Mobile Home Insurance in Texas

Mobile home insurance provides homeowners in Texas with financial protection.... Read More

Finding a car insurance company based near you can come with a lot of benefits, like a personal relationship with an agent which can mean better customer service.

Smaller regional companies tend to offer cheap rates and reliable customer service. It can also be easier to work with an agent with an office nearby than someone located in a call center across the country.

Many large insurance companies and regional providers have local agents who understand the needs of drivers near you. Additionally, working with someone near you can make the claims process much easier if you're ever in an accident.

State Farm is the best car insurance company in 28 states.

That's because State Farm has great customer service reviews, affordable rates and most people are able to buy insurance from them.

However, the best car insurance near you may be different. Erie and Farm Bureau offer excellent customer service and affordable rates in the states where they sell insurance.

The best car insurance near you also depends on factors like your driving history and age, since these factors affect how much you'll pay for insurance. For that reason, it's important to compare quotes from multiple companies to find the best company for you.

Find Cheap Auto Insurance Quotes in Your Area

USAA has the best customer service in many states, along with very affordable rates. But only military members, veterans and some of their family members can get car insurance from USAA.

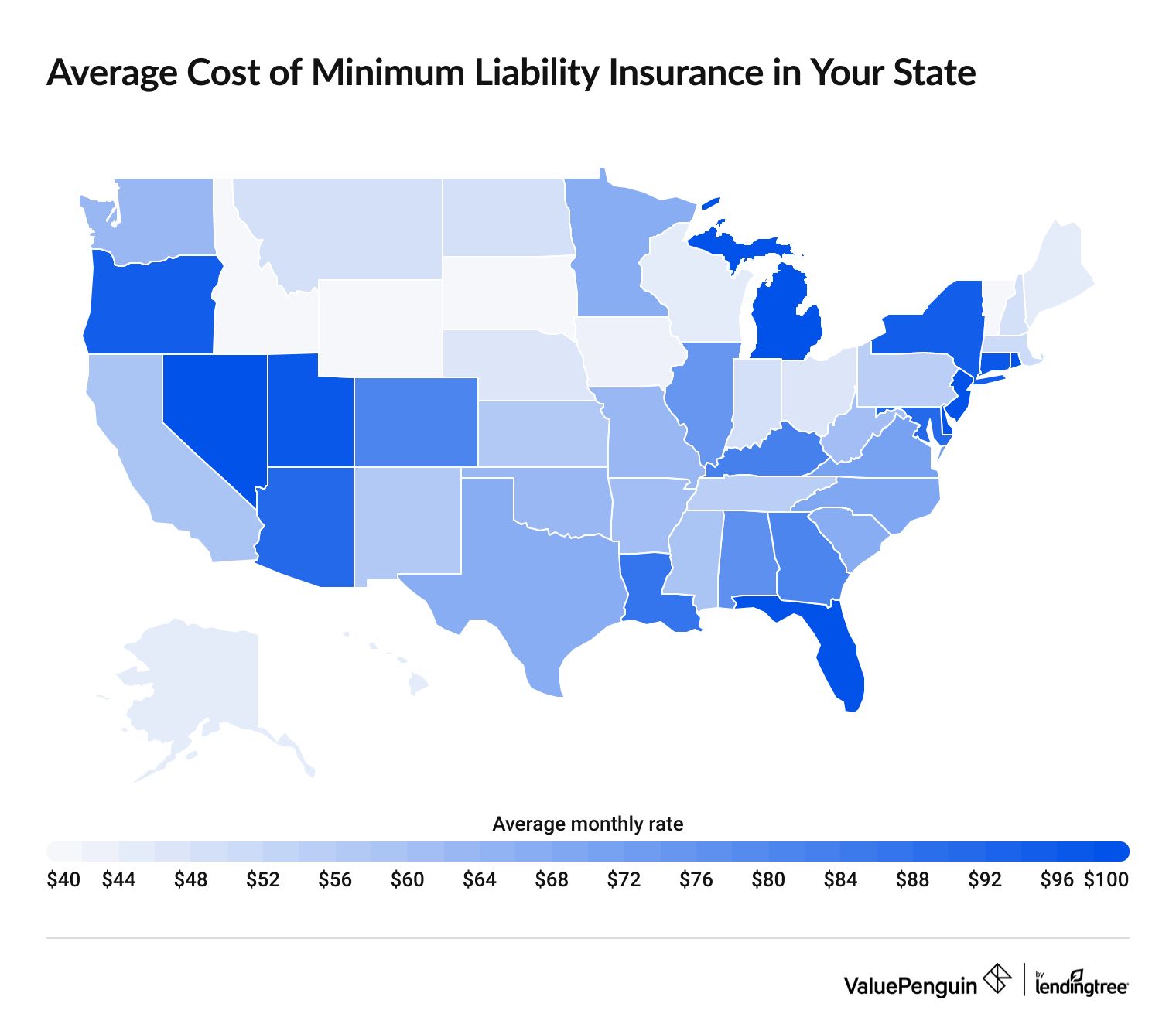

Where you live can have a big impact on your car insurance rates. For example, drivers in Wyoming pay $31 per month for minimum coverage auto insurance, on average. People living in Michigan pay four times as much for the same coverage, at $133 per month.

It's important to compare rates from a handful of companies near you to find the best price for car insurance.

Mobile home insurance provides homeowners in Texas with financial protection.... Read More

The average cost of mobile home insurance in Florida is $112 per month. Most major insurance companies don't offer mobile home insurance in... Read More

People with VA home loans are required to have insurance, but insurers may offer perks to military members.... Read More

Gap insurance isn't required of drivers in Texas; in fact, the state prohibits a gap waiver to be a requirement of a car lease or loan.... Read More

The national average cost of condo insurance is $531 per year. However, the average condo insurance cost can differ by as much as $773 per... Read More

Root offers competitive auto insurance rates to good drivers, but its coverage options are limited and its customer service reputation is... Read More

Retirees can save on their home and auto insurance by taking advantage of various discounts including telematics and safe driver... Read More

