Best & Cheapest Car Insurance Quotes in West Virginia (2026)

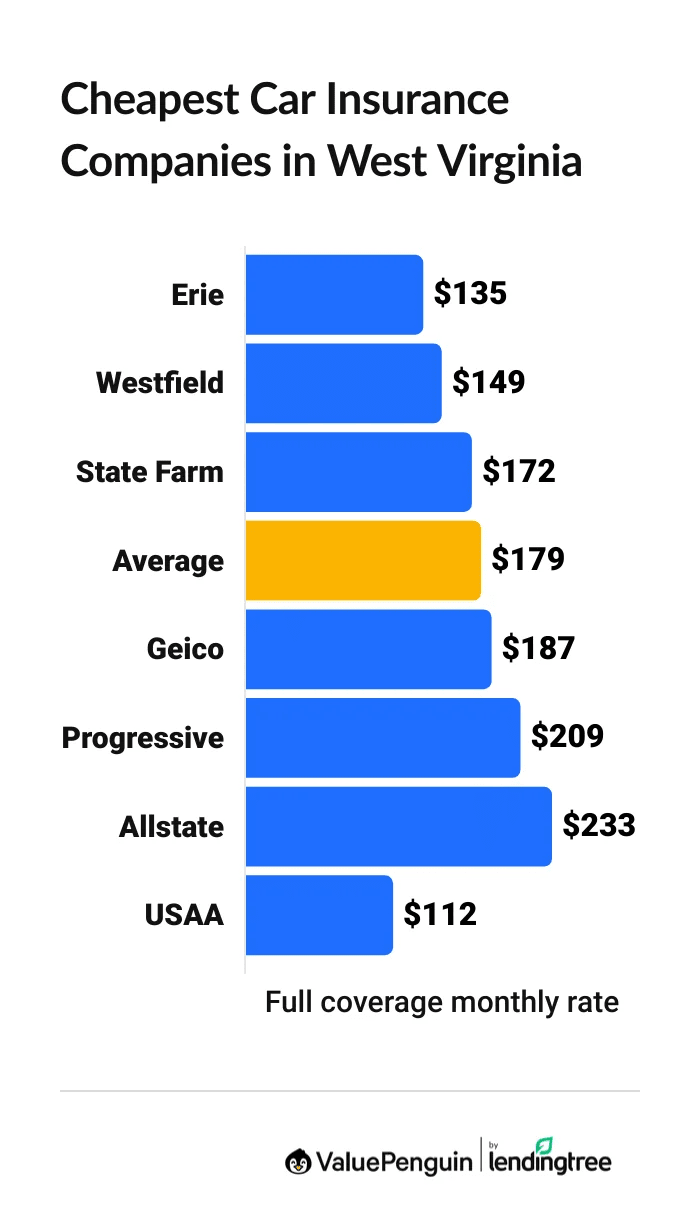

Erie has the best cheap car insurance in West Virginia. Full coverage from Erie costs $135 per month, which is $44 per month less than the state average.

Find Cheap Auto Insurance Quotes in West Virginia

Best cheap auto insurance in WV

Best and cheapest car insurance in West Virginia

- Cheapest full coverage: Erie, $135/mo

- Cheapest minimum liability: Erie, $35/mo

- Cheapest for young drivers: Erie, $76/mo

- Cheapest after a ticket: Erie, $148/mo

- Cheapest after an accident: Erie, $161/mo

- Cheapest for teens after a ticket: Erie, $89/mo

- Cheapest after a DUI: Erie, $206/mo

- Cheapest for poor credit: Westfield, $212/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Erie offers the best mix of reliable customer service and cheap quotes in West Virginia. But drivers should also compare quotes from State Farm and Westfield, which have affordable rates and good service, too.

Cheapest car insurance in West Virginia: Erie

Erie and USAA have the cheapest quotes for full coverage car insurance in West Virginia.

Find Cheap Auto Insurance Quotes in West Virginia

- Erie offers the best combination of cheap rates and great service for most West Virginia drivers. Full coverage insurance from Erie costs around $135 per month, which is one-quarter less than the statewide average.

