State Auto Insurance Review: Cost and Coverage

State Auto is a good insurance company if you want to add to your coverage, but it's expensive and its customer service is below par.

Find Cheap Auto Insurance Quotes in Your Area

State Auto will no longer offer new car and home insurance policies directly as of January 2023. Liberty Mutual acquired State Auto in March 2022, and most State Auto policies have transitioned to Safeco. State Auto will continue to offer commercial policies to businesses and farms.

State Auto is part of Liberty Mutual, and it is fairly expensive compared to other companies. But if you want to add certain protections, such as pet and cell phone coverage, it's a good option.

Pros and cons

Pros

Unique coverage add-ons, such as pet and personal effects coverage

Cons

Expensive rates

Poor customer service

Can't shop for a policy online

State Auto car insurance rates and discounts

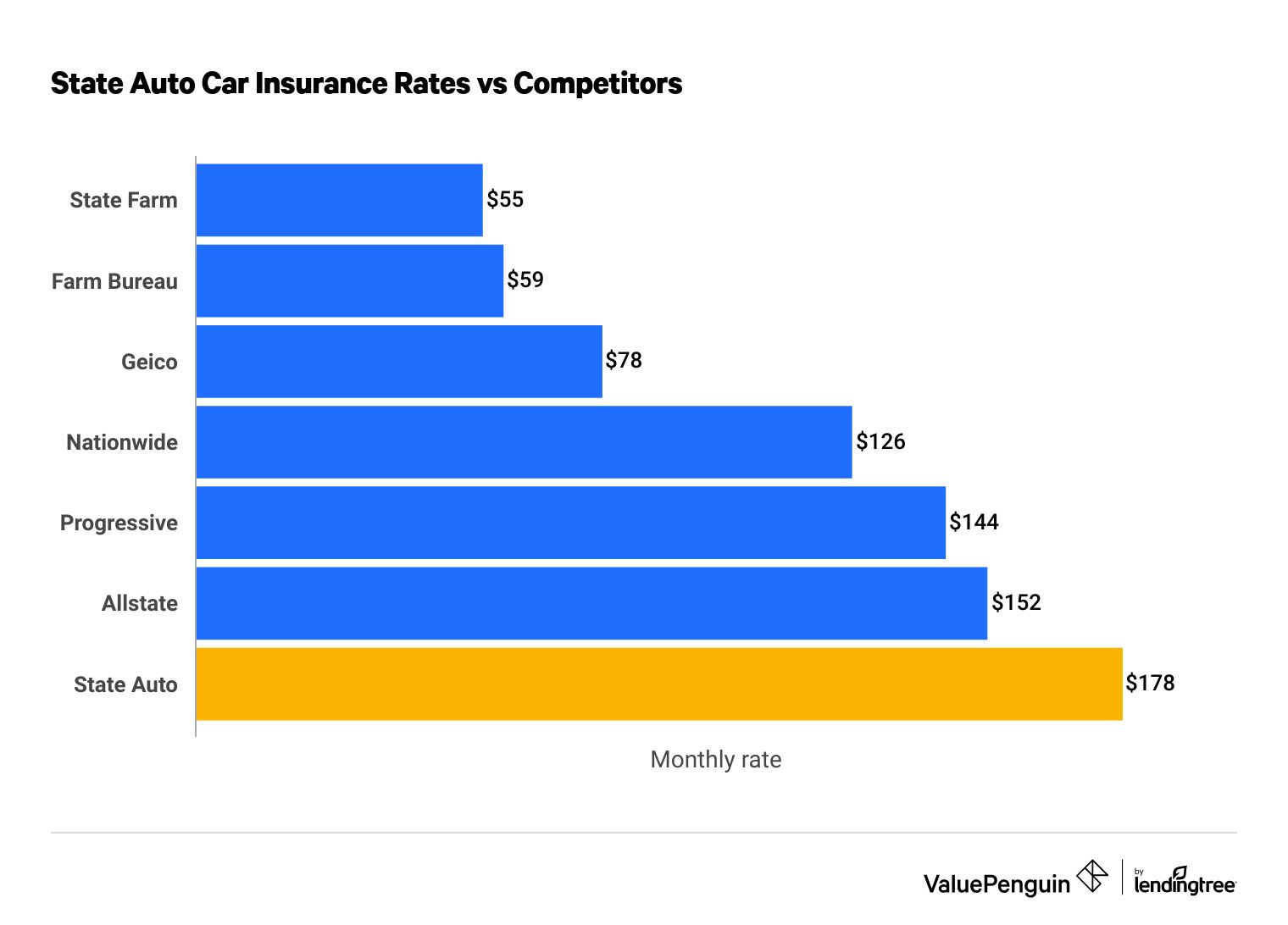

State Auto charges higher auto insurance rates than most competitors. The company's average rate of $178 per month is more than three times the price State Farm charges and twice as expensive as Geico's rate.

Find Cheap Auto Insurance Quotes in Your Area

State Auto car insurance rates vs. competitors

Company | Monthly rate | |

|---|---|---|

| State Farm | $55 | |

| Farm Bureau | $59 | |

| Geico | $78 | |

| Nationwide | $126 | |

| Progressive | $144 | |

| Allstate | $152 | |

| State Auto | $178 |

We recommend comparing quotes from multiple companies before you purchase car insurance from State Auto.

State Auto car insurance discounts

State Auto's car insurance discounts are mostly in line with what is typically offered by other insurers. These include discounts for being a good student, insuring multiple cars and paying in full at the start of your policy.

Highlighted discount: State Auto Start-Up

One of the more unique discounts that State Auto offers is its Start-Up discount. This incentivizes prospective customers — who are currently insured — to switch to State Auto before their existing auto insurance policy expires. The size of this discount depends on your previous insurer and how long you were with the company.

Accident-prevention course

