Who Has The Best Car Insurance Rates In Boston?

Geico offers the cheapest full coverage car insurance in Boston, with average quotes of $116 per month for full coverage.

Find Cheap Auto Insurance Quotes in Boston

Best cheap car insurance companies in Boston

How we chose the top companies

Best and cheapest car insurance in Massachusetts

- Cheapest full coverage: Geico, $116/mo

- Cheapest minimum liability: Geico, $36/mo

- Cheapest for young drivers: Geico, $99/mo

- Cheapest after a ticket: Geico, $127/mo

- Cheapest after an accident: Plymouth Rock, $150/mo

- Cheapest for teens after a ticket: Geico, $99/mo

- Cheapest after a DUI: Geico, $190/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Cheapest car insurance in Boston: Geico

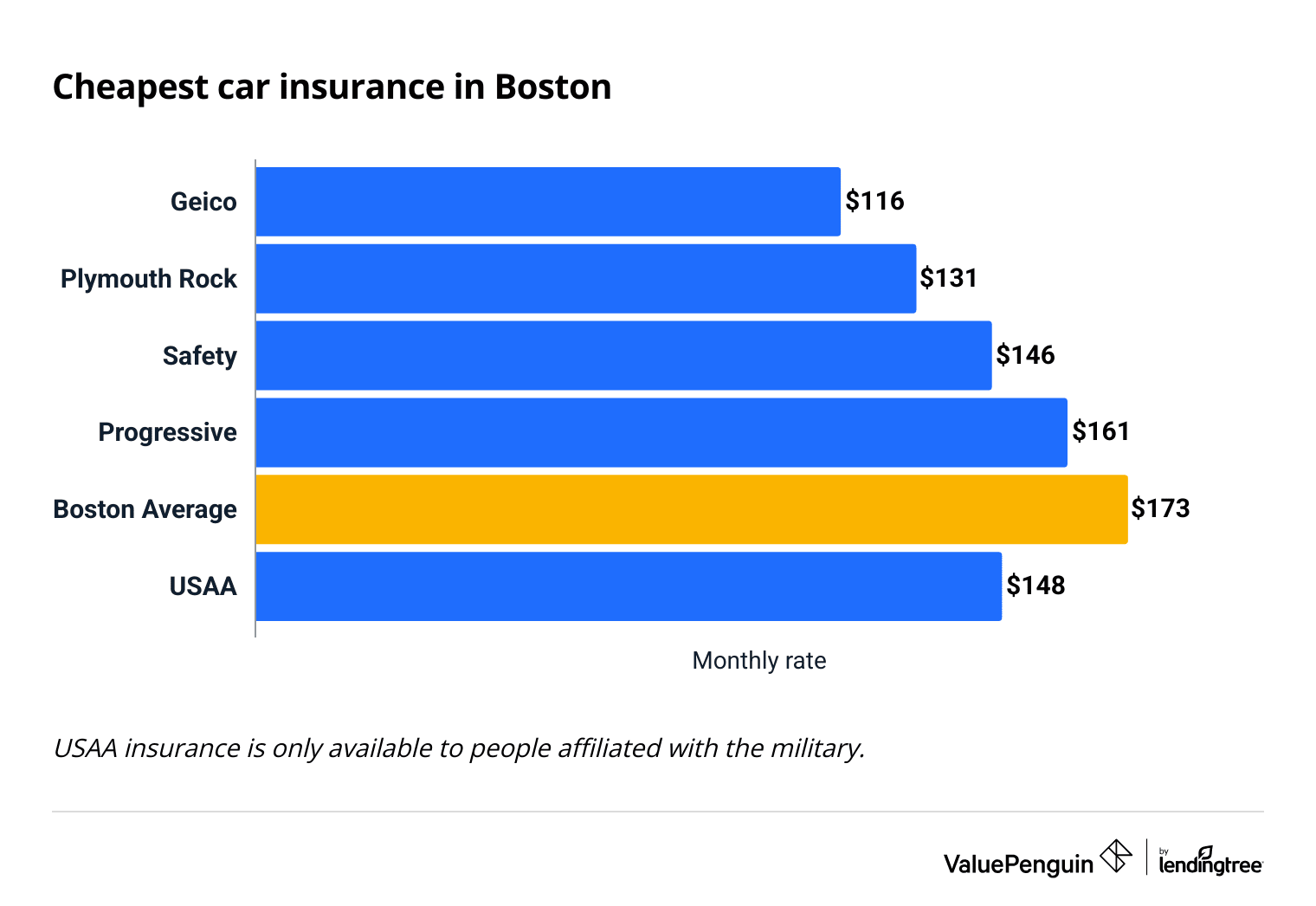

Geico has the cheapest rates for full coverage car insurance in Boston, with an average quote of $116 per month.

