Who Has the Cheapest Car Insurance in Jersey City, NJ?

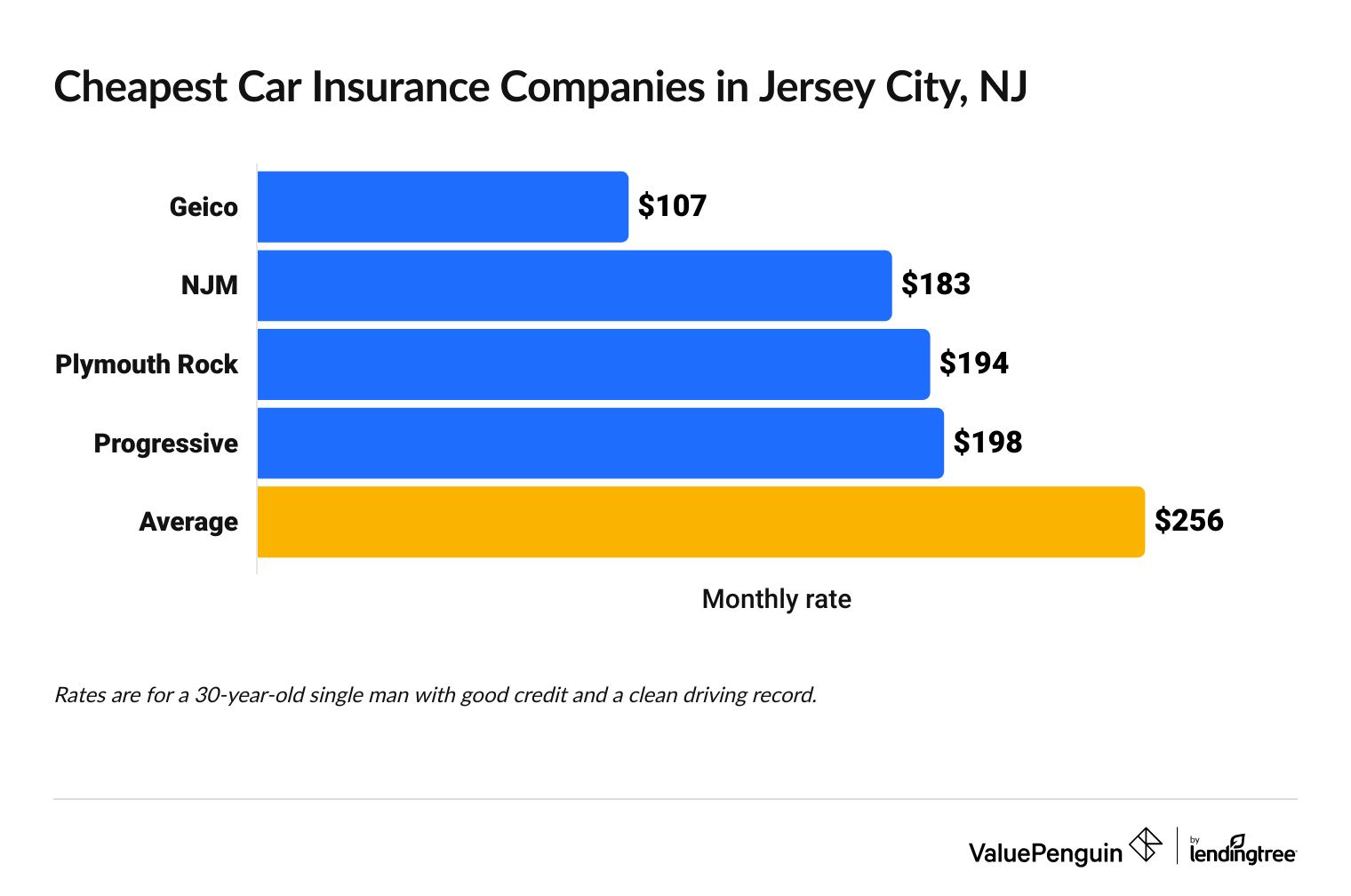

Geico has the cheapest auto insurance in Jersey City, NJ. A full coverage policy costs $107 per month, on average.

Compare Car Insurance Rates in Jersey City, NJ

Best cheap car insurance in Jersey City, NJ

How we chose the top companies

Best and cheapest car insurance in New Jersey

- Cheapest full coverage: Geico, $107/mo

- Cheapest minimum liability: Geico, $45/mo

- Cheapest for young drivers: Geico, $86/mo

- Cheapest after a ticket: Geico, $107/mo

- Cheapest after an accident: Geico, $149/mo

- Cheapest for teens after a ticket: Geico, $86/mo

- Cheapest after a DUI: Geico, $215/mo

- Cheapest for poor credit: Geico, $246/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Geico has the cheapest auto insurance in Jersey City, New Jersey. The company has the most affordable rates across the board.