Drivers who are over 21 years old and have taken an accident-prevention course within the last three years.

Anti-theft devices

Those with vehicles that are equipped with anti-theft devices such as passive disabling devices.

Driver training (driver’s education)

Drivers under the age of 21 who have taken a driver’s education course.

Good student

Full-time students who have at least a 3.0 GPA.

Multipolicy

Those who have at least two lines of insurance with State Auto, such as homeowners or umbrella.

Multicar

Drivers who insure multiple vehicles with State Auto.

Paid in full

Those who pay the full amount owed for their policy at the start of its term.

State Auto also offers discounts through State Auto Safety 360, its usage-based telematics program. Policyholders install a tag device and a mobile app, which monitors and scores their driving behavior based on factors like mileage, acceleration, braking, cornering and speed. The better your performance, the higher your discount. You also get a 10% discount just for participating.

However, we do not recommend State Auto Safety 360. While the maximum discount of 50% is higher than what most other insurers offer, policyholders run the risk of surcharges, as State Auto may raise rates for poor driving performance. Policyholders also rate the State Auto Safety 360 app as just mediocre, with Apple users giving it a 2.8 out of 5 and Android users giving it a slightly lower score of 2.7 out of 5. Other telematics programs offer a better user experience.

State Auto's car insurance policies

Though the available options may vary by state, State Auto typically offers three levels of auto insurance coverage to its customers: Standard, Protection Plus and Premier. All coverage levels include the standard auto insurance coverages, such as liability, medical payments, uninsured motorist liability, and comprehensive and collision insurance.

Drivers who are interested in more than just the typical coverages should consider State Auto's Protection Plus and Premier offerings. Choosing one of these levels of coverage will give you the choice to add optional coverages that aren't available to those who purchase the Standard car insurance package.

