How Much Does Condo Insurance Cost?

The average cost of condo insurance, also called HO-6 insurance, is $499 per year.

Find Cheap Condo Insurance Quotes in Your Area

However, the cost of condo insurance can differ widely depending on where you live, the amount of coverage you need and the insurance company you choose. Average condo insurance rates can fall between $310 and $1,084 per year.

Average condo insurance cost

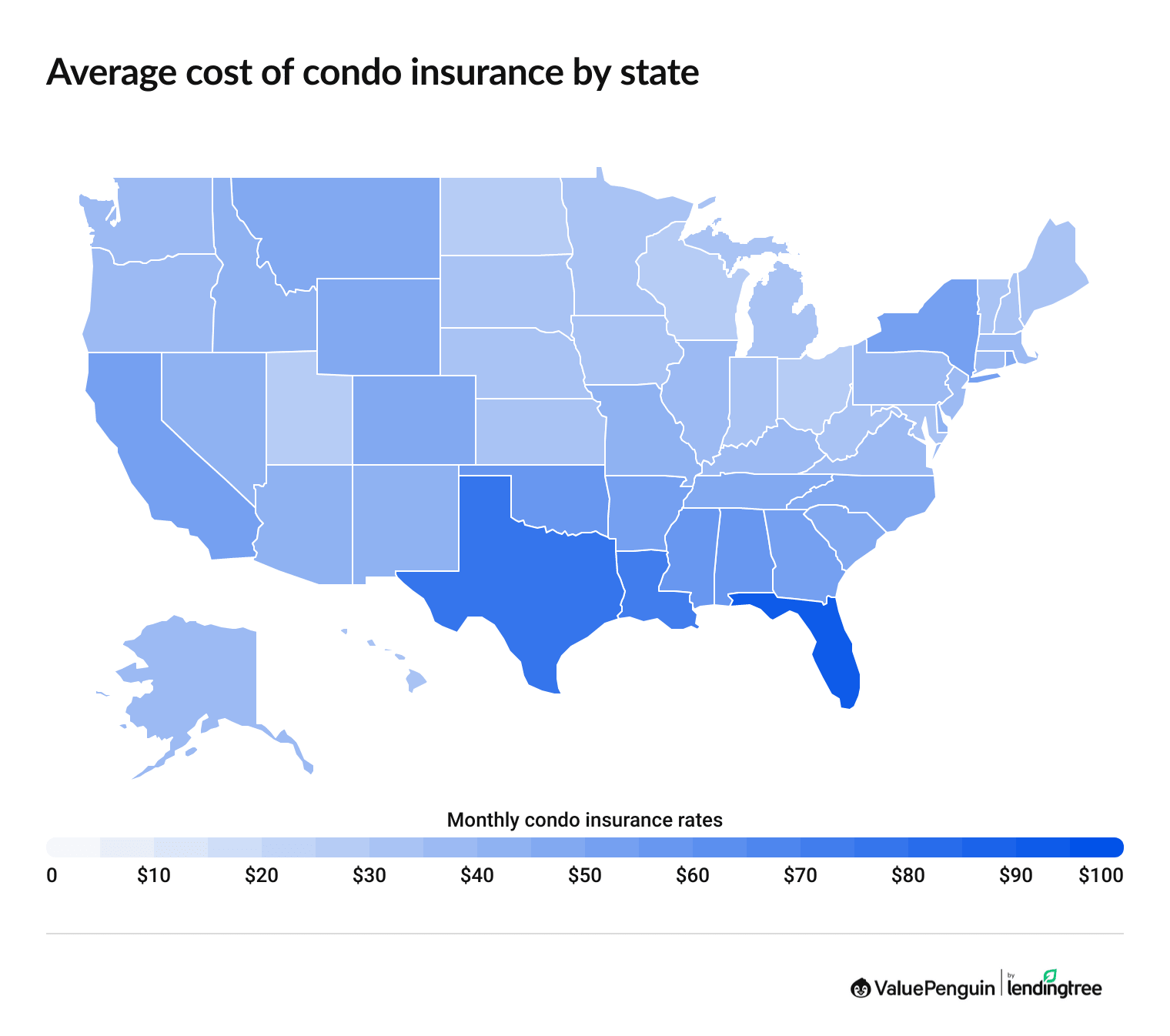

Condo owners pay an average of $499 per year for condo insurance. However, average HO-6 insurance rates differ by up to $774 per year, depending on the state where you live.

What impacts your rates?

The amount you'll pay for insurance depends on the value of your condo, the amount of coverage you need, your location and any unique risk factors .