- USAA has even cheaper rates for full coverage insurance, at just $112 per month. However, only active-duty military members, veterans, reservists and some of their family members can get car insurance from USAA.

Best cheap full coverage auto insurance in West Virginia

Company | Monthly rate | |

|---|---|---|

| Erie | $135 | |

| Westfield | $149 | |

| State Farm | $172 | |

| Geico | $187 | |

| Progressive | $209 |

*USAA is only available to current and former military members and their families.

Data-powered research on West Virginia car insurance

Data-powered research on WV car insurance |

|---|

Cheapest liability insurance car insurance quotes in WV: Erie

Erie has the cheapest minimum liability car insurance quotes in West Virginia.

At $35 per month, a minimum liability policy from Erie costs $30 per month less than the state average.

Cheapest West Virginia auto insurance rates

Company | Monthly rate |

|---|---|

| Erie | $35 |

| Westfield | $41 |

| State Farm | $57 |

| Geico | $74 |

| Allstate | $87 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in West Virginia

Cheap car insurance in WV for young drivers: Erie

Erie is the cheapest option for young drivers shopping for car insurance in West Virginia.

A minimum liability policy from Erie costs $76 per month for an 18-year-old driver. That's less than half the West Virginia average.

Erie also has the cheapest full coverage rates for teen drivers. At $302 per month, full coverage from Erie costs $242 per month less than the state average.

Affordable WV auto insurance quotes for teens

Company | Liability only | Full coverage |

|---|---|---|

| Erie | $76 | $302 |

| Westfield | $128 | $465 |

| Geico | $164 | $417 |

| State Farm | $191 | $502 |

| Progressive | $213 | $549 |

*USAA is only available to current and former military members and their families.

In West Virginia, 18-year-old drivers pay around three times as much for car insurance than 30-year-olds. Insurance companies charge young drivers higher rates because their lack of driving experience makes them more likely to cause crashes.

The best way for West Virginia teens to save money on their car insurance is by sharing a policy with their parents or an older relative. A family policy typically costs much less than two separate policies.

Most car insurance companies also offer discounts geared toward young drivers. For example, Erie offers discounts for drivers under 21 years old who live with their parents or take a driver training course.

It's also a good idea to bundle your renters or homeowners insurance with your auto policy for more savings.

Cheap insurance in WV after a speeding ticket: Erie

Erie is the cheapest company for West Virginia drivers with a recent speeding ticket. Full coverage from Erie costs $148 per month, which is $69 per month less than the West Virginia average.

It's also a good idea to also get a quote from Westfield. You’ll need to contact an agent directly to get a quote, but the company has good customer service and might be cheaper for you than Erie.

Cheapest West Virginia insurance after a ticket

Company | Monthly rate |

|---|---|

| Erie | $148 |

| Westfield | $149 |

| State Farm | $183 |

| Geico | $238 |

| Progressive | $277 |

*USAA is only available to current and former military members and their families.

In West Virginia, drivers with a speeding ticket pay 21% more for car insurance than those with a clean record. That's an average increase of $39 per month for a full coverage policy.

Cheapest insurance in WV after an accident: Erie

Erie has the best auto insurance quotes for West Virginia drivers with an at-fault accident. At $161 per month, full coverage from Erie is $94 per month cheaper than the state average.

State Farm also has affordable rates after an accident, at $172 per month, on average.

Affordable WV car insurance companies after an accident

Company | Monthly rate |

|---|---|

| Erie | $161 |

| State Farm | $172 |

| Westfield | $214 |

| Progressive | $257 |

| Geico | $311 |

*USAA is only available to current and former military members and their families.

Car insurance quotes in West Virginia go up by an average of 42% after an accident.

There’s no need to rush and switch insurance companies right after an accident. Your rates won't increase until your current policy renews. However, any quotes you get will consider your accident, so they'll probably be more expensive than your current rate.

