The Best Renters Insurance Companies

Lemonade and State Farm have the best renters insurance for most people.

Compare Cheap Renters Insurance in Your Area

The 3 Best Renters Insurance Companies

The best renters insurance companies combine low-cost coverage, dependable customer service and the right amount of protection for your situation.

To compare renters insurance quotes, we analyzed rates from major insurance companies across every state in the U.S. Quotes are based on $30,000 in personal property coverage, $100,000 in liability protection and $1,000 in medical payments to others, with a $500 deductible.

Best insurance for most renters

The best renters insurance depends on the coverage you need and where you live.

Company | Best for | Editor's rating | Average monthly rate |

|---|---|---|---|

| Lemonade | Overall | $12 | |

| State Farm | Widely available cheap rates | $14 | |

| Amica | Customer service | $17 | |

| Nationwide | Extra coverage options | $18 | |

| USAA | Military families | - |

Find the best renters insurance in your state

Best for cheap renters insurance: Lemonade

-

Editor rating

-

Monthly rate

$12 ?

Pros and cons

Lemonade offers the best renters insurance rates for most people. Its average policy costs $140 per year, which is $74 per year cheaper than the national average. However, Lemonade renters insurance is only offered in 29 states and Washington, D.C., so it's not available to everyone.

If you need to get renters insurance quickly, you should consider Lemonade.

You can download Lemonade's app, get a quote and start coverage within minutes.

As for claims, renters generally have a smooth experience using Lemonade’s app. The company receives fewer customer complaints than competitors of a similar size, according to the National Association of Insurance Commissioners (NAIC). It also earned a high score on J.D. Power's annual customer satisfaction survey. That means renters can count on Lemonade to help them get their life back to normal quickly after an emergency.

Lemonade's entire service experience is online, so if you’re a renter who prefers a relationship with an agent, you should consider other insurers.

Best major renters insurance company: State Farm

-

Editor rating

-

Monthly rate

$14 ?

Pros and cons

State Farm's national presence and cheap rates make it a great choice for most renters. At $166 per year, a policy from State Farm costs $48 per year less than the national average.

State Farm customers are generally happy with their customer service experience. The company was awarded a high customer satisfaction score from J.D. Power. It also receives fewer complaints than other insurers based on its size, according to the NAIC.

Renters can expect State Farm to provide a quick, easy claims process.

However, State Farm only gives renters a couple of options to customize their coverage. Renters can purchase earthquake coverage and identity theft protection, but popular upgrades like replacement cost coverage and water backup coverage aren't available.

Best renters insurance company for customer service: Amica

-

Editor rating

-

Monthly rate

$17 ?

Pros and cons

Great customer service can make your life much easier if you ever have to file a claim. Amica offers renters a stress-free claims process, which is vitalin an emergency situation. The company only receives 12% as many complaints from customers as other insurers of a similar size, according to the NAIC.

Coverage from Amica is 3% cheaper than the national average — its average policy costs $208 per year. Amica can be expensive in some states, but the company offers a number of discounts to make its coverage more affordable. You can save by:

- Remaining claim-free for three years

- Bundling renters and car insurance

- Signing up for automatic payments

- Receiving bills online

- Having a policy with your current insurer for two years or more

Renters insured by Amica can increase coverage for valuable items, upgrade to replacement cost and add on identity theft protection. However, the company doesn't offer common add-ons like water backup protection and earthquake coverage.

Best for extra renters insurance coverage: Nationwide

-

Editor rating

-

Monthly rate

$18 ?

Pros and cons

Renters who have expensive belongings or live in hazardous areas should consider Nationwide. The company offers a number of ways to enhance your coverage, including:

- Earthquake coverage

- Extended liability coverage

- Extra protection for valuable items

- Identity theft protection

- Replacement cost coverage

- Water backup coverage

An average policy from Nationwide costs $18 per month, which is in line with the national average. However, the customer service experience at Nationwide is hit or miss. The company receives far fewer complaints than competitors, according to the NAIC. However, it scored below average on J.D. Power's customer satisfaction survey.

