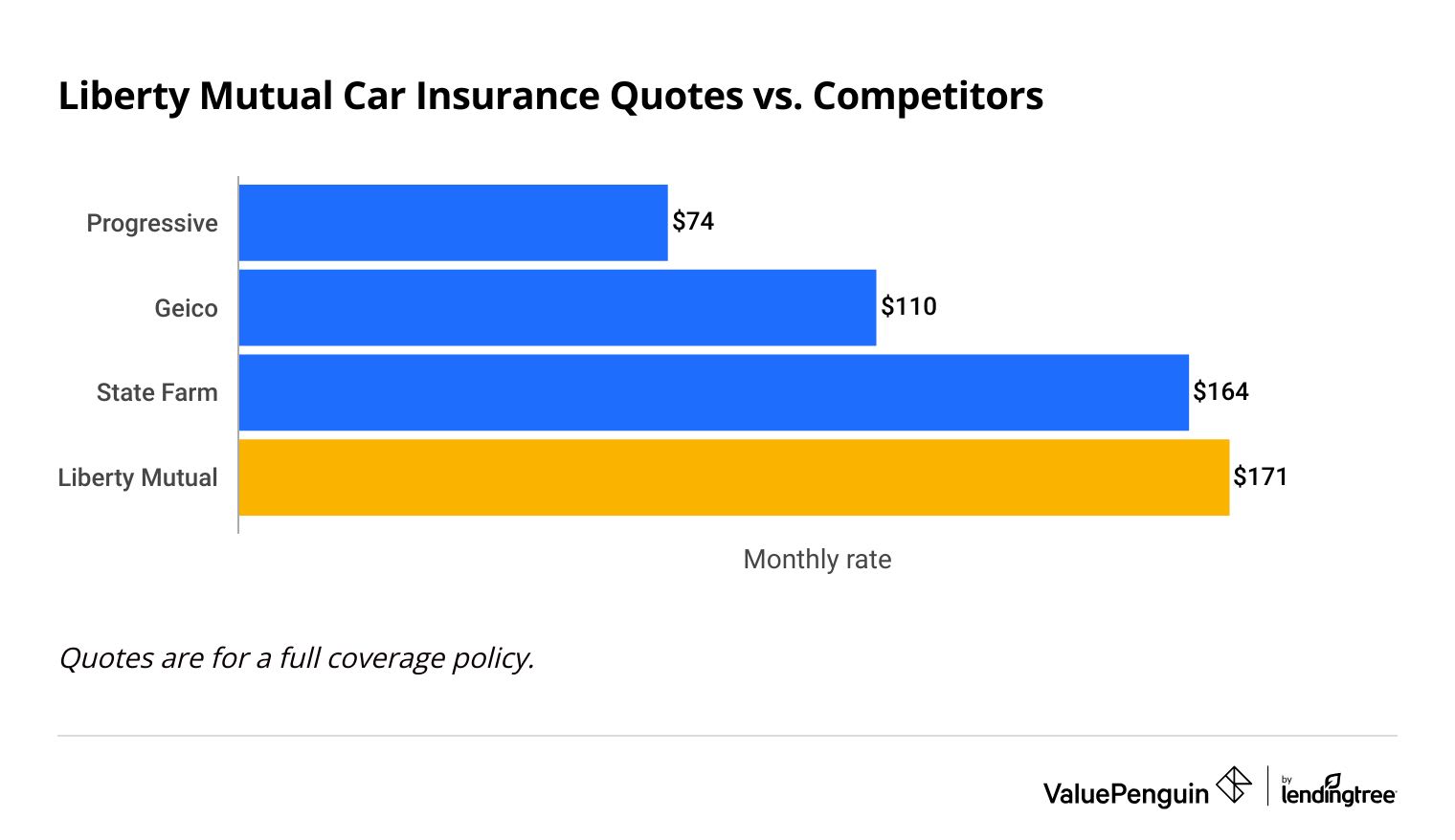

Full coverage car insurance from Liberty Mutual costs around $171 per month. That's 32% more expensive than what other major companies charge for the same coverage.

Find Cheap Auto Insurance Quotes in Your Area

Car insurance quotes can vary greatly depending on your driving history and age, the car you drive and where you live. You should always compare rates from multiple companies to find the best policy for you.