Instead, wait until you get your renewal offer in the mail or via email before you shop for a new policy. This typically arrives a few weeks to a month before your current policy expires. Then, you should compare quotes from multiple companies to find the best price for you.

Cheapest WV insurance for teens with a speeding ticket or accident: Erie

Erie offers the cheapest rates for young drivers in West Virginia with a speeding ticket or recent at-fault accident.

After a speeding ticket, Erie charges teens $89 per month for minimum liability insurance. That's less than half the West Virginia state average.

Minimum liability coverage from Erie costs $91 per month after an at-fault accident, which is also less than half the state average.

Cheapest car insurance in WV for teens with bad driving records

Company | Ticket | Accident |

|---|---|---|

| Erie | $89 | $91 |

| Westfield | $128 | $145 |

| Geico | $198 | $252 |

| State Farm | $208 | $191 |

| Progressive | $235 | $227 |

*USAA is only available to current and former military members and their families.

Young drivers in West Virginia see increases of about 17% after a ticket and 25% after a crash. This is because insurance companies believe teens with a recent ticket or crash are more likely to cause crashes in the future.

Cheap auto insurance for West Virginia drivers with a DUI: Erie

At an average of $206 per month for full coverage, Erie has the cheapest quotes in West Virginia for drivers with a DUI, . That's $111 per month less than the average rate statewide.

Best rates from WV car insurance companies after a DUI

Company | Monthly rate |

|---|---|

| Erie | $206 |

| Progressive | $300 |

| Allstate | $315 |

| Geico | $331 |

| Westfield | $344 |

*USAA is only available to current and former military members and their families.

Car insurance quotes are 77% more expensive for drivers with a DUI in West Virginia. A DUI is one of the most serious driving offenses, and insurance companies believe that people with DUIs are much more likely to make insurance claims.

Low-cost car insurance in WV for drivers with poor credit: Westfield

Westfield has the best quotes for West Virginia drivers with poor credit, at $212 per month for full coverage. This is $140 per month cheaper than average.

Although Westfield doesn't offer online quotes, its cheap rates make up for the extra time it takes to speak with an agent. Geico is the cheapest company with online quotes for West Virginia drivers with poor credit, but the company's rates are still $65 per month more than Westfield's.

Cheapest WV car insurance with poor credit

Company | Monthly rate |

|---|---|

| Westfield | $212 |

| Geico | $277 |

| Erie | $311 |

| Nationwide | $328 |

| Progressive | $360 |

*USAA is only available to current and former military members and their families.

Drivers in West Virginia with poor credit pay an average of 96% more for full coverage insurance than those with good credit scores. This is because insurance companies believe drivers with poor credit scores are more likely to file insurance claims.

Best car insurance in West Virginia

Erie is the best car insurance company in West Virginia for most people.

Erie customers are typically happy with their claims service. And, the company has a great overall mix of low rates, helpful staff and useful coverages.

State Farm and USAA are also good companies with reliable service. USAA is only available to current military members, veterans and some of their family members, but it's a great choice if you're eligible.

Top insurance companies in West Virginia

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| Erie | 703 | A | |

| State Farm | 650 | A++ | |

| Nationwide | 645 | A | |

| Westfield | 647 | A |

West Virginia car insurance rates by city

Martinsburg, the largest city in the eastern panhandle of the state, has the cheapest car insurance in West Virginia.

The average cost of car insurance in Martinsburg is $158 per month for a full coverage policy.

Kermit, a very small town on the West Virginia-Kentucky border, has the most expensive rates in the state, at $227 per month.

Average car insurance quotes in WV by city

City | Monthly rate | % from average |

|---|---|---|

| Accoville | $205 | 14% |

| Adrian | $191 | 6% |

| Advent | $184 | 3% |

| Albright | $188 | 5% |

| Alderson | $173 | -4% |

How much you'll pay for car insurance changes based on where you live. For instance, you might pay more if your city has poorly maintained roads, which may lead to more accidents, or if you live in an area with a lot of car thefts.

