Who Has the Cheapest Renters Insurance Quotes in Houston?

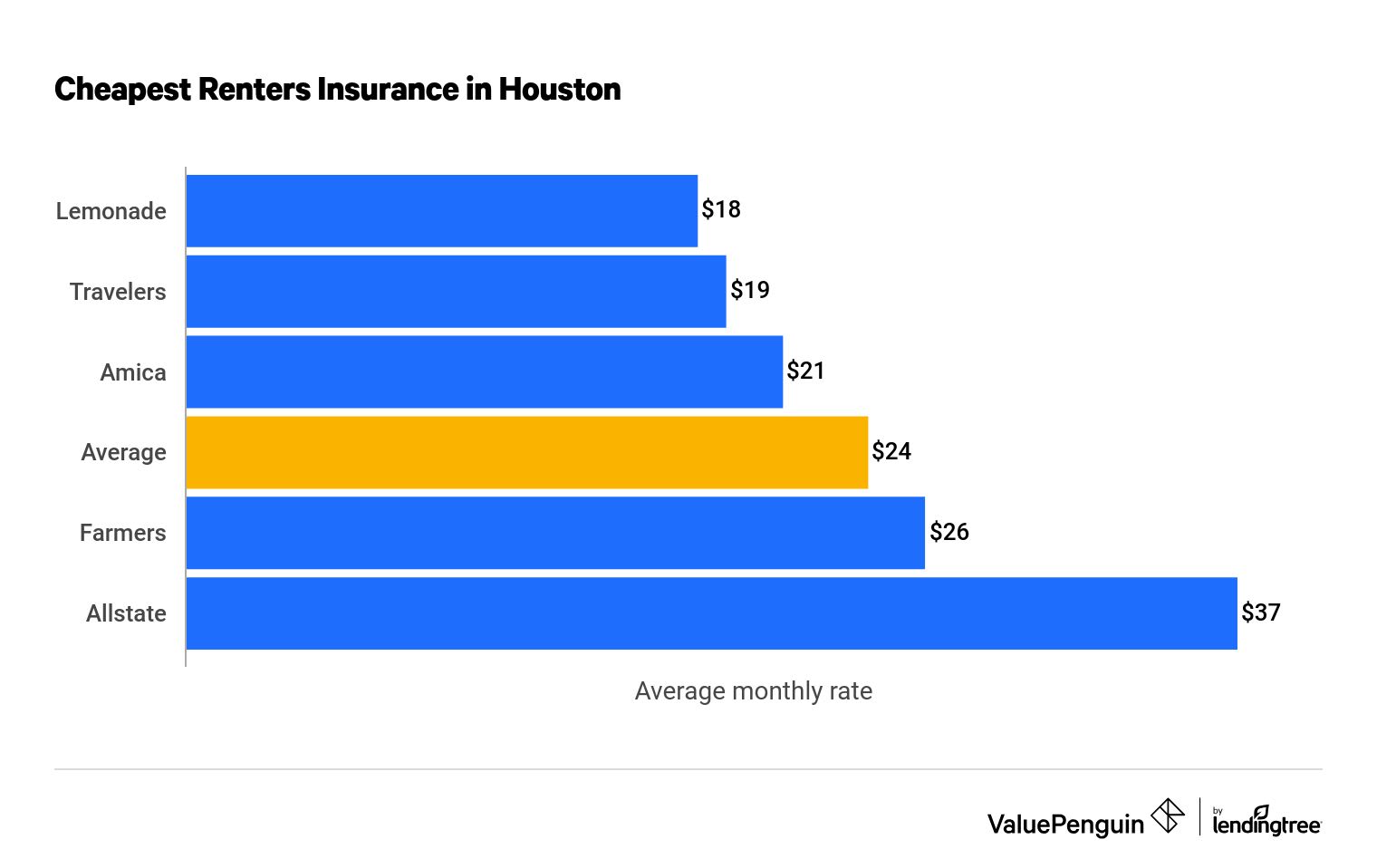

Lemonade offers the cheapest renters insurance in Houston. On average, a policy from Lemonade costs $18 per month.

Compare Cheap Renters Insurance in Houston

However, the cost of coverage isn't the only factor you should consider when choosing an insurer. The best renters insurance combines quality coverage, dependable customer service and affordable rates.

To find the best renters insurance in Houston, we analyzed each company's rates, customer service ratings and availability of coverage options.

To find average costs, we gathered sample quotes from five top companies that offer renters insurance in the city. Quotes include $30,000 of personal property coverage and $100,000 in liability protection with a $500 deductible.

Cheapest renters insurance companies in Houston

The cheapest renters insurance in Houston comes from Lemonade. A policy from Lemonade costs around $18 per month, which is 25% cheaper than the Houston average.

The average cost of renters insurance in Houston, TX is $24 per month, or $290 per year.

Compare Cheap Renters Insurance in Houston

Houston renters pay significantly more than the average cost of renters insurance across Texas, which is $18 per month.

Cheapest renters insurance companies in Houston, TX

Best for most renters in Houston: Lemonade

-

Editor rating

-

Average monthly rate

$18 ?

Pros and cons

Lemonade has the best renters insurance for most people living in Houston. An average policy from Lemonade costs $18 per month, which is $6 per month cheaper than the Houston average.

Lemonade's website and app make it easy to purchase a policy or file a claim quickly.

That's one of the reasons it earned an excellent score on J.D. Power's customer satisfaction survey. Lemonade also receives fewer complaints than competitors of a similar size, according to the National Association of Insurance Commissioners (NAIC).