Compare car insurance quotes from Liberty Mutual

Company | Annual rate | ||

|---|---|---|---|

| Progressive | $74 | ||

| Geico | $110 | ||

| State Farm | $164 | ||

| Liberty Mutual | $171 | ||

Rates are for a 30-year-old driver in Wisconsin with comprehensive and collision coverage.

Liberty Mutual car insurance discounts

Liberty Mutual offers more discounts than most other car insurance companies. This is especially important because its rates are typically expensive.

Apply and pay for your policy online and save up to 12%

Get a quote with Liberty Mutual before your current policy expires to earn a discount.

Bundle your auto policy with home, renters or condo insurance coverage from Liberty Mutual.

Save money when you insure more than one vehicle on your policy.

Get a discount for owning a home, even if Liberty Mutual doesn't insure it.

Active or reserve military members and veterans get a discount from Liberty Mutual.

Save money if you haven't filed a claim for five years or longer.

Allow Liberty Mutual RightTrack to monitor your driving for 90 days and earn a safe driving discount of up to 30%.

Get a discount if you haven't had a traffic ticket in five years or longer.

Sign up for automatic monthly payments from your bank account or pay your balance in one to two payments to earn a discount.

Get a discount when you agree to eSign forms and view bills online instead of by mail.

Save money if you have a full-time student on your policy who earns a GPA of 3.0 or higher.

Get a discount if your child went away to school and left their car at home.

Liberty Mutual ByMile

ByMile is Liberty Mutual's pay-per-mile insurance program. Liberty Mutual calculates your insurance rate based on the number of miles you drive per month. It does this using a plug-in device that tracks your location.

People who don't drive often, like retirees, students and people who work from home, can save an average of 25% with ByMile.

ByMile is currently available in 17 states and Washington, D.C.

Liberty Mutual car insurance coverage

Liberty Mutual offers more car insurance coverage add-ons than most other companies like Progressive.

For example, Liberty Mutual has both new and better car replacement. These coverages can be helpful if you drive a brand-new vehicle. And its rental car reimbursement program includes extra services that most competitors don't offer.

Better car replacement pays for a car that's one model year newer if your vehicle is totaled in an accident.

New car replacement pays for a brand new car if your vehicle is one year old or newer and is totaled in an accident.

Roadside assistance from Liberty Mutual provides help if you have a dead battery or flat tire, run out of gas, get locked out of your car, or need towing.

Rental car reimbursement pays for a rental car while your car is in the shop after an accident.

Liberty pays rental car costs for as long as it takes to fix your car. However, you must repair your vehicle at an approved shop and allow Liberty to arrange your rental. In comparison, most companies only pay for a rental car until the costs reach a limit you choose.

Liberty Mutual also offers a claims valet service. If your car needs repairs but is still driveable, a Liberty Mutual rep will deliver your rental car to your home. Then, they'll drive your vehicle to the repair shop for you.

Original parts replacement replaces any damaged parts with original manufacturer parts or the highest quality parts available.

Drivers with no accidents or tickets in the past five years can get accident forgiveness. This coverage protects you from a price increase after your first accident.

Gap insurance covers the difference between the amount you owe on your car loan or lease and the value of your car if it's totaled.

Mexico car insurance provides car insurance coverage from Liberty Mutual's partner company, MexPro, when you cross the border.

Liberty Mutual offers a unique program for teachers that expands your coverage to protect you from specific damage. Liberty covers up to $2,500 of school-owned property or teaching materials that are damaged in an accident or stolen from your car.

Liberty Mutual will waive your deductible if someone vandalizes your car while parked on school property or at a school-related event. You also won't have to pay a deductible if you're in an accident while driving on school business.

The Liberty Mutual Deductible Fund is a savings account that you can use toward future deductible payments. It costs a few extra dollars per month and builds up to $100 each year.

This is similar to a vanishing or disappearing deductible. It may be helpful if you avoid getting in an accident for several years.

If one of Liberty Mutual's guaranteed repair network locations fixes your car, LiMu will guarantee the repairs as long as you own the vehicle.

Liberty Mutual also offers all of the standard coverage options that you would expect from a car insurance policy.

Liberty Mutual has partnered with AccuWeather to help protect customers with hail alerts. Drivers in 21 states can opt-in to receive real-time hail alerts via text message. This can give you time to move your car inside to prevent damage.

Hyundai Power Protect

Hyundai owners can get a special package called Hyundai Power Protect from Liberty Mutual. The basic package includes 24-hour roadside assistance and better car replacement, which usually cost extra.