Coverages | Description | Standard | Protection Plus | Premier |

|---|---|---|---|---|

| Roadside assistance | Covers towing, fuel delivery, tire changes, battery jumps and lockout services (up to $100). | |||

| Full safety glass | Deductible is waived on repairs for vehicle glass and lights. | |||

| OEM parts | Having this coverage will insure that only original equipment manufacturer (OEM) parts — as opposed to potentially lower-quality aftermarket parts — will be used when your car is repaired as a result of a covered loss. |

The Protection Plus and Premier insurance packages both automatically include the minor violation forgiveness benefit and the accident forgiveness benefit. With these coverages, State Auto customers who qualify — by not having any violations or at-fault accidents within a certain amount of time — will not see their rates rise after their first traffic violation or at-fault accident. This benefit can potentially save you a lot on your auto insurance, as being convicted of a minor traffic violation can cause a 14% increase in auto insurance costs.

You can also add auto replacement cost coverage, which will pay to replace a car two model years or newer from the start date of the policy, or rideshare gap coverage.

Highlighted coverage: AutoXtended Endorsement package

The AutoXtended Endorsement — a benefit that is included for State Auto customers who purchase Protection Plus or Premier coverage — includes a number of additional coverages that can be complementary additions to the standard car insurance offerings. Standout features include injury-related coverage like emergency travel and total disability coverage, as well as protections for your pet and personal property stored in your car.

There are two AutoXtended Endorsement packages: AutoXtended Plus and AutoXtended Premier.

Benefit | AutoXtended Plus | AutoXtended Premier |

|---|---|---|

| Bail bonds | $350 | $500 |

| Cellphone | Actual cash value, $500 maximum | Replacement cost, $1,000 maximum |

| Death indemnity | $20,000/$40,000 | $50,000/$100,000 |

State Auto homeowners insurance review

State Auto's home insurance is more expensive than average, but it does offer a wide range of extra coverage options to customize your policy.

