Lemonade Insurance Review: Low Rates & Basic Coverage

Lemonade offers cheap rates for basic home, renters, car and pet insurance. However, customer service can be inconsistent.

Compare Cheap Renters Insurance Options in Your Area

Lemonade is an excellent choice for people looking for basic coverage at affordable rates. It offers some of the cheapest insurance quotes we've found, but in exchange for those lower rates, you'll give up extra features like specialized coverage and in-person customer support.

Pros and cons

Pros

Cheap insurance coverage

Easy online shopping and claims

Cons

Mixed customer service reviews

No agents makes it difficult to speak to a person

Lemonade insurance: Excellent rates for the basics

Where can I get Lemonade insurance?

- Car insurance: 9 states

- Home insurance: 23 states and D.C.

- Renters insurance: 29 states and D.C.

- Pet insurance: 37 states and D.C.

Lemonade is not currently selling home or renters insurance in California. It may resume business in California in the future.

Renters insurance takeaway: If you're looking for the lowest renters insurance rates and only need basic coverage, Lemonade is a great choice.

Home insurance takeaway: Homeowners who need basic coverage should take advantage of Lemonade's excellent rates. However, the company doesn't offer a lot of coverage options, so it may not be the best fit for homeowners who need extra protection, like replacement cost coverage for personal belongings.

Car insurance takeaway: Lemonade only sells car insurance in a few states. Drivers looking for basic coverage can find very cheap rates from Lemonade. Its basic policy also includes roadside assistance, which other insurers charge extra for. However, other add-ons are limited.

Pet insurance takeaway: Pet insurance from Lemonade is cheaper than average. In addition, it offers preventive care programs that can save you money on your annual vet bills.

Lemonade's strongest features are its low rates and easy-to-use online experience. Shopping for insurance from Lemonade is easy — you can get quotes and purchase a policy in a few minutes. Filing claims and making adjustments to your policy are usually done through the Lemonade app, which is easy to use, too.

Coverage from Lemonade isn't available nationwide.

A major limiting factor for prospective Lemonade customers is its coverage area, which is different for each type of insurance.