Liberty Mutual car insurance reviews and ratings

Liberty Mutual doesn't have a great customer service reputation.

J.D. Power ranked Liberty Mutual's car insurance claims process 20th out of 25 of the top companies in the country. That means customers aren't typically happy with the service they get from Liberty after an accident.

In addition, Liberty Mutual gets more complaints than expected for its size, according to the National Association of Insurance Commissioners (NAIC). Most complaints are about its long claims process. If you choose Liberty Mutual, it may take longer to fix your car and get back on the road after a crash.

However, you don't have to worry about Liberty Mutual's ability to pay claims. It has an "A" or excellent financial strength rating from AM Best. That means it should have enough money to pay customer claims, even after a major emergency.

Liberty Mutual home insurance review

Liberty Mutual has affordable home insurance rates and lots of discounts.

However, it only offers a few ways to upgrade your coverage, and its customer service is average.

Liberty Mutual home insurance quotes

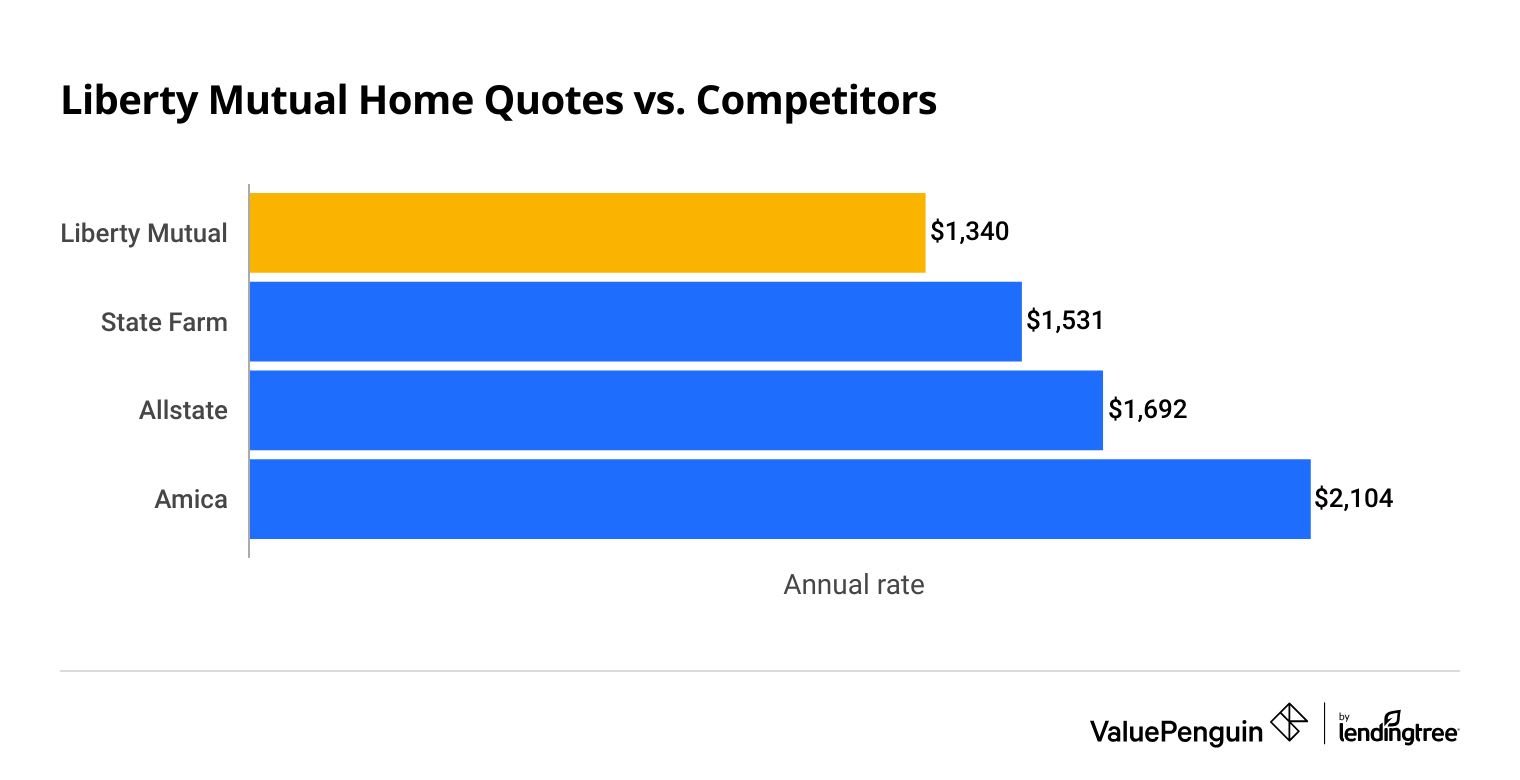

Liberty Mutual homeowners insurance is typically affordable. A policy from Liberty Mutual costs $1,340 per year for around $287,000 of dwelling coverage. That's 20% cheaper than average.

Find Cheap Homeowners Insurance Quotes in Your Area

Homeowners insurance rates vary depending on where you live and the value of your home. It's important to compare quotes from multiple companies to find the best rate for you.

Liberty Mutual home insurance rates vs. competitors

Company | Annual rate | |

|---|---|---|

| Liberty Mutual | $1,340 | |

| State Farm | $1,531 | |

| Allstate | $1,692 | |

| Amica | $2,104 | |

Rates are for a home in Wisconsin with an average of $287,000 of dwelling replacement coverage.

Liberty Mutual homeowners insurance discounts

One of the best parts about Liberty Mutual's homeowners insurance is its wide range of discounts.

It offers a lot more ways to save than most large insurance companies.

Many of LiMu's discounts are easy to qualify for, which could make getting homeowners insurance from Liberty Mutual even more affordable.

You may get multiple discounts from Liberty Mutual if you've recently moved into a new house or remodeled your home. You could also qualify for more than one discount by using Liberty Mutual's online quote form to shop for homeowners insurance.

Save when you bundle your home and auto policies with Liberty Mutual.

Earn a discount if you purchased your home recently.

If you switch insurance companies, you'll save if you haven't filed a claim with your previous company for at least five years.

You could qualify for this discount after being claim-free with Liberty Mutual for at least three years.