State Auto home insurance quotes

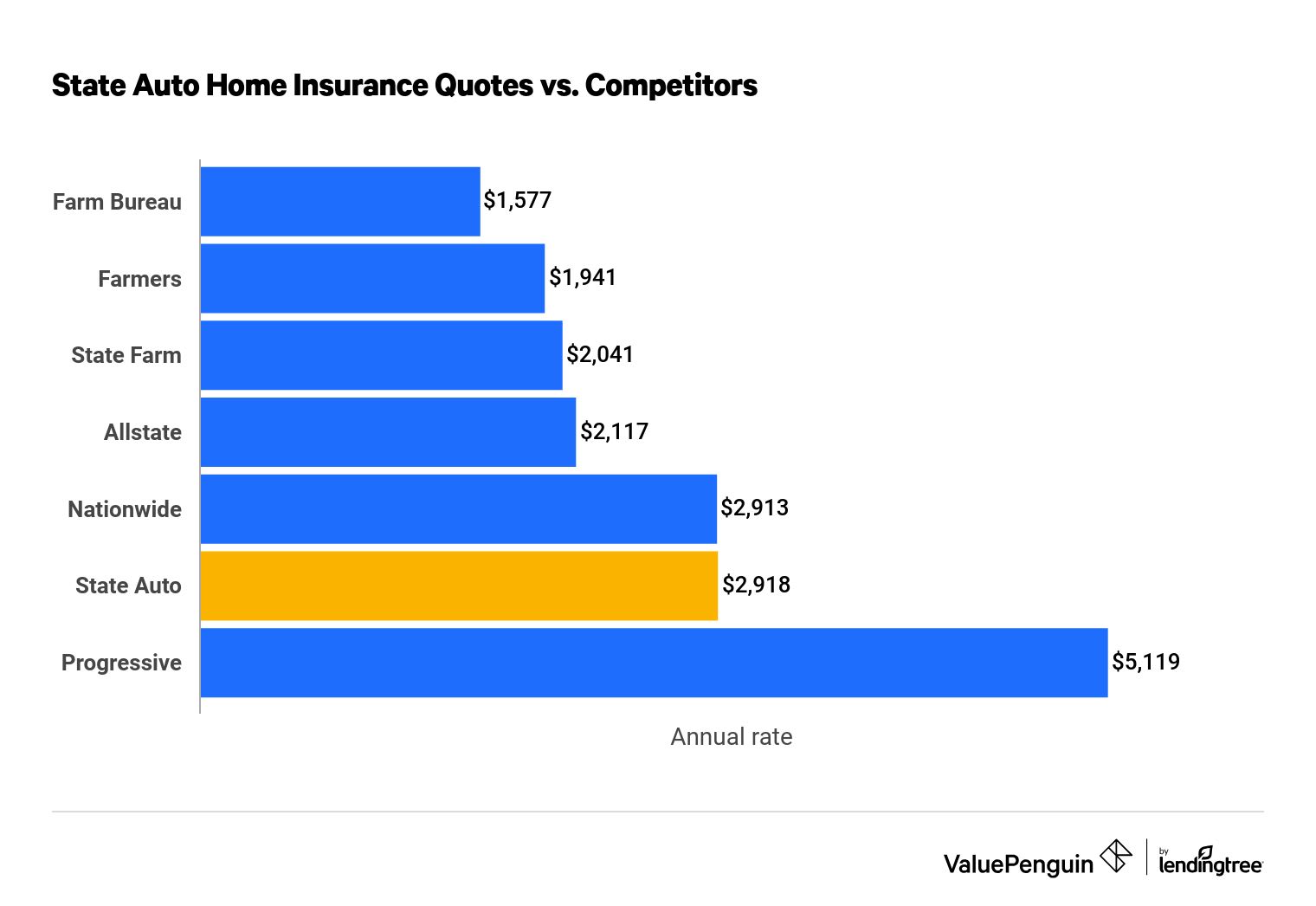

State Auto has expensive rates that are 10% higher than average, compared to large national insurers. With an average rate of $2,918 per year, State Auto is more expensive than Farm Bureau, Farmers, State Farm and Allstate.

Find Cheap Homeowners Insurance Quotes in Your Area

Average annual home insurance rates

Company | Annual rate | |

|---|---|---|

| Farm Bureau | $1,577 | |

| Farmers | $1,941 | |

| State Farm | $2,041 | |

| Allstate | $2,117 | |

| Nationwide | $2,913 | |

| State Auto | $2,918 | |

Homeowner coverage options at State Auto

State Auto homeowners insurance provides the standard types of coverage offered by all insurance companies and a wider variety of extra options that many insurance companies don't offer.

Similar to the company's car insurance, State Auto offers three levels of homeowners coverage: Standard, Protection Plus and Premier. Each one offers access to different kinds of optional coverages:

Coverages | Standard | Protection Plus | Premier |

|---|---|---|---|

| ID Theft | |||

| Replacement cost coverage | |||

| Freezer contents (up to $1,000) | |||

| Golf cart rental coverage | |||

| Special items coverage | |||

| Volunteer wrongful acts coverage |

State Auto has a range of types of coverage, including stand-alone fire protection, earthquake coverage and other ways to add to your policy.

Blanket personal property coverage

Sets a limit for a certain category of items, such as guns, jewelry or computers.

Earthquake coverage

Covers your home for damage resulting from an earthquake.

Home-sharing coverage

Provides a range of protections if you rent out your home for up to 180 days, or parts of your home for longer than that. Includes coverage for furnishings in the house, protection of rental income and some coverage for guests' injuries.

Home systems protection coverage

Covers equipment in your home, such as your air conditioning system, pool pumps, power tools and appliances like refrigerators and washing machines.

Identity fraud expense

Pays to help you repair your credit, replace lost income or hire a lawyer and pay legal fees.

Ordinance or law coverage

Pays for costs that result from complying with new laws and regulations when rebuilding a home after a calamity.

Service line coverage

Covers damage to underground pipes and wires, as well as other service lines. Can be used if lines are damaged by factors such as root growth, lightning, corrosion or an accident in landscaping.

Water backup coverage

Pays for repairs if a sewer backup, drain backup or sump pump failure causes damage to your home.