Condo owners in Wisconsin pay an average of $325 per year, or $27 per month, for insurance. But rates in higher-risk states, like Florida, can be much higher. On average, Florida condo owners pay $1,084 per year or $90 per month for the same coverage.

Condo insurance rates by state

State | Annual rate | Monthly rate | Difference from average |

|---|---|---|---|

| Alabama | $682 | $57 | 37% |

| Alaska | $459 | $38 | -8% |

| Arizona | $497 | $41 | 0% |

| Arkansas | $640 | $53 | 28% |

| California | $653 | $54 | 31% |

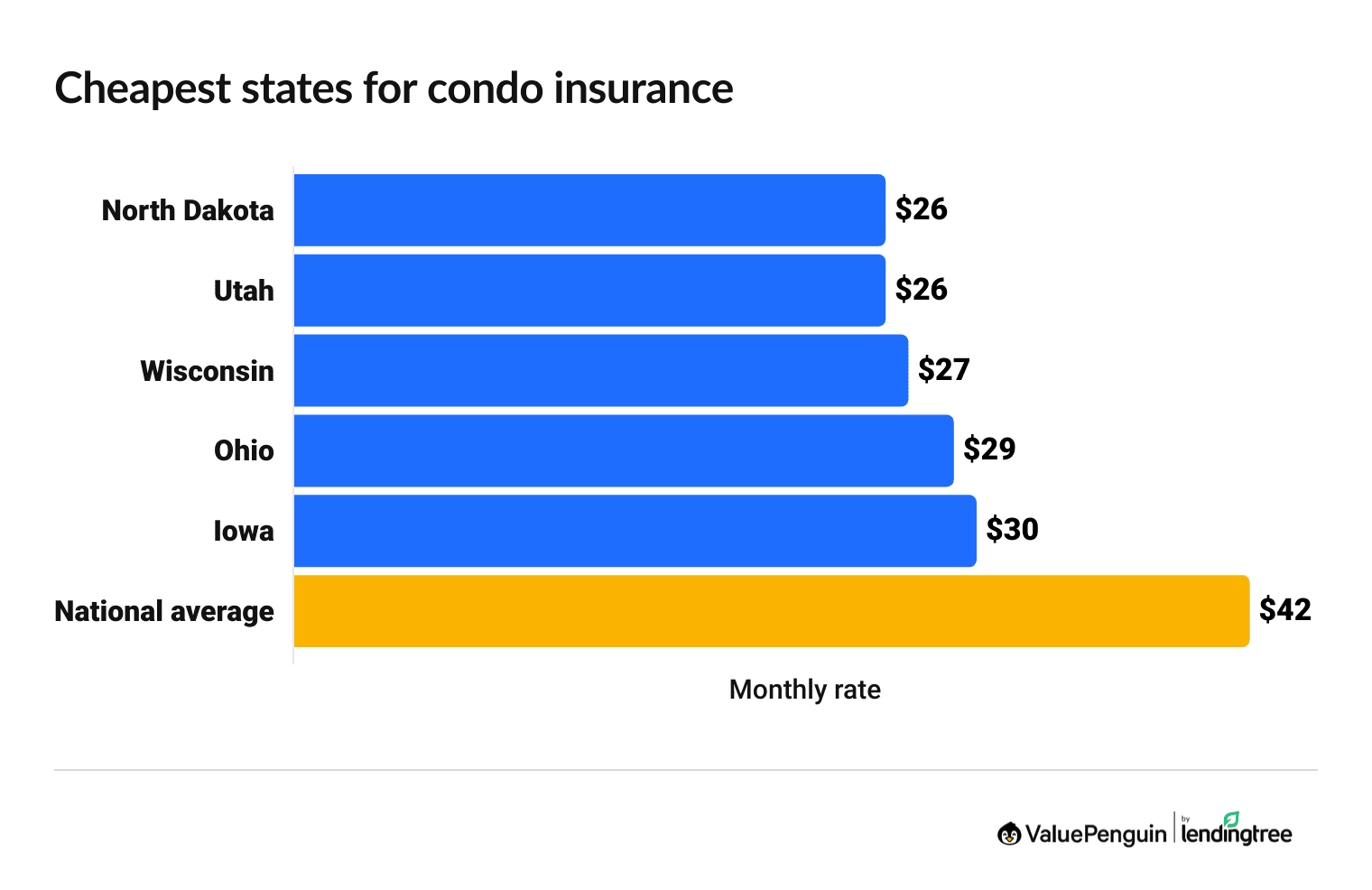

States with the cheapest average condo insurance cost

North Dakota, Utah, Wisconsin, Ohio and Iowa are the five states with the cheapest average condo insurance quotes. All five have rates at least 29% lower than the average across the United States.