This discount is available to active duty, reserve and retired military service members.

Get a discount when you install protective devices in your home. This can include smart home systems, smoke alarms, deadbolts, fire extinguishers, fire alarms, burglar alarms or sprinklers.

Save when you insure your property for up to 100% of the cost to replace your home. This benefits you because you'll have enough coverage to rebuild your home after a total loss, like a fire that destroys your entire home.

Purchasing a new home or substantially renovating an older home earns you this discount.

Get a discount if you have a new or recently replaced roof.

Qualify for this discount by signing up for automatic monthly payments.

Sign up for paperless billing to earn this discount.

Liberty Mutual home insurance coverage

Liberty Mutual offers a few home insurance coverages you can add for an extra fee. These coverages are common add-ons you'll find with most insurance companies.

Hurricane damage coverage pays for damage to your home caused by a hurricane. This coverage may require a separate deductible.

Water damage pays for damage caused by water backup or overflow from sewers, drains and sump pumps.

This coverage automatically adjusts your limits to keep pace with inflation each time your policy renews.

Blanket jewelry coverage replaces lost or stolen jewelry without needing an appraisal. You also won't have to pay a deductible.

Personal property replacement cost provides enough money to repair or replace your damaged things with brand new items.

In contrast, standard personal property coverage factors in wear and tear. That means it typically won't pay enough to replace your belongings with brand-new items.

Liberty Mutual's standard homeowners insurance also includes basic protection like coverage for your home's structure and your personal items.

Ratings and reviews of Liberty Mutual home insurance

Liberty Mutual home and renters insurance customer service is just average.

You may not have a bad experience at Liberty Mutual. But chances are you can find better service elsewhere.

J.D. Power ranked Liberty's property insurance claims process 11th out of 19 top companies. It earned sixth place out of 14 companies for renters insurance customer satisfaction.

However, Liberty Mutual gets 22% fewer home insurance complaints than other major companies, according to the NAIC. That means customers are typically satisfied with the service they get at Liberty.

In addition, Liberty Mutual has an "A" or Excellent rating from AM Best. That means Liberty should have enough funds to pay customer claims, even in a challenging economy or after an emergency like a major hurricane.

Liberty Mutual renters insurance review

Liberty Mutual is one of the cheaper options for renters insurance. It also offers more discounts than most other companies.