Lemonade renters insurance

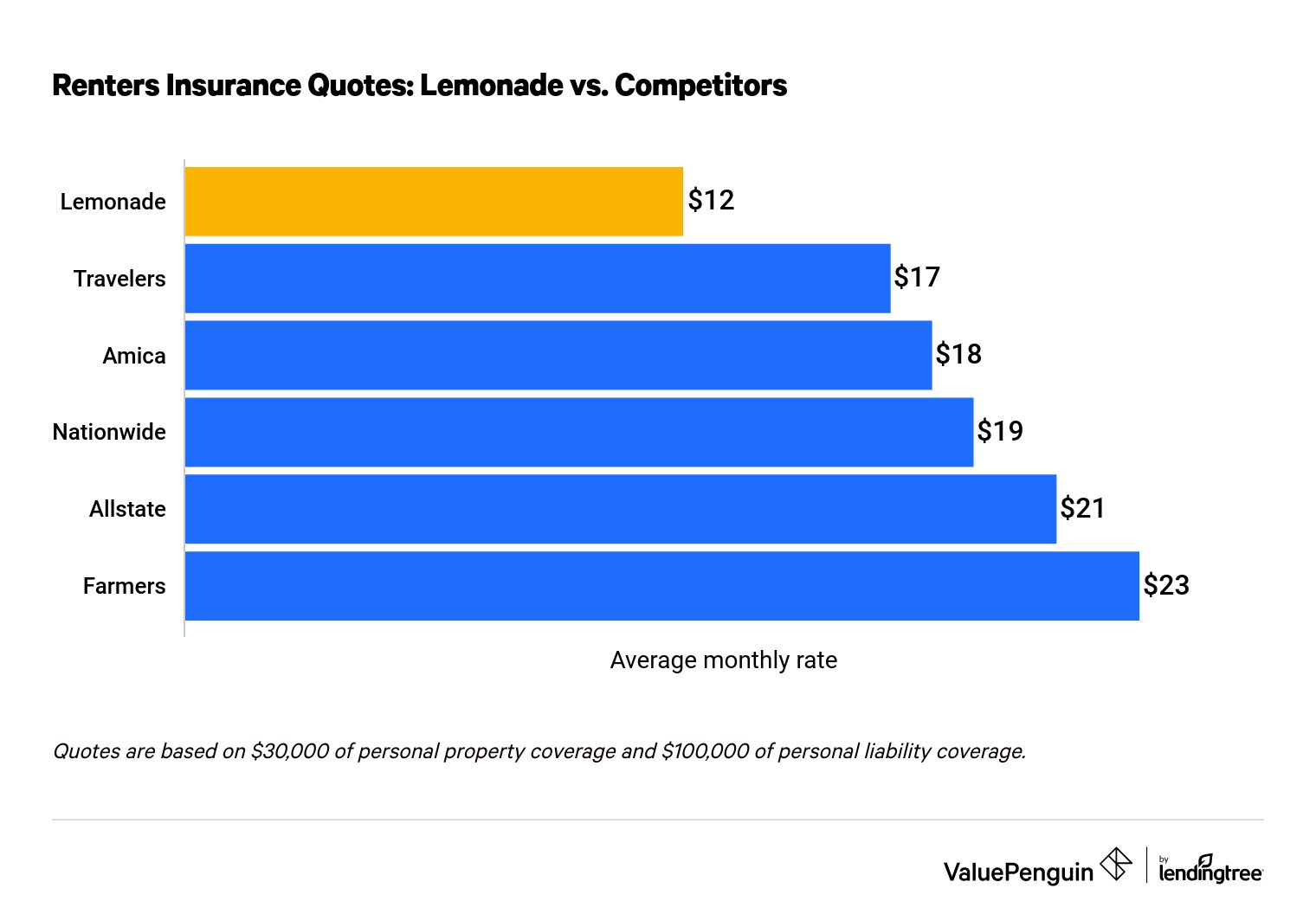

Lemonade renters insurance quote comparison

Lemonade renters insurance costs $12 per month, or $140 per year, on average. That's 40% cheaper than average and amounts to a savings of $78 per year.

Compare Cheap Renters Insurance Options in Your Area

Quotes from other major insurers are significantly higher than quotes from Lemonade. A policy from the second-cheapest company, Travelers, costs 49% more than the same coverage from Lemonade. That's $5 more per month, or $68 more per year.

Lemonade renters insurance rates vs. competitors

Company | Average monthly cost |

|---|---|

| Lemonade | $12 |

| Travelers | $17 |

| Amica | $18 |

| Nationwide | $19 |

| Allstate | $21 |

| Farmers | $23 |

Lemonade renters insurance discounts

While Lemonade might reduce your renters insurance quote based on factors like the age of your apartment or whether you've made a claim in the past, the company only offers three discounts that renters can actively take advantage of.

- Multipolicy discount

- Pay-in-full discount

- Protection equipment discount

Other insurance companies, like Allstate, typically offer customers additional discounts, such as one for setting up automatic bill payment and going a certain period of time without filing a claim. However, it's unlikely that these additional discounts would lower the cost of your renters insurance enough to make it competitive with Lemonade's already-low rates.

Lemonade renters insurance coverage

Most renters insurance companies offer similar coverages, including personal property, liability and loss of use. Plus, Lemonade offers a few useful add-ons to help you personalize your policy:

Extra coverage

The extra coverage policy add-on gives you extra protection for expensive items, such as bicycles, jewelry and art.

Any belongings that have extra coverage are protected against what’s called accidental loss, which isn't included in a standard policy. For example, if your necklace falls off at the beach, Lemonade will replace it. Plus, you don't have to pay a deductible for "extra coverage" items, so you'll be able to replace your belongings without paying anything out of pocket.

The expanded protection that "extra coverage" offers can help give you peace of mind that your most important belongings are protected in almost any situation.

Equipment breakdown coverage

Lemonade offers equipment breakdown coverage, which protects most of the electronics and appliances in your home from damage caused by electrical failure or equipment breakdown. This includes things like your television, refrigerator and computer.

Water backup

Water backup coverage protects your belongings if a pipe or sump pump backs up and floods your home.