Best renters insurance for military families: USAA

Editor rating

Pros and cons

Renters who are in or have close ties to the military should compare quotes from USAA. Rates from USAA are generally very affordable.

In addition, a standard policy includes replacement cost coverage and protection against floods and earthquakes.

While many other insurance companies offer these coverages for an additional cost, at USAA, they're free.

USAA is very familiar with the unique needs of military members, too. For example, USAA renters insurance policies provide coverage for lost military uniforms.

Renters insured with USAA can also count on the company to provide a hassle-free claims experience. USAA receives very few customer complaints, according to the NAIC.

How much is renters insurance?

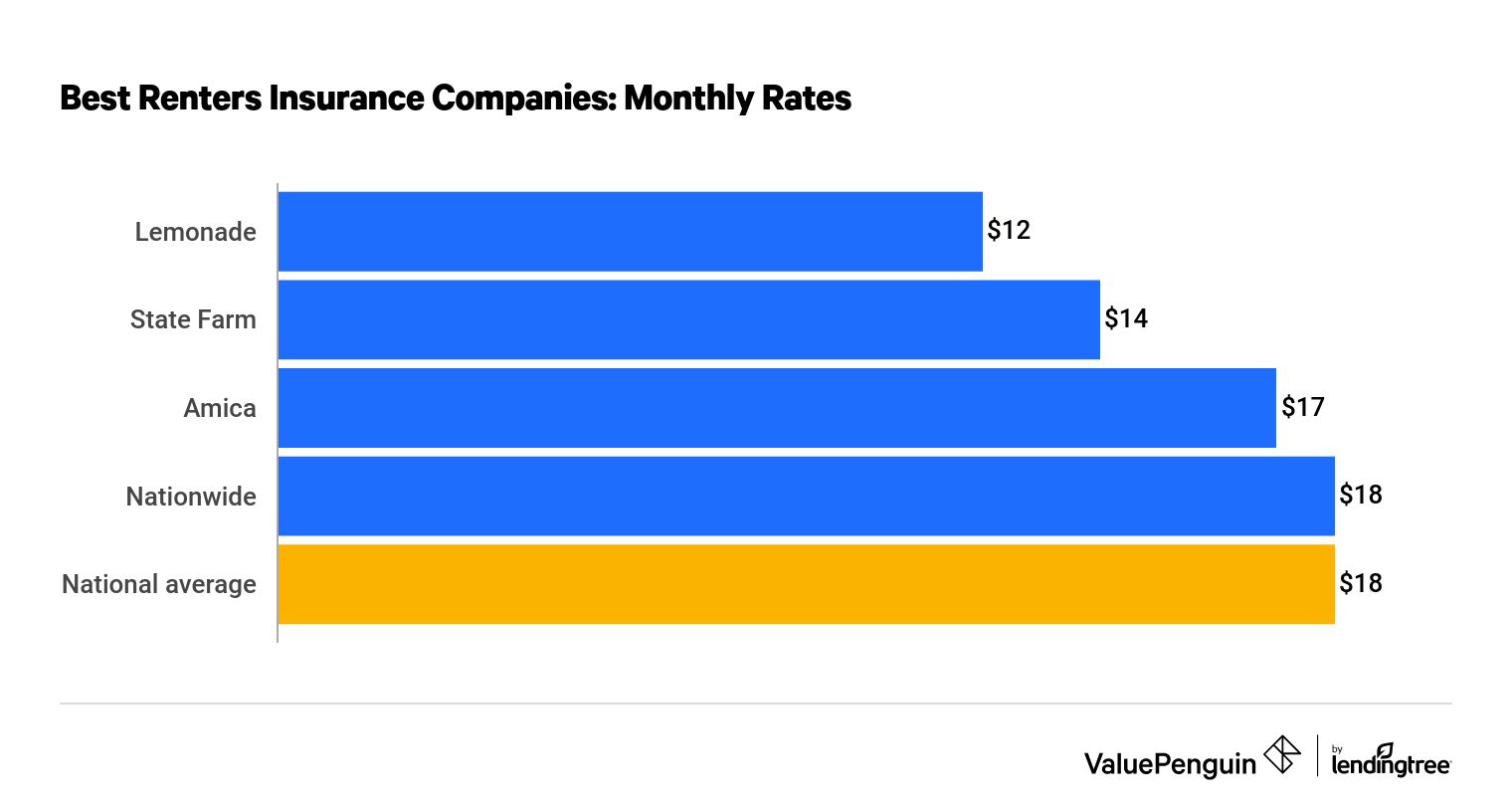

Renters insurance costs $18 per month on average.