However, its extra coverage options and customer service are fairly standard.

Liberty Mutual plans to stop renewing California renters and condo insurance plans starting in January 2026. So if you already have renters or condo insurance with Liberty Mutual, it won't offer you a new policy when your current policy expires. This is after the company stopped selling new renters and condo policies in California in 2023.

If you live in California and have renters or condo insurance with Liberty Mutual, you should plan to shop around for a new company a few weeks before your current policy expires. That way you have plenty of time to buy a new policy and avoid a gap in coverage.

Liberty Mutual renters insurance quotes

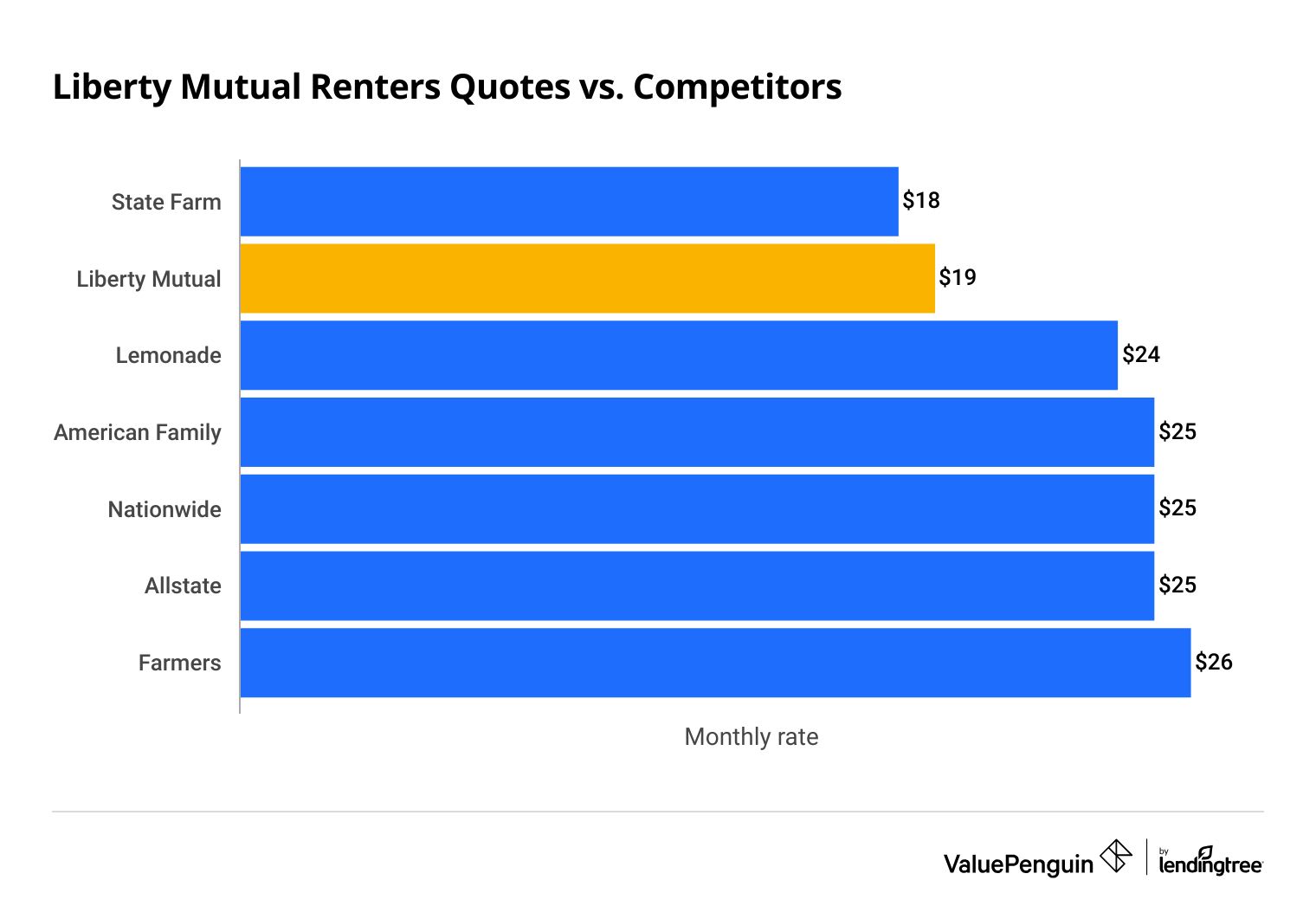

Liberty Mutual offers some of the cheapest renters insurance rates in the country. Its average monthly rate is only $1 more expensive than the most affordable company, State Farm.