Some of the cheapest states for condo insurance are among the least populated in the country, including North Dakota and South Dakota. Iowa and Utah also have smaller-than-average populations.

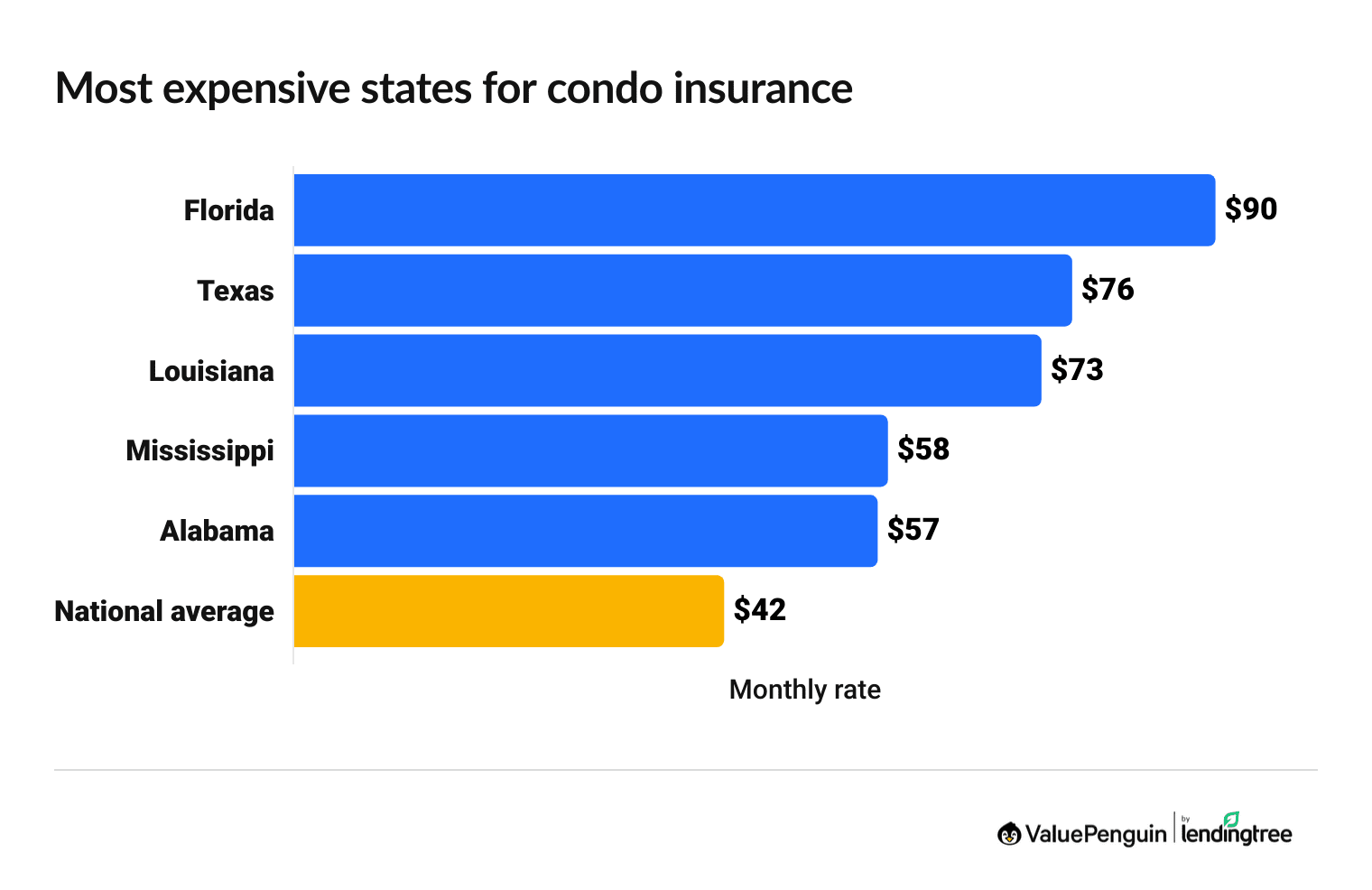

States with the highest average HO-6 insurance cost

Florida, Texas, Louisiana, Oklahoma and Mississippi are the five most expensive states for HO-6 condo insurance. These states are likely expensive because they're prone to natural disasters. For instance, hurricanes are common in Florida, Louisiana and Mississippi, while Oklahoma and Texas often experience tornadoes.