NJM offers the best customer service among top car insurance companies in Jersey City. The company also has the second-most affordable rates for full coverage car insurance.

Cheapest car insurance in Jersey City: Geico

Geico sells the cheapest car insurance in Jersey City, NJ.

A full coverage Geico policy costs $107 per month, on average. That's less than half the

Jersey City average.

Find Cheap Auto Insurance Quotes in Jersey City

NJM has the second cheapest rates in Jersey City, at an average of $183 per month. That's 29% cheaper than the citywide average.

NJM is alsot highly rated for customer satisfaction in the U.S.’s mid-Atlantic region, according to a recent JD Power study. Companies with a reputation for good service typically have a faster and easier claims filing process.

Cheapest full coverage car insurance in Jersey City

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $107 | ||

| NJM | $183 | ||

| Plymouth Rock | $194 | ||

| Progressive | $198 | ||

| State Farm | $306 | ||

Cheapest minimum coverage in Jersey City: Geico

Geico has the cheapest auto insurance in Jersey City for minimum liability policies.

The company charges $45 per month, on average. That's about a third the cost of the citywide average.

Best cheap liability auto insurance

Company | Monthly rate |

|---|---|

| Geico | $45 |

| Plymouth Rock | $80 |

| NJM | $101 |

| Progressive | $104 |

| Travelers | $149 |

Find Cheap Auto Insurance Quotes in Jersey City

Cheapest car insurance in Jersey City for teens: Geico

Geico has the cheapest full and minimum coverage car insurance for teen drivers in Jersey City.

The company charges an average of $86 per month for a full coverage policy. That's about a fifth of the Jersey City average.

Geico also has the cheapest minimum coverage policies in Jersey City, at an average of $230 per month. That's roughly a quarter of the city average.

Monthly car insurance rates for teen drivers

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $86 | $230 |

| NJM | $244 | $415 |

| Travelers | $325 | $701 |

| Allstate | $464 | $961 |

| Plymouth Rock | $578 | $1,452 |

Teen drivers can get cheaper car insurance rates by sharing a policy with their parents.

Other ways for teen drivers to get cheap car insurance include taking advantage of discounts for young people. For example, many companies offer discounts for college students who leave their cars at home during the school year and students with a 3.0 GPA or higher, or who rank in the top fifth of their class.

Most affordable auto insurance in Jersey City after a speeding ticket: Geico

Geico has the most affordable quotes for Jersey City drivers with a speeding ticket, at an average of $107 per month. That's around a third of the Jersey City average.

Cheapest coverage after a speeding ticket

Company | Monthly rate |

|---|---|

| Geico | $107 |

| Plymouth Rock | $194 |

| NJM | $247 |

| Progressive | $278 |

| State Farm | $306 |

Cheapest auto insurance in Jersey City after an accident: Geico

Geico has the cheapest rates for Jersey City drivers with an accident on their record. The company charges an average of $149 per month. That's 71% cheaper than the city average of $508 per month.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| Geico | $149 |

| NJM | $200 |

| Plymouth Rock | $278 |

| Progressive | $345 |

| State Farm | $512 |

Getting in an at-fault accident will roughly double your monthly rate in Jersey City, on average. You can lower the amount you pay for coverage after a crash by comparing quotes and taking advantage of common auto insurance discounts.

Keep in mind that how much extra you'll pay for insurance after a crash will depend on your company. For example, the cost of a Farmers policy roughly triples after a crash while Geico raises its customers rates by less than half, on average.

Cheapest car insurance for teens after a ticket or accident: Geico

Geico has the most affordable rates for teen drivers in Jersey City who've gotten a speeding ticket, at $86 per month, on average. That's less than a sixth of the city average of $608 per month.

The company also has the cheapest quotes for teen drivers with an accident on their record, at an average of $98 per month. That's a tenth of the city average.

Monthly minimum coverage rates for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Geico | $86 | $98 |

| NJM | $306 | $244 |

| Travelers | $420 | $559 |

| Plymouth Rock | $578 | $872 |

| Progressive | $621 | $691 |

Cheapest car insurance in Jersey City for drivers with a DUI: Geico

Geico has the cheapest auto insurance in Jersey City for drivers who've gotten a DUI. The company charges an average of $215 per month for coverage, which is just over half the Jersey City average.

