Who Has the Cheapest Renters Insurance Quotes in Michigan?

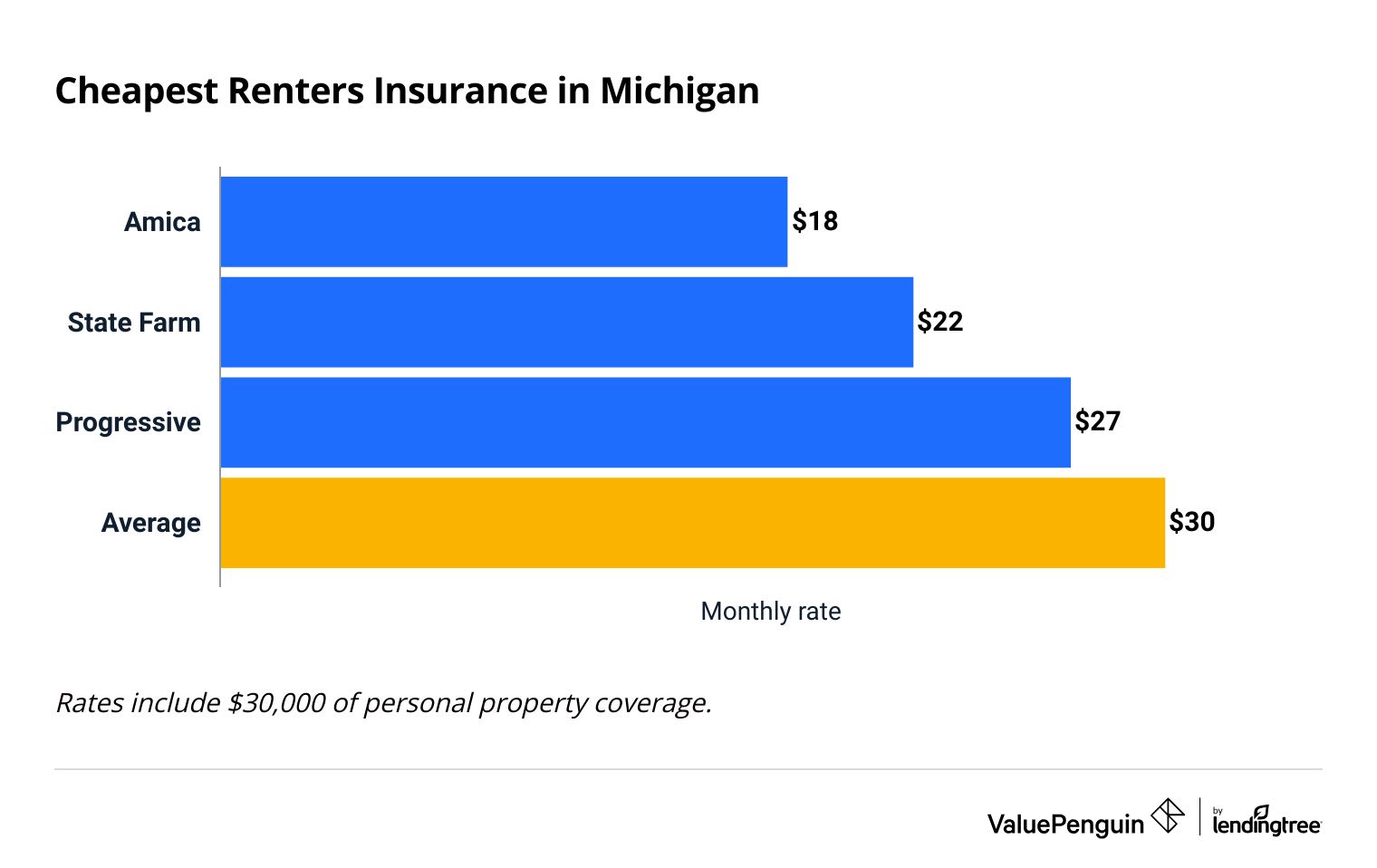

Amica has the cheapest renters insurance quotes in Michigan, at $18 per month on average.

Compare Renters Insurance Quotes in Michigan

Best Cheap Renters Insurance in MI

ValuePenguin's editors made these top picks by considering each company's rates, customer satisfaction metrics and coverage options.