The average cost of condo insurance in Florida is $177 more expensive per year than the second-most expensive state, Texas. Condo owners in Florida tend to pay those high rates largely because of the frequent hurricanes the state experiences.

HO-6 insurance covers everything in the interior of a condo unit, including walls. That means it can cover damage to your condo from a hurricane or tropical storm, but that risk is also factored into your prices.

Find Cheap Condo Insurance Quotes in Your Area

Cost of condo insurance by company

Average condo insurance costs can differ by $456 per year depending on the insurance company you choose. State Farm offers the cheapest HO-6 insurance quotes, with an average of $552 per year.

Company | Editor's rating | Average annual rate | |

|---|---|---|---|

| State Farm | $552 | ||

| Farmers | $612 | ||

| Liberty Mutual | $780 | ||

| Progressive | $1,008 |

Rates are based on quotes for condos located in New York, Dallas and Philadelphia.

How do you pay for condo insurance?

If you have a mortgage on your condo, you likely pay for insurance through your escrow account.

Your mortgage company takes a portion of your monthly mortgage payment and puts it in the escrow account until the end of the year. At the end of the year, they'll use those funds to pay your condo insurance premium in full for the next year. As long as you're making payments on time, your insurance should stay active.

However, if you own your condo outright or your mortgage lender doesn't require an escrow account, you'll pay for condo insurance directly. You'll typically have two choices: Pay your premium for the entire year upfront or make monthly payments for coverage.

How to save money on condo insurance

There are three main ways to lower your condo insurance rates: Shop around for quotes, find discounts and raise your deductible.

- The best way to save money on insurance is to compare condo insurance quotes from multiple companies. Each company uses a different method to determine your HO-6 insurance rates, so your quotes may differ from our averages.

- Next, it's important to research discounts, so you can make sure you're getting all of the discounts you qualify for. Common condo insurance discounts include bundling discounts for insuring your condo and car with the same company, and safety discounts for installing a home security system.

- If you're still struggling to find cheap HO-6 insurance, you can consider raising your deductible. A higher deductible means you'll usually save on the upfront cost of insurance, but you will have to pay more for repairs after an emergency. However, it's important to choose a deductible you'll be comfortable paying in an emergency.

What does condo insurance include?

Condo insurance has four main types of coverage: personal property coverage, building property coverage, liability coverage and loss of use coverage.

Condo association master policy coverage

A master policy is an insurance policy owned by the condo association, and condo owners share the cost with their neighbors.

This policy protects common areas like hallways, elevators and shared amenities. Also called condo association insurance, this type of policy is managed by your condo's board or management team. Your association dues help pay for the coverage.

The top condo and home insurance companies

Many home insurance companies also offer condo insurance. Companies that score highly in ValuePenguin’s home insurance ratings are also worth considering for condo coverage.

Frequently asked questions

How much is condo insurance?

Condo insurance, also known as HO-6 insurance, costs $499 per year across the U.S., on average. However, average rates can differ by $774, depending on the state where you live.

Is condo insurance cheaper than home insurance?

Yes, condo insurance is much cheaper than home insurance. On average, an HO-6 condo insurance policy costs $1,652 less per year, or $135 less per month, than a standard homeowners insurance policy. That's because most condo insurance policies don't protect the outside of your condo since it's usually covered by your condo association's master policy.

What is the average cost of condo insurance in Florida?

Condo owners in Florida typically pay $1,084 per year for HO-6 insurance. That's more than double the national average, making Florida the most expensive state for condo insurance.

How much is insurance on a condo in Texas?

The average cost of condo insurance in Texas is $907 per year, which is 81% more expensive than the national average. Texas is the second-most expensive state in the country for HO-6 insurance.

Do you need homeowners insurance for a condo?

If you have a mortgage or home equity loan for your condo, your lender will usually require you to buy condo insurance. Even if your condo is paid off, you should still consider buying HO-6 insurance. The cost is fairly cheap, and it can save you a lot of money if your home and belongings are damaged in a covered loss, like a fire or theft.

Methodology

ValuePenguin collected condo insurance rates from the most recent report on condo insurance from the National Association of Insurance Commissioners (NAIC), which provides the average coverage level and premiums for condo (HO-6) insurance across the 50 states and the District of Columbia.

To find the average cost of condo insurance by company, our experts gathered rates from four top companies in Dallas, New York and Philadelphia.

Quotes from specific companies are for the following coverage limits:

Coverage | Limit |

|---|---|

| Building property coverage | $18,000 |

| Personal property protection | $60,000 |

| Liability coverage | $100,000 |

| Deductible | $1,000 |

About the Author

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.