Replacement cost

Extended liability insurance

Mold protection

Hurricane coverage

Lemonade home insurance

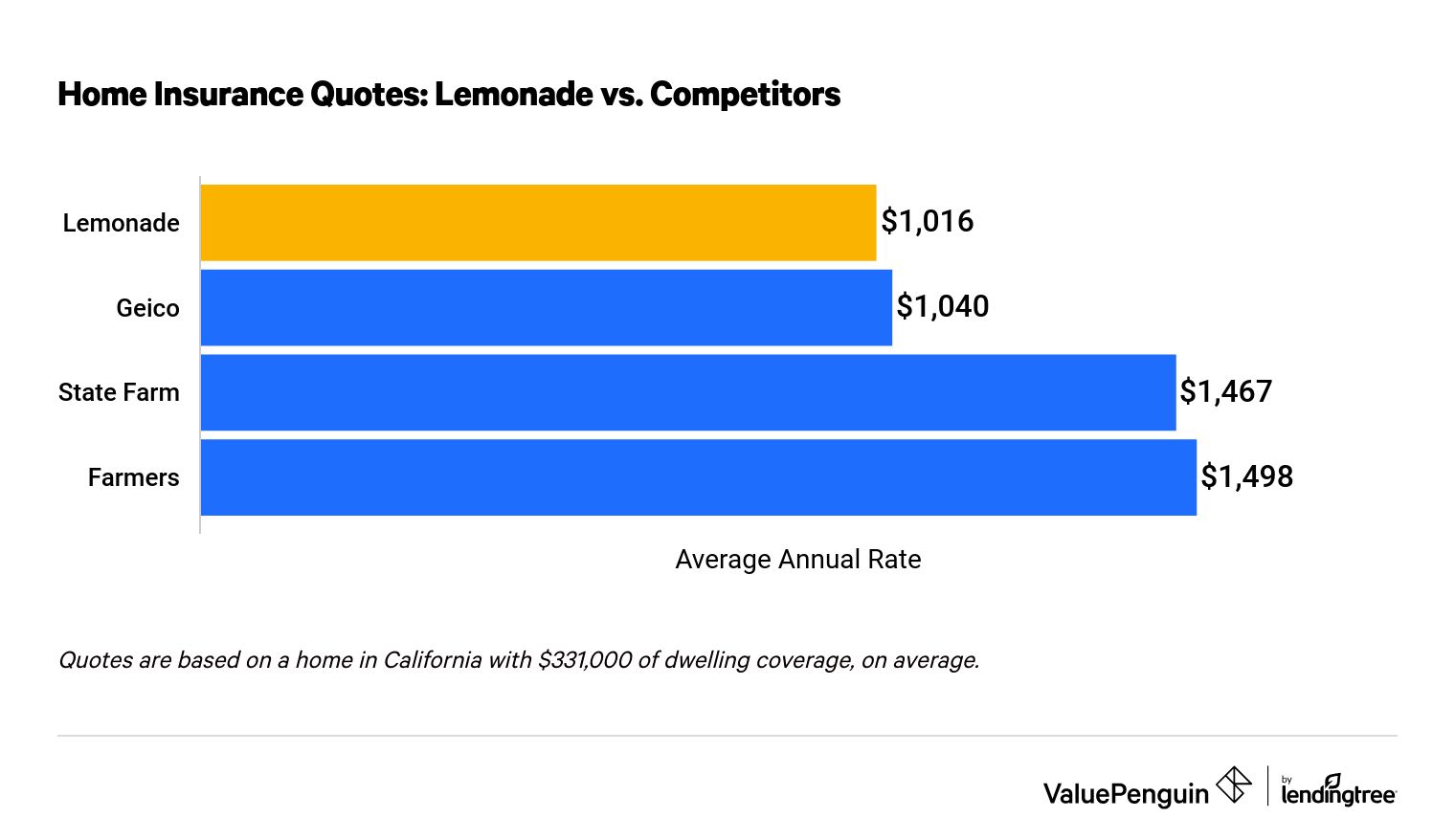

Lemonade home insurance quote comparison

Lemonade offers the most affordable home insurance quotes across the insurers we analyzed. On average, a policy costs $1,016 per year, or $85 per month, which is 19% cheaper than average.

Find Cheap Homeowners Insurance Quotes in Your Area

Quotes from State Farm and Farmers are significantly more expensive than the average quote from Lemonade. A State Farm policy costs $451 more per year, while coverage from Farmers is $482 per year more expensive, on average.

Lemonade home insurance rates vs. competitors

Company | Average annual cost |

|---|---|

| Lemonade | $1,016 |

| Geico | $1,040 |

| State Farm | $1,467 |

| Farmers | $1,498 |

Lemonade home insurance discounts

Lemonade offers a few basic home insurance discounts, most of which are typical of home insurance companies.

- Bundling discount

- Fire protection discount

- Gated community

- Material discount

- Pay in full discount

- Protection equipment discount

A notable discount many Lemonade policyholders may not be eligible for is the auto insurance bundling discount. That's because Lemonade only offers auto insurance in nine states, meaning most customers can't take advantage of this common discount.