Average rates came from collecting 160 quotes from seven companies across 25 of the largest cities in Michigan.

Cheapest renters insurance companies in Michigan

Amica offers Michigan's cheapest renters insurance.

Amica's average rate is $18 per month for $30,000 of coverage to replace your stuff. That's $12 per month less than the state average.

Compare Cheap Renters Insurance Quotes in Michigan

There's a substantial difference in price among renters insurance companies in Michigan. The cheapest insurer, Amica, is 54% less expensive than the most expensive, Lemonade. Switching could save a Michigan renter $255 per year.

Cheapest renters insurance companies in Michigan

Company | Monthly cost | ||

|---|---|---|---|

| Amica | $18 | ||

| State Farm | $22 | ||

| Progressive | $27 | ||

| Allstate | $33 | ||

| Farmers | $34 | ||

Best renters insurance in Michigan for most people: Amica

-

Editor's rating

- Cost: $18/mo

Amica has great customer service and the cheapest coverage in Michigan.

-

Cheap quotes

-

Good customer service

-

No options for mold or water backup coverage

Amica has the cheapest renters insurance coverage in Michigan and topflight customer service.

The company's average rate of $18 per month is 39% lower than the state average in Michigan.

Amica also has some of the best customer service in the state. The company gets only one-third the complaints expected for an average company its size. . It also got a high all-around ranking from ValuePenguin's editors.

Amica doesn't offer that many extra coverage options for renters who need extra protection. For example, renters with Amica can't get mold coverage or water backup protection, which protects your belongings against water damage from backed-up pipes, sewers or sump pumps.

Best Michigan renters insurance for extra coverage: State Farm

-

Editor's rating

- Cost: $22/mo

State Farm has a wide range of coverage options and low rates.

-

Wide range of coverage options

-

Good customer service

-

Strong network of local agents

-

Few ways to lower rates with discounts

If you want to add extra protections to your policy and still save money, State Farm is a good option in Michigan.

State Farm lets you customize your renters insurance policy with extra coverage for damage from water backup or flooding. You can also raise your limits for valuable items like art and jewelry, which not every company offers. And you can get coverage for identity theft, as well.

State Farm's quotes for renters insurance are low in Michigan, with an average of $22 per month.

You'll also get good customer service with State Farm, but one big drawback is that it doesn't offer a lot of discount options. Outside of a bundling discount with car insurance, the only other way to lower your rates is to add home security features.

Best MI renters insurance for discounts: Progressive

-

Editor's rating

- Cost: $27/mo

Progressive offers a good range of discounts to lower your rates.

-

Wide range of discounts

-

Good options to add to your policy

-

Poor customer service

-

Not the cheapest rates

Progressive offers a wide range of discounts to help you lower your rates.

Progressive discount options

- Bundling

- Early shopper

- Pay in full

- Paperless

- Gated community

You can also get a range of good extra coverages to improve your policy. That includes protections for identity theft, valuable items and replacement cost coverage.

Progressive has cheaper-than-average rates at $27 per month, but you can get cheaper coverage from Amica and State Farm. The biggest downside with Progressive is its customer service. The company gets 43% more complaints than an average company its size, which means you might have more hoops to jump through when you need a claim paid.

Renters insurance in Michigan: Cost by city

Renters living in Detroit pay the highest prices for renters insurance in Michigan, while people in Wyoming pay the cheapest rates among the major cities in the state.

Prices for renters insurance vary significantly across the largest cities in Michigan. In Detroit, renters can expect to pay $60 per month, on average. On the other hand, people living in Wyoming pay an average of $21 per month for the same coverage. That's a difference of more than $400 per year.

City | Monthly rate | % from average |

|---|---|---|

| Ann Arbor | $21 | -28% |

| Canton | $28 | -6% |

| Clinton | $27 | -9% |

| Dearborn | $29 | -1% |

| Dearborn Heights | $33 | 11% |

People who live in areas with more crime or severe weather may pay more for coverage, as insurers believe they're more likely to make a claim.

How to find cheap renters insurance in Michigan

The best way to find the cheapest renters insurance in Michigan for you is to first figure out how much coverage you need and then compare quotes from multiple companies. That way, you can pay the least for the coverage you need.