Lemonade offers the cheapest renters insurance quotes, with an average rate of $140 a year, or $12 a month. That's 35% cheaper than the national average, which is $214 per year.

Find the Cheapest Renters Insurance Insurance Quotes Near You

If you're looking for an affordable renters insurance policy, it's worth comparing quotes from State Farm. Its average rate is $2 per month more than Lemonade's, but individual rates may be cheaper in your area.

Monthly renters insurance rates by company

Company | Average monthly rate | |

|---|---|---|

| Lemonade | $12 | |

| State Farm | $14 | |

| Amica | $17 | |

| Nationwide | $18 |

How to choose the best renters insurance company

Before you buy renters insurance, it's important to compare quotes from multiple companies. The cost of a policy is important, but you also need to make sure that it includes enough coverage to protect you and your belongings. In addition, you'll want to choose a company that has good customer service reviews. That way, you know you'll be taken care of if you ever have to file a claim.

Decide how much insurance coverage you need

Before you start shopping for the best renters insurance company, it's important to determine how much coverage you need.

Personal property coverage

Personal property coverage protects all of your belongings. That means the limit should be high enough to replace all of your stuff if it's destroyed or stolen. The best way to determine how much coverage you need is to create a home inventory listing all of your belongings and an estimated cost to replace them.

Actual cash value vs. Replacement cost

Most insurers offer two options when it comes to replacing your personal property. Standard policies typically pay you based on actual cash value, which takes into account any wear and tear on your items.

If you upgrade to replacement cost, your insurer will pay to replace your items with the same or similar new ones.

While the overall limit is the most important thing to consider, pay attention to coverage for expensive or valuable items. Insurers cover a maximum amount in certain categories, like jewelry. If your valuables exceed the coverage limit, you may need to purchase additional insurance.

Examples of items that you may need to purchase additional insurance for include:

- Engagement and wedding rings

- Expensive electronics

- Business property

- Musical instruments

- Artwork

- Pricier sports equipment, like bikes or golf clubs

Liability insurance

Personal liability coverage protects your assets if you cause damage to someone else's property or hurt somebody. The amount of coverage you need depends on how likely you are to be sued and the value of the assets you need to protect.

Standard renters insurance policies include $100,000 of liability coverage. However, you may need more coverage if your apartment or home poses an increased risk to guests. For example, if you rent a home with a pool, you're at a greater risk of being held responsible for a slip and fall.

Additional living expenses

Additional living expenses (ALE) coverage covers your cost of living if you have to move out of your home after a loss. This coverage can help pay for a hotel room or rent and moving costs. It may also cover additional transportation expenses associated with living away from home and the cost of food if your temporary space doesn't have a kitchen.

Your additional living expenses limit is usually calculated as a percentage of your policy's personal property coverage.

Renters insurance protects you against large expenses, like having to replace all of your stuff. That's why coverage limits are so important. Cheap renters insurance might not be worth the savings if it doesn't include enough coverage to protect you and your belongings.

Determine whether you need additional coverages

The best renters insurance company for you should offer whatever additional coverage options you think are necessary.

Coverage and who needs it | Major companies that offer it |

|---|---|

| Decreasing deductible | Travelers |

| Earthquake insurance | Geico, Nationwide, Progressive, State Farm |

| Equipment breakdown | Lemonade, Travelers |

| Extended liability | Allstate, Nationwide, Progressive, State Farm, Travelers |

| Identity theft protection | Allstate, Amica, Assurant, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers |

For people who want the most comprehensive list of add-ons, Nationwide and Travelers are the best options.