As a tech-based insurer, Lemonade doesn't have agents. That makes it a poor choice for renters who prefer to manage their policy or file a claim in person.

A renters insurance policy from Lemonade includes basic protections, like personal property coverage and medical payments to others. In addition, renters can upgrade their policy with common add-ons like replacement cost coverage and water backup protection.

Lemonade does not offer flood insurance, so renters concerned about hurricane damage and weather-related flooding should consider another insurer.

Best customer service: Amica

-

Editor rating

-

Average monthly rate

$21 ?

Pros and cons

Houston renters searching for excellent customer service should consider Amica. The company only receives 12% as many complaints as similar-sized insurers, according to the NAIC. ValuePenguin editors also gave it an excellent rating based on the overall value it provides Houstonians, coverage availability and customer service reviews. That means renters can count on Amica to help them get their life back to normal quickly after an emergency.

At $21 per month, renters insurance from Amica isn't the cheapest in Houston. However, its rates are more affordable than average.

Amica also offers a lot of discounts to help renters save money on insurance, including:

- Automatic payments discount

- Bundling discount

- Claims-free discount

- Loyalty discount

- Paperless discount

In addition to basic renters insurance coverage, Amica gives renters the ability to add protection for valuable items and upgrade to replacement cost coverage.

Most importantly, Houston renters can purchase flood insurance from Amica.

Weather-related flooding is common in Houston and isn't covered by a standard renters insurance policy. Buying renters and flood insurance from the same company will make it much easier for you to file a claim after a natural disaster.

Best for military families: USAA

-

Editor rating

Pros and cons

Houston renters that qualify for USAA should consider buying a policy from the insurance company. Not everyone qualifies — you need to either be a military member or veteran or have a relative that's a USAA member.

Renters insured with USAA can expect a stress-free experience if you ever have to file a claim. The company earned the highest score on J.D. Power's customer satisfaction survey. In addition, it only receives half as many complaints as expected, according to the NAIC.

The renters insurance coverage you get at USAA is unmatched. A basic USAA renters policy includes replacement cost coverage, flood insurance and earthquake coverage. These natural disasters aren't covered by standard renters insurance from other companies.

If you live in an area prone to flooding, USAA's flood coverage can save you several hundred dollars per year because you won't have to purchase a separate policy.

Houston renters insurance quotes vs. other cities in Texas

Houston is the most expensive large city in Texas for renters insurance at $24 per month. Areas neighboring Houston are also expensive. Renters insurance in Pasadena also costs around $24 per month, making it the second-most expensive city in the state.

Why do Houston renters need insurance?

Houston renters need insurance — it's the only way to protect your stuff against damage and theft. Renters insurance also helps cover the cost of a lawsuit if you accidentally hurt someone or damage their property. In addition, it helps pay for extra living expenses if your home is damaged and you have to live somewhere else temporarily.

Hurricanes and flooding in Houston

Hurricanes and flood damage are fairly common in Houston. The city experiences a major flood event every two years, on average. The National Flood Insurance Program (NFIP) has paid out more flood-related claims in Harris County, where Houston is located, than in any other community.

Renters insurance helps protect your belongings against damage from hurricane-force winds. While most basic renters insurance policies don't cover damage from weather-related flooding, many major insurers give renters the ability to purchase flood insurance as an add-on or a separate policy.

Fire damage in Houston

In Houston, there are between 40,000 and 46,000 fire-related incidents every year — around two fires for every 100 Houstonians. Renters that experience a fire can end up losing thousands of dollars worth of stuff. In addition, you'll probably have to pay for a hotel room or other living arrangements if repairs need to be made.

Renters insurance will pay to repair or replace your belongings after a fire, and help cover the cost of any extra living expenses.

Property theft in Houston

There are around 47,000 cases of theft, burglary and robbery in Houston each year. That's nearly five crimes for every thousand Houstonians. Victims of theft, burglary or robbery could end up having to replace several thousand dollars worth of your belongings.

A renters insurance policy will help cover the cost to replace your stolen things.

Frequently asked questions

How much is renters insurance in Houston?

The average cost of renters insurance in Houston is $290 per year, or $24 per month. That's $71 per year more expensive than the Texas state average.

Who has the best renters insurance in Houston?

Lemonade has the best renters insurance for most people in Houston. It offers the cheapest quotes in Houston, along with reliable customer service.

Is renters insurance required in Houston?

Renters insurance is not required by law in Houston. Your landlord or property management company can legally require you to buy a policy as a part of your rental agreement. Renters insurance is also the only way to protect your belongings from damage.

How much does renters insurance cost per month in Texas?

The average cost of renters insurance in Texas is $18 per month, or $219 per year.

Methodology

To determine the best renters insurance companies in Houston, we considered three main factors: affordability, coverage availability and quality of customer service.

To find the best rates, we compared quotes from five of the top Texas insurers that offer coverage in Houston. Our sample renter is a 25-year-old single man living alone with no history of insurance claims.

Quotes are based on the following coverage limits:

Coverage | Limit |

|---|---|

| Personal property coverage | $30,000 |

| Personal liability coverage | $100,000 |

| Medical payments | $1,000 |

| Deductible | $500 |

The quality of a company's customer service was determined by analyzing data from the National Association of Insurance Commissioners (NAIC), J.D. Power's annual renters insurance customer satisfaction survey and our own ValuePenguin editor's ratings.

Sources

- Fire statistics: Houston Fire Department

- Crime statistics: Greater Houston Partnership

- Flood statistics: Harris County Flood Control District

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.