Customers can typically save around 15% on total insurance costs when purchasing homeowners and auto insurance from the same company.

Lemonade home insurance coverage options

Lemonade's home insurance offerings are somewhat typical. Besides the standard coverage offerings of dwelling, personal property, liability and loss of use, there are only a few noteworthy home coverage options.

Homeowners can take advantage of the same coverage add-ons available to renters through Lemonade: equipment breakdown, valuables coverage, water backup and earthquake coverage.

In addition, Lemonade offers homeowners:

- Extended reconstruction costs: Pays to rebuild your home, even if the construction costs more than your dwelling coverage limit.

- Swimming pool liability coverage: Pays medical bills and lawsuit expenses if someone gets hurt while using your pool.

Lemonade car insurance

Lemonade offers cheap car insurance, but it's currently only available in nine states: Arizona, Colorado, Illinois, Indiana, Ohio, Oregon, Tennessee, Texas and Washington.

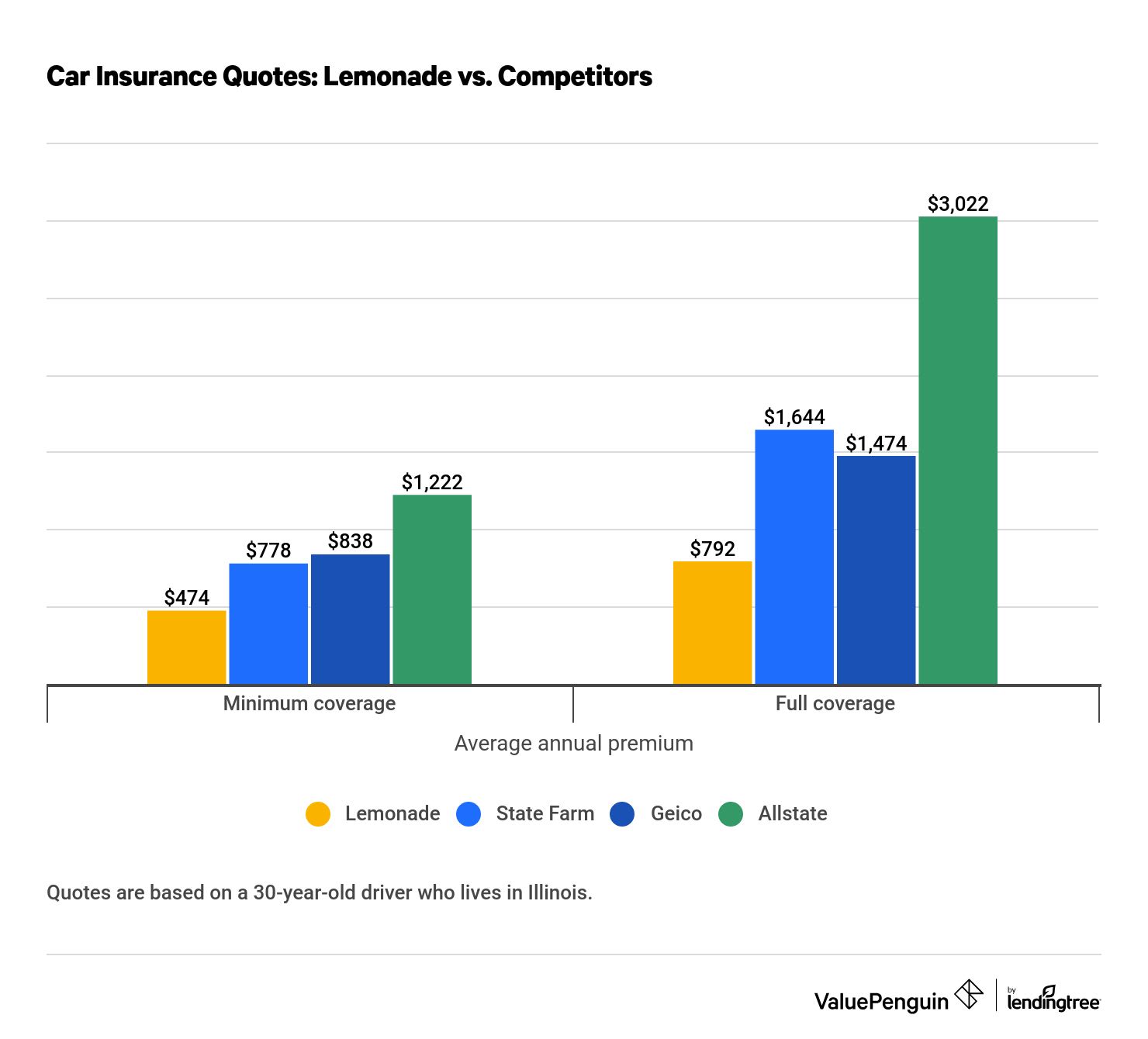

Lemonade auto insurance quote comparison

Car insurance from Lemonade is significantly cheaper than coverage from its competitors. A minimum coverage policy from Lemonade costs $40 per month, 43% cheaper than average.