Renters who feel they don't need extra coverage — a standard policy provides enough protection — should consider Lemonade or State Farm. Although a policy from one of these companies is fairly basic, coverage usually costs less.

Compare renters insurance companies

Once you know how much insurance you need, you can start comparing quotes. Make sure that each policy has the same coverage limits so you can make an apples-to-apples comparison.

In addition to coverage options, you should consider:

- Rates: The cost of renters insurance is based on a number of factors, including where you live, how much coverage you need and your insurance history. You’ll want to compare your renters insurance quotes to national and state averages to make sure you’re getting the best rates.

- Reviews and ratings: It's important to choose an insurance company with great reviews and ratings because they tell a lot about its claims process and how it will treat you. If you ever need to file a claim, you’ll have peace of mind knowing that your insurer will help you get your life back to normal quickly.

- Financial strength: Your renters insurance policy is only as good as your insurance company’s ability to pay out claims. A company with a great financial strength rating should be able to make claim payments, even in difficult economic situations.

The best renters insurance companies offer affordable rates, adequate protection and reliable customer service.

Company |

Editor's rating

|

J.D. Power

|

NAIC

|

AM Best

|

|---|---|---|---|---|

| State Farm | 866 | 0.32 | A++ | |

| USAA | 893 | 0.2 | A++ | |

| Lemonade | 870 | 0.61 | A (Demotech) | |

| Nationwide | 834 | 0.16 | A+ | |

| Travelers | 815 | 0.19 | A++ |

How to save on renters insurance

There are a number of ways for you to save money on your renters insurance. Qualifying for policy discounts is an easy way to reduce your costs. You should also compare quotes from multiple companies to find the cheapest renters insurance rates.

Raising your deductible will also lower your monthly bill. However, you'll end up paying more if you file a claim.

Renters insurance discounts

Many insurers provide discounts for customers who take steps to make their homes safer, or for those who buy multiple policies. Common discounts available to renters include:

- Multipolicy discount

- Safety discount

- Claim-free discount

- Payment discount

- Online shopping discount

Renters insurance deductible

A deductible is the amount of money you have to pay when you file an insurance claim.

How your deductible works

Your couch is insured for $3,000 and needs to be replaced. If you have a $500 deductible, your insurance company will send you a check for $2,500. However, if your deductible is $1,000, your payout will only be $2,000.

Higher deductibles mean less protection and lower rates, while lower deductibles equal more protection and higher rates.

Ultimately, choosing a deductible comes down to your preference for risk. You either save money on your monthly bill or save money on any potential claims.

Frequently asked questions

Who has the best renters insurance?

The best renters insurance company is not the same for everyone. State Farm has some of the cheapest renters insurance rates and is available nationally. For renters with military ties, USAA may be the best option for renters.

Who has the cheapest renters insurance quotes?

Renters can get the cheapest quotes from Lemonade — a policy costs $12 per month, on average. However, it's only available in 29 states and Washington, D.C.. Renters who can't buy a policy from Lemonade should consider State Farm, which offers affordable rates across the country.

Which company has the best rental insurance coverage?

Renters who need extra protection should consider Nationwide, which offers lots of coverage options, like earthquake protection and replacement cost coverage. Coverage from Nationwide is also affordable at $18 per month, on average.

Which company has the best renters insurance reviews?

Amica offers the best customer service. Its reputation for a quick and easy claims process will help alleviate stress in an emergency situation. Renters can also get dependable coverage from USAA, but it's only available to people with ties to the military.

Methodology

To find average nationwide renters insurance rates, ValuePenguin compiled quotes from the largest insurance companies in each state, based on data availability. The sample renter is an unmarried 25-year-old man with no roommates or pets and no history of insurance claims.

Quotes are based on the following coverage limits:

Coverage | Amount |

|---|---|

| Personal property | $30,000 |

| Personal liability | $100,000 |

| Medical | $1,000 |

| Deductible | $500 |

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.