That's one-third less than the city average of $218 per month.

Drivers looking for great coverage options should also consider Plymouth Rock. Its rates are about the same as Geico's, but . These include extended coverage for your windshield, personal property damaged or stolen from your car, and payment for loss of earnings after a crash, among others.

Find Cheap Auto Insurance Quotes in Boston

Average rates in Boston are 22% higher than in Massachusetts overall.

Cheapest full coverage car insurance in Boston

Company | Monthly rate | |

|---|---|---|

| Geico | $116 | |

| Plymouth Rock | $131 | |

| Safety | $146 | |

| Progressive | $161 | |

| Arbella | $194 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Boston: Geico

Geico offers Boston's cheapest minimum-coverage insurance policies, with an average rate of $36 per month.

Hanover's rates are 38% less than average in Boston, and $9 per month less than the second-cheapest option, Plymouth Rock.

The most expensive car insurance company for liability-only coverage in Boston charges two-and-a-half times as much as Geico, so it's always worth it to shop around for the best price.

Cheap minimum-coverage car insurance in Boston

Company | Monthly rate |

|---|---|

| Geico | $36 |

| Plymouth Rock | $45 |

| Farmers | $49 |

| Hanover | $51 |

| Safety | $60 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Boston

Cheapest quotes for teen drivers in Boston: Geico

Geico has the cheapest full-coverage quotes for young drivers in Boston.

Geico has by far the cheapest insurance for teen drivers in Boston, at $99 per month for liability-only coverage.

Geico costs $291 per month for full coverage.

Monthly car insurance rates for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $99 | $291 |

| Plymouth Rock | $103 | $293 |

| Hanover | $165 | $712 |

| Travelers | $179 | $484 |

| Farmers | $187 | $609 |

*USAA is only available to current and former military members and their families.

An 18-year-old typically pays about 90% more for auto insurance than a 30-year-old adult. Insurance companies have found that younger, less experienced drivers are more likely to get in a crash or file an insurance claim than older adults

Teen drivers who want to avoid paying sky-high rates should stay on their parents' policy if they can. Keeping a teen on a parent's policy may cost half as much as a teen purchasing their own policy.

Other ways for young drivers to reduce their car insurance rates include taking a defensive driving course or getting good grades. Insurers view these steps as a sign of decreased risk and offer discounts because of it.

Cheapest car insurance in Boston after a speeding ticket: Geico

Geico has the cheapest rates in Boston for drivers with a speeding ticket on their records, with an average price of $127 per month. That's $95 less per month than the city average.

Cheapest Boston car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| Geico | $127 |

| Safety | $183 |

| Plymouth Rock | $189 |

| Arbella | $194 |

| Progressive | $208 |

*USAA is only available to current and former military members and their families.

Car insurance rates in Boston increase by 29% after a speeding ticket, to $222 per month for full coverage.

Cheapest car insurance in Boston after an accident: Plymouth Rock

Plymouth Rock offers the cheapest car insurance for Boston drivers after an accident, at $150 per month. That's 43% cheaper than the city average of $261= per month.

Cheapest auto insurance after an accident

Company | Monthly rate |

|---|---|

| Plymouth Rock | $150 |

| Geico | $167 |

| Arbella | $222 |

| Safety | $222 |

| Progressive | $230 |

*USAA is only available to current and former military members and their families.

Average rates go up by 52% for Boston drivers after they get into an at-fault accident. Progressive and Plymouth Rock raise rates the least, $53 per month, although Plymouth Rock is one of the most expensive options overall.

Cheapest car insurance for teens after a ticket or accident: Geico and Plymouth Rock

For teens who've recently gotten a speeding ticket, Geico has the best rates at $99 per month. Geico sometimes won't increase a teen's rates after a single ticket.