Find Cheap Auto Insurance Quotes in Your Area

Full coverage car insurance is also cheaper from Lemonade. On average, a policy from Lemonade costs $66 per month — 54% less expensive than average.

Lemonade auto insurance rates vs. competitors

Company | Minimum coverage | Full coverage |

|---|---|---|

| Lemonade | $474 | $792 |

| State Farm | $778 | $1,644 |

| Geico | $838 | $1,474 |

| Allstate | $1,222 | $3,022 |

Lemonade car insurance discounts

Lemonade doesn't offer as many car insurance discounts as other companies. However, its rates are so much lower than competitors' rates that a long list of discounts isn't as important.

Drivers can take advantage of the following discounts from Lemonade:

- Bundle discount

- Driving with the Lemonade app

- Electric or hybrid car discount

- Payment discount

- Plan ahead savings

In addition, Lemonade offers a usage-based discount and a low mileage discount.

Lemonade requires drivers to download its app, which is used to track the number of miles you drive. The app also monitors your driving behaviors, like speeding, erratic turns, hard braking and the time of day you drive. These factors are used to determine how much you save for good driving.

Lemonade car insurance coverage options

Above the basic coverages, Lemonade doesn't offer many add-ons to help drivers customize their policy. A standard policy can include the typical car insurance coverage options, like bodily injury and property damage liability, medical payments coverage or personal injury protection (PIP), uninsured motorist, and comprehensive and collision coverage.

Lemonade's base policy includes roadside assistance at no additional cost. That's an important perk that most other insurers charge extra for.

Roadside assistance will send help and pay for towing or simple repairs if you're stuck on the side of the road with a flat tire, you're locked out of your car or you simply ran out of gas. Lemonade's plan even includes an EV charge for electric vehicles.

In addition, policyholders also receive emergency crash assistance for free. This service uses the technology included in Lemonade's app to alert the company if you're in an accident so that it can send help.

Drivers can also purchase:

- Extended glass and windshield coverage, which pays the cost to repair or replace your windshield with little or no deductible, depending on where you live.

- Temporary transportation coverage, which covers the cost of a rental car, public transportation or rideshare service for up to a month while your car is being repaired after a covered incident.

However, Lemonade doesn't seem to offer gap insurance, which would pay off your loan or lease if your new car is totaled and it's worth less than what you owe.

Lemonade pet insurance review

Lemonade pet insurance quote comparison

Pet health insurance from Lemonade is cheaper than average. A policy for a 4-year-old dog costs $27 per month, or $324 per year, on average. That's 12% less expensive than the average we found, which is $30 per month.

Pet insurance quotes for cats are also more affordable from Lemonade. A policy costs $16 per month for a 4-year-old cat — $1 per month cheaper than average.

Lemonade pet insurance rates vs. competitors

Company | Cat | Dog |

|---|---|---|

| Embrace | $13 | $30 |

| Lemonade | $16 | $27 |

| Figo | $18 | $33 |

| AKC/PetPartners | $19 | $32 |

Lemonade pet insurance discounts

In addition to below-average prices, Lemonade offers a few discounts to help pet parents save money on pet health insurance:

- Bundle discount: Save up to 10% when you purchase home, renters, auto or life insurance from Lemonade.

- Multipet discount: Save up to 5% when you insure multiple pets.

- Pay-in-full discount: Save 5% by paying your annual premium up front.

Lemonade pet insurance coverage options

Lemonade's standard pet insurance policy helps pay for your pet's medical bills if they have an accident or get sick. This includes diagnostics like blood tests and X-rays, procedures and medication.