Figure out how much protection you need for your property. How much coverage you decide on will have the biggest impact on how much you end up paying for renters insurance. You should get enough to cover the property in your home, plus other costs if you can't live there after a disaster. But you also don't want to pay for coverage you don't need.

Shop around for multiple quotes. There's a difference of a little over $21 per month between the cheapest and most expensive companies in Michigan. That means you could save $255 depending on the quote you choose.

In addition to the level of coverage you get, insurance companies usually factor in other details like your age, marital status and location to set rates. They also may consider if you've made claims in the past, your credit score and other aspects of your insurance history. As a result, the cheapest company for your friends or neighbors might not be the cheapest option for you.

What renters insurance coverage do I need in Michigan?

When you rent a home in Michigan, you'll need coverage for the possibility of severe storms, from blizzards in the winter to hailstorms, wind gusts, tornadoes and possible flooding in the spring and summer. You need to make sure your renters insurance covers damage from these kinds of conditions.

Does Michigan renters insurance cover snow damage?

Snow can do significant damage, especially if a broken window lets it into your home. Storms coming off the Great Lakes that surround the state can dump high volumes of "lake-effect snow." That can break pipes, flood apartments and damage property if snow gets inside.

Water damage to your personal property caused by snow or ice is usually covered by renters insurance. You won't be covered, however, if the damage is because of your own negligence. So if your TV is damaged because you left a window open during a storm, it likely won't be covered.

Does renters insurance in Michigan cover flooding?

Standard renters insurance doesn't cover damage caused by flooding. Floods are relatively common in much of Michigan, especially in the Upper Peninsula. To get that protection, you'll need a separate flood insurance policy.

If you live in an apartment that isn't on the ground floor, you likely won't get any benefit from purchasing flood insurance.

"Flooding" is when land areas that are usually dry are temporarily covered in water. Your home or basement flooding from something like a broken pipe or washing machine issue should be covered by renters insurance.

Floods often happen when it rains hard and too quickly for the ground to absorb it, or when a river or body of water jumps its banks, especially because of snowmelt.

