Is Therapy Covered by Insurance and How Much Does It Cost?

Find Cheap Health Insurance in Your Area

Health insurance usually covers therapy, but only if it is for a specific mental health condition.

How much coverage you have depends on your policy, and you might still have to pay some of the costs. Individual health insurance plans are required to cover mental health benefits. Most employer plans cover therapy too, but it isn't required.

Does insurance cover therapy?

Most health insurance plans cover therapy as treatment for diagnosed mental health conditions.

If you don't have a mental health diagnosis, your therapy might not be considered medically necessary. For example, your insurance is more likely to cover your therapy if you have been diagnosed with depression, anxiety, post-traumatic stress disorder, an eating disorder or a phobia, and the therapy is an essential part of your treatment plan.

If you want to talk to a therapist about daily stress or lower-level anxiety, your insurance might not view it as medically necessary and might not pay.

Even if you have therapy insurance coverage, you will probably still have to pay for some of your treatment yourself. You may have to meet your health insurance deductible first, for example, and you might have a copayment for office visits.

Individual health insurance

Individual health insurance plans almost always have coverage for mental health benefits, which includes some types of therapy.

The Affordable Care Act requires that all plans on the federal health insurance marketplace and state marketplaces include coverage for mental and behavioral health services, which includes therapy. Plans that you buy directly from insurance companies also have coverage for mental health.

Individual health insurance is any plan that you buy, as opposed to a plan that you get from your job. You can buy plans from the health insurance marketplace or directly from an insurance company.

Individual health insurance plans have to include at least three types of mental health coverage.

- Behavioral health treatment, like therapy and counseling

- Inpatient mental health, like treatment centers

- Substance use disorder treatment

You can't be denied coverage if you have a preexisting mental health condition. Marketplace plans and ACA-compliant plans you buy directly from an insurance company can't put yearly or lifetime dollar limits on your mental health coverage, either. This means that no matter how much mental health support you need, your insurance company has to continue to cover it.

The amount of coverage you have depends on the plan you choose. Catastrophic and Bronze plans have lower monthly rates compared to Silver, Gold and Platinum plans. But you'll also likely have to pay for more of your treatment yourself if you choose a lower-tier plan. This is because you'll probably have a higher deductible, as well as higher copays and coinsurance.

Some types of individual plans, like short-term health insurance and supplemental insurance, aren't required to follow ACA guidelines. That means these plans don't have to include coverage for mental health benefits. These types of plans might still have therapy insurance, but be sure to check before you buy.

Group health insurance

Most health insurance plans from employers cover therapy, but they aren't required to.

Health insurance that you have through a job is called group health insurance. The coverage you have depends on the type of company you work for and what kind of health insurance, if any, it offers.

Companies with under 51 employees

If you work for a company that has 50 or fewer employees and your company offers health insurance, you will have coverage for therapy. That's because small businesses that offer health insurance to employees have to use plans that comply with the Affordable Care Act. This means that mental and behavioral health coverage is mandatory.

But small businesses aren't required to offer health insurance to their employees. This means you might not have any health insurance at all, as well as no mental health and therapy insurance.

If you work for a small business, you'll only have therapy insurance if your job chooses to offer health insurance.

Companies with 51 employees or more

If you work for a large employer, one that has 51 or more employees, you may or may not have coverage for therapy.

Large companies aren't required to cover the ACA essential health benefits. This means mental health benefits and therapy might not be included in your plan. However, most large companies still offer mental health benefits, so chances are you'll have coverage for therapy even though it's not required. The level of coverage you have depends on the plans your company offers and which one you choose.

Some companies offer Employee Assistance Plans (EAPs) that might cover therapy. These programs aren't insurance, but they give employees access to services like therapy, counseling, financial help and legal advice. Each Employee Assistance Plan covers different things, so check your company's benefits to know if you have access to an EAP and if therapy is included.