For teens who have recently been at-fault in an accident , Plymouth Rock has the best rates in Boston, at just $121 per month. That's 47% less than average.

Cheapest Boston insurance for teens with a driving incident

Company | Ticket | Accident |

|---|---|---|

| Geico | $99 | $121 |

| Plymouth Rock | $125 | $114 |

| Farmers | $197 | $241 |

| Travelers | $211 | $272 |

| Hanover | $213 | $221 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance after a DUI in Boston: Geico

Geico has the lowest rates for Boston drivers looking for affordable insurance after a DUI, at $190 per month for full coverage. That's 37% cheaper than the average rate citywide.

Progressive's rates are within a dollar per month Geico, also at $190 per month.

Cheapest Boston car insurance after a DUI

Company | Monthly rate |

|---|---|

| Geico | $190 |

| Progressive | $190 |

| Plymouth Rock | $195 |

| Arbella | $321 |

| Safety | $324 |

*USAA is only available to current and former military members and their families.

Boston drivers with a DUI pay an average of $300 per month for full coverage, an increase of 73% from a clean record. A DUI is one of the most serious citations you can have on your record.

Your car insurance company won't change your car insurance rates from a DUI until your next renewal. You can keep paying your regular rate until about a month before your policy expires, then start shopping around. Plus, the longer ago your DUI was, the smaller your rate hike will be.

Average car insurance quotes in Boston by neighborhood

The most expensive neighborhood for car insurance is East Boston near the airport , at $207 per month.

The next-most expensive neighborhood is South Boston , at $183 per month.

The price of car insurance is roughly the same across the rest of the city, with the same average price of $170 per month across 15 out of Boston's 18 ZIP codes.

Full-coverage quotes in Boston by ZIP code

ZIP | Monthly Rate | % from average |

|---|---|---|

| 02108 | $170 | -2% |

| 02109 | $170 | -2% |

| 02110 | $170 | -2% |

| 02111 | $170 | -2% |

| 02113 | $170 | -2% |

Rates in a specific area may be higher because of factors such as population density, the number of cars on the road, traffic congestion or higher crime rates.

Frequently asked questions

How much does car insurance cost in Boston?

In Boston, car insurance costs $59 per month for minimum coverage, on average, and $173 per month for full coverage. The average rate for full coverage is 22% higher than the state of Massachusetts overall.

Who has the cheapest car insurance in Boston?

Why is car insurance expensive in Boston?

Car insurance is expensive in Boston because of a range of factors, including the city's population density and narrow roads, which can lead to more accidents. Full-coverage car insurance costs 22% more in Boston compared to the state overall.

Methodology

ValuePenguin pulled quotes from the largest insurance companies in Massachusetts. Unless otherwise noted, rates are for a 30-year-old man who has a full-coverage policy for a 2016 Honda Civic EX and good credit.

Minimum-coverage policies match the minimum requirements in Massachusetts, while full-coverage policies include more liability than the state minimum, as well as comprehensive and collision.

Coverage type | Full-coverage limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Personal injury protection | $8,000 |

| Comprehensive and collision | $500 deductible |

Quadrant Information Services supplied the rate data in this analysis. Rates were publicly sourced from insurer filings and are intended for comparative purposes only. Your own quotes may differ.

Lead Writer

Matt Timmons is a Lead Writer on the insurance team at ValuePenguin, where he writes in-depth and timely pieces helping find the right coverage for them.

He's covered insurance at ValuePenguin since 2018, specializing in auto and home insurance, as well as life insurance. He's paid special attention to the EV insurance market, where prices are much higher than for gas cars.

Before he started writing about personal finance, Matt wrote about professional skills and online tools at an e-learning company.

How insurance helped Matt

During freshman orientation in college, Matt's iPod was stolen off his table while he was eating lunch. Luckily, he'd bought a college insurance plan the day before and he had money to buy a replacement before classes started.

Expertise

- Auto insurance

- Home insurance

- Insurance rate analysis

- Life insurance

Referenced by

- CNBC

- Miami Herald

- Yahoo! Finance

Education

- BA, Wesleyan University

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.