What is the minimum insurance in West Virginia?

Drivers in West Virginia need to have a minimum amount of liability car insurance to legally drive, often written as 25/50/25. In addition, West Virginia drivers also need uninsured motorist insurance, which covers you if you're in an accident with an uninsured driver.

- Bodily injury liability: $25,000 per person and $50,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident

- Uninsured motorist property damage: $25,000 per accident

If you use your car seasonally, you can cancel your insurance while it's stored and you're not driving it. Before cancelling your policy, you must submit what's called a Statement of Seasonal Insurance with the West Virginia DMV. Just make sure to reinstate your policy or buy a new one before driving your car on public roads.

What's the best car insurance coverage for West Virginia drivers?

Most drivers in West Virginia should get full coverage car insurance.

Minimum coverage meets West Virginia's minimum legal requirements for car insurance, but it doesn't protect you or your vehicle.

Full coverage includes collision and comprehensive insurance. These coverages pay for damage to your car after a crash, theft, vandalism or a natural disaster — regardless of who's at fault.

Most lenders require you to have comprehensive and collision coverage if you have a car loan or lease. Both types of coverage are also a good idea if your car is newer than eight years old or worth more than $8,000.

If you choose the lowest liability coverage limits and skip comprehensive and collision coverage, you'll save money on your monthly rate, but you risk having to pay a lot more out of pocket if your car is damaged in an at-fault crash.

For example, if you crash into and total a brand new pickup truck, $25,000 of property damage liability probably won't be enough to pay for a new vehicle for the other driver. If you only have minimum liability insurance, you'll have to pay the difference.

Frequently asked questions

What is the cheapest car insurance in WV?

For 2026, Erie has the cheapest full coverage car insurance rates in West Virginia, at an average of $135 per month. That's $45 per month less than the statewide average. Erie also has the cheapest minimum liability coverage in West Virginia, at $36 per month.

How much is car insurance in West Virginia?

Car insurance in West Virginia costs an average of $179 per month for full coverage insurance. Minimum liability coverage costs $65 per month.

Is Westfield cheaper than State Farm?

Westfield had cheaper rates than State Farm in West Virginia. The average rate for full coverage in WV is $135 per month. The same coverage from State Farm costs $172 per month.

What is full coverage insurance in WV?

Full coverage insurance usually means that you get liability insurance plus collision and comprehensive coverage, which pay for various types of damage to your car, regardless of who causes it. Typically with full coverage, you also choose higher liability limits than the state requirements. This can save you money in the long run if you end up causing an expensive accident, because the minimum liability limits may not cover the full cost.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across West Virginia for the largest insurance companies in the state. Quotes are for a 30-year-old man with a 2018 Honda Civic EX and good credit.

Full coverage rates are for a policy with liability coverage above the minimum limits, plus collision and comprehensive coverage.

- $50,000 of bodily injury liability coverage per person and $100,000 per accident

- $50,000 of property damage liability

- $50,000 of bodily injury uninsured motorist coverage per person and $100,000 per accident

- Collision and comprehensive coverage with a $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Managing Editor

Ben Breiner is the Managing Editor of ValuePenguin/LendingTree's insurance vertical. He oversees a team of writers who focus on guiding readers through the rigors of home and auto coverage. He still loves that moment when the words fall together and he can translate an intimidating topic so a reader can make the best choice.

Ben got involved in insurance in 2021 when he joined ValuePenguin. He moved up from writer to editor and watched the team grow to expand the ways it helps consumers. Before that, he spent a decade as a sportswriter for newspapers in the Southeast and Midwest.

Ben had to put off buying his first car because of high insurance rates, so he's keenly aware how the wrong policy can get in the way of your goals. He should've shopped around and looked to the experts.

Insurance tip

Always keep an eye out for insurance you can load up on at a low price. A lot more liability coverage won't break the bank and protects your hard-earned assets.

Expertise

- Car insurance

- Home insurance

- Renters insurance

Education

- BA, Economics and Journalism, University of Wisconsin-Madison

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.