If your employer-sponsored health insurance does cover mental health benefits, you won't have to pay more for your therapy than you would for physical health concerns. By law, your coverage can't be more restrictive than the medical portion of your policy. Companies that cover mental health and therapy also can't put a spending limit on your coverage, which means that as long as you need the benefits, your coverage will continue to pay out.

Medicare

Medicare covers therapy and other mental health treatments. The details of the coverage depend on what kind of treatment you need.

Outpatient therapy sessions are covered under Medicare Part B. You'll have to meet the annual deductible first, and then Medicare will begin paying. You'll pay for 20% of the Medicare-approved amount, and Medicare will pay for the remaining 80%.Medicare Part B also covers marriage and family therapists (MFTs) and mental health counselors (MHCs).

Example: Therapy costs with Medicare Part B

You start therapy sessions in January. Each session costs $100, and you attend eight sessions. The total cost is $800, and Medicare approves the amount. You have to pay your $257 deductible first. After that, you'll pay 20% of the remaining costs. In total, you'll pay about $365.

You pay | |

|---|---|

| Deductible | $257 |

| Coinsurance | $108 |

| Total | $365 |

If you are hospitalized with a mental health concern and you need therapy in an inpatient setting, Medicare Part A kicks in. Each time you are hospitalized, you start a new Medicare benefit period. You have to pay a $1,676 deductible before Medicare starts paying. After that, you might have daily copays, depending on how long you are hospitalized.

Days in hospital | Daily copay |

|---|---|

| 1-60 | $0 |

| 61-90 | $419 |

| 91 and over | $838 |

You'll also pay 20% coinsurance on the Medicare-approved amount for services you get.

Example: Therapy costs with Medicare Part A

You are hospitalized with severe depression. You spend a total of 20 days in the hospital, and the total bill is $5,000. The mental health services you receive, including therapy, account for $1,000 of the total. You have to pay your $1,676 deductible, the daily copay amount for your hospital days and 20% coinsurance on the services you receive. In total, you would pay $1,876. This is the same amount you would pay if you were hospitalized for a physical injury or illness.

You pay | |

|---|---|

| Deductible | $1,676 |

| Daily copay | $0 |

| Coinsurance | $200 |

| Total paid | $1,876 |

If you have a Medicare Supplement plan, your costs might be reduced. That's because Medicare Supplement plans help pay for costs that Original Medicare doesn't pick up. And if you have a Medicare Advantage plan, your coverage might be different. The companies that sell Medicare Advantage plans often include extra benefits. You could find a plan that offers therapy coverage with a different level of coverage than Original Medicare.

Medicaid

Medicaid usually covers therapy, but the specifics vary by state.

Kaiser Family Foundation found that the Medicaid program in nearly all states covers some form of therapy. If you want Medicaid specifically for therapy coverage, check with your state Medicaid agency to make sure therapy is covered.

If you're eligible for Medicaid, it can be a good way to get health insurance coverage. Most Medicaid programs are designed for low-income households, but each state can decide, to a degree, who qualifies.

Children's Health Insurance Program (CHIP)

Just like Medicaid, coverage for therapy under the Children's Health Insurance Program depends on your state's laws. Some states include CHIP as part of their Medicaid coverage and some states create a separate program. Talk to your state's Medicaid agency to see if the Children's Health Insurance Program in your state covers therapy.

There are two laws that come into play when dealing with mental health insurance coverage.

- The Affordable Care Act (ACA): This law requires that most health insurance plans cover mental and behavioral health services, including therapy and substance use disorder treatments. These treatments are considered essential health benefits and are covered by all ACA-compliant plans.

- The Mental Health Parity and Addiction Equity Act (MHPAEA): Under this law, insurance plans that offer mental health and substance use disorder benefits have to provide the same or better coverage as they do for medical or surgical treatments. This means that treatment limitations, deductibles, and copays and coinsurance levels have to be equal to or better than the type of coverage you have for medical or surgical issues.

How to find therapy covered by insurance

You may be able to find therapy covered by insurance in a few ways.