Instead of hiring a contractor, you can sometimes do home repairs covered by insurance yourself. But there's no guarantee it will save you... Read More

American Family earned 3.5/5 stars from ValuePenguin editors based on above-average prices, good customer service and useful coverage... Read More

Mopeds, scooters and motorized bikes are defined differently under Florida law. Learn how these categories can impact your license,... Read More

Home repair insurance covers repair or replacement costs for some items that homeowners insurance won't cover.... Read More

Step 1: Determine how much time you have to switch. Step 2: Get a new auto insurance policy. Step 3: Apply for a new license. Step 4:... Read More

Your condo association may require you to buy HO-6 insurance. This type of policy can cost as little as $20 to $50 per... Read More

A flood insurance policy in Texas costs $791 per year on average. The price you pay will depend on factors like where you live and how your... Read More

California has different rules for mopeds, scooters and motorized bikes. You'll need either a motorcycle or driver's license for any that... Read More

If your dog is on your home insurance company's list of restricted dog breeds, you might have a harder time getting liability... Read More

Regular home insurance won't apply if your home is empty for long, but vacant home insurance can cover your... Read More

You can get home or renters insurance if you have a pit bull. But in most states, insurance companies can deny or limit coverage for pit... Read More

State Farm usually has the cheapest rates among national car insurance companies. However, it might not be the cheapest option near you, especially if you have access to smaller regional companies like Erie, Farm Bureau or Country Financial.

This depends on how you prefer to connect with your insurance company. If you prefer speaking with someone in person or on the phone, then a local agent is the best choice for you. However, if you would rather manage your insurance with an app and prefer virtual chat to phone calls, you may not need a local agent.

To find rates by state, ValuePenguin compared quotes from the top insurance companies in each state. Rates are for a 30-year-old man with good credit and a clean driving record who owns a 2015 Honda Civic EX.

Full coverage limits are greater than any one state's minimum requirement. Full coverage also includes comprehensive coverage, collision coverage and uninsured/underinsured motorist bodily injury coverage.

The best car insurance companies offered quotes in at least five states. ValuePenguin editors rated insurance companies based on J.D. Power customer satisfaction survey scores, data from the National Association of Insurance Commissioners (NAIC) complaint index, coverage availability and the overall value provided to customers.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.