Cheapest Jersey City car insurance after a DUI

Company | Monthly rate |

|---|---|

| Geico | $215 |

| Plymouth Rock | $237 |

| NJM | $247 |

| Progressive | $248 |

| Allstate | $526 |

In Jersey City, a DUI raises the cost of car insurance by an average of 55%. Remember, if you get a DUI, your monthly rate won't change until your next policy renewal. It's a good idea to shop around at that time to get the cheapest quotes.

You could save nearly $1,000 per month by switching from the most expensive car insurance after a DUI (Farmers) to the cheapest (Geico).

Cheapest quotes for Jersey City drivers with poor credit: Geico

Geico has the cheapest rates for drivers in Jersey City who have a low credit score. The company charges $246 per month for coverage, on average. That's about two-fifths of the city average.

Cheap car insurance in Jersey City for poor credit

Company | Monthly rate |

|---|---|

| Geico | $246 |

| NJM | $321 |

| Progressive | $330 |

| Plymouth Rock | $470 |

| Allstate | $632 |

In Jersey City, drivers with a bad credit score pay more than double for car insurance than drivers with good credit. Companies use credit scores when setting rates because they think people with low credit scores file more claims than drivers with high credit scores, on average.

Average cost of car insurance in Jersey City by neighborhood

Communipaw, along with parts of the West Side and McGinley Square have the most expensive average rates in Jersey City, at an average of $259 per month. The most affordable areas for car insurance in Jersey City are in the Historic Downtown, Hamilton Park, Harsimus Cove, Paulus Hook and the Powerhouse Arts District neighborhoods, at $253 per month, on average.Jersey City is about 15 square miles of land area, which could be a major reason why car insurance costs roughly the same across the city.

Full coverage quotes by Jersey City ZIP code

ZIP | Monthly rate | % from average |

|---|---|---|

| 07302 | $253 | -1% |

| 07304 | $259 | 1% |

| 07305 | $257 | 0% |

| 07306 | $259 | 1% |

| 07307 | $259 | 1% |

Frequently asked questions

Who has the cheapest auto insurance in Jersey City, NJ?

Geico has the cheapest car insurance in Jersey City, at $107 per month for a full coverage policy, on average. The company also has the cheapest average rates for minimum liability insurance, at $45 per month.

What is the best car insurance company in Jersey City?

NJM is the best car insurance company in Jersey City. The company has high customer satisfaction ratings according to a recent JD Power study. NJM also got a perfect five-out-of-five star rating from ValuePenguin editors.

How much is car insurance in Jersey City?

A full coverage car insurance policy in Jersey City costs $256 per month, on average. That's higher than the New Jersey state average of $199 per month.

Methodology

To find the best cheap car insurance in Jersey City, NJ, ValuePenguin collected quotes from eight of the most popular insurance companies in New Jersey. Rates are for a 30-year-old single man with good credit and no accident history who drives a 2015 Honda Civic EX.

Full coverage policies include comprehensive and collision coverage, plus liability limits that meet the legal requirements for New Jersey.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $10,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates came from public insurance company filings and should be used for comparative purposes only. Your own quotes may differ.

Senior Writer

Talon Abernathy is a ValuePenguin Senior Writer who specializes in health insurance, Medicare and Medicaid. He's also contributed to other insurance verticals including home, renters, auto, motorcycle and flood insurance.

Talon came to ValuePenguin in 2023. Since his arrival, he's helped to expand the site's health insurance-related content offerings. He enjoys helping readers understand the ins and outs of America's all too complicated health insurance landscape.

Before coming to ValuePenguin, Talon worked as a freelance writer. His prior work has touched on a broad range of personal finance-related topics including credit-building strategies, small business incorporation tactics and creative ways to save for retirement.

Insurance tip

In many parts of the country, you can qualify for a free Silver health insurance plan if you meet certain income requirements. Government subsidies in the form of premium tax credits and cost-sharing reductions may mean you'll pay nothing for coverage.

Expertise

- Health insurance

- Medicare and Medicaid

- Flood insurance

- Homeowners insurance

- Renters insurance

- Auto and motorcycle insurance

Referenced by

- The Miami Herald

- Money.com

- MSN

- Nasdaq

- The Sacramento Bee

- Yahoo! Finance

Education

- BA, University of Washington

- Certificate in Copyediting, UC San Diego

Credentials

- Licensed Life & Disability Insurance Agent

- Licensed Property & Casualty Insurance Agent

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.