- Check your insurance website: Most insurance companies offer an online portal that you can use to search for in-network therapists. You could also call the company directly to see which therapists are in-network. Be sure to first check that therapy is a covered benefit in your plan.

- Ask a therapist: Some therapy offices have a list of the insurance types they take on their website. Calling an office or therapist directly might also help you find out if that office takes insurance and what companies they accept.

- Use an online search tool: Therapist search tools can help you find a therapist near you, and they might show which insurance plans the therapist takes. Popular search tools include those from the American Psychological Association and Psychology Today.

- Try online therapy: Online therapy can be cheaper than in-person therapy, but not all online therapy platforms take insurance. Make sure to do your research before you commit to a therapy plan.

Many therapists don't take insurance. In that case, you would have to pay for your sessions yourself, even if you have an insurance plan that covers therapy. Therapists who work with insurance companies are often reimbursed at a lower rate, which means they don't earn as much. Working with insurance companies can also be complex. Not all therapists have the time or ability to work closely with insurance companies.

How much does therapy cost?

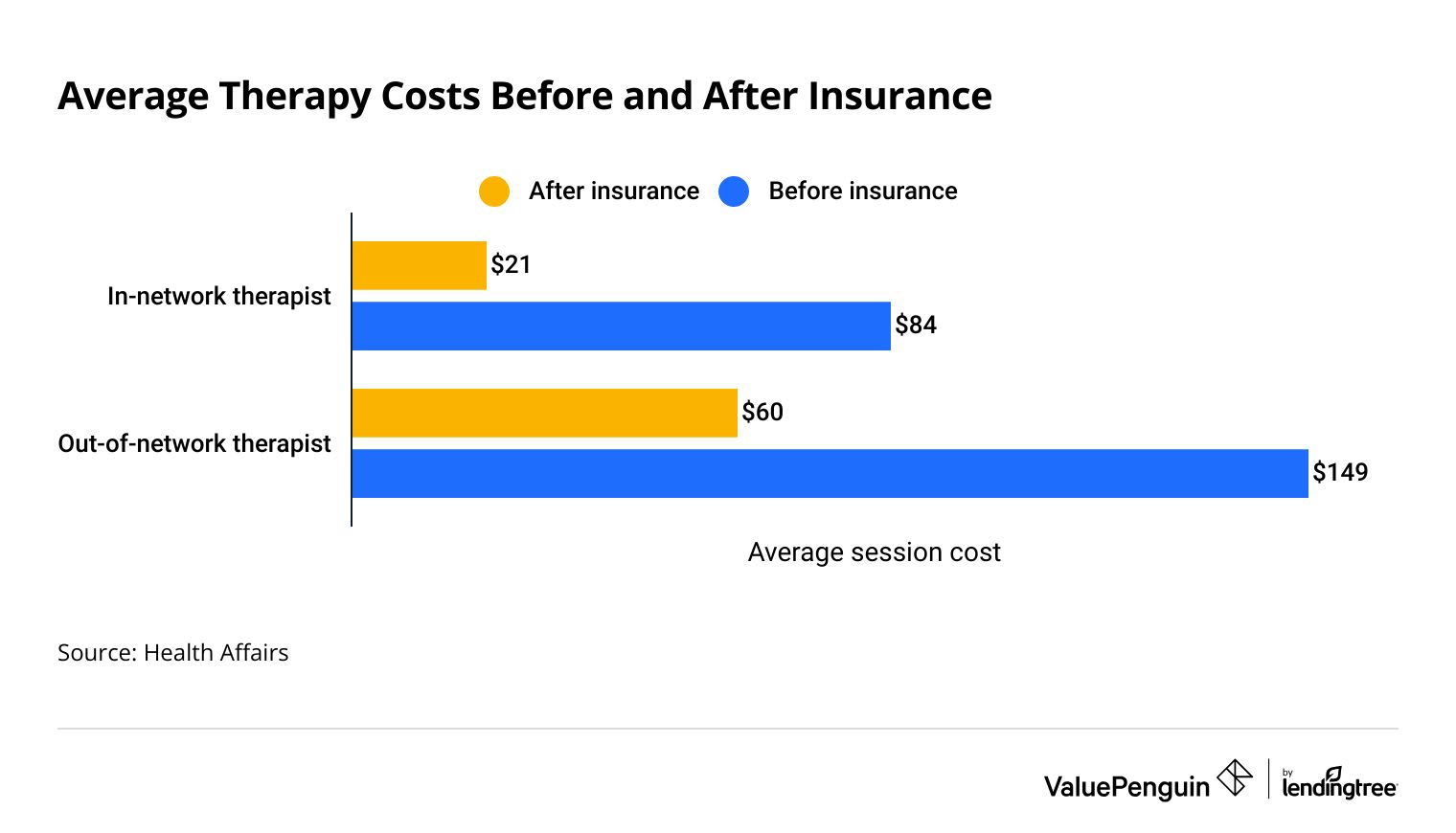

Therapy costs an average of $21 per session for an adult who has insurance and uses an in-network therapist.

If the same adult goes to an out-of-network therapist, the average cost is $60 per session.

Find Cheap Health Insurance in Your Area

Insurance reduces the cost of therapy between 60% and 75%. Before insurance pays, an in-network therapy session is about $84, and an out-of-network session is $149. If you don't have insurance, you'll pay the full cost of each therapy session yourself.

Average therapy costs before and after insurance

Before | After | Savings | |

|---|---|---|---|

| In-network | $84 | $21 | $63 |

| Out-of-network | $149 | $60 | $89 |

*Average cost per session. Source: Health Affairs

Frequently asked questions

Is therapy covered by insurance?

It depends on the type of health insurance you have, but therapy is usually covered by insurance. To have coverage, you'll generally need to have a mental health diagnosis. Otherwise, your therapy sessions might not be considered medically necessary, and your health insurance might not pay.