Policyholders with Plus and Premier level protection can also add HomeXtended coverage, which includes a range of smaller protections.

HomeXtended coverage

Benefit | Description | HomeXtended Endorsement |

|---|---|---|

| Cellular phone coverage | Helps you replace a lost or damaged cellphone | Up to $500 |

| Computer personal records coverage | Pays to restore or replace records on a destroyed computer | $1,500 |

| False alarm | Pays fees after police or the fire department answer a false alarm | Up to $1,000 aggregate limit per policy period |

State Auto Insurance home discounts

State Auto offers a modest set of discounts for home insurance, which can help you reduce the company's high rates.

- Fortified home discount: This discount reduces your rates if your home is built to protect against weather like hurricanes, hail and wind.

- Advance quote discount: Getting a quote at least eight days before a policy goes into effect will reduce the price you pay.

- Roof construction discount: A newer roof made with stronger materials earns you a discount.

- Prior carrier (loyalty) discount: This goes into effect if you've been with a previous carrier for a longer period of time.

- Multipolicy discount: Save up to 14% if you have auto, dwelling fire or umbrella coverage with your home policy.

- New construction discount: Pay less if your home was built within the past year.

- Protective devices discount: Receive a discount if you have a central fire alarm, burglar alarm or certain other technology that protects your home.

State Auto Insurance customer service reviews and ratings

State Auto has a mixed customer service reputation. It receives more complaints than average for car insurance, mostly for claim handling issues and delays. It does, however, have a lower-than-average rate of complaints for home coverage.

Rating agency | Rating |

|---|---|

| Auto NAIC complaint index | 1.61 (1.00 is average) |

| Home NAIC complaint index | 0.58 (1.00 is average) |

| AM Best financial strength rating | A (excellent) |

The National Association of Insurance Commissioners (NAIC) complaint index ratings are for State Auto Property & Casualty Association, the company's largest subsidiary, and lower is better.

State Auto customers do not have to worry about their insurer's ability to pay out for insurance claims, as it has received excellent ratings from AM Best for its financial strength.

State Auto Insurance agents and payments

State Auto Insurance is based in Ohio and offers a variety of insurance products for individuals, businesses, farms and ranches. The company sells its products primarily through independent agents.

The company operates in at least 26 states, but you'll need to use its website to find a local agent. You can use State Auto's agent locator tool to find a local car insurance agent near you.

- Alabama

- Arizona

- Arkansas

- Colorado

- Connecticut

- Indiana

- Kansas

- Kentucky

- Maine

- Maryland

- Michigan

- Minnesota

- Mississippi

- Missouri

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- West Virginia

- Wisconsin

Its core insurance products for individuals include auto, home and personal umbrella insurance.

State Auto provides its customers with a number of ways to make their insurance payments. Drivers with State Auto car insurance can pay their bills online or over the phone. Note that to pay your bill you will have to provide your insurance policy number, which can be found on your State Auto ID card.

Frequently asked questions

What company owns State Auto Insurance?

Liberty Mutual owns State Auto Insurance. The acquisition was finalized in July 2021.

Can I still buy a policy from State Auto Insurance?

You can still buy an insurance policy from State Auto, but it may eventually be converted to Liberty Mutual.

Is State Auto a good insurer?

State Auto is a good insurer if you want to add extra coverages like GPS or bail bond coverage to your policy and don't mind paying more. It has high rates and subpar customer service, though its coverage options are better than average.

Methodology

ValuePenguin pulled quotes from every ZIP code across the state of Texas for a 30-year-old male driver with a clean record, good credit and a 2015 Honda Civic EX. In addition to liability insurance, the auto policy included collision and comprehensive insurance with a $500 deductible.

State availability based on NAIC data for premiums of State Auto subsidiaries.

Rates were collected using Quadrant Information Services. They were sourced from insurer filings. Prices should be used for comparative purposes only, as your rates will likely be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.