You should only consider renters insurance from Liberty Mutual if you own less than $25,000 worth of property. That's the maximum amount of property coverage available through Liberty.

Find Cheap Renters Insurance Quotes in Your Area

On the other hand, you can purchase coverage for as little as $5,000 of property. That makes it an excellent option for young renters and those with small apartments or roommates.

Liberty Mutual renters insurance rates vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $18 | ||

| Liberty Mutual | $19 | ||

| Lemonade | $24 | ||

| American Family | $25 | ||

| Nationwide | $25 | ||

| Allstate | $25 | ||

| Farmers | $26 | ||

Liberty Mutual renters insurance discounts

Like Liberty Mutual's other insurance policies, there are several ways to lower your renters insurance rates with discounts.

You can save if you haven't filed a claim with your previous company for five years or more.

Bundle your renters insurance with another form of protection from Liberty Mutual, like car or life insurance.

Buy your renters insurance policy online and get a discount.

Get a quote with Liberty Mutual before your current policy expires and get a discount.

Get a discount when you sign up for automatic payments linked to your bank account.

Liberty Mutual renters insurance coverage

Liberty Mutual offers a few ways for renters to upgrade their insurance coverage. These add-ons are relatively common among major renters insurance companies.

- Replacement cost coverage: Liberty Mutual will pay to replace damaged belongings with new items. In comparison, standard renters insurance typically considers the condition your stuff was in before damage to determine your payout.

- Blanket jewelry protection: This coverage increases the protection for your jewelry and waives the deductible. Basic renters insurance typically limits jewelry coverage to a few thousand dollars.

- Earthquake insurance: If you live in an eligible area, you can add this coverage to protect your stuff from the damage caused by earthquakes. For example, tremors could cause your TV to fall off the wall and break. Or, a post-earthquake mudslide might ruin your furniture.

Liberty Mutual's standard renters insurance covers damage to your personal property, damage to other people's property that you're responsible for and additional living expenses if your home is temporarily unlivable.

Frequently asked questions

Does Liberty Mutual have good car insurance?

Liberty Mutual is a good choice for car insurance if you can qualify for some discounts or need extra coverage, like new car replacement or gap insurance. You might also consider Liberty Mutual if you want to bundle home and auto insurance since its home insurance rates are typically affordable. However, most drivers can find cheaper rates and better service elsewhere.

Is Liberty Mutual a good home insurance company?

Liberty Mutual is a good choice if you're looking for cheap rates and basic coverage. Liberty Mutual typically has affordable home insurance quotes, and it offers lots of discounts to help lower your rates. However, it only has a few coverage upgrades and its customer service is just okay.

Is Liberty Mutual good at paying claims?

Yes, Liberty Mutual is good at paying claims. The company doesn't have many customer complaints about claim payments. Most complaints are about the company's long claim process, so fixing your car or home after an accident may take a while.

How do I contact Liberty Mutual?

You can call 800-290-8711 for Liberty Mutual customer service, 800-426-9898 for roadside assistance, or 800-295-2820 for a quote. Customers can file a claim through the Liberty Mutual website portal or via the company's highly rated app.

Does Liberty Mutual offer gap insurance?

Yes, Liberty Mutual offers gap insurance if you have an auto loan or lease your vehicle.

Methodology

Auto insurance

To find the average cost of Liberty Mutual vehicle insurance, ValuePenguin collected quotes for the five most populated cities in Wisconsin. Rates are for a 30-year-old man with a clean driving record who owns a 2015 Honda Civic EX.

Quotes are for a full coverage policy with higher liability limits than most states require, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

Home insurance

To find the average cost of Liberty Mutual home insurance, ValuePenguin collected quotes for homes in the five largest cities in Arizona. Rates are for a 40-year-old single man with no prior insurance claims.

- Dwelling coverage: $287,940 on average

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000 or lowest available

Renters insurance

ValuePenguin sourced renters quotes from across the country for a 25-year-old single man with no prior insurance claims to find the average cost of Liberty Mutual renters insurance.

- Personal property coverage: $25,000

- Personal liability coverage: $100,000

- Deductible: $500

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.