Does BetterHelp take insurance?

No, BetterHelp doesn't take insurance. The company can't file claims with Medicare, Medicaid or health insurance plans. BetterHelp says this is because its services are offered online, because patients come from across the country and because its therapists are not allowed to diagnose mental conditions through the platform. A BetterHelp subscription costs $60 to $90 per week and is billed every four weeks.

Does Talkspace take insurance?

Yes, Talkspace takes insurance. It also works with some employee assistance plans (EAPs) to offer therapy. Most Talkspace members pay a copay of $30 or less for each therapy session. You can pay with a health savings account (HSA) or flexible spending account (FSA), too. If you don't have health insurance, you can still use Talkspace. You'll just have to pay for the service yourself. Talkspace says the average cost for therapy with insurance is less than $30. If you pay yourself, plans range from $69 to $109 per week, depending on the features you want.

Does Blue Cross Blue Shield cover therapy?

It depends on your plan, but most Blue Cross Blue Shield plans cover therapy. The easiest way to make sure you have therapy coverage is to buy a plan from the health insurance marketplace. If you have Blue Cross Blue Shield health insurance through your job, you'll need to check your plan details to see if therapy is covered. And remember that not all types of health insurance cover therapy. It's always a good idea to read about the benefits before you buy coverage.

Sources

Therapy costs come from a 2020 Health Affairs study analyzing therapy prices over 10 years. The prices listed are for adults. Medicare data for 2025 is from the Centers for Medicare & Medicaid Services (CMS).

Medicaid coverage information comes from the Kaiser Family Foundation study "Medicaid Coverage of Behavioral Health Services in 2022: Findings from a Survey of State Medicaid Programs". Arkansas, Delaware, Georgia, Minnesota, New Hampshire and Utah were not included in the study.

Other sources include BetterHelp, Blue Cross Blue Shield, CMS.gov, HealthCare.gov, Talkspace and the U.S. Department of Health and Human Services.

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.