What Is Hurricane Insurance and Do You Need It?

Hurricane insurance is actually a combination of several insurance policies to best shield your home from wind and water damage.... Read More

Finding a car insurance company based near you can come with a lot of benefits, like a personal relationship with an agent which can mean better customer service.

Smaller regional companies tend to offer cheap rates and reliable customer service. It can also be easier to work with an agent with an office nearby than someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

State Farm is the best car insurance company in 28 states.

That's because State Farm has great customer service reviews, affordable rates and most people are able to buy insurance from them.

However, the best car insurance near you may be different. Erie and Farm Bureau offer excellent customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age, since these factors affect how much you'll pay for insurance. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Find Cheap Auto Insurance Quotes in Your Area

USAA has the best customer service in many states, along with very affordable rates. But only military members, veterans and some of their family members can get car insurance from USAA.

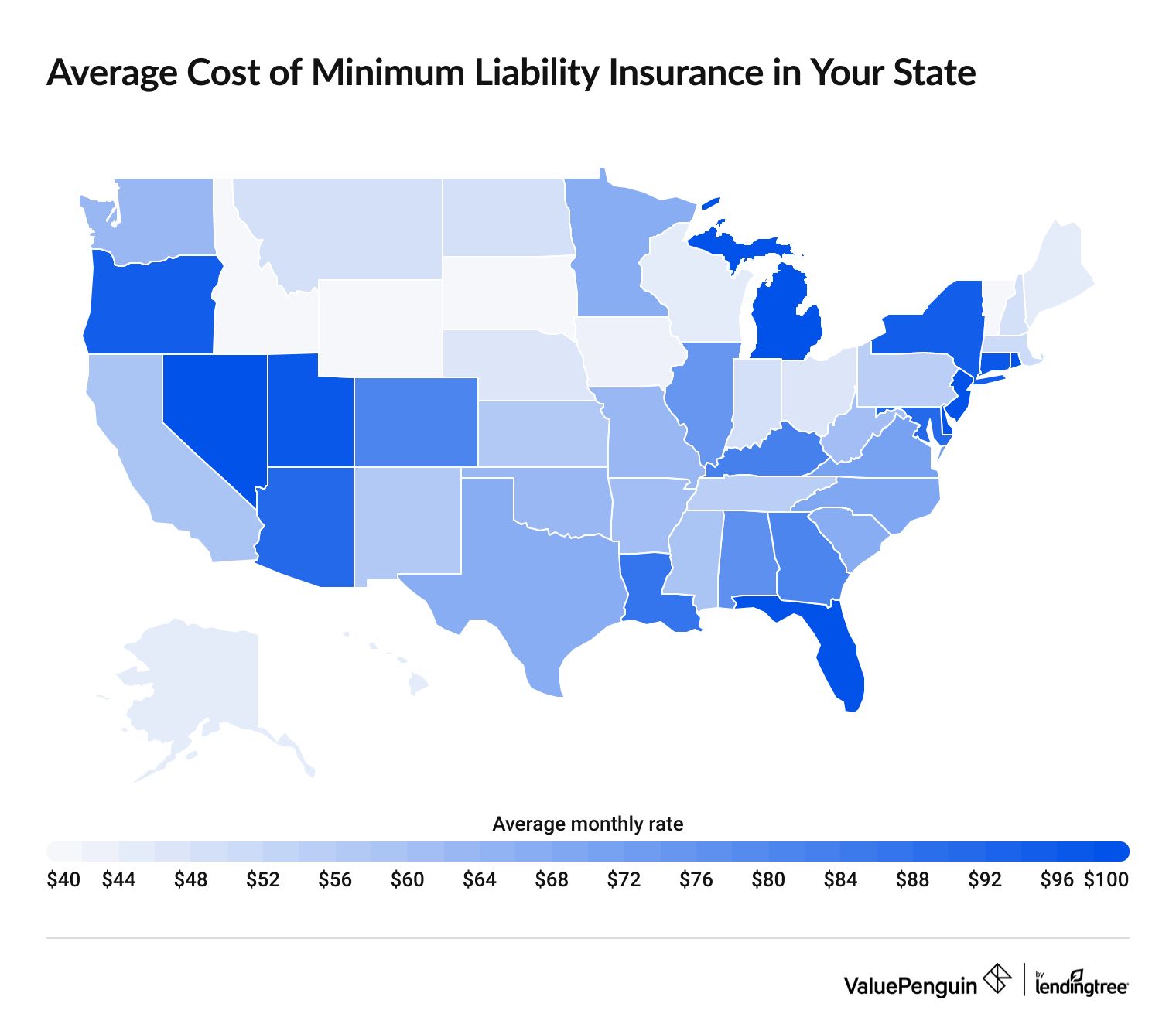

Where you live can have a big impact on your car insurance rates. For example, drivers in Wyoming pay $31 per month for minimum coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $133 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

Hurricane insurance is actually a combination of several insurance policies to best shield your home from wind and water damage.... Read More

Lemonade has the cheapest renters insurance in San Antonio. Coverage costs $21 per month, on... Read More

You might not want to file an insurance claim after a minor accident if the cost is close to your deductible, there were no injuries, only... Read More

Filing a renters insurance claim can be an easy process, as long as you follow the right steps. Make sure to document your belongings and... Read More

Most people don't need a separate bike insurance policy. But if you have an expensive bike or you ride in races, you should consider... Read More

We examined data from Freddie Mac's Primary Mortgage Market Survey to identify historical mortgage rate trends. Click to read about the... Read More

Houston renters can find the cheapest quotes from Lemonade, where a policy costs around $18 per month. The average cost of renters... Read More

Damage from fire and smoke in your home are both covered by renters insurance in most circumstances. Learn when your renters policy will... Read More

Aflac is the leader in supplemental insurance. Here's what you need to know about this type of coverage and if it's something you should... Read More

On average, FEMA flood insurance costs $818 per year. Your rate will depend on factors like where you live and how your home was... Read More

When you rent a car in Europe, liability coverage is included in your rental fee. You may need to pay extra if you want to protect yourself... Read More

Renters insurance will generally cover items in self-storage units — though usually only up to a certain percentage of your total... Read More

Standard renters insurance policies cover flooding from a plumbing leak, but not due to weather. You need to have a separate flood... Read More

Renters insurance will cover mold damage if it is caused by a covered event — like a burst pipe or leaky AC. But mold is not covered... Read More

We break down statistics regarding average auto loan rates in America, carving the data up term length, credit scores and other facts. We... Read More

Your car is protected from vandalism if you have comprehensive insurance as part of your broader auto insurance policy.... Read More

Your insurance may sometimes cover damage to your property caused by pets, but exclusions... Read More

If you are sued for a slip and fall in your home, your homeowners insurance will cover you financially in most... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, it might not be the cheapest option near you, especially if you have access to smaller regional companies like Erie, Farm Bureau or Country Financial.

This depends on how you prefer to connect with your insurance company. If you prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you would rather manage your insurance with an app and prefer virtual chat to phone calls, you may not need a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who owns a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.