Michigan renters insurance trends

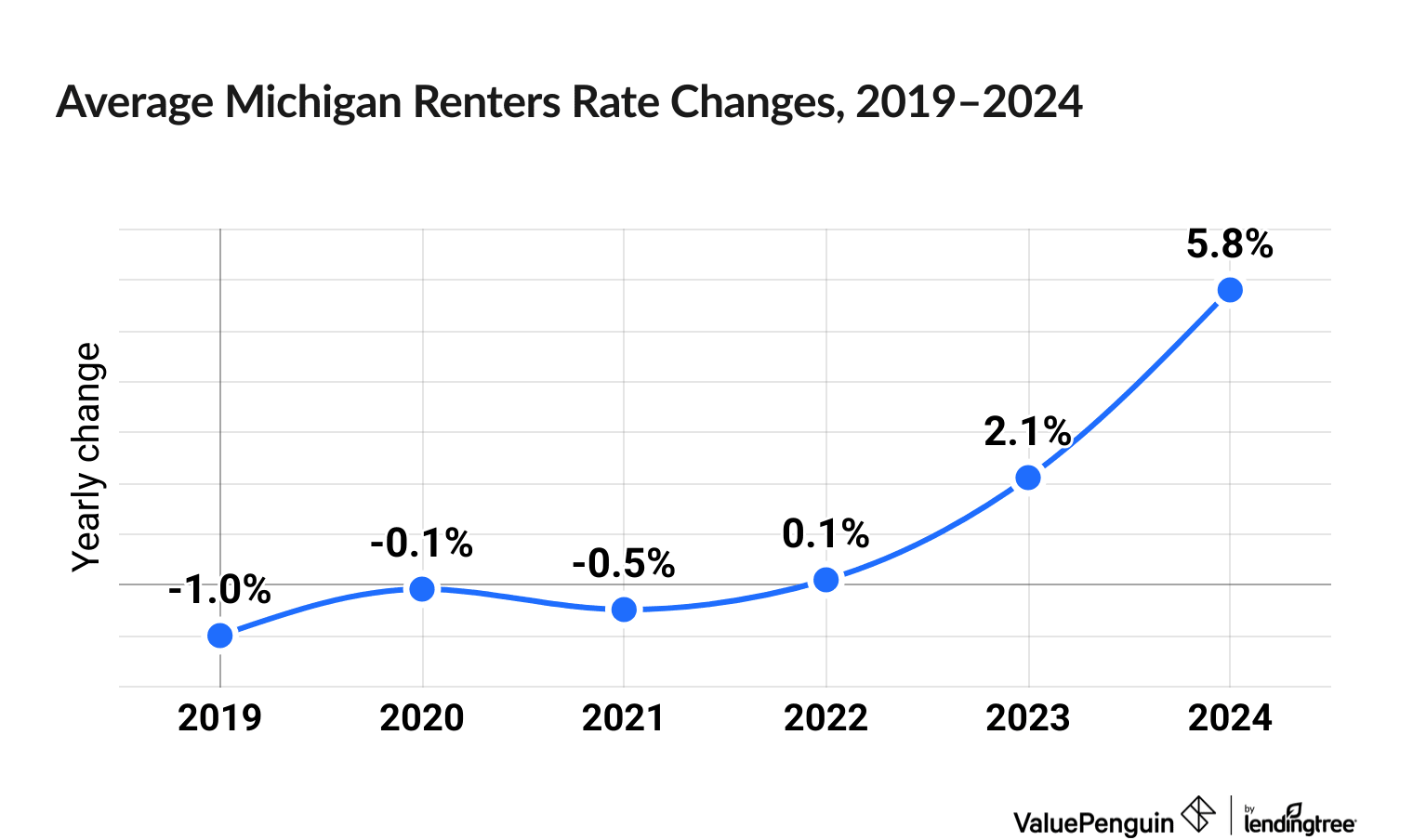

Renters insurance prices have gone up 6.6% in Michigan over the last six years.

Michigan renters insurance rates went up between 0.1% and 39.3% over the last six years, depending on the company.

Renters insurance prices, on average, decreased in 2020 and 2021, but then increased steadily, with an uptick of 8.1% across 2023 and 2024.

Among the major MI insurers, the biggest increases have been at American Family Insurance (39.3%), Nationwide (28.9%) and Michigan Farm Bureau (21.2%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in Michigan?

Renters in Michigan pay an average of $30 per month for insurance. However, in Michigan, average renters insurance rates can vary by up to $39 per month depending on where you live, which means some renters can expect to pay significantly more than the state average.

Who has the cheapest renters insurance quotes in Michigan?

Amica offers the cheapest renters insurance rates in Michigan. A policy costs $18 per month, on average.

Is renters insurance required in Michigan?

Renters insurance is not legally required in Michigan, but your landlord may require you to purchase a policy as a part of your lease agreement.

Methodology

ValuePenguin got more than 150 quotes from across Michigan's 25 largest cities. Rates are for a 30-year-old woman who is not married and has no claims history. Coverage limits include:

- $30,000 of personal property coverage

- $9,000 for loss of use

- $500 deductible

- $100,000 of personal liability

- $1,000 of medical payments to guests

Customer service ratings take into account complaint ratings from the National Association of Insurance Commissioners (NAIC), J.D. Power's 2023 renters insurance customer satisfaction study rankings, cost data and coverage options.

These rates should be used for comparative purposes only. Your quotes may differ.

Managing Editor

Ben Breiner is the Managing Editor of ValuePenguin/LendingTree's insurance vertical. He oversees a team of writers who focus on guiding readers through the rigors of home and auto coverage. He still loves that moment when the words fall together and he can translate an intimidating topic so a reader can make the best choice.

Ben got involved in insurance in 2021 when he joined ValuePenguin. He moved up from writer to editor and watched the team grow to expand the ways it helps consumers. Before that, he spent a decade as a sportswriter for newspapers in the Southeast and Midwest.

Ben had to put off buying his first car because of high insurance rates, so he's keenly aware how the wrong policy can get in the way of your goals. He should've shopped around and looked to the experts.

Insurance tip

Always keep an eye out for insurance you can load up on at a low price. A lot more liability coverage won't break the bank and protects your hard-earned assets.

Expertise

- Car insurance

- Home insurance

- Renters insurance

Education

- BA, Economics and Journalism, University of Wisconsin-Madison

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.