In addition, Lemonade offers the following coverage options if you need additional protection:

Coverage | Description | Approx. monthly cost |

|---|---|---|

| Vet visit fees | Covers expenses for eligible accidents and illnesses | $2.75 |

| Physical therapy | Covers expenses for acupuncture, chiropractic care and more | $0.92 |

| End of life | Covers euthanasia, cremation and memorial items for up to $500 with no deductible | $2.50 |

Lemonade also offers no-deductible preventive care packages for pets, which help pay for annual vet expenses.

- For an additional $10 per month, pet owners receive one wellness exam, one parasite test, three vaccines, one heartworm or feline leukemia test and one blood test.

- For an additional $16 per month, pet owners receive the benefits listed above, plus routine dental cleaning and flea/tick or heartworm medication.

Lemonade insurance reviews and customer service

Lemonade receives mixed reviews when it comes to customer service.

The company receives nearly twice as many customer complaints as is typical for an insurer of its size, according to the National Association of Insurance Commissioners (NAIC). That means policyholders aren't always happy with the service they receive from Lemonade.

Most complaints are regarding delays in the claims process and claim denials. That means Lemonade customers may need to wait longer to make repairs or replace damaged belongings than people insured with other companies.

On the other hand, Lemonade received the second-best score for customer satisfaction on J.D. Power's annual renters insurance survey.

While Lemonade doesn't have a financial stability rating from AM Best, a popular insurance rating agency, it received a rating of "A" from Demotech, which evaluates the stability of regional and specialty insurers. This rating indicates that Lemonade has an "exceptional" ability to pay out claims.

It's not a perk that directly affects customers, but we like Lemonade's Giveback program, which launched in 2017. After operating costs and claim payouts, Lemonade donates excess premiums to charity each year. In 2021, Lemonade gave $2.3 million to over 100 charities.

In addition, Lemonade is planting trees to help reduce your carbon footprint. When you purchase car insurance from Lemonade, the company will use its app to determine how many trees to plant based on the number of miles you drive.

Frequently asked questions

Is Lemonade a good insurance company?

Overall, Lemonade is a good insurance company. It offers fairly standard insurance coverage at an excellent price. However, customer service reviews are mixed, so it may take longer to make repairs after filing a claim.

Does Lemonade have car insurance?

Yes, Lemonade offers car insurance. However, it is currently only available to drivers in Arizona, Colorado, Illinois, Ohio, Oregon, Tennessee, Texas and Washington.

How much is Lemonade renters insurance?

Renters insurance from Lemonade costs 12 per month, or $140 per year, on average. That's the cheapest quote we found among major insurers.

Does Lemonade have a phone number?

Yes, you can contact Lemonade by phone at 844-733-8666.

Who underwrites Lemonade insurance policies?

Lemonade underwrites its own policies, which are then reinsured by other companies — a common practice in the insurance industry. Lemonade is reinsured by multiple companies, including Swiss Re, Munich Re and Hannover Re.

Methodology

To compare renters insurance rates, we gathered quotes from some of the top insurers across every state in the United States. Rates are based on a 25-year-old single man living alone with no pets and no claims history. Quotes include the following coverage limits:

Coverage | Limit |

|---|---|

| Personal property | $30,000 |

| Personal liability | $100,000 |

| Medical payments | $1,000 |

| Loss of use | $9,000 |

| Deductible | $500 |

To compare home insurance rates, we gathered quotes for single-family homes in nine of the largest cities in California. Rates are based on a 30-year-old single man with no claims history. On average, the homes quoted were 1,340 square feet and built in 1962. Quotes include the following coverage limits:

Coverage | Limit |

|---|---|

| Dwelling | $330,556 |

| Personal liability | $100,000 |

| Medical payments | $5,000 |

| Deductible | $1,000 |

Dwelling coverage is an average across all nine properties quoted.

To compare auto insurance rates, we gathered quotes from the five largest cities in Illinois. Our sample driver was a 30-year-old man driving a 2015 Honda Civic EX with a clean driving record. Rates are based on the following coverage limits:

Coverage | Minimum-coverage | Full-coverage |

|---|---|---|

| Bodily injury liability | $25,000/$50,000 | $50,000/$100,000 |

| Property damage liability | $20,000 | $25,000 |

| Uninsured motorist bodily Injury | $$25,000/$50,000 | $50,000/$100,000 |

| Comprehensive & collision deductible | waived | $500 |

To compare pet insurance rates, we gathered quotes from the five largest cities in California. Our sample dog was a 4-year-old male mixed-breed, and our sample cat was a 4-year-old female domestic shorthair. Rates are based on a $500 deductible, $5,000 annual maximum and 